Source: On-Chain Mind, compiled by Shaw Jinse Finance When it comes to Bitcoin, miners are almost the insiders we are most familiar with. Their reserves, income, and behavior not only reflect the health of the network, but also often foreshadow the direction of the market. They are under constant economic pressure. How they manage funds, cash flow, and infrastructure reflects the underlying health of Bitcoin better than any chart. In this article, we will analyze the signals currently sent by miners, the structural changes affecting the industry, and the impact of these changes on Bitcoin and mining stocks. Ignore these signals, and you will miss an important piece of the puzzle.

Cooling Network Demand: Bitcoin's average block size has declined, indicating a lull in network activity despite record-high prices.

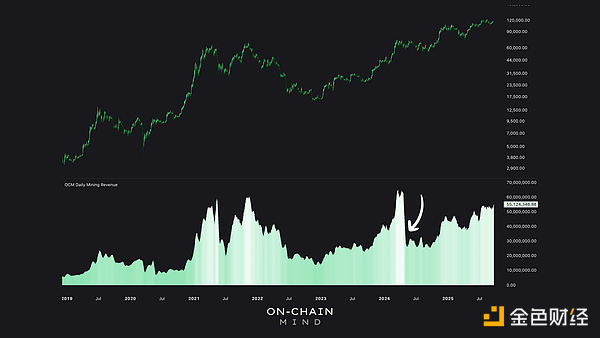

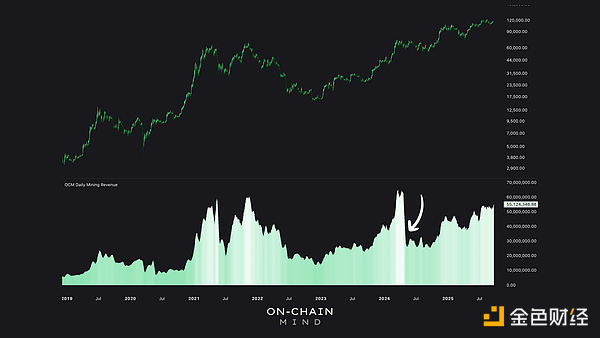

Robust Miner Economics: Even after the halving, daily revenue remains at multi-cycle highs.

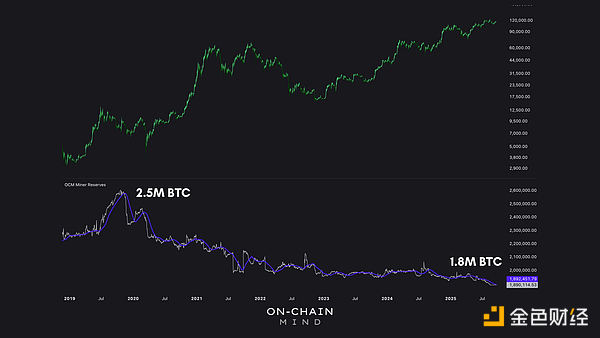

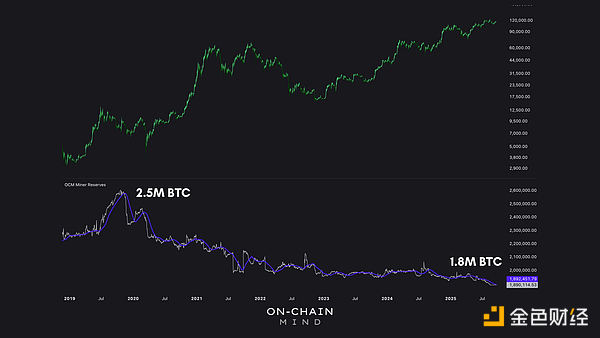

Structural Changes in Reserves: Miners are consistently distributing tokens rather than hoarding them, signaling the industrialization of the sector.

Stocks and Bitcoin: Mining stocks are highly correlated with Bitcoin but are currently overbought, making them a risky alternative to directly holding Bitcoin. One of the most straightforward yet instructive metrics is average block size, measured in megabytes (MB). This measures the amount of transaction data packed into each Bitcoin block. Historically, Bitcoin's block size limit was set at 1MB in its early days, a cap introduced by Satoshi Nakamoto to prevent spam and ensure scalability. However, this cap was later increased in 2017 with Segregated Witness (SegWit), allowing blocks to reach sizes of up to 4MB under optimal conditions. Today, the average block size hovers around 1.5MB, having declined slightly in recent months despite record highs in Bitcoin prices. This doesn't mean Bitcoin is weakening—it simply reflects a temporary slowdown in demand for block space. Importantly, miners' profitability relies heavily on transaction fees, and decreased block congestion reduces their fee income. The average block size provides a real-time snapshot of demand and fluctuates with price and mass market speculation. This decline is not a danger signal for the integrity of the network; rather, it indicates a temporary decrease in transaction throughput and network usage.

