Source: Crypto Market Observer

I saw a big news this morning: BlackRock officially launched its tokenized asset fund on the Ethereum network and conducted an investment in the asset tokenization company Securitize. made strategic investments. The fund, called BlackRock USD Institutional Digital Liquidity Fund, is represented by the blockchain-based BUIDL token, is fully backed by cash, U.S. Treasuries and repurchase agreements, and will pay daily earnings to token holders via the blockchain . Securitize will serve as the transfer agent and tokenization platform, while BNY Mellon is the custodian of the fund’s assets.

BlackRock CEO, the man who pushed BTC into ETFs

BlackRock is really cool, the Bitcoin spot ETF has just passed two After many months of introducing crypto assets into traditional finance, this wave of backhand has introduced traditional financial assets into crypto.

What does this mean for some places that claim to “embrace encryption” and create “policy high ground”? (I’m talking about HK) These places are just intermediaries themselves. They don’t have their own financial markets, and they are procrastinating on policies and following others.

In a future where encryption accelerates financial globalization, I am afraid it will be really cool.

The rest of this article mainly refers to my friend’s Twitter. His views on RWA are very professional. If you have time, you can go to Twitter to read the original text:

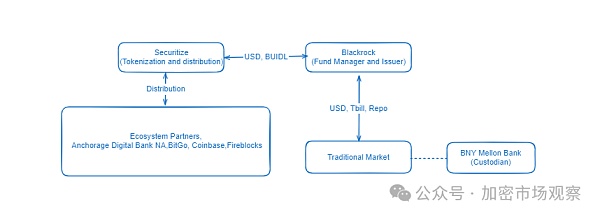

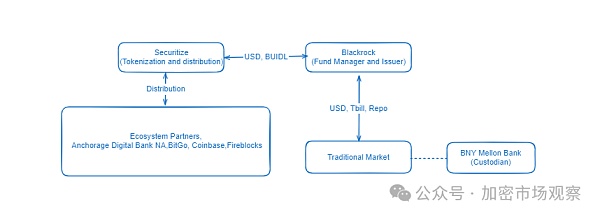

Blackrock obviously wants to develop its efforts in the field of public chain tokenization. The name of this Fund is BUIDL, which is also very cool (Blackrock USD Institutional Digital Liqudity Fund, the first letter of each word); previously, the BTC Spot ETF was actually Web3 assets sold to Web2 through Web2. This time, Web2 assets were sold to Web3 (and Web2) through Web3. Similar to the various compliance and technical processes polished by the previous BTC Spot ETF, this type of product needs to take into account both the Web2 system and the Web3 system. The minimum subscription amount of this product is 5M, and it is open to qualified investors. It maintains 1 BUIDL = 1 USD, and uses daily rebase to distribute interest (the token price remains consistent, and the number of tokens increases with income). Only circulated in the whitelist.  The structure is as shown below, and the most concerning thing should be securitization. Securitize Markets has an ATS (alternative trading system) license in the United States and is Finra's broker dealer; Securitize LLC is also an SEC-registered Transfer Agent, and the system is deployed on the public chain. This is similar to the Capital Market Service and Recoginzed Market Operator licenses obtained by @DigiFTTech in Singapore, which uses the public chain as the underlying technology for primary market issuance and secondary market transactions.

The structure is as shown below, and the most concerning thing should be securitization. Securitize Markets has an ATS (alternative trading system) license in the United States and is Finra's broker dealer; Securitize LLC is also an SEC-registered Transfer Agent, and the system is deployed on the public chain. This is similar to the Capital Market Service and Recoginzed Market Operator licenses obtained by @DigiFTTech in Singapore, which uses the public chain as the underlying technology for primary market issuance and secondary market transactions.

Blackrock entering this field as a fund management company will need to find such an institution to help them tokenize. Other institutions such as BNY Mellon Bank provide traditional asset custody, and ecological cooperation with BitGo supports the custody and distribution of such assets.

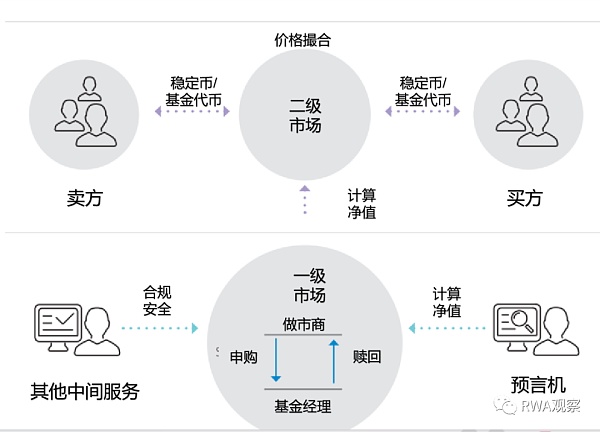

Compared with previous RWA assets, the highlight of this Fund is real-time subscription and redemption, which is also something traditional institutions like Blackrock are very eager to achieve. Get ten points of income on AAVE in the Web3 world, and the entry and exit are real-time. This is the most attractive point of public chain technology for financial institutions - clearing and settlement are completed in real time. However, in traditional channels, due to the inconsistent account books of various institutions, clearing and settlement are required in the middle, involving various external institutions and internal processes. As long as the entire link becomes longer, T+2, 3 or even T+5 are normal. matter.

