Author: Matt Hougan, Chief Investment Officer, Bitwise; Ryan Rasmussen, Head of Research, Bitwise; Translated by: 0xjs@黄金财经

2024 is a significant year for cryptocurrencies.

Cryptocurrency prices soared to all-time highs, spot Bitcoin ETFs had the most successful launch ever, and pro-cryptocurrency politicians won a landslide victory in Washington.

But we foresee a brighter future: 2025 will usher in the golden age of cryptocurrency. Here are 10 predictions for 2025.

Prediction 1: BTC, ETH, and Solana will hit all-time highs, and BTC prices will exceed $200,000.

Prediction 2: Bitcoin ETFs will attract more capital flows in 2025 than in 2024.

Prediction 3: Coinbase will surpass Charles Schwab to become the world's most valuable brokerage firm, and its stock price will exceed $700 per share.

Prediction 4: 2025 will be the “year of the crypto IPO,” with at least five crypto unicorns going public in the U.S.

Prediction 5: Tokens launched by AI agents will lead a meme coin craze that’s even more frenetic than in 2024.

Prediction 6: The number of countries holding Bitcoin will double.

Prediction 7: Coinbase will be included in the S&P 500 and MicroStrategy will enter the Nasdaq 100, adding crypto to the portfolio of nearly every U.S. investor.

Prediction 8: The U.S. Department of Labor will relax guidance on restrictions on crypto in 401(k) plans, prompting billions of dollars to flow into crypto assets.

Prediction 9: Stablecoin assets will double to $400 billion as the U.S. passes long-awaited stablecoin legislation.

Prediction 10: Tokenized real-world assets (RWAs) will be worth more than $50 billion as Wall Street embraces cryptocurrencies.

Bonus prediction: Bitcoin will surpass the $18 trillion gold market by 2029, with each Bitcoin priced at more than $1 million.

Introduction

2024 was a landmark year for cryptocurrencies. Bitcoin surged to a new all-time high of $103,992 (up 141.72% year-to-date as of this writing), helped by the record launch of a U.S. Bitcoin spot ETF with $33.56 billion in assets. Other major crypto assets also surged: Solana was up 127.71% for the year, XRP was up 285.23%, and Ethereum soared 75.77%. Meanwhile, crypto stocks like MicroStrategy and Coinbase surged 525.39% and 97.57%, respectively.

Record prices aren’t the only noteworthy development. Cryptocurrencies have come to the fore in the 2024 U.S. election, bringing a brighter outlook for U.S. cryptocurrency regulation. President-elect Trump championed cryptocurrencies on the campaign trail, vowing to build a strategic Bitcoin reserve and restructure the U.S. SEC, which has historically been hostile to cryptocurrencies. He also nominated Scott Bessent as Treasury Secretary, who has said that “cryptocurrency is about freedom, and the crypto economy is here to stay.” Congress is leaning heavily toward cryptocurrencies heading into 2024, with pro-crypto candidates defeating crypto opponents in several key races. We expect crypto-friendly legislation to be introduced in the coming months.

Add to that the upcoming global stimulus from China and other major central banks, rising institutional adoption, and rapid improvements in blockchain technology, and the outlook for 2025 looks pretty bright.

We recently convened the Bitwise elite to look ahead to 2025. Our take: We are entering a golden age for cryptocurrencies. What exactly can we expect in 2025? In the following pages, we lay out our top predictions for the year ahead.

Please note: As with all forecasts, these are not guarantees, but our best educated estimates. The future is complex and conditional, and whether these forecasts come to pass exactly as stated will depend on many complex factors. None of the following constitutes investment advice.

