Author: Tom Mitchelhill, CoinTelegraph; Compiled by: Whitewater, Golden Finance

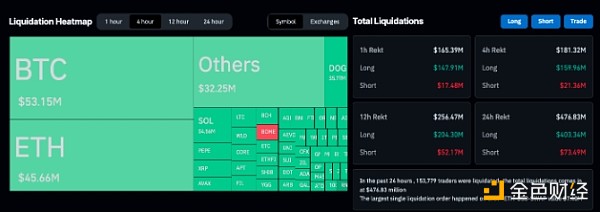

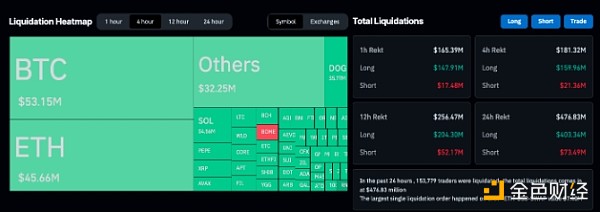

Bitcoin prices suddenly fell 5% on Tuesday, causing traders with leveraged exposure to Bitcoin and other cryptocurrencies to lose money in less than Over $165 million was lost in 2 hours.

According to data from TradingView, in the early morning of March 2nd UTC, Bitcoin traded in less than 30 minutes It plummeted 5% from $69,450 to $65,970.

On April 2, Bitcoin suddenly plummeted by more than 5%. Source: TradingView

Bitcoin’s sharp decline resulted in more than 165 million losses, according to Coinglass Leveraged US dollar positions were wiped out, with Bitcoin longs holding just over $50 million and Ethereum longs accounting for the majority.

Approximately $6 million in Dogecoin long positions and $4 million in Solana long positions were liquidated, trailing BTC and ETH.

Bitcoin’s sudden drop led to $165 million in leveraged liquidations. Source: CoinGlass

According to FarSide data, At around the same time, Bitcoin exchange trading Funds (ETFs) saw net outflows of $86 million, breaking a four-day streak of positive inflows.

BlackRock's ETF was the top-performing fund with $165.9 million in net inflows, while Fidelity's ETF saw $44 million in net inflows. Inflow ranks second.

However, inflows were dragged down by a $302 million outflow from Grayscale’s GBTC, bringing net daily outflows across all funds to $85.7 million.

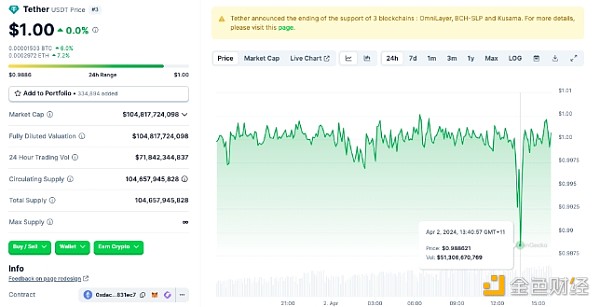

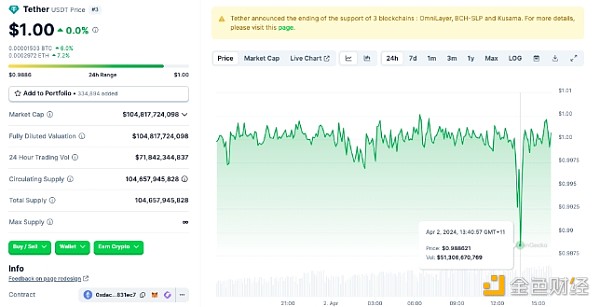

USDT briefly decoupled

At the same time as Bitcoin flash crashed, the value of USDT also fell. Tether, the U.S. dollar-pegged stablecoin, also moved around 1%, briefly falling from its $1 peg to $0.988, according to data from CoinGecko and Google Finance.

Tether experienced brief volatility on some price tracking sites. Source: CoinGecko

It’s unclear whether USDT’s volatility is a bug in some data tracker’s API, or if the currency’s value has suddenly dropped – however, the brief decoupling did not Doesn't appear on other price trackers.

JinseFinance

JinseFinance