This is the pulse of the Bitcoin economy—sometimes pounding, sometimes steady.

Revenue: Resilience After the Halving

The halving, which cuts the block reward in half every four years, always raises concerns that miners will be forced out of the market. However, history has shown that miners can adapt—and the recent halving was no exception.

Today, miners generate approximately $55 million in total daily revenue, a level only surpassed during a brief surge to $70,000 at the peak of the 2021 bull run and before the most recent halving.

Following the April 2024 halving, many expected revenue to contract. However, data shows that revenue is climbing and has exceeded levels seen for most of the previous cycle.

The resilience of mining is important because:

It shows that the network remains secure despite the reduction in issuance.

High revenues support infrastructure reinvestment and expansion.

Strong miner economics provide confidence for continued growth in hash rate (and therefore security).

In short, the halving has not weakened miners’ power; it has strengthened Bitcoin’s economic underpinnings.

Reserves: From Long-Term Holders to Enterprises

In 2019, miners collectively held over 2.5 million BTC. Today, that number has fallen to 1.8 million, with no signs of reversing. This extended period of decline tells a story of transformation: Early on: Miners often behaved like investors, hoarding cryptocurrencies as a speculative asset. Today: Mining has become industrialized. Operators continue to sell cryptocurrencies to maintain operations, reinvest, and manage cash flow. By gradually distributing tokens, miners can avoid "capitulation selling" - a sudden flood that causes prices to plummet. It promotes organic price discovery that relies on a diverse group of investors rather than a concentrated group.

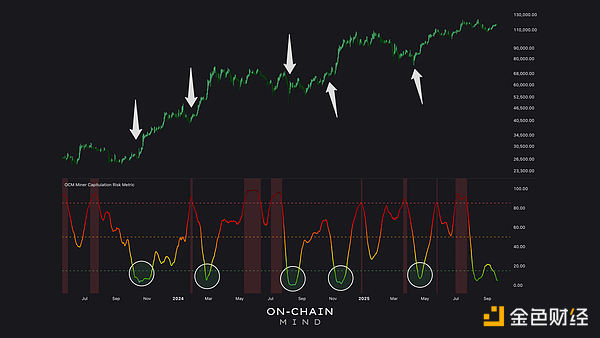

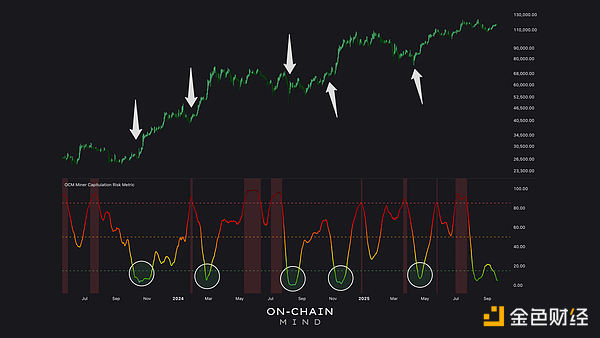

At first glance, the continued sell-off may seem bearish. But in reality, this is a positive development: It prevents miners from collectively selling their reserves and causing a sudden "supply shock." This makes Bitcoin's price discovery less dependent on miners and more dependent on broad market demand. The decline in miner reserves reflects a maturing ecosystem—one in which miners act as infrastructure providers rather than speculators. Capitulation Risk Pressure Levels: Nothing matters more in Bitcoin than whether miners are forced to sell. To track this, we use the "Miner Capitulation Risk Indicator" to compare short-term (30-day) and long-term (60-day) hashrate averages.

Green Zones = Stable miners, with a lower risk of a massive sell-off.

Red Zones = Stressed miners, with a higher likelihood of capitulation.

Historically, green zones have been the best place to accumulate. While they are not predictive, they generally reduce downside risk.