Prediction 1: BTC, ETH, and Solana will hit new all-time highs, with BTC price exceeding $200,000

The big three in cryptocurrencies — BTC, ETH, and Solana — outperformed all major asset classes in 2024, rising 141.72%, 75.77%, and 127.71%, respectively. Meanwhile, the S&P 500 returned 28.07%, gold returned 27.65%, and bonds returned 3.40%. We expect this momentum to continue into 2025, with BTC, ETH, and Solana all rising to new all-time highs. Our price targets for each asset are as follows:

BTC: $200,000. Record inflows into Bitcoin ETFs push Bitcoin to new all-time highs in 2024. We don’t see this slowing down anytime soon (see Prediction 2). Combine this demand with the reduction in new supply due to the April 2024 halving, plus new purchases by businesses and governments… well, we’ve seen this before. (Note: $200,000 would become $500,000 or more if the U.S. government implements its proposal to establish a 1 million Bitcoin strategic reserve.)

ETH: $7,000. Despite Ethereum’s 75.77% gain in 2024, the second-largest crypto asset has lost favor with many investors, who have either looked to Bitcoin or the fast-growing programmable blockchains that compete with Ethereum. But, as Warren Buffett’s aphorism goes, “Be fearful when others are greedy, and be greedy when others are fearful.” We expect a narrative shift in Ethereum in 2025 as activity on second-layer blockchains like Base and Starknet accelerates and Ethereum spot ETFs attract billions of dollars in inflows. Another catalyst? Massive growth in stablecoins and tokenized projects built on Ethereum.

Solana: $750. The crypto phoenix, rising from the ashes of the 2022 market crash, soars to new heights in 2024, fueled by a meme coin frenzy that makes the GameStop saga look mundane. We think Solana’s momentum is just beginning to build. The catalyst for 2025 will be “serious” projects migrating to the network to supplement its meme coin dominance. We’re already seeing early examples with projects like Render. We expect this to accelerate in the year ahead.

Catalysts:

Institutional investment

Corporate buying

Large brokerage approval

US strategic Bitcoin reserve

Better regulatory/political environment

Bitcoin halving leads to tight supply

Layer 2 expansion

Macro windfall (rate cuts, China stimulus)

Increased allocations (3% is the new 1%)

Potential headwinds:

Prediction 2: Bitcoin ETFs will attract more inflows in 2025 than in 2024

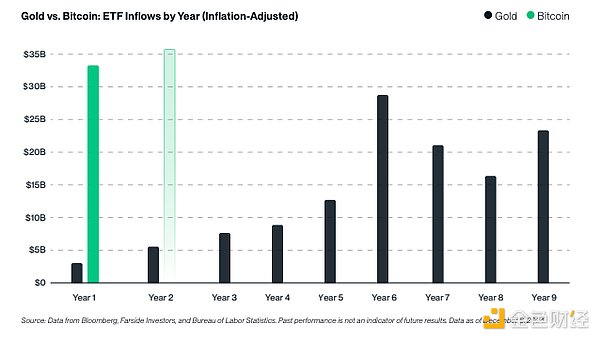

When U.S. Bitcoin spot ETFs launched in January 2024, ETF experts predicted that the group would see inflows of $5 billion to $15 billion in the first year. They exceeded the upper end of that range within the first six months. Since launching, the record-breaking ETFs have attracted inflows of $33.6 billion. We expect inflows to exceed that figure in 2025.

How is this possible? Three reasons:

The first year is typically the slowest for ETFs: The best historical analogy for Bitcoin ETF launches is the launch of gold ETFs in 2004. They started strong that year with $2.6 billion in inflows, and everyone was excited. But look what happened in the subsequent years: $5.5 billion in year two, $7.6 billion in year three, $8.7 billion in year four, $16.8 billion in year five, and $28.9 billion in year six (data adjusted for inflation). The key point is: the inflows in year two exceeded the first, consistent with the gold example. It would be unusual for the inflows to taper off.

Major Brokerages Coming Online: For Bitcoin ETFs, the world’s largest brokerages—from Morgan Stanley and Merrill Lynch to Bank of America and Wells Fargo—have yet to unleash their armies of wealth managers, who have been largely blocked from accessing these products. We believe this will change in 2025, and the trillions of dollars managed by these firms will begin to flow into Bitcoin ETFs.

