Author: Erik Lowe, Head of Content, Pantera Capital; Translation: 0xjs@黄金财经

So far, cryptocurrencies, especially DeFi, have mainly operated in their own world. The primitives that have been built are essentially focused on meeting the needs of token holders within the DeFi ecosystem. For example, DEXs mainly support the exchange of governance, utility, or gas tokens for other similar tokens. Lending protocols allow users to borrow tokens using other tokens as collateral. There is a lot of activity, but most of it is still within the scope of the "crypto world". This raises the question: "How and when will this technology break into the world outside of blockchain?"

The answer may be earlier than we think. In fact, the fusion of the "crypto world" and the "real world" is happening.

The world's largest asset management company integrates DeFi

BlackRock has been making waves in the digital asset space since announcing the launch of a spot Bitcoin ETF last year. They recently launched their first on-chain fund called BUIDL (The BlackRock USD Institutional Digital Liquidity Fund), represented in Ethereum tokens and backed by U.S. Treasuries.

BUIDL seeks to provide a stable value of $1 per token and pays daily accrued dividends as new tokens directly into investor wallets each month. The fund invests 100% of total assets in cash, U.S. Treasuries, and repurchase agreements, allowing investors to earn yield while holding blockchain tokens. Investors can transfer their tokens to other pre-approved investors 24/7/365. Fund participants will also have flexible custody options, allowing them to choose how to hold their tokens.

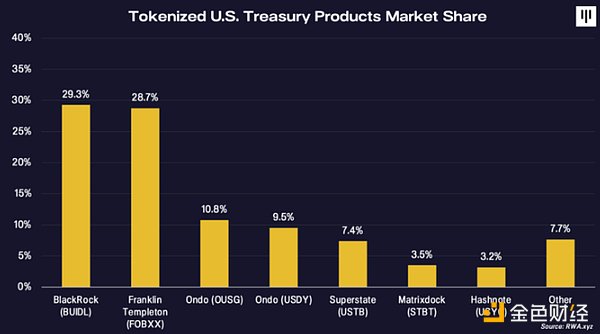

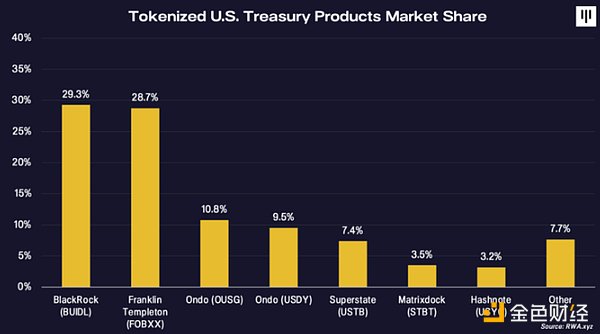

Since its launch on March 21, BUIDL has accumulated $375 million in assets, representing nearly 30% of the U.S. Treasury tokenization market. Much of this growth has been driven by Pantera portfolio company Ondo, which contributed $140 million to the fund through its on-chain Short-Term U.S. Treasury Bond Fund.

BlackRock and Franklin Templeton are leading the way in the tokenized US Treasury market, bringing RWAs ("real world assets") to the front and center. The world of centralized finance is merging with decentralized finance.

"We believe the next step will be the tokenization of financial assets. This means that every stock, every bond will basically have its own CUSIP. They will be recorded on a general ledger. Every investor will have his or her own identification number.

"We can eliminate all the problems associated with illegal activities in bonds and stocks through tokenization. But most importantly, we can customize strategies through tokenization that suit everyone....

“We believe this is a technological transformation for financial assets.”

- BlackRock CEO Larry Fink, Bloomberg TV interview, January 12, 2024

The practical benefits of tokenization cannot be ignored, which is why we believe more traditional companies will follow suit. Benefits include 24/7/365 liquidity, instant trade settlement, and reduced operational friction, features that are rarely achieved in traditional systems. This is not only a technological upgrade for financial operations, but also a strategic expansion that may ultimately enhance financial inclusion and deepen the market.

BlackRock’s BUIDL fund may promote broader integration between TradFi and DeFi. Ultimately, the distinction between traditional finance and decentralized finance may become increasingly blurred.

JinseFinance

JinseFinance