Source: Liu Jiaolian

When the house leaks, it rains all night, and when the ship is late, it encounters headwinds.

With Powell's hawkish speech on March 31, the expectation of interest rate cuts has retreated step by step.

BTC (Bitcoin) plummeted for two consecutive days on April 1 and 2, breaking through the 30-day moving average support, from a high of 71k to 65k, a drop of more than 8%.

Some people say that this is due to the weakening expectations of interest rate cuts, rising US bond yields, rising US dollar index, falling US stocks, and Bitcoin linkage.

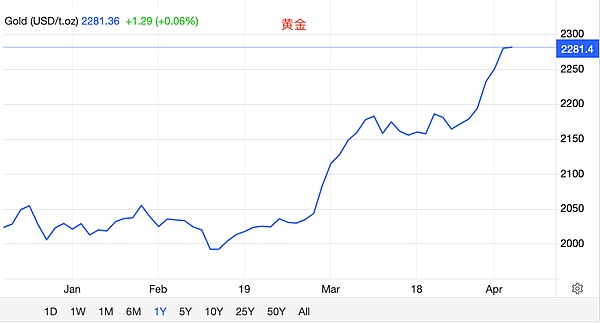

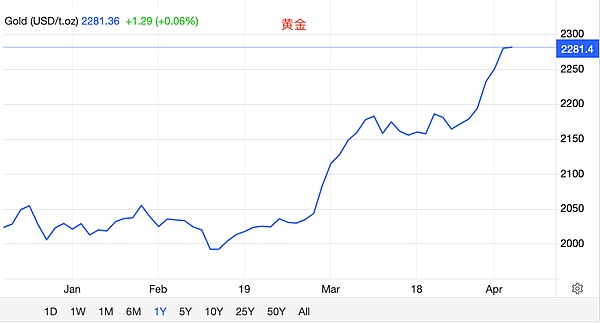

However, gold is like a wild horse that has run away, and it has continued to climb despite the weakening expectations of interest rate cuts, and has already broken through $2280. How should it be explained?

The only explanation is that the macro side is a smokescreen. The truth lurks under the false appearance.

The beauty rolls up the pearl curtain, sitting deep with frowning eyebrows.

But I see the wet tears, I don’t know who I hate in my heart.

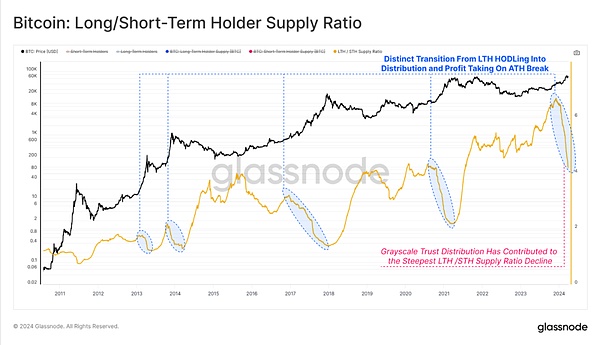

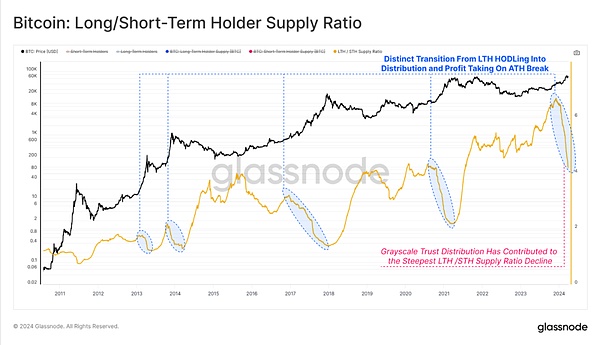

Data shows that since BTC broke through $40,000 at the end of 2023, the holdings of LTH (long-term holders, holding on the chain for more than 155 days) have been continuously declining, while the holdings of STH (short-term holders) have been correspondingly rising. This shows that old leeks are shipping, while new leeks are buying. The past three or four months have been a period of high turnover of the two groups. In the figure below, the blue curve is the LTH holdings, and the red curve is the STH holdings:

In the process of BTC rushing from 40,000 to 70,000, old leeks sold about 900,000 BTC (of which GBTC ETF sold 286,000). The new investors have accumulated 1.121 million BTC, including 900,000 BTC sold by the old investors, and 121,000 BTC from the trading platform.