Investors Gradually Increase Allocations—3% Is the New 1%: In the seven years that Bitwise has helped investment professionals enter the cryptocurrency space, we have observed a clear pattern: Most investors start with a small allocation and then gradually increase it over time. We suspect that most investors who buy a Bitcoin ETF in 2024 will double down in 2025.

Prediction 3: Coinbase will surpass Charles Schwab to become the world's most valuable brokerage firm, and its stock price will exceed $700 per share

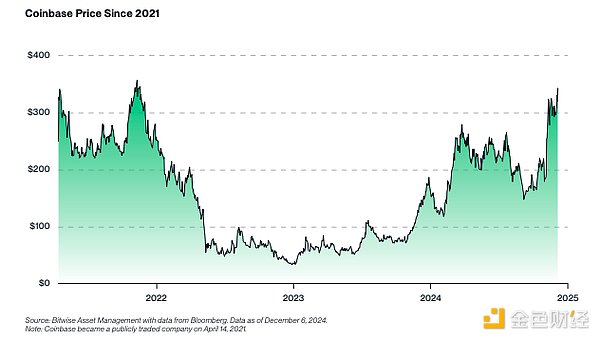

Entering 2023, investors can buy Coinbase stock at $35. Today, it trades at $344, up nearly 10 times. We think it can go even higher. Much higher.

Our prediction: Coinbase stock will trade above $700 per share in 2025 (more than double today's price). This would make Coinbase the most valuable brokerage firm in the world, surpassing Charles Schwab.

Our prediction: Coinbase stock will trade above $700 per share in 2025 (more than double today's price). This would make Coinbase the most valuable brokerage firm in the world, surpassing Charles Schwab.

Why? Coinbase is more than just a brokerage firm. There are three major catalysts that will help it get there:

Stablecoins: Coinbase's stablecoin business is booming, thanks to its partnership with USDC issuer Circle. So far this year, stablecoin revenue has grown by $162 million (up 31%). If we are right about the trajectory of stablecoins, this trend should continue.

Base: Last year, Coinbase launched Base, a new L2 network built on Ethereum. It is now the top L2 in both transactions and total locked value. With growth comes revenue—lots of it. Base now generates tens of millions of dollars in revenue per quarter, and we expect that number to grow as more developers, users, and capital flow into the ecosystem.

Staking and Custody Services: As of Q3, these two businesses generated $589 million in revenue. That’s an increase of $304 million (106%) year-over-year. Both businesses are driven by asset balances and net flows of new assets. We expect both to increase significantly by 2025, driving annual revenue for these business lines to over $1 billion.

Prediction #4: 2025 Will Be the “Year of the Crypto IPO,” With At Least Five Crypto Unicorns Going Public in the U.S.

The past few years have been quiet on the crypto IPO front. But we expect a slew of crypto unicorns to go public in 2025.

Why now? The context for publicly traded crypto companies today is very different than in previous years. Cryptocurrency prices are rising, investor demand is growing, institutional adoption is soaring, blockchain technology has gone mainstream, the macro environment is favorable, and - perhaps most importantly - the political environment has heated up. This has created conditions for many of the industry's largest companies to go public.

Here are five candidates for possible IPOs in 2025:

Circle: As the issuer of one of the largest stablecoins, USDC, Circle has been actively preparing for its public debut for some time. Circle's strong position in the stablecoin market and its ongoing expansion into new financial services may prompt it to IPO.

Figure: Figure is known for using blockchain technology to provide a variety of financial services such as mortgages, personal loans, and asset tokenization. The company has reportedly been exploring an IPO since 2023, and now may be the right time given Wall Street's growing obsession with tokenization.

Kraken: As one of the largest cryptocurrency exchanges in the United States, Kraken has been considering an IPO since at least 2021. The company's plans have been delayed due to market conditions, but it may regain momentum in 2025.

