During the Spring Festival, Chinese people are immersed in family joy, but the encryption market is difficult to calm down.

On the one hand, thanks to the increase in funds brought by spot ETFs, Bitcoin has reversed its previous downward trend, continued to perform strongly, and began to recover the previous price difference. , and broke through $50,000 on February 14, setting a new high since December 2021, and then remained fluctuating around $51,000.

On the other hand, the much-watched Coinbase Q4 financial report announced that Q4 revenue reached US$954 million, achieving quarterly profit for the first time in two years. On an annual basis, Coinbase Inflows of assets under custody were $7 billion, with assets under custody at the end of the year at $101 billion. According to its CEO, Coinbase currently manages 90% of the $37 billion in Bitcoin ETF assets, but this revenue was not included in the Q4 quarter, so its custody revenue will further increase in fiscal 2024.

On one side, the price of Bitcoin continues to hit new highs, and on the other side, Coinbase is full of money visible to the naked eye. All of this seems to be the most consistent with the public impression. It has nothing to do with the traditional banking industry in the United States, where “custody” is one of its main businesses.

In this context, U.S. banks finally couldn’t sit still.

Bitcoin surges, Coinbase earnings report is eye-catching

February coincides with the Chinese New Year, which is full of flowers, and Bitcoin seems to have caught up with this wind of blessing. During the Spring Festival, Bitcoin experienced a surge. On February 9, Bitcoin rose to US$47,000. On February 11, it exceeded US$48,000. On February 14, Bitcoin exceeded US$50,000 and once reached US$52,700. , then continued to oscillate at US$51,000, and is now trading at US$51,624, up more than 26% in 7 days.

Bitcoin price trend, source: Binance

From a market perspective When it comes to the reasons for the increase, although the halving is gradually approaching, it mainly comes from the net inflow of funds brought by Bitcoin spot ETFs. Judging from the data, as of February 15, the total number of Bitcoin holdings in 11 ETFs has exceeded 720,000. Although Grayscale is still in a sell-off state, with a total outflow of 15.97 coins, other ETFs are in an inflow state. According to a post on the X platform by CoinShares research director James Butterfill, as of February 14, the total net inflow of U.S. spot Bitcoin ETFs has exceeded $4 billion. According to data from BitMEX Research, the Bitcoin spot ETF saw a net inflow of US$2.2734 billion last week, and the total net inflow since January 11 reached US$4.9269 billion.

Coincidentally, Coinbase’s Q4 quarterly financial report was also released after the market closed on February 16. Overall, the financial report is undoubtedly extremely eye-catching. Affected by high compliance costs and supervision, Coinbase's performance after listing was far inferior to that of large offshore exchanges such as Binance. Especially in the past two years, the market downturn directly led to a double decline in Coinbase's performance and stock price. However, in 23 In the last quarter of the year, Coinbase finally ushered in a rare perfect ending.

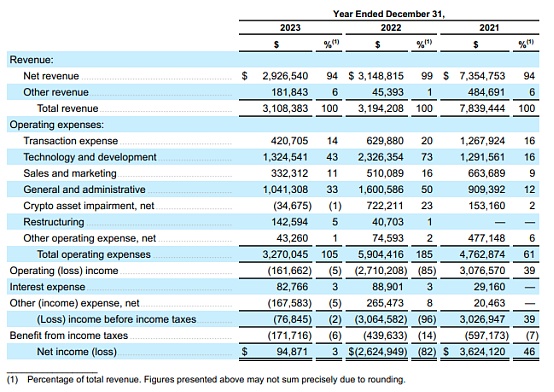

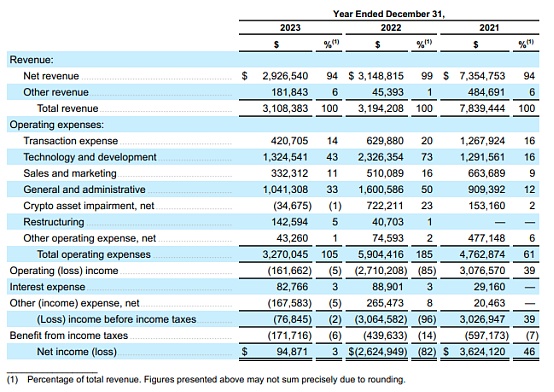

Affected by the rise in the cryptocurrency market, Coinbase turned a profit in the fourth quarter, achieving a net profit of US$273 million, fully reversing last year's performance During the same period, it suffered a loss of US$557 million, but for the full year, it achieved net income of US$95 million and adjusted EBITDA of nearly US$1 billion, with total revenue reaching US$3.1 billion.

