By Stephen Katte, CoinTelegraph; Compiled by Tao Zhu, Golden Finance

Against the backdrop of a slump in the cryptocurrency market that recently saw Bitcoin prices fall below $80,000, mentions of crypto dips on social media have surged to their highest level since July last year.

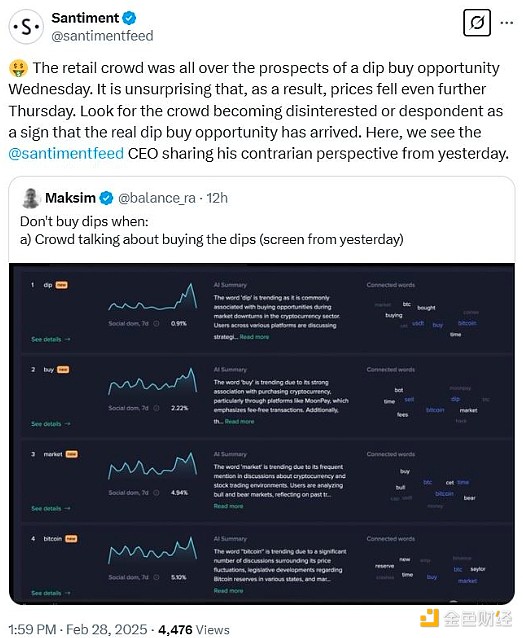

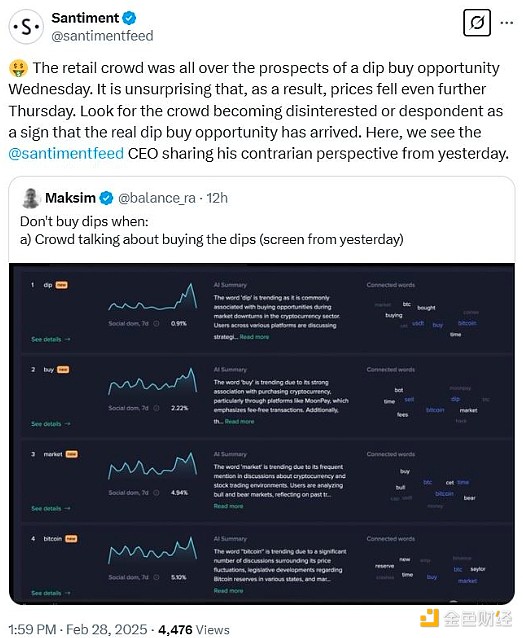

Santiment’s social sentiment tracker found that discussions between February 25 and 26 on various social media channels such as X, Reddit and Telegram “showed very high confidence” that the drop was “a good time to buy,” the platform said in a February 28 post to X.

It added that this was the highest level of crypto dip buying interest in seven months.

On February 25, U.S. President Donald Trump announced plans to impose a 25% tariff on Canada and Mexico, and Bitcoin fell below $90,000.

Since then, Bitcoin prices have further given up post-US election gains, falling below $80,000 on Feb. 28, following Trump’s threat of a further 10% tariff on China and other macroeconomic uncertainties.

Santiment’s tracker sifted through cryptocurrency-specific social media channels to identify the 10 terms that have grown most significantly over the past 14 days. Source: Santiment

However, the analytics platform said that high interest in buying the dip is not necessarily a signal to enter the market, as markets tend to move in the opposite direction of expectations.

“Ideally, we are waiting for this herd enthusiasm to fade, a sign that retail traders have suffered enough to justify a rebound,” Santiment said.

“The market is moving in the opposite direction of mass expectations, so the decline in optimism and the decline in the level of buying the dip can serve as a bullish signal.”

According to Santiment’s methodology, its tracker sifts through crypto-specific social media channels such as X and Telegram to identify the top ten terms that have seen the most significant increase in social media mentions compared to the previous two weeks.

Bitcoin is down more than 21% in the past 30 days and 5% in the past 24 hours, trading at around $80,400, according to CoinMarketCap. Ethereum is down more than 30% in the past 30 days and 7.54% in the past day, trading at around $2,139.

Santiment said in a follow-up article that it would not be surprising if prices fell further after "retail investors became confident in the prospect of buying the dip."

The platform said: "If people become uninterested or frustrated, it means that the real opportunity to buy on the dip has arrived."

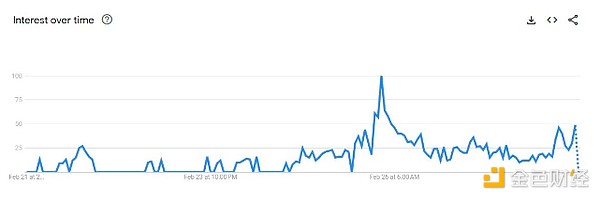

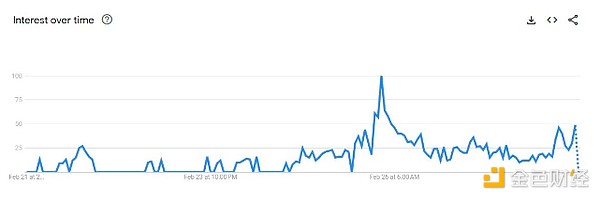

Google Trends data shows that in a one-week time frame, search interest for "buy on the dip" surged to 100 on February 26. However, search interest has since fallen to 49 out of 100.

Google Trends data shows that many people are interested in the term "buy on dips". Source: Google Trends

Meanwhile, on February 25, the search volume for the term "crypto" reached a peak of 100 in the past seven days and is currently 87 points (out of 100).

According to the Google Trends FAQ, a score of 100 indicates that the search volume for the term has reached its highest level, while a score of 0 indicates that the search volume for the term on that day was relatively low.

Catherine

Catherine