Author: David Lawant;Compiled by: Qin Jin, Carbon Chain Value< /p>

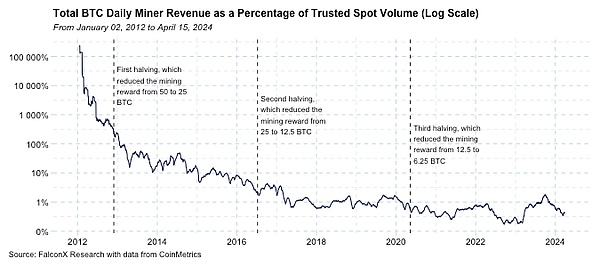

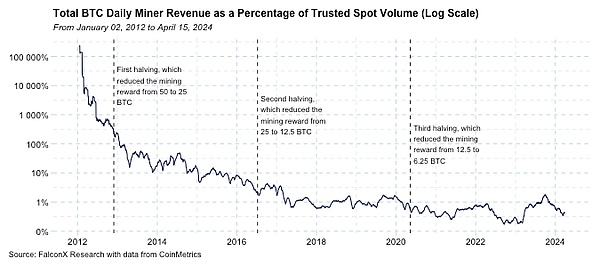

To understand the dynamics of Bitcoin halving, the most critical chart is the one below, not the price chart. It shows the ratio of total mining revenue to Bitcoin spot trading volume since 2012, with three halving dates noted.

While miners remain an integral part of the Bitcoin ecosystem, their influence on price formation has significantly diminished. In 2012, total mining revenue accounted for multiples of daily transaction volume, reaching double digits in 2016, but over time, this impact has narrowed significantly.

Even this analysis is only an upper limit estimate of the importance of miner traffic in the formation of BTC prices, because not all mining revenue will be affected. Half of the impact is that not all mined BTC will be sold.

However, this does not mean that the Bitcoin halving will not have an impact on BTC in the coming months, as it has in the past three cycles It's important to do that. Bitcoin halving events tend to occur at key monetary policy turning points, so it would be perfect to assume that they don’t affect price. This is where things get interesting. The halving event finally demonstrates Bitcoin’s primary immutability guarantee:its 21 million supply cap.

A strange phenomenon is that the Bitcoin halving also occurs at a time when traditional monetary policy has exposed its fragility. This juxtaposition helps clarify Bitcoin’s core investment case to a wider range of investors.

In 2020, these concerns surround what Paul Tudor Jones calls "The Great Monetary Inflation," which This article opens the door for mainstream macro investors to consider Bitcoin investment thesis. I believe this is a more important factor in the 2020-2021 bull market than the direct traffic impact from the halving.

It's 2024, and the focus is on fiscal reforms that have been in place for decades but have been strengthened in a world very different from four years ago. / In terms of the consequences of monetary policy, the implementation of these policies is being accelerated.

We are likely to enter a new stage of the macroeconomic cycle, and the macroeconomics is becoming a more critical factor affecting the price trend of BTC. Even if the direct impact of the Bitcoin halving on the price is not as large as before, it is very exciting for Bitcoin to demonstrate its immutability in a macro environment where its raison d’être shines brightest.

JinseFinance

JinseFinance