Coinbase's income, source: Coinbase official website

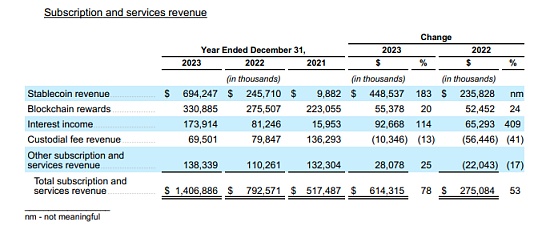

A closer look at the financial report, Coinbase Revenue is mainly divided into two parts, one is transaction revenue, and the other is subscription and service revenue. From the perspective of trading revenue, due to the relatively sluggish crypto market last year, Coinbase's trading revenue throughout the year is still showing a downward trend. The overall trading revenue in 2023 will be US$1.5 billion, a year-on-year decrease of 36%. The total trading volume was US$468 billion, a year-on-year decrease of 44%; the ordinary user trading volume was US$75 billion, a year-on-year decrease of 55%, and the institutional trading volume was US$393 billion, a year-on-year decrease of 41%.

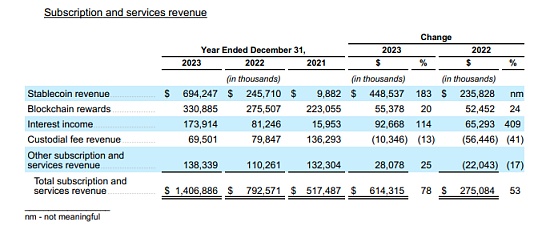

However, a decline in transaction revenue was offset by a rise in subscription and services revenue. The total subscription and service revenue for the year was US$1.4069 billion, with the most obvious growth in the fourth quarter, achieving subscription and service revenue of US$375 million, an increase of 12%. The main driving factors for the growth were stablecoin income and interest Revenue and blockchain rewards (staking and price escalation factors). Among them, stablecoin revenue was US$171.6 million, higher than US$145.7 million in the same period last year; blockchain rewards were US$95.1 million, higher than US$62.4 million in the same period last year; custody fee revenue was US$19.7 million, higher than US$145.7 million in the same period last year. Compared with US$11.4 million in the same period last year; interest income was US$42.6 million, higher than US$36.5 million in the same period last year; other subscription and service revenue was US$46.5 million, higher than US$26.7 million in the same period last year.

Coinbase subscription and service revenue, source: coinbase official website

It is worth noting Unfortunately, in this financial report, due to the adoption of the ETF in January 24, the custody income of the Bitcoin ETF, which has attracted much attention, was not recorded. As the custodian of 8 major institutions among the 11 spot Bitcoin ETFs, It currently has custody of about 90% of ETF assets, and this revenue will be disclosed in the Q1 quarter of 2024, which means that Coinbase's revenue still has a lot of room for growth. Indeed, according to the CEO, the company expects first-quarter subscription and service revenue to be between $410 million and $480 million.

Bitcoin continues to grow, and the corresponding direct institutional profits are also becoming increasingly prominent. This has undoubtedly attracted the "red eyes" of other institutions, and they cannot sit still. It is the U.S. banking industry that was previously skeptical of encryption. After all, from a functional perspective, the business of fund custody is the main source of income for many banks.

Judging from the timeline, before 2020, only specific crypto custodians can provide cryptocurrency custody services, and they need to be licensed by the state. The procedures for issuance of trust charters by financial regulatory agencies are complex and cumbersome. At that time, although there were no actual laws and regulations prohibiting banks from hosting cryptocurrency, due to risk and size considerations, there were very few banks engaged in this field.

The situation was improved until July 22, 2020, when the Office of the Comptroller of the Currency (OCC), an independent agency under the U.S. Department of the Treasury, issued an open letter clarifying that the national bank and the Federal Savings Association have the legal right to custody cryptocurrency assets. Since then, many banks, led by Bank of New York Mellon, have begun to get involved in the crypto asset custody business.