Currently, the indicator is dark green. This is important because:

It suggests miners are in good financial shape and unlikely to sell off their holdings.

Historically, periods like this have often foreshadowed strong rallies due to minimal supply pressure.

Since May 2023, every low-risk reading has been followed by a strong uptrend.

This indicator provides one of the clearest windows into Bitcoin's internal health. And today, it suggests:market conditions are stable.

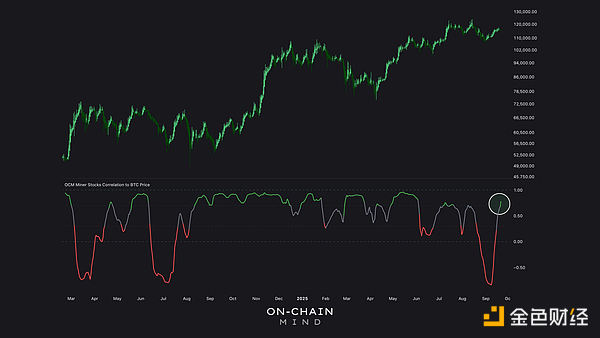

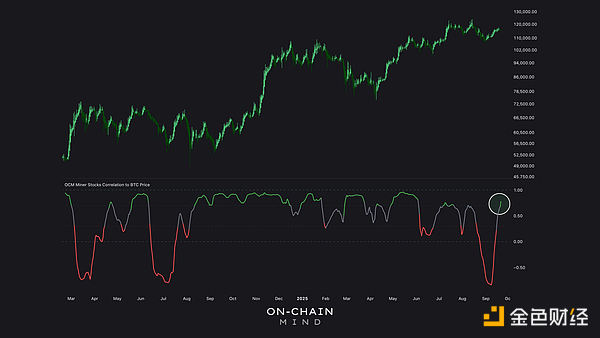

Mining Stocks: A Riskier Alternative

Publicly traded mining stocks—such as Marathon, Riot, and Hive—offer investors indirect exposure to Bitcoin. But how have they actually performed?

The Mining Stock Correlation Indicator tracks how closely these stocks are correlated with the price of Bitcoin. Currently, the correlation is very high—meaning that mining stocks move in near lockstep with Bitcoin. Mining stocks correlate with Bitcoin most of the time, and the real advantage comes from smart trading in those rare red areas.

Mining stocks function similarly to leveraged Bitcoin exposure, which can magnify gains and losses, but not entirely.

Across most meaningful timeframes, mining stocks have underperformed Bitcoin itself.

Unless you have a clear edge, holding a large investment in mining companies will increase volatility without consistent outperformance.

Personally, I wouldn't allocate more than 5% of my portfolio to mining stocks. This is a tactical investment, not a core holding. The benchmark is always Bitcoin.

Mining Stock RSI

To gauge stock momentum, we can look at the Relative Strength Index (RSI) for mining stocks.

The RSI suggests that even if Bitcoin rises, a pullback is possible due to its overvaluation.

Currently, the RSI value for mining stocks (on average) has reached its highest level since I started tracking it in early 2024. This is a double-edged sword:

On the one hand, it confirms extremely bullish momentum.

On the other hand, it warns that the sector is overextended and vulnerable to a short-term pullback.

Even if Bitcoin rises further, mining stocks could underperform simply because they have already risen too far, too fast. To me, this suggests caution is warranted.

Summary

Reviewing the data, we can see that the picture presented is remarkably consistent.

Network activity has cooled slightly, but miner revenue remains strong. Meanwhile, the way miners manage their reserves suggests the industry has matured—they're no longer hoarding Bitcoin for future profits, but operating like legitimate businesses, steadily selling to support growth and cover costs. This shift is healthy; it eliminates the risk of sudden supply shocks and allows Bitcoin's price discovery to rely more on organic demand. The most encouraging sign, in my view, is the low risk of capitulation. Miners are stable and profitable, and aren't facing significant selling pressure, which provides a positive backdrop for Bitcoin itself. However, I'm cautious when it comes to mining stocks. They typically move in tandem with Bitcoin's price, and they're currently overheated, making them a riskier alternative to directly holding Bitcoin itself. For me, the lesson is simple: Bitcoin is the benchmark. Mining stocks may offer tactical returns, but their volatility and long-term underperformance mean they'll always play a supporting role in my portfolio.

Kikyo

Kikyo