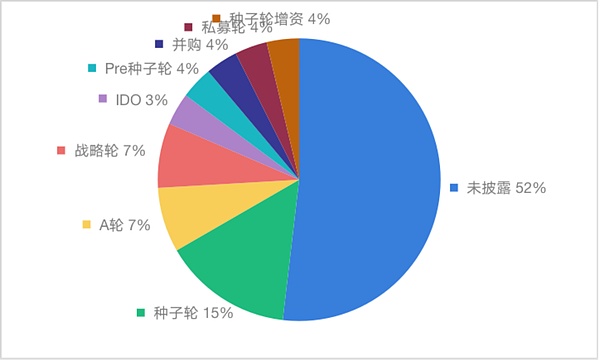

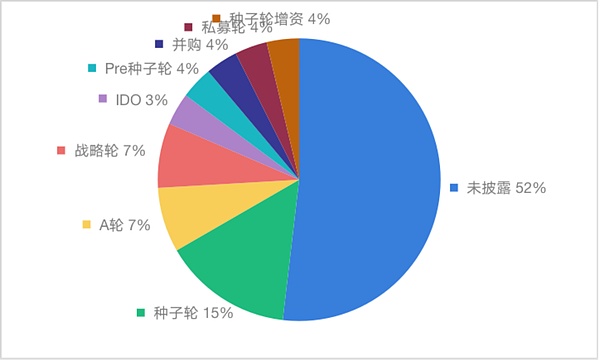

There were 27 financing incidents last week. The disclosed financing amount exceeds US$160 million. Among them, 8 companies have not disclosed; 11 companies have raised financing amounts of 0 to 5 million US dollars; 4 companies have raised financing amounts of 5.01 million to 10 million US dollars; 3 companies have raised financing amounts of 10.01 million to 20 million US dollars; and 1 mining company has raised 55 million US dollars. Dollar.

These financing events include the participation of some well-known and powerful investment institutions, such as Morningstar Ventures, GBV Capital, Spark Capital, Solana Ventures, Hashed, Spartan Group, SOSV, Bex Ventrue, Rarestone Capital, Red Beard Ventures, Big Brain Holdings, Maven11, Balderton Capital, Framework Ventures, SevenX Ventures, Quantstamp, Pantera Capital, OKX Ventures, Lightspeed Venture, Polychain, Binance Labs, etc. (Ranked in no particular order)

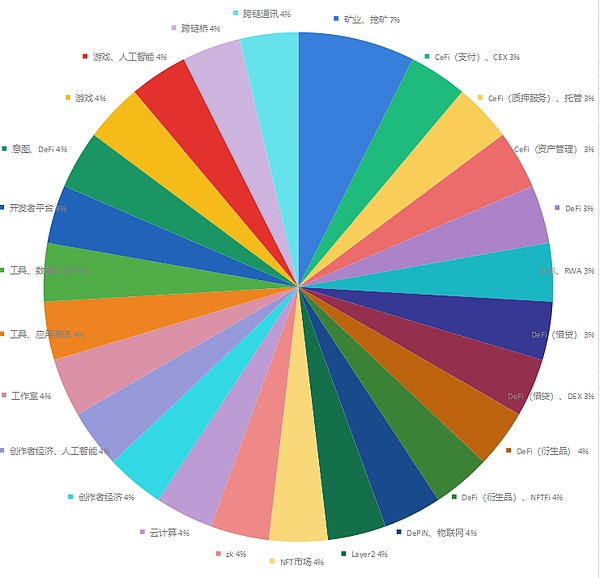

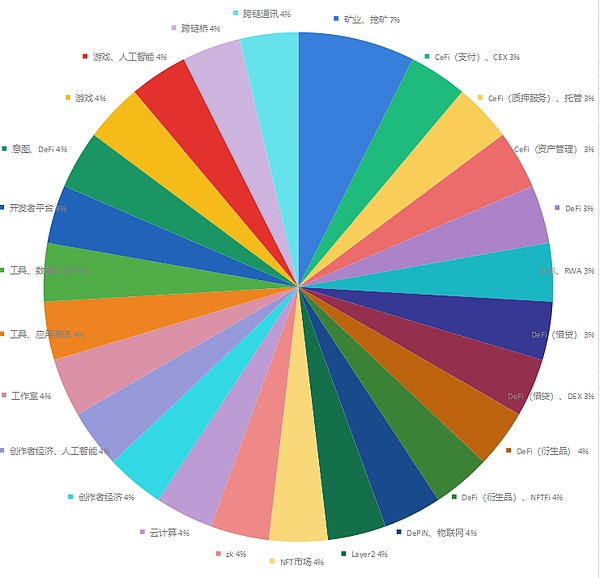

This round of financing covers the creator economy, mining, DeFi, artificial intelligence, cloud computing, games, NFT market, Internet of Things, etc. The specific projects involved include decentralized finance lending and exchanges, centralized finance payment and asset management, zero-knowledge tools, cross-chain technology, developer platforms and other tracks.

The huge scale of financing in the lending and DEX fields reflects the market's strong interest in unintermediated and efficient financial services, but it may also bring about a highly competitive market environment that requires a higher level of innovation. At the same time, pledge services and custody financing in the CeFi field show the market’s confidence in traditional financial services for digital transformation.

In the future, the trends of DeFi and CeFi in the secondary market will be affected by fierce competition and industry innovation. Institutional knowledge of these areas needs to find a balance between centralization and decentralization to adapt to the evolving fintech landscape.

JinseFinance

JinseFinance