Traditional fund transaction process

It is claimed that subscription and redemption can be achieved in real time, but after all, when it comes to traditional and legal currency systems, there will still be friction and time for clearing and settlement. There will be too many stuck points and prerequisites. I have not tested it but I have some conjectures. I would like to share with you the current situation of traditional channels and the problems to be solved:

- 1. Among them Securitize can support the subscription and redemption of USDC and USD, which is similar to the DigiFT platform. If users use USDC to subscribe, they still need to exchange through Circle (currently Circle only has Customer bank). Unless both Securitize and blackrock open accounts at the bank, or there is an inter-bank real-time transfer network, it cannot be completed in real time.

- 2. If the user uses USD, they also need to recharge to the Securitize platform first. If they are not from the same bank, they will need to pay for the time difference and wear and tear of inter-bank transfers. Bank transfers between Securitize and blackrock can be processed in real time if they are in the same bank.

- 3. Subscription enables real-time transactions, allowing Blackrock to mint new fund shares in real time. However, it takes time for the USD invested to purchase the underlying assets, which is somewhat similar to STETH and will dilute the overall APR. However, if a large redemption exceeds the cash retained in the Blackrock fund, the underlying assets will need to be sold, which will take longer; however, as the largest asset manager, the liquidity that Blackrock can provide is still very sufficient.

The current circulation of 40M BUIDL is held by two addresses, holding 35M and 5M BUIDL respectively. Blackrock requires a minimum subscription amount of 5M, and generally few Web3 organizations can participate. Observing the situation on the chain, we did not see USDC subscription behavior, and the buyers were basically traditional institutions.

In fact, from the above link, it is just fund shares Tokenization and other processes are actually off-chain. (It’s still the first step)Achieving real-time is just Blackrock’s ability to mint new shares in real-time through securitize subscription, and the middle is the connection between the above two parties. Redemptions are subject to Blackrock’s own liquidity arrangements. The entire structure is basically the "real time" that traditional institutions can barely achieve through various advanced fund reserves, system automation docking and other solutions, and through a lot of consultation and collaboration; compared with Web3, although Web2 is larger in size, it must be able to This function really took a lot of effort and ten years of hard work to achieve Web3 and complete the transaction with a wave of the hand.

But no matter how complicated it is, this is a very good attempt. It is a big step in the integration process of Web2 and Web3. It does not matter how big it can be. The key is here. During the process, different participants promoted the entire infrastructure level and further explored the ability to integrate traditional channels and emerging infrastructure. In the future, more assets will enter Web3, especially more assets will be issued directly on the chain, and there will be more stablecoins, especially bank stablecoins and even CBDC on the chain, enabling token-to-token exchanges in the Web3 world. Direct transactions and exchanges, this is how web3 truly changes the financial world.

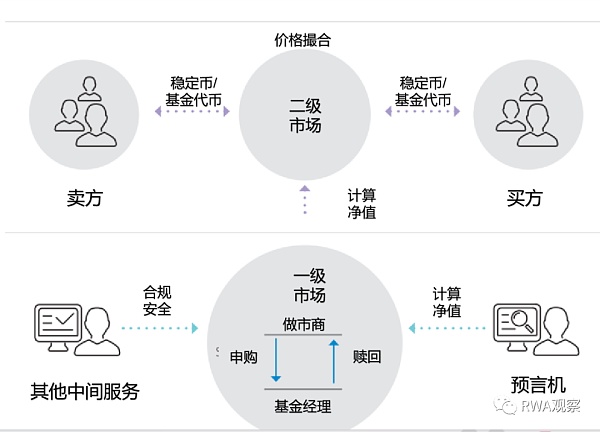

Future on-chain funds (currently only the primary market part has been completed)

Catherine

Catherine

The structure is as shown below, and the most concerning thing should be securitization. Securitize Markets has an ATS (alternative trading system) license in the United States and is Finra's broker dealer; Securitize LLC is also an SEC-registered Transfer Agent, and the system is deployed on the public chain. This is similar to the Capital Market Service and Recoginzed Market Operator licenses obtained by @DigiFTTech in Singapore, which uses the public chain as the underlying technology for primary market issuance and secondary market transactions.

The structure is as shown below, and the most concerning thing should be securitization. Securitize Markets has an ATS (alternative trading system) license in the United States and is Finra's broker dealer; Securitize LLC is also an SEC-registered Transfer Agent, and the system is deployed on the public chain. This is similar to the Capital Market Service and Recoginzed Market Operator licenses obtained by @DigiFTTech in Singapore, which uses the public chain as the underlying technology for primary market issuance and secondary market transactions.