Author: On-Chain Mind, Translator: Shaw, Jinse Finance

Bitcoin's price action hasn't followed most people's expectations. If you're still hoping the classic four-year cycle will peak in 2025, you're probably using outdated strategies.

The fact is: this cycle appears to be longer than historical patterns suggest, and the most explosive phase may yet be to come.

In this article, I'll explore why the traditional four-year cycle may be outdated, predict the possible peak date and price target for this bull market, and explain how market psychology interacts with these extended cycles.

Key Takeaways: The classic cycle is shifting: Bitcoin's historical four-year cycle pattern no longer aligns with current price movements, suggesting potentially longer cycles in the future. Linear vs. Quadratic Models: Different methods for predicting the next peak yield different dates and price ranges, presenting conservative and aggressive perspectives. Price Prediction: The linear model predicts a peak between $174,000 and $243,000; the quadratic model predicts a peak as high as $272,000 in a long-term bullish scenario.

Psychological Shift: Longer cycles can boost investor confidence, but as patience wears off, the likelihood of a sharp market top and crash increases.

Rethinking the Four-Year Cycle

For years, the Bitcoin community has clung to the clear concept of a four-year cycle, typically associated with halving events. Halving events reduce mining rewards, theoretically triggering scarcity-driven price increases.

This is certainly a reassuring narrative. Every four years, like clockwork, we prepare for a bull market, reach the peak, and then inevitably face a correction. But as someone who has meticulously studied charts and on-chain data for years, I can tell you: The market doesn't care about our seemingly perfect theories. It's constantly evolving, heavily influenced by institutional and global liquidity factors that didn't exist in Bitcoin's early days.

Rethinking the Four-Year Cycle

For years, the Bitcoin community has clung to the clear concept of a four-year cycle, typically associated with halving events. Halving events reduce mining rewards, theoretically triggering scarcity-driven price increases.

This is certainly a reassuring narrative. Every four years, like clockwork, we prepare for a bull market, reach the peak, and then inevitably face a correction.

To understand why I believe the classic cycle is waning, we need to take a step back and examine the definition of a cycle. In fact, there has never been a universal consensus on how to measure a "cycle": Some take a route from one peak to another. Some prefer a bottom-up approach. Halving events are also commonly used reference points. Some studies focus on macroeconomic or liquidity cycles.

There is no one-size-fits-all approach. Some analysts believe in the halving date, others rely on macroeconomic indicators such as M2 money supply, and many others use the turning point of the bull-bear cycle as a benchmark.

I have chosen a more comprehensive framework that combines the best elements of these methods: measuring the cycle from the low point of a bear market to the peak of a bull market.

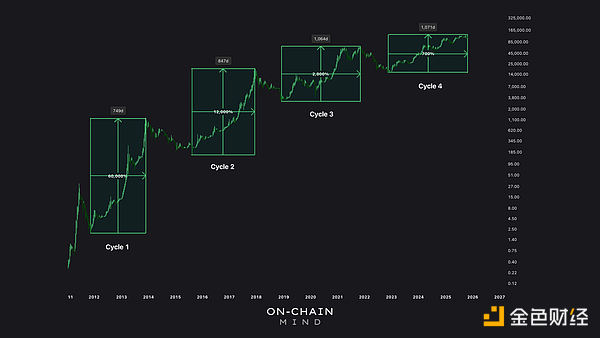

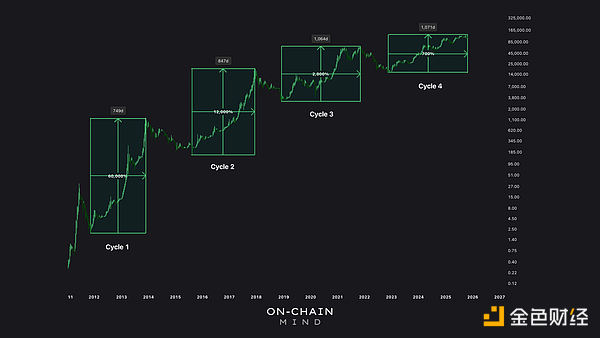

In my view, this method most clearly demonstrates the complete emotional shifts throughout the Bitcoin cycle. Examining Bitcoin's historical cycles from this perspective reveals a significant pattern: each cycle is gradually lengthening.

Period 1: Duration 749 days; Price increase 60,000%

Period 2: Duration 847 days; Price increase 12,000%

Period 3: Duration 1064 days; Price increase 2000%

Fast forward to today, our fourth cycle has passed **1071 days**. This falls exactly within a three-year cycle, remarkably consistent with historical trends. If the six-month extension prediction holds true, then the peak has not yet arrived.

A survey conducted on X shows that 62% of people believe the four-year cycle has ended. While consensus is often wrong, the data does indicate a shift in the market. There are two main methods for predicting the potential location of Bitcoin's next peak: 1. Linear Regression Model This method assumes that the cycle will continue to extend at a stable and predictable rate, similar to the previous three cycles. According to this method, the fourth cycle will last approximately **1202 days (about 3.5 years)**. Counting from the bottom of the last bear market, the potential peak of the bull market may occur around **March 2026**. Linear regression is the most conservative model. It assumes that Bitcoin will continue to move along its historical trajectory without significant acceleration. 2. Quadratic Model A more complex approach considers the phenomenon of accelerated cycle lengthening. By fitting data from the first three cycles, the model predicts the fourth cycle will last approximately 1400 days (3.5 to 4 years), suggesting its peak may occur around September 2026. This approach reflects the compounding effect over longer periods: the market not only extends in time but also absorbs higher prices and investor confidence in the process. Predicting Fair Value Prices and Market Tops To quantify potential valuations, I used a logarithmic growth band indicator. This tool can plot Bitcoin's long-term price movement and account for diminishing returns as the asset matures.

1. Linear Regression Model

According to the linear regression model, the fair value of Bitcoin is approximately $106,000 by March 2026, with an upper limit close to $243,000 and a lower limit of approximately $52,000. During a typical bull market frenzy, the price of Bitcoin may fluctuate between $174,000 and $243,000, reflecting the phenomenon that prices often exceed fair value later in the cycle.

2. Quadratic Model

In the quadratic model scenario considering the extended period of acceleration, the fair value rises to approximately $126,000, with a potential peak between $199,000 and $272,000.

The Psychology of Long-Term Cycles

Long-term cycles are not just about dates and prices, but also a psychological game. The longer Bitcoin consolidates, the more likely high prices will become the norm.

Davin

Davin