Since GBTC was converted to ETF, its holdings have dropped from 620,000 BTC before the conversion to 329,000 BTC today (April 3). A 47% decrease in three months.

Some people say that the outflow of GBTC ETF has been absorbed by several other ETFs? This should be a market neutral event.

However, unfortunately, this explanation is wrong. Because the money in the hands of investors is limited and cannot be double-spending - if they take over the ETF, they cannot take over the spot sold by the old investors.

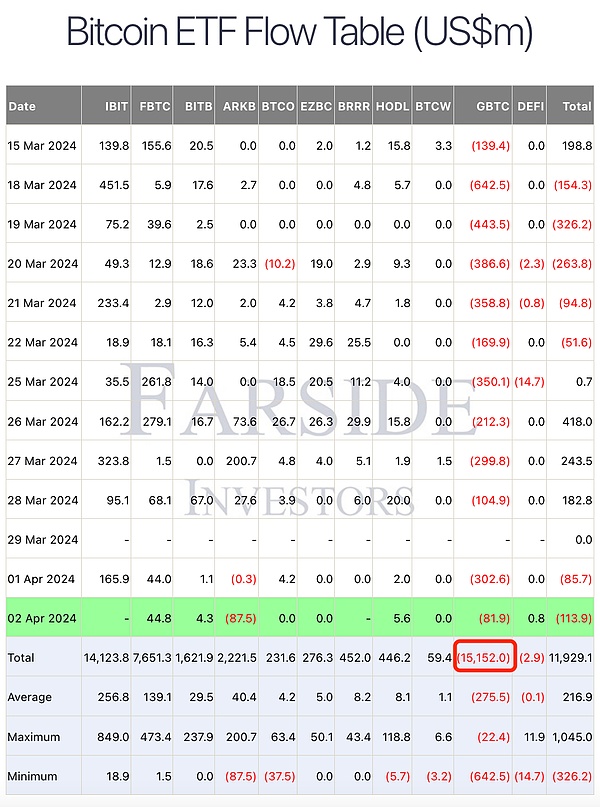

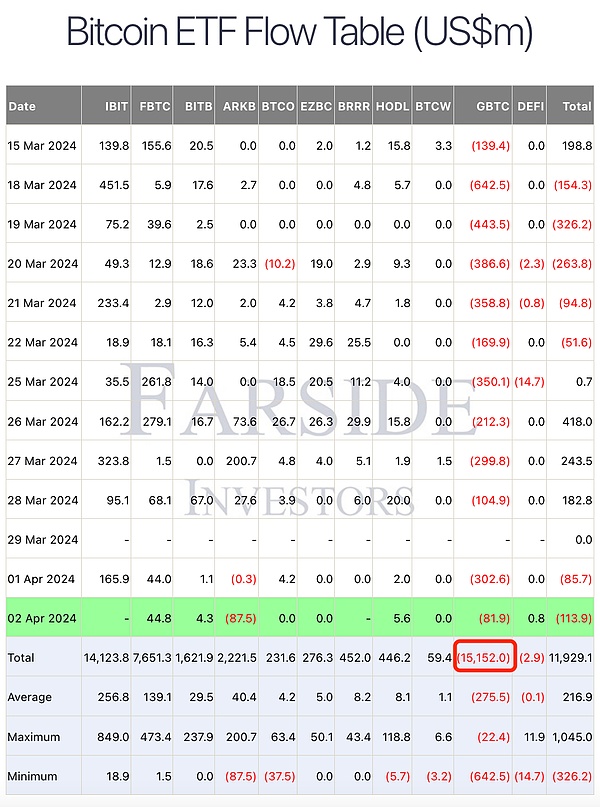

On January 25, Jiaolian pointed out that the GBTC ETF had an outflow of 4.3 billion dollars in two weeks, exceeding the 3 billion dollars expected by JPMorgan Chase. As of April 2, GBTC has outflowed more than 15 billion dollars. Look at the data in the table below:

It cannot be said that JPMorgan Chase's forecast is inaccurate, but it can only be said that JPMorgan Chase's forecast is too inaccurate. The actual blood loss is already 5 times the expected blood loss, and there is no sign of stopping the bleeding. Is it a coagulation factor deficiency?