Anchorage Digital: Anchorage provides infrastructure services for digital assets and has a diverse client base that includes investment advisors, asset managers, and venture capital firms. The company’s status as a federally chartered bank and its comprehensive crypto services could lead to a public listing.

Chainalysis: Chainalysis’s position as a market leader in blockchain compliance and intelligence services makes it a prime candidate to enter the public markets in 2025. The company’s unique product and growth trajectory make it likely to enter the public markets, especially given the increasing importance of compliance in the crypto industry.

Prediction 5: Tokens Launched by AI Agents Will Lead a Memecoin Mania Even Bigger Than 2024

As we head into 2025, it looks like we’re in for a memecoin mania even bigger than 2024. We think tokens launched by AI agents will lead the way.

For example, a16z’s Marc Andreessen’s recent interaction with an autonomous chatbot called Truth Terminal led the AI agent to promote a little-known meme coin, GOAT. What started out as a quirky experiment quickly became an asset with a market cap of over $1.3 billion, demonstrating the huge potential when you combine AI with the wild world of meme coins.

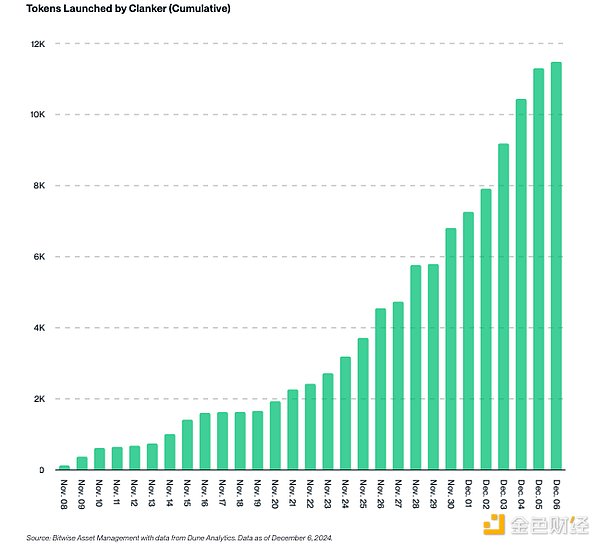

But the breakthrough we’re most excited about is Clanker, an AI agent designed to autonomously deploy tokens on Coinbase’s second-layer scaling solution, Base. Users simply tag Clanker in a post on Farcaster, tell the AI agent to launch a token with a given name and image, and it will automatically deploy the token.

In less than a month, Clanker has already launched over 11,000 tokens (and generated over $10.3 million in fees). We believe AI-launched tokens will drive a new meme coin craze in 2025.

Will these meme coins ever have actual use? Unlikely. Will most of them go to zero? Yes. But they represent an interesting collision of two groundbreaking technologies—AI and cryptocurrency—that’s worth keeping an eye on.

Prediction 6. The number of countries holding Bitcoin will double

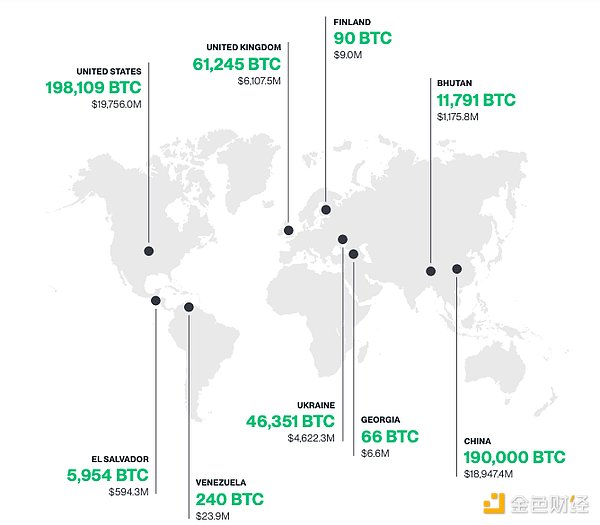

We don’t know if the United States will establish a strategic Bitcoin reserve in 2025. It is definitely possible. Senator Cynthia Lummis has introduced a bill that requires the United States to purchase 1 million Bitcoins within five years, and President-elect Trump also supports the idea. But Polymarket believes that the probability is less than 30%, and how can we go against the prophecy of truth?

