Source: Finance Magazine

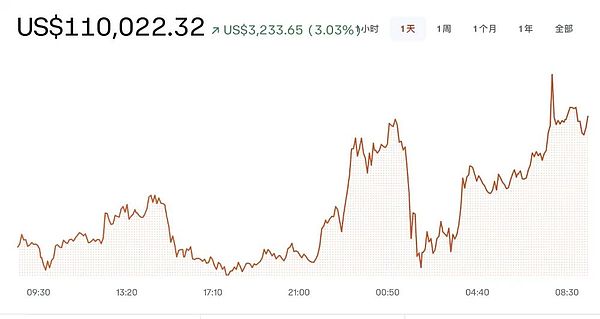

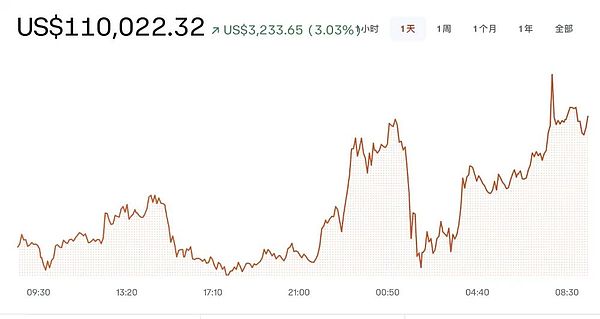

On May 22, the price of bitcoin rose to over US$110,000. As of press time, it was US$110,000.022,000.0 text="">USD/dollars, intradayrising3.03%, Another historical high.

Image source: Coinbase

So far, the total market value of Bitcoin has reached2.184trillion U.S. dollars, ranking fifth in the global asset market value ranking, second only to gold, Microsoft, Nvidia and Apple.

As the price of Bitcoin hit a new high, cryptocurrencies such as Ethereum and Solanaalso rose by more than 2%.

HashKeyGroup chief analyst Ding Zhaofei told Caixin that the sharp rise in Bitcoin was mainly due to the progress in US stablecoin legislation, the continued inflow of institutional funds, and the improvement of the macroeconomic environment.

Fundamentals

support. These factors indicate that Bitcoin will follow a more durable and mature path to hit new historical highs. Looking back at this round of Bitcoin's rise and fall, we have to start from November 2024, when Trump was elected as the US president. At that time, Bitcoin prices continued to rise, and in January 2025, it even sprinted to more than $10.9 million. But after Trump launched the tariff war in early April, the cryptocurrency market was also affected. On April 9, the price fell below $75,000. USD. Subsequently, the price of Bitcoin continued to recover, and it decoupled from the U.S. stock market at the same frequency, and it rose against the U.S. stock market and developed an independent trend. Since May, the price of Bitcoin has risen by nearly 16% in the month, while the year-to-date increase of Bitcoin is about 17%. JPMorgan Chase believes that driven by corporate demand and U.S. government support, Bitcoin may outperform gold in the second half of this year. "From mid-February to mid-April, gold's rise was at the expense of Bitcoin, while in the past three weeks we have observed the opposite, that is, Bitcoin's rise was at the expense of gold." JPMorgan Chase believes, "Overall, we expect the zero-sum game between gold and Bitcoin to continue for the rest of the year, but we are more inclined to believe that factors driven by the crypto industry itself will bring more upward momentum to Bitcoin in the second half of the year."

01 Why did it rise above $110,000?

As for the reasons for the rise in Bitcoin prices, Ding Zhaofei believes that it is the result of the joint action of multiple structural forces, including stablecoin legislation at the policy level, continuous inflow of institutional funds and improvement of the macroeconomic environment, etc.fundamentals support, etc.

local timeon May 19, the U.S. Senate formally passed the procedural vote of the GENIUS Stablecoin Act with a vote of 66 to 32. The bill aims to regulate the stablecoin market, which currently has a market value of nearly

250 billion US dollars, requiring issuers to meet strict conditions such as full reserves and regular security audits, and prohibiting the unregulated circulation of algorithmic stablecoins. If the legislation is passed, the

GENIUS

Stablecoin Actwill become the first federal legislation in the United States for stablecoins, which will have a far-reaching impact on the global crypto market. The compliance costs of virtual assets may reshape the market structure, and leading institutions may take the opportunity to consolidate their positions.

Ding Zhaofei said that the

GENIUS

Stablecoin Act

has

passed

the Senate procedural motion, and now the bill will enter the Senate plenary voting stage. Passage is inevitable, which will bring new funding channels

to the digital currency market, and hundreds of billions of new funds will be injected into the digital currency market through stablecoins. The Chairman of the Securities and Exchange Commission (SEC) of the United States has instructed staff in the policy department to begin drafting rule proposals related to cryptocurrencies. It is worth noting that after the U.S. Senate accelerated the legislative process of the GENIUS Stablecoin Act, the Hong Kong Stablecoin Regulatory Bill was passed ahead of the United States. On May 21, 2025, the Legislative Council of Hong Kong formally passed the Stablecoin Bill, establishing a clear regulatory framework for the issuance of stablecoins. In addition, in the buyer's market of Bitcoin, there is a continuous inflow of funds from institutions and retail investors.

Ding Zhaofei mentioned that Glassnodedata show that the illiquid supply of Bitcoin has reached a historical peak, indicating that the current rise of Bitcoin is not driven by retail enthusiasm, but by multiple structural forces, including institutional capital inflows, historic supply tightening and improved macroeconomic environment. In addition, spot BitcoinETFcontinues to attract capital inflows, showing that its fundamental support is strong. Even with Moody's downgrading the US credit rating and the risk-averse stock market sentiment, Bitcoin was still able to rise in the near term, further strengthening its position as a store of value. This narrative is gaining more consensus and is expected to become a long-term positive catalyst.

For the price target of Bitcoin this year, Ding Zhaofei believes that it will reach 150,000-180,000 US dollars, """""""

02 mpa-from-tpl="t">TRUMP coin dinner causes controversy

Just as Bitcoin hits a new all-time high, Trump will host the "TRUMP Gala" at the Trump National Golf Club in Washington on May 22 local time. ", this event sets a target of 220 investors with the most coin holdings to be eligible to have dinner with Trump, and the top 25 will be eligible to participate in a VIP tour of the White House. If Trump is absent, limited edition NFTs will be issued as a substitute.

This activity has caused concern, with many industry insiders believing that it provides access through transactions that directly benefit the president and has sparked criticism about potential conflicts of interest.

“This design of holding a position as a privilege directly converts political influence into a scarcity premium for digital assets, exposing that the cryptocurrency market is being alienated from a field of technological innovation to a speculative tool for symbols of power. ”Industry insiders criticized.

“

The rise of the TRUMPtoken marks the official entry of Meme culture (meme coins, cryptocurrency without asset support) into the core circle of political power. This communication model, born from Internet subculture, is reshaping the narrative logic of traditional politics. This cultural paradigm shift poses a severe challenge to the cryptocurrency industry. When politicians begin to systematically use Meme coins to harvest attention, the industry's technical idealism is being replaced by realistic utilitarianism. text="">”Ting Zhaofei said. In addition, the world's most influential cryptocurrency conference - "Bitcoin 2025 Conference " will be held in Las Vegas from May 27to

29. The guest lineup includes US Vice President Vance and Trump's son Eric. ·Trump, the world's largest listed company with the largest amount of currency holdingsStrategyfounder Michael·Seller, Vlad, CEO of zero-commission trading platform Robinhood·Tennef, etc.

Joy

Joy