Author: Beijing Business Daily reporter Yue Pinyu Dong Hanxuan

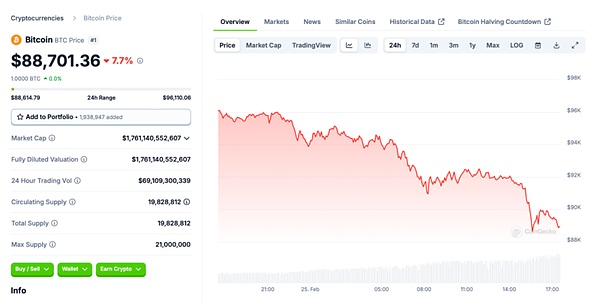

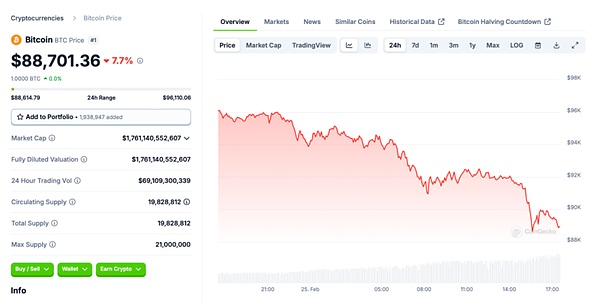

Bitcoin plunges again. On February 25, the cryptocurrency market fell sharply, and Bitcoin once fell below $90,000, hitting a new low since mid-January.

Behind this, multiple factors such as US President Trump's tough stance on Canada and Mexico's tariff policies, geopolitical tensions, and weakening market momentum are intertwined. It is worth mentioning that in the past 24 hours, nearly 370,000 people worldwide were liquidated, with a total liquidation amount of $1.36 billion. This also means that a large number of tightrope speculators have been bloodbathed.

01 Falling below $90,000

The latest data shows that the decline of Bitcoin has further widened and has come below $89,000. As of 17:30 on February 25, the price of Bitcoin was $88,701, down 7.7% in 24 hours. Ethereum, Solana, Dogecoin and other cryptocurrencies all fell by more than 10%.

Along with the price fluctuations comes huge market shocks. According to Coinglass data, nearly 370,000 people worldwide were liquidated in the past 24 hours, with a total liquidation amount of US$1.36 billion.

On the news front, Trump's tough tariff policy has become the main reason for the recent decline in Bitcoin. On February 24, local time, Trump held a joint press conference with visiting French President Macron at the White House. When asked about the upcoming deadline for the US to impose additional tariffs on Mexico and Canada next month, Trump said that the tariffs are being pushed forward as planned, and it seems to be progressing "very fast."

Trump signed an executive order on the 1st of this month to impose a 25% tariff on products imported from Mexico and Canada, including a 10% tariff on Canadian energy products. On the 3rd, Trump announced a 30-day suspension of the implementation of the tariffs on the two countries and continued negotiations. According to this decision, the relevant tariffs will take effect on March 4.

In addition, earlier, the largest theft in the history of the currency circle has again questioned the security of cryptocurrencies, leading to panic selling by a large number of investors. "The current market decline is obviously related to the interweaving of multiple factors, and the sustainable pressure in the short term is likely to continue for some time." Yu Jianing, co-chairman of the Blockchain Committee of the China Communications Industry Association and honorary chairman of the Hong Kong Blockchain Association, told the Beijing Business Daily reporter. Yu Jianing also pointed out that the recent range fluctuations of Bitcoin on the technical side also reflect the weakening of market momentum. Since the beginning of February, the price of Bitcoin has fluctuated between $90,000 and $100,000, and the market has failed to break through this range continuously. With the strong rise in the previous period, the market has seen profit-taking pressure. If confidence is not restored quickly, the price may remain in this range, and there may even be a downward breakthrough. However, in Yu Jianing's view, the current decline is likely to be a technical adjustment rather than a long-term trend reversal. In the medium and long term, Bitcoin prices are expected to re-enter the upward channel after the current adjustment. Potential macroeconomic catalysts including the continued inflow of funds attracted by ETFs, the strategic allocation of institutional investors, and the expectation of a rate cut by the Federal Reserve may all drive prices to warm up.

02 Regulatory attitudes are clearly divided

Another piece of news related to cryptocurrency has also attracted market attention in recent days. Members of the South Dakota legislature postponed a vote that could allow the state to invest in Bitcoin, which effectively killed the bill.

Although Trump had loudly declared during his presidential campaign that he would promote Bitcoin to become a national "strategic reserve asset," there are now large differences in attitudes towards this matter within the United States. Although many states have proposed bills to establish strategic reserves of Bitcoin, some states, such as Montana, have vetoed them.

Turning our eyes to the world,regulatory attitudes towards cryptocurrencies in various countries are also clearly divided. For example, the European Central Bank strongly opposes the inclusion of Bitcoin in its reserves. However, the Czech National Bank is evaluating the possibility of allocating 5% of its reserves to Bitcoin, arguing that its low correlation with traditional assets can enhance diversification.

Some people have high hopes for Bitcoin as "digital gold", while others worry about its high risks. Overall, the different understandings and emphases of the nature of virtual assets in different countries, as well as the different balance considerations for financial stability, innovation potential and capital flows, determine the differentiated positioning of Bitcoin. Developed economies generally adopt a cautious regulatory route, while Asia shows an extreme contrast, with Japan and Singapore moving towards institutional acceptance and Hong Kong, China vigorously developing the virtual asset industry. "In general, the strictness or relaxation of supervision directly affects the development space and innovation momentum of the virtual asset market, but it also exacerbates the problem of risk control at another level," said Yu Jianing.

It is worth noting that the concept of using Bitcoin as a strategic reserve is theoretically attractive, especially its scarcity and decentralized characteristics make it a tool to hedge against inflation and financial system instability. However, there are still many risks and obstacles in practice, including the volatility of Bitcoin prices, which makes it difficult to predict its value in the short term; the global financial system has different regulatory attitudes towards Bitcoin, and the legal frameworks of many countries have not yet fully adapted to virtual assets. International coordination and consensus have also become a major obstacle. Yu Jianing predicts that in addition to the United States, which may accelerate the promotion of Bitcoin reserve-related bills under the leadership of the new Trump administration, there is a relatively high possibility that some regions will implement Bitcoin as a strategic reserve, especially those countries that have experienced high inflation, currency depreciation or financial crisis, which may tend to consider Bitcoin as a reserve asset. For example, El Salvador, as the first country in the world to use Bitcoin as legal tender, still insists on buying Bitcoin for reserves despite external pressure. Other countries such as Argentina and Venezuela, which have long been troubled by high inflation and currency depreciation, may also be more open to Bitcoin and consider it as an alternative to stabilize foreign exchange reserves. In addition, some economies with a strong sense of financial innovation, such as some countries in the Middle East, especially those rich in oil resources, may also consider Bitcoin as a new type of strategic reserve asset.

Joy

Joy