Author: Jesse Coghlan, CoinTelegraph; Compiler: Wuzhu, Golden Finance

Analysts at cryptocurrency exchange Bitfinex said that Bitcoin once fell below $91,000, and After nearly 90 days of trading in a narrow range, Bitcoin is at a "critical moment."

In the three months when market momentum stagnated, Bitcoin traded between $91,000 and $102,000, and "remains at a critical moment after nearly 90 days of consolidation," analysts said in the Bitfinex Alpha report on February 24.

Analysts said: "The momentum required for a sustained breakout has been insufficient, which has led to a period of contraction and consolidation across almost all major crypto assets."

Bitcoin fell more than 4.5% in the past 24 hours, hitting a low below $91,00 - its lowest price since late November, according to CoinGecko. The broader cryptocurrency market also fell 8% in the past day, falling from more than $3.31 trillion to about $3.09 trillion.

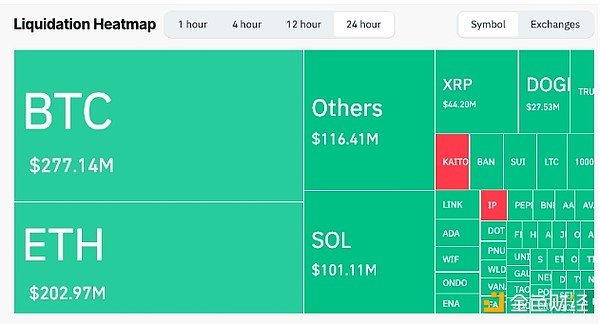

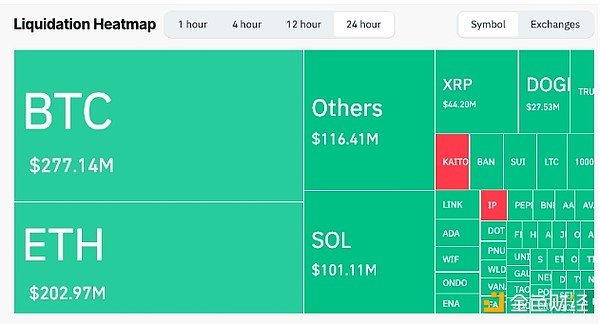

The plunge in the cryptocurrency market triggered a wave of liquidations, with more than $961.65 million in liquidations in the past day, including $891.52 million in long bets and $70.14 million in short bets, according to CoinGlass data.

Bitcoin long bets accounted for the largest share of liquidations, with more than $277 million in liquidations in the past day.

Bitcoin long bets led the liquidations in the cryptocurrency market over the past day, with total liquidations approaching $1 billion. Source: CoinGlass

Bitfinex analysts said that Bitcoin’s correlation with traditional markets is becoming increasingly strong, and a major factor affecting the stagnant cryptocurrency market is that “traditional financial markets have also seen a similar stagnation” caused by “macro uncertainty.”

The S&P 500 has fallen 2.3% over the past five trading days, while the Nasdaq Composite has fallen 4% over the same period. Bitfinex said that "broader equity market suppression has impacted risk assets, including cryptocurrencies."

Institutional demand for bitcoin through spot exchange-traded funds has also "slowed significantly," with outflows totaling $552.5 million per trading day in the week ending February 21, the analysts added.

Bitfinex said that weaker consumer confidence and further rising inflation expectations pose challenges to the overall U.S. economy.

The company noted that the February 21 University of Michigan Consumer Survey found that U.S. consumer confidence fell 10% in February from January to its lowest level in 15 months, reflecting "growing concerns about inflation and economic uncertainty," which could slow consumption.

Bitfinex analysts also said that a series of tariffs proposed by President Trump "are adding to inflationary pressures" and offsetting some of the progress made towards deflation over the past two years.

Catherine

Catherine