However, our point is that this does not matter. The fact that the United States is actively considering establishing a strategic Bitcoin reserve will trigger a global race for governments to buy Bitcoin before it is too late. You’ve seen lawmakers from Poland to Brazil introduce bills to push for strategic Bitcoin reserves in their countries.

According to BitcoinTreasuries.net, nine countries currently hold Bitcoin (led by the United States). We expect that number to double by 2025.

Prediction 7. Coinbase will enter the S&P 500 and MicroStrategy will enter the Nasdaq 100, adding cryptocurrency exposure to almost every American investor’s portfolio

The average American investor has no cryptocurrency exposure. Cryptocurrency is a new asset class that many investors either don’t understand or simply don’t choose. But nearly every investor owns a fund that tracks the S&P 500 or the Nasdaq 100. Many hold exposure to both.

However, so far, these indexes have excluded the largest publicly traded cryptocurrency companies, Coinbase and MicroStrategy. We expect that to change as early as this month, at the next major reorganization of the two indexes. And the impact could be significant.

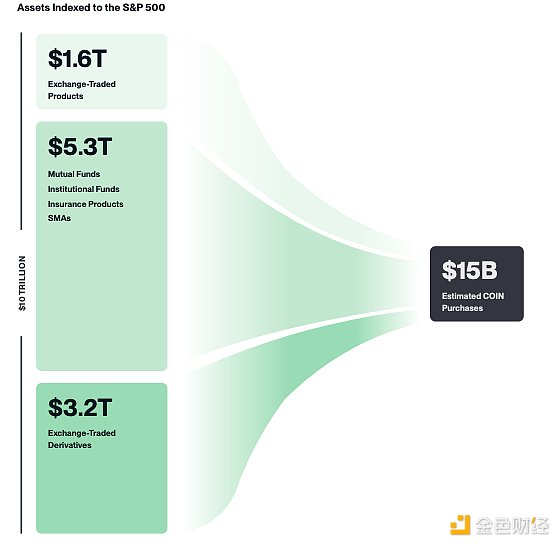

Consider this: $10 trillion in assets track the S&P 500 directly, and another $6 trillion is “benchmarked to the index.” If Coinbase entered the index, we expect funds would have to buy about $15 billion of the stock. If funds benchmarked to the index added Coinbase, that would be another $9 billion purchase.

Given the relative size of funds tracking the Nasdaq 100, the expected impact from MicroStrategy is smaller, but still significant.

Prediction 8. The U.S. Department of Labor will relax its guidance on cryptocurrencies in 401(k) plans, allowing billions of dollars to flow into crypto assets

In March 2022, the U.S. Department of Labor issued guidance that "warns 401(k) plan trustees of the significant risks of adding cryptocurrency investment options to their plans." The Department of Labor even said it would "launch an investigation program to protect plan participants from these risks."