The good times did not last long. After experiencing the FTX incident in 2022, the U.S. authorities realized that there was a possibility of transferring crypto asset risks to systemic risks, and crypto regulations were quickly withdrawn. tight. Three major federal banking regulators issued a joint statement emphasizing the risks of crypto-asset risks to banking institutions, implying that banks should not engage in crypto-related business. In January 2023, the U.S. Federal Reserve Board (FRB) decided to reject applications for membership of cryptocurrency-focused custodian banks. From 2022, the consensus thatbanking regulators were cautious and skeptical about cryptocurrencies and their exposure to the financial system was essentially embedded throughout the financial industry until the passage of the Bitcoin Spot ETF this year.

On February 14 this year, SEC Chairman Gary Gensler received a special Valentine’s Day letter. The letter was sent by the Bank Policy Institute, the American Bankers Association, the Securities Industry and Financial Markets Association, and the Financial Services Forum, requesting that they amend Staff Accounting Bulletin (SAB) 121 to improve the situation in which cryptocurrencies are restricted in the banking industry.

Screenshot of letter sent by banking institutions to SEC, source: American Bankers Association official website

The communiqué was published by the SEC on April 11, 2022. The communique regulates cryptocurrency custody and requires financial institutions, credit unions and banks that provide crypto custody services to retain a certain amount of funds to support their customers. digital assets. To put it simply, in order to ensure transparency, the custodian institution needs to include crypto assets in the liability column of the balance sheet, and to ensure the balance of assets and liabilities, the asset column should also increase by the same amount. This will undoubtedly increase the custody cost of the custodian institution. , and also violates the basic principle of equal treatment of assets.

The letter clearly expresses dissatisfaction with this provision and believes that regulated banking organizations are prevented from providing digital asset protection services on a large scale, and investors and customers, as well as the financial system as a whole, will be negatively affected. It also emphasized that the on-balance sheet requirements, combined with the overly broad definition of “crypto-assets” in SAB 121, will have a chilling effect on banking organizations’ ability to develop distributed ledger technology (DLT) applications.

The SEC certainly does not agree with this, saying that accounting guidance is necessary. Compared with other assets held by banks for customers, crypto assets have unique characteristics. Risks and uncertainties, it is important to maintain transparency and risk hedging. Gary Gensler even bluntly stated in an interview that "the cryptocurrency industry lacks appropriate and necessary disclosures related to securities."

In fact, it is not just the banking industry that has expressed dissatisfaction with the regulations. The differences in attitudes towards encryption between the two parties also make the regulations face challenges. Huge controversy.

As early as August 22, Senator Lummis sent a letter to the U.S. Comptroller General questioning whether the regulation complies with the provisions of the Congressional Review Act. the rule of. Later, in January 2023, Cynthia Lummis and U.S. Representatives Mike Flood and Wiley Nickel once again introduced a resolution to determine that the announcement had no legal effect. As of November 23, the resistance to SAB 121 has not stopped, with a memo from members of Congress asking for clarification on the Government Accountability Office (GAO) findings and questioning its enforceability.

Judging from the current results, although the game between the two parties is still continuing, the attitude has been expressed very clearly. Compared with the previous dismissive attitude , the current Bank of America hopes to actively participate in the custody of Bitcoin ETFs, obtain custody fees and possible other fees, and begin to put pressure on regulators for this purpose.

In the long term, due to security considerations, the status quo of Coinbase alone will inevitably be unsustainable, and the increase in the diversity of custody institutions is also an objective trend. The intervention of mature banks has a positive effect on the development of the encryption industry. On the one hand, it can force custody institutions to improve security and transparency and reduce custody costs; on the other hand, this move has once again increased the mainstream popularity of crypto assets. From a common sense point of view, banks have always been the most important part of the financial system. Banks’ access to crypto will once again lower the threshold for crypto assets and broaden channels for public participation.

Of course, the accounting regulations will not be adjusted in the short term, and this wave of bank operations will inevitably be suspected of being eager for quick success, but the world is bustling. , all for profit, and there is no shame in wanting to get a piece of the pie. As Bitcoin gradually enters the mainstream, spectators will eventually become accustomed to the reversal drama of Hedong and Hexi in the past 30 years.

Brian

Brian