The decline without reason is depressing, but the rise without reason is also worrying.

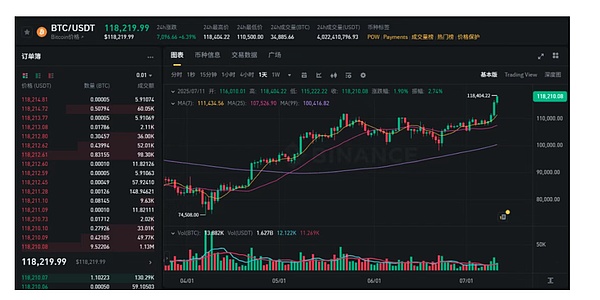

The crypto market in the past two days has smelled the smell of "bull". Not only did Bitcoin continue to rise, breaking through $118,000 and constantly setting new historical highs, ETH also regained its life, rising all the way to break through $3,000, becoming the leader of the crypto market. From the overall point of view, the crypto market is showing an overall upward trend, with a total market value of $3.7 trillion, up more than 1% in 24 hours.

The market is enjoying the sweet rain of the rise, but also wondering about the reason for the rise. After all, no one wants to be attracted by false prosperity to stand guard on the mountain. But the problem seems to be here, what is the logic of this round of rise?

Where is the benefit?

In fact, to find out the real reason for the rise is as absurd as trying to prove that "your mother is your mother". Attribution is essentially a wrong association, but there must be a cause for every effect, which is the operating logic that the market is more accustomed to. However, the changes in the macro environment seem to be limited, and the driving force of a single event is too small. If it is to be linked to the cause, I am afraid that there is only one explanation, which is the resonance of multiple factors.

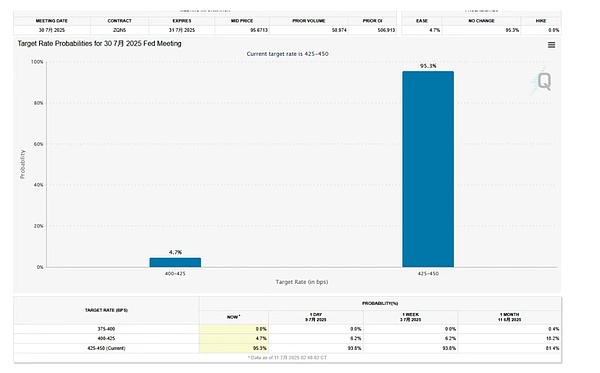

From the perspective of the old-fashioned macro environment, there are mixed blessings and worries, and environmental uncertainty still exists. Countries around the world are still fighting on tariffs. The tariff letters of the United States have been released one after another, making a number of countries anxious. However, as tariffs have become a common weapon, the global market has become accustomed to this tool. Although the big stick is still waving, it has long since caused panic like Liberation Day. On the other hand, looking back to the United States, according to data released by the U.S. Department of Labor on the 3rd, the U.S. non-agricultural sector added 147,000 jobs in June, and the unemployment rate was 4.1%, a decrease of 0.1 percentage points from the previous month. The employment data was significantly better than market expectations, which once again reduced the possibility of the Fed cutting interest rates. The latest CME "Fed Watch" data showed that the probability of the Fed keeping interest rates unchanged in July was as high as 95.3%.

Fortunately, although the probability of a recent rate cut is declining, the probability of a rate cut in the medium and long term is continuing to increase. In addition to Trump's renewed attack on social media, Fed Governor Waller, who is regarded as one of the hot candidates for the next Fed chairman, made it clear that the Fed should still discuss the issue of rate cuts at the July interest rate meeting, and San Francisco Federal Reserve Bank President Daly also expressed support for two rate cuts this year. Although there is no more unified opinion on rate cuts, the split consensus among committee members clearly reflects that this process is accelerating.

From the perspective of the industry, the overall positive trend continues. In terms of regulation, major bills have made corresponding progress. The Stablecoin Genius Bill is only one step away from being delivered to the president, and the US Digital Asset Market Clarity Act has also begun to go through the Senate process. The approval of altcoin ETFs has also ushered in the dawn. Although the US SEC has not successfully passed any altcoin ETF, according to crypto journalist Eleanor Terrett, the SEC is working with various trading platforms to develop a general listing standard for cryptocurrency ETFs, which is still in the early stages. If the cryptocurrency meets the standards, the issuer can skip the 19b-4 process and directly submit the S-1 document, and wait 75 days for the trading platform to put it online. This method can save the issuer and the SEC a lot of paperwork and time for repeated comments.

