By Matt Hougan, Chief Investment Officer, Bitwise; Translated by Golden Finance. Later this week, Bitwise will release a major new research report—the inaugural "Bitwise Bitcoin Long-Term Capital Market Forecast." This report will provide data-driven forecasts of Bitcoin's returns, volatility, and correlations over the next decade. I'll share a summary of our findings at the end of this memo, but first, let me share a short story to illustrate why this report is so important. Why Long-Term Capital Market Forecasts Matter: Long-term capital market forecasts play a key role in how institutional investors construct their portfolios. Every year, major Wall Street firms and leading asset managers pool their top talent and vast amounts of data to produce in-depth reports forecasting future returns for stocks, bonds, real estate, and private credit. These reports form the foundation of many institutional investors' portfolios, providing them with core forecasts for blending assets to achieve specific return and risk objectives. They are perhaps the most important and anticipated reports released by most firms each year. Since 2017, Bitwise has been dedicated to helping professional investors capitalize on opportunities in the cryptocurrency space. Here’s how many times each year large institutional investors have asked us about our long-term capital market expectations for Bitcoin:

2017: 0

2018: 0

2019: 0

2020: 0

2021: 0

2022: 0

2023: 0

2024: 0

2025: 12

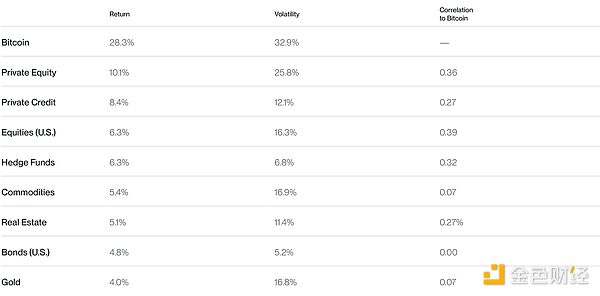

Twelve may not sound like a lot, but it's actually significant: most of the new requests are coming from large, national account platforms, which manage hundreds of billions, or even trillions, of dollars in assets. Multiply 12 by $500 billion, and you can see the sheer volume of capital involved. So, what changed? Before this year, we received zero requests for two reasons: 1) Most large platforms hadn't approved a Bitcoin exchange-traded fund (ETF); and 2) professional investors largely viewed Bitcoin as a niche, opportunistic investment. The fact that they're now asking about long-term capital market expectations suggests a shift in perspective: Bitcoin is no longer a one-time investment on the fringe of a portfolio, but is starting to be considered a core component. Bitcoin's maturation into a truly institutional-grade asset class will not happen overnight. It will require hard-won advances in processes and infrastructure, as well as the tireless efforts of many individuals. This process truly begins with the launch of spot Bitcoin ETFs in January 2024 and is gaining momentum earlier this year as these ETFs are gradually approved by national account platforms and are accelerating as these platforms begin to include Bitcoin in their model portfolios. But make no mistake: it's happening, brick by brick. What are the Bitwise Research Findings? Okay, that's all for the opening remarks. What does our research actually show? I won't reveal everything; you'll have to read the full report yourself. But I can offer a few words. Using a conservative analytical approach, we forecast that Bitcoin will be the best-performing major asset globally over the next 10 years, with a compound annual growth rate of 28.3% and steadily declining (though still elevated) volatility. The table below provides context for our forecasts by comparing them to forecasts for other asset classes from firms like JPMorgan and BlackRock.

2025-2035 Forecast: Bitcoin’s Return, Volatility, and Correlation with Major Asset Classes

Source: Bitwise Asset Management

Bitcoin return and volatility forecasts are prepared by Bitwise. Forecasts for other asset classes are an average of estimates from capital markets reports by JPMorgan Chase, PIMCO, BlackRock, and Vanguard, which may be based on different indices and date ranges. Details for each asset class are as follows: Bitcoin: Bitcoin spot price. Commodities: Deutsche Bank DBIQ Optimal Income Diversified Commodity Index Total Return. Gold: Gold spot price. Hedge Funds: Bloomberg Macro Hedge Fund Index. Private Credit: Indxx Private Credit Index. Private Equity: S&P Listed Private Equity Total Return Index. Real Estate: MSCI U.S. REIT Total Return Index. U.S. Bonds: Bloomberg U.S. Aggregate Bond Index. U.S. Equities: S&P 500 Total Return Index. Note: Traditionally, correlations between -0.5 and 0.5 are defined as "low" or "no" correlation.

For more details and the quantitative and qualitative analysis supporting our data, please read the full report.

You can sign up to receive this report and other future research from Bitwise here: https://bitwiseinvestments.com/sign-up.

JinseFinance

JinseFinance

JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance MarsBit

MarsBit Cointelegraph

Cointelegraph Cointelegraph

Cointelegraph Cointelegraph

Cointelegraph