Author: Jeran Wittenstein, Ryan Vlastelica, Bloomberg; Translator: Tao Zhu, Golden Finance

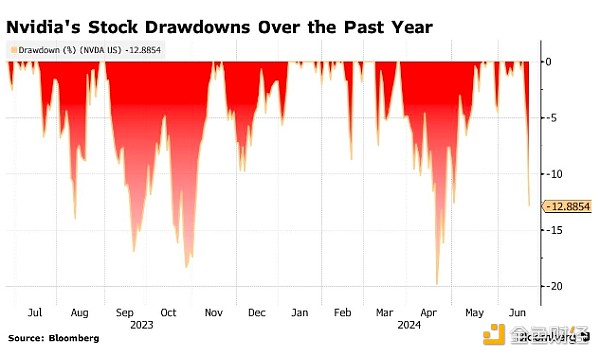

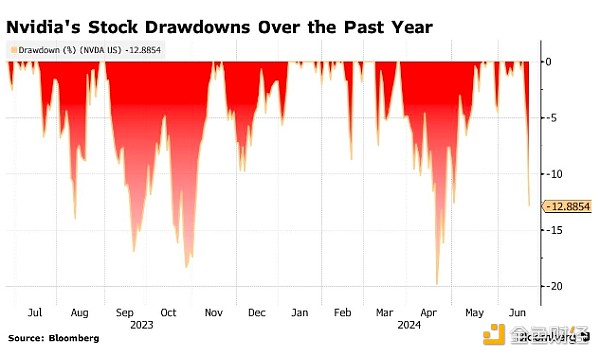

Nvidia's three-day sell-off worth $430 billion has traders turning to technical analysis for clues about where the bottom might be.

Nvidia shares have fallen 13% since briefly surpassing Microsoft.Nvidia was named the world's most valuable company last week. This led to the first technical adjustment in Nvidia's stock price since April, that is, a drop of 10% or more from a recent high. Buff Dormeier, chief technical analyst at Kingsview Partners, said the sudden reversal included some clear signs of compromise.

“The fact that this happened after all this good news — the spinoff, becoming the largest company — is concerning,” he said of the 10-for-1 stock split announced last month. Dormeier sees short-term support around $115, with the next important level at $100.

The $115 area in Nvidia’s stock price is near a key Fibonacci retracement level, a tool used by technical analysis to determine support or resistance lines for stocks and other assets. The stock is trading about 2% below Monday’s close at the 38.2% retracement of its move from April’s intraday low to last week’s record high.

While technical analysis, which looks for insights into historical trading patterns, isn’t exact, it can provide a useful roadmap for investors.

Nvidia has surged this year on strong demand for its chips that dominate the artificial intelligence computing market. In its latest rally, the stock surged 43% from its May 22 earnings report and stock split announcement to a June 18 peak when it closed with a market value of $3.34 trillion, surpassing Microsoft’s $3.32 trillion. Despite three days of losses since then, Nvidia is still up 139% this year.

Ari Wald, head of technical analysis at Oppenheimer, believes that the long-term trend is more important for Nvidia than any specific level, and the long-term trend remains strong, with Nvidia's stock price still well above its 50-day moving average of about $101 and its 100-day moving average of $92.

"Usually, a major top is a process that takes several rounds of buying and selling, and then price momentum gradually emerges and fails to hold key levels. We haven't seen anything like that," he said in an interview. "This is how Nvidia trades."

While he believes, like Dormeier, that the long-term uptrend remains intact, he is keeping a close eye on the $100 level.

"For a stock like Nvidia that's in an uptrend, a break below the first support level isn't something to worry about," said Bruce Zaro, chief technical strategist at Granite Wealth Management. However, he said it would be bad if the stock fell below $100.

"It may not have a long-term impact, but it shows that you should be patient, especially during a period when the market can be volatile and has a downside bias as we wait for the election and the Fed to put pressure on interest rates."

JinseFinance

JinseFinance