The opening of a new regulatory cycle has given rise to strong institutional demand. First, the existing Bitcoin and Ethereum ETFs continue to flow in, showing the optimistic attitude of institutions. On July 9, the Bitcoin spot ETF had a net inflow of $218 million, and the Ethereum spot ETF had a net inflow of $211 million, with net inflows for five consecutive days and four consecutive days, respectively. The second is the "crypto vault" trend of listed companies that has been very popular in recent months. Metaplanet and Murano from the hotel industry, Semler Scientific and DDC from the cultural and medical industry, and even manufacturers and technology companies have started to deploy one after another, following Strategy's unique cryptocurrency reserve strategy. The reserve range ranges from Bitcoin to Ethereum, and then continues to spread to BNB, SOL, XRP and other wider currencies. The real money obtained by convertible bonds has driven the growth of the crypto market. Keyrock statistics show that the corporate group headed by Strategy currently holds a total of 725,000 bitcoins, of which Strategy holds 597,000 bitcoins, and the total amount of bitcoins held by companies accounts for about 3.6% of the total supply of Bitcoin.

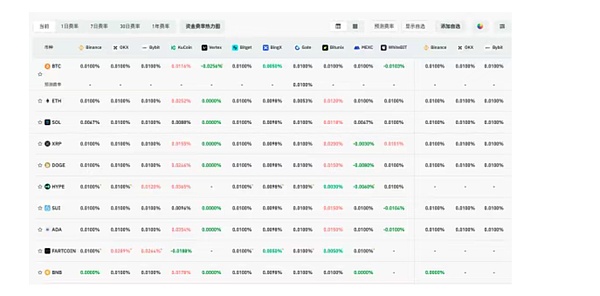

From the perspective of external events, the foreseeable interest rate cuts, regulatory opening cycles and institutional buying sprees have jointly promoted the improvement of fundamentals, but from the perspective of data, the reasons for the rise are even more interesting. Although BTC and ETH have both broken new highs, they have not increased in volume, and the trading volume performance is quite average. On the other hand, the data on the exchange inventory continues to decline, especially during the rising period of the past week, the decline rate has accelerated significantly. Corresponding to this is the increase in the number of long-term holders. The latest "Bitcoin Monthly Report" released by ARK Invest pointed out that the total amount of Bitcoin held by long-term holders has reached 74% of the total supply, a proportion that has set a new high in the past 15 years.

From this point of view, the reason for the rise seems to be very simple - there are fewer sellers. Buyers are gradually increasing, but the number of people willing to sell is decreasing, and even sellers have a tendency to hoard coins, causing prices to rise, but the volume has not increased. The turnover rate data also illustrates this point. The Bitcoin turnover rate within 24 hours is already a new high in the past 7 days, but it is only 3.51, and the trading activity is limited. But in a positive sense, the low activity will make the chip concentration stronger. From the perspective of support, the current Bitcoin chip range has further increased to 104,000-108,000 US dollars. Glassnode's report also expressed a similar view, believing that the current price rebound of Bitcoin is mainly driven by leveraged funds, and the spot demand is insufficient. The core reason is that various investors have been tightening the supply with strong fund-raising, and the market volatility has been compressed, causing the market to become extremely sensitive to any demand shock.

Does the stock market drive the currency market?

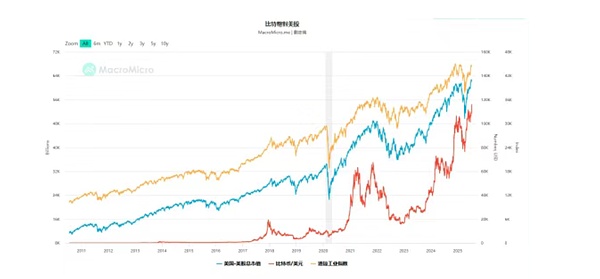

It is worth emphasizing that the linkage between the crypto market and the US stock market is becoming closer. As can be seen from the figure below, Bitcoin and the market value of US stocks are highly positively correlated. From the data, the Nasdaq index and the S&P 500 have both hit new highs in the past two days, which is very synchronized with the time when Bitcoin reached a new high. In addition, using individual stocks to correspond to BTC, Nvidia's market value of 4 trillion US dollars on July 9 also reflects the consistent trend of the currency and stock trends. This also seems to show that the risk market including crypto assets is ushering in a new round of easing cycle.