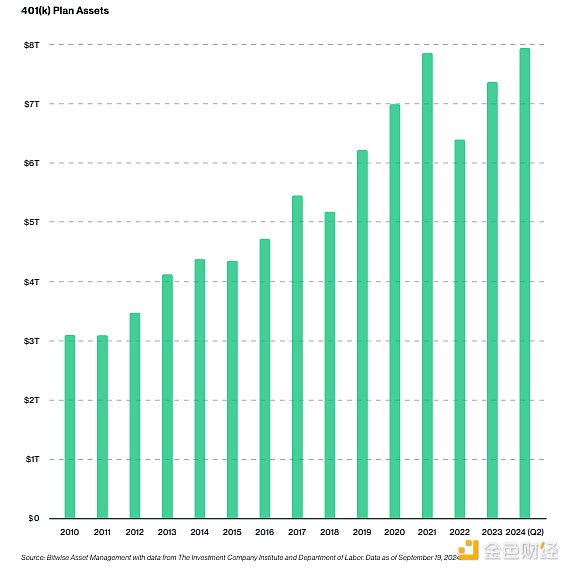

The U.S. 401(k) plan holds $8 trillion in assets. More money flows into these funds every week. If cryptocurrencies account for 1% of 401(k) assets, that's $80 billion in new capital entering the field, and there will be a steady inflow of funds thereafter. 3% would be $240 billion.

This is a big deal. With the new administration in Washington, we expect the DOL to soften the guidance.

Why should you care? There are at least $80 billion reasons.

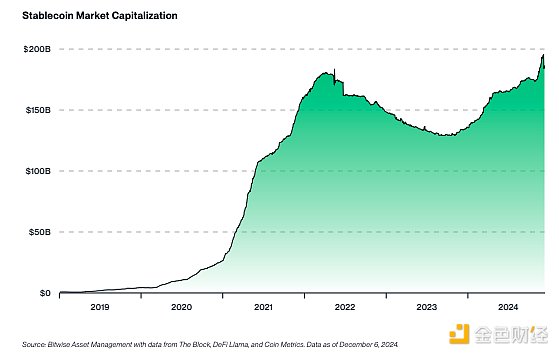

Prediction 9. Stablecoin assets will double to $400 billion as the U.S. passes long-awaited stablecoin legislation

The stablecoin boom in 2025 will see the market value of stablecoins reach $400 billion or more. Four catalysts will drive growth:

Stablecoin Legislation: The lowest hanging fruit for the new regime of pro-crypto policymakers in Washington is the passage of comprehensive stablecoin legislation. Clear answers to big questions like who regulates them? What are the appropriate reserve requirements? will spark huge new interest from issuers, consumers, and businesses. When that happens, expect some big traditional banks like JPMorgan to enter the space.

Fintech Integration: Payments giant Stripe spent $1.1 billion to acquire stablecoin platform Bridge in October, calling stablecoins "superconductors for financial services" due to their speed, accessibility, and low costs. PayPal launched its own stablecoin (PYUSD) in 2023, and Robinhood recently announced plans to launch a global stablecoin network in partnership with several crypto companies. As stablecoins penetrate popular fintech applications, we expect stablecoin assets under management (AUM) and transaction volumes to soar.

Global Trade and Remittances: Stablecoins are already eating into the global payments and remittances market. The $8.3 trillion in stablecoin transactions we see in 2024 is only slightly lower than Visa's $9.9 trillion in payment volume during the same period. Additionally, stablecoin giant Tether recently financed a $45 million crude oil trade with its USDT stablecoin, clearly demonstrating the potential for stablecoins to facilitate large-scale global trade. As digital dollars continue to disrupt these massive markets, demand for stablecoins will grow.

Bull Market Growth: Finally, there is the most obvious catalyst, the “bull market”. When the crypto economy expands, stablecoin AUM tends to expand. We are bullish on cryptocurrencies in 2025, so we are also bullish on stablecoins.

Prediction 10. As Wall Street's acceptance of cryptocurrencies grows, the value of tokenized real-world assets (RWAs) will exceed $50 billion