Take advantage of your illness to kill you. Is this to take advantage of the fact that BTC is bleeding and pull gold to attract funds there?

Jianlian has said many times before that JPMorgan Chase is the global gold trader. This determines that its position is generally to exclude BTC and crypto assets. Its CEO Jamie Dimon has repeatedly spoken foul language. For example: "JPMorgan Chase CEO: Satasi will appear again and delete all Bitcoins".

This time, the old leeks' operation of reducing their positions when the price rises is no different from every previous cycle. If there is any difference, it is that this time the selling is faster and more intense. The reason is naturally due to the outflow of GBTC. See the figure below (the orange curve is LTH holdings):

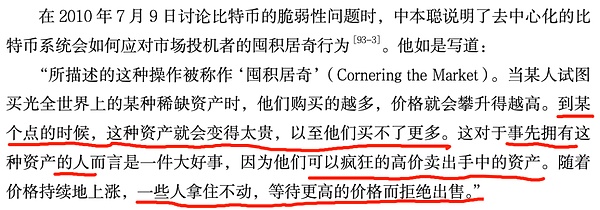

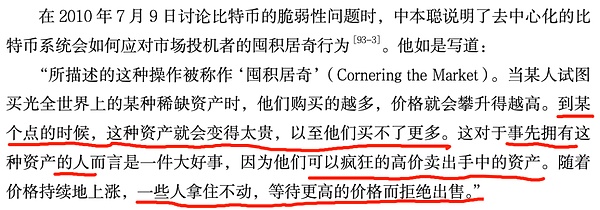

For the concerns that some people once expressed that ETFs would buy up all BTC, Satoshi Nakamoto talked about this issue as early as July 9, 2010. According to Chapter 18, Chapter 93 of Leanpub’s History of Bitcoin (https://leanpub.com/history-of-bitcoin), Satoshi Nakamoto said:

Simply put, Satoshi Nakamoto meant three things: 1. Prices will rise higher and higher, until ETFs cannot buy them; 2. Early hoarders can sell them when prices rise and take advantage of the opportunity to make a profit; 3. There are still many people who are bullish in the long term and will refuse to sell.

Since Grayscale fell into a bear market in 2022, it has turned into a negative premium. By the end of 2022, it even reached an astonishingly exaggerated level of -50% to -60%. This is equivalent to a half-price promotion. Looking back at a series of Leanpub internal references, we can see that GBTC is still a negative premium until the third quarter of 2023, although it is narrowing. "Data shows that Grayscale GBTC has no premium/discount."

Because of the iron wall of the trust, the institutions that used the positive premium to leverage arbitrage in 2020-2021 died or were disabled. Their bankruptcy transferred the benefits to the institutions that boldly bought the bottom at the negative premium in the past two years.

Buying at a discount is similar to a risk-free leverage. It is others who have helped you eat the risk. Buying at a 50% discount, the return is doubled, and the risk is halved.

If we think that the outflow of GBTC with no discount to other ETFs is a neutral event, then the discounted GBTC is not a neutral event, Jiaolian thinks so.

The funds that could have bought 1 BTC now buy 2 because of the 50% discount promotion. Then, when selling at high prices, the extra one for free is not neutral, but negative.

GBTC's negative premium was once halved. Now GBTC outflows are almost half. In terms of neutrality score, Jiaolian thinks that the loss of more than half of GBTC may be regarded as the release of negative factors. Then, GBTC may have a truly neutral impact on the market.

We can see from the chart of LTH cyclical selling and accumulation that long-term holders always reduce their positions during the bull market, and then increase their positions during the peak decline. In fact, it is not that they increase their positions during the decline, but that the new leeks who take over the old leeks and sell them during the rise have become old leeks.

The flowers are similar every year, but the people are different every year.

JinseFinance

JinseFinance