An interesting phenomenon is that Bitcoin continues to hit new highs, but the market's voice is decreasing, and people in the currency circle are more concerned about the price performance of Ethereum. The reason is that Bitcoin has risen to such a high level that it has divided the circle from the price, and retail investors can no longer reach it. On the other hand, Ethereum has a stronger ecological spillover effect, and altcoins also use it as a weather vane. Today, most altcoins are still more than 80% lower than their previous highs, which also makes the market have natural expectations for Ethereum. At present, affected by the positive factors such as pledge and RWA, and from the perspective of the BTC/ETH exchange rate, ETH is still in the undervalued range. Today, ETH has returned to $3,000, and there are also traces to follow.

What's more interesting is that this round of altcoin market seems to have appeared in the stock market. With the rise of the crypto market, the performance of companies holding coins through backdoor listings continues to improve. From today's point of view, coin holding stocks have collectively risen. As of press time, the SOL version of "MSTR" Upexi has risen by more than 3.2%, and the Ethereum version of "MSTR" SharpLink Gaming has risen by more than 8%. Looking at the companies that hold coins through backdoor listings, most of their main businesses are relatively bleak, and they only rely on the premium of the net value of the coins they hold, becoming another form of "copycat coins".

On the other hand, compared with the previous "watching the fire from the other side of the river", this wave of cryptocurrencies has also had a miraculous effect on the A-share and Hong Kong stocks. The concept of stablecoins is popular in the United States, and A-shares and Hong Kong stocks will naturally not miss this wave of hot spots. Since June, the stablecoin concept sector has been extremely active, with many stocks such as Jida Zhengyuan, Huafeng Microfiber, Xinzhi Software, Sifang Jingchuang, and Hengbao Shares rising significantly. Puxing Energy even rose by more than 280% during the day due to a news of "subscribing to Series A preferred shares issued by HashKey Holdings", and the closing increase reached 141%, showing the market's enthusiasm for stablecoins and digital currencies. Just yesterday, the Party Committee of Shanghai State-owned Assets Supervision and Administration Commission held a central group study meeting to study the development trends and response strategies of cryptocurrencies and stablecoins. He Qing, Secretary of the Party Committee and Director of the Municipal State-owned Assets Supervision and Administration Commission, pointed out that it is necessary to adhere to innovation-driven, maintain a keen sense of emerging technologies, and strengthen research and exploration of digital currencies. It can be foreseen that the attention of local governments in China may give the concept of stablecoins more hype and narrative space.

Is there still controversy in the market outlook?

Back to the topic, whether it is hype or betting, under the joint effect of multiple factors such as macro recovery, favorable supervision, parallel stock market and institutional demand, the crypto market is showing an upward trend. This is an objective reality, and the subsequent trend of the market has also become the focus of heated discussion.

The vast majority of institutions and traders hold very positive views, especially optimistic about Ethereum. Today, JackYi, founder of LDCapital, posted on social media that Ethereum's breakthrough of $3,000 marks the official start of the bull market in the crypto industry, and said that it has released research reports many times since $1,450, repeatedly emphasizing firm confidence and advising investors not to short.

Bitwise CIO Matt Hougan said that the rise in Bitcoin prices is mainly due to the relentless demand meeting limited supply, and companies and ETFs buying in large quantities. In addition, it is expected that Bitcoin will exceed $200,000 by the end of the year, and the acceleration of institutional and corporate funds will drive prices up sharply.

Trader Eugene posted in his personal community, "Ethereum has only broken through $2,800 three times in history, and the price quickly rushed to around $4,000 after each breakthrough. History will not simply repeat itself, but it often has similar rhymes. I will continue to hold my long positions and prepare for a crazy journey." Trader AguilaTrades was more direct, increasing his 20x long position in Bitcoin to 3,000 BTC on Hyperliquid.

Of course, facing the aggressive bull market, retail investors who have been educated countless times before have also expressed a very cautious attitude. Some people even said that such a high-intensity sudden rise is suspected of short squeeze. Judging from the funding rate data of Coinglass, mainstream exchanges mostly maintain a base rate of 0.01%, reflecting that the market has not yet reached the point of full bullishness.

It is definitely a good thing to be cautious in the current market, but from the perspective of the superposition of internal and external mechanisms, the probability of crypto assets ushering in a new cycle in the second half of the year is increasing significantly. The long-awaited bull market may be just around the corner, but whether everyone's assets from the last bull market will come back is still a big question mark.

Alex

Alex

Alex

Alex Brian

Brian Weiliang

Weiliang Joy

Joy Miyuki

Miyuki Brian

Brian Weiliang

Weiliang Miyuki

Miyuki Joy

Joy Joy

Joy