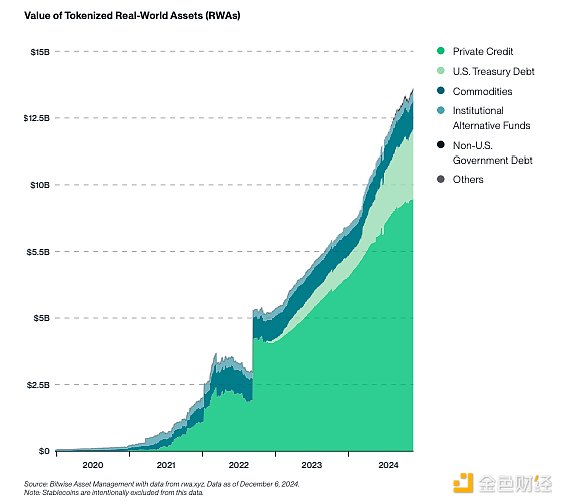

Three years ago, the crypto industry "tokenized" less than $2 billion in real-world assets (such as private credit, U.S. debt, commodities, and stocks). Today, the market is worth $13.7 billion. What explains this huge growth? Why tokenize real-world assets - that is, represent real assets on the blockchain?

Simply put: tokenization is better. It provides instant settlement, costs far less than traditional securitization, and has round-the-clock liquidity - while bringing transparency and accessibility to nearly every asset class.

That’s why BlackRock CEO Larry Fink, the one-time Bitcoin skeptic turned tokenization maximalist, says that “the next generation of markets will be the tokenization of securities.” Worth emphasizing: Those words come from the leader of the world’s largest asset manager.

We agree. In our view, Wall Street is only just beginning to wake up to this, which means big institutional money could soon be pouring into tokenized real-world assets.

How much? We believe that by 2025, the tokenized real-world asset market will be $50 billion — with the potential to grow exponentially from there.

Apparently we’re not the only ones who think this: venture capital firm ParaFi recently predicted that the tokenized real-world asset market could grow to $2 trillion by 2030, while the Association for Global Financial Markets predicts $16 trillion.

Bonus Prediction: Bitcoin will surpass the $18 trillion gold market by 2029 with a price of over $1 million per bitcoin

When making predictions, people tend to look one year ahead. But why? We are long-term cryptocurrency investors at Bitwise, so let's look further ahead.

We believe Bitcoin will surpass the gold market by 2029. At gold's current market capitalization, this would mean Bitcoin prices will rise to over $1 million per coin.

Why 2029? Bitcoin has historically moved in four-year cycles. While there’s no guarantee this will continue, 2029 will mark the top of the next cycle (and Bitcoin’s 20th anniversary). To surpass gold within 20 years of launch would be a remarkable achievement, but we think Bitcoin can do it.

(Note: Bitcoin prices could reach $1 million per coin sooner if the U.S. announces a purchase of 1 million Bitcoins for a strategic reserve.)

(Note: Bitcoin prices could reach $1 million per coin sooner if the U.S. announces a purchase of 1 million Bitcoins for a strategic reserve.)

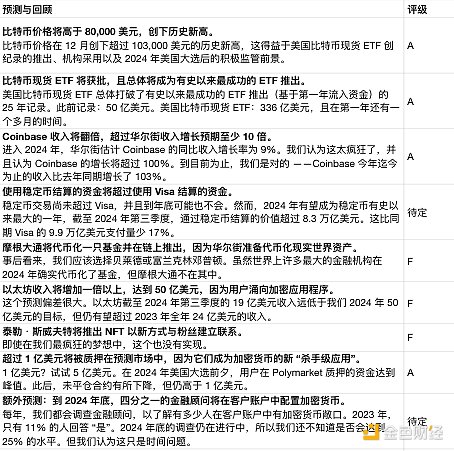

2024 Prediction Scorecard

In November 2023, the Bitwise Research team looked ahead and made 10 predictions for 2024 (plus one bonus prediction). We predicted that Bitcoin would hit new all-time highs, that a Bitcoin spot ETF would become the most successful ETF launch ever, and that Polymarket’s growth would soar. We’re happy to report: we weren’t optimistic enough.

Here are the results of those predictions, detailed in “Bitwise: A Review of Crypto Market Predictions to 2024”

https://www.jinse.cn/blockchain/3704301.html

JinseFinance

JinseFinance

JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance Bernice

Bernice Xu Lin

Xu Lin JinseFinance

JinseFinance Sanya

Sanya Beincrypto

Beincrypto