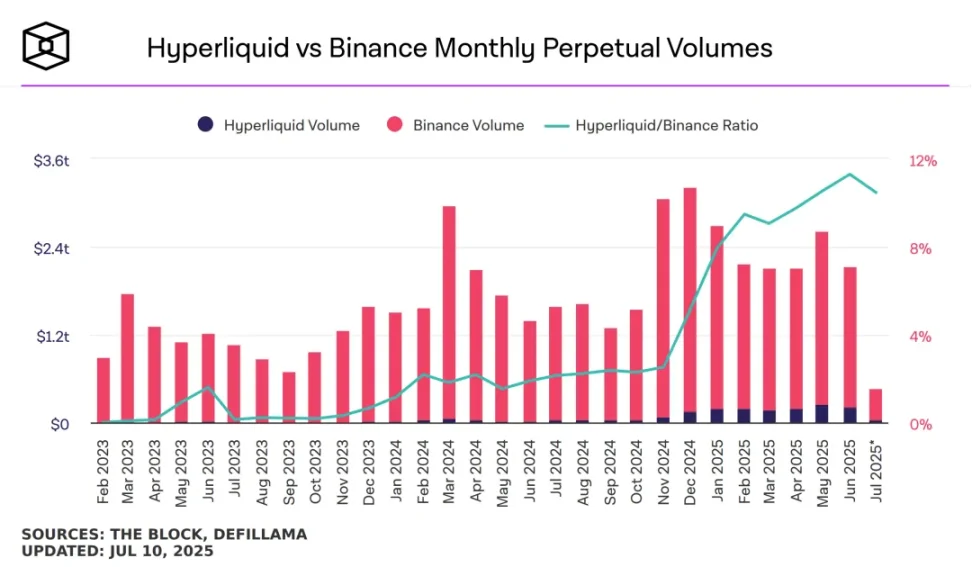

Think about a question, if Binance is destined to be unable to stop the rise of Hyperliquid, then how should it maximize its interests?

Image Description: Comparison of HyperLiquid and Binance Futures Trading Volumes, Image Source: @TheBlock__

At a time when $PUMP is far superior to other CEXs in Hyperliquid, Binance, which is under the greatest pressure, responded by improving the liquidity of Binance Alpha. Please note that it is the liquidity of Alpha that is improved, not the return rate of participants.

Before listing on Binance, it was equivalent to listing on Binance spot, but now it is more equivalent to listing on Alpha. In order to avoid the disappearance of the "Binance listing effect", it will lead to Alpha, contracts and BNB Chain, but it is too strange for the exchange not to trade, so the trading attributes of Alpha must be improved.

In addition, empowering $BNB is crucial to the entire Binance-YZi-BNB Chain system. The income of BNB holders is the daily liability of the Binance system. In addition to economic value, more use value and even emotional value must be introduced.

To sum up, Binance Alpha opens trading for two reasons:

1. Counterattack the listing effect of Hyperliquid and increase the overall liquidity of Binance;

2. Empower $BNB with more practical value and improve the stability of the Binance system.

On these two points, it is easy to understand that Binance and FourMeme jointly launched Bonding Curve to launch TGE, and even carried the meme launcher revival wave that drove FourMeme to keep up with PUMP token issuance. After all, Bonk and MemeCore can both be popular.

For details, please refer to: Pump/Bonk/$M Three Memes, Two Paths for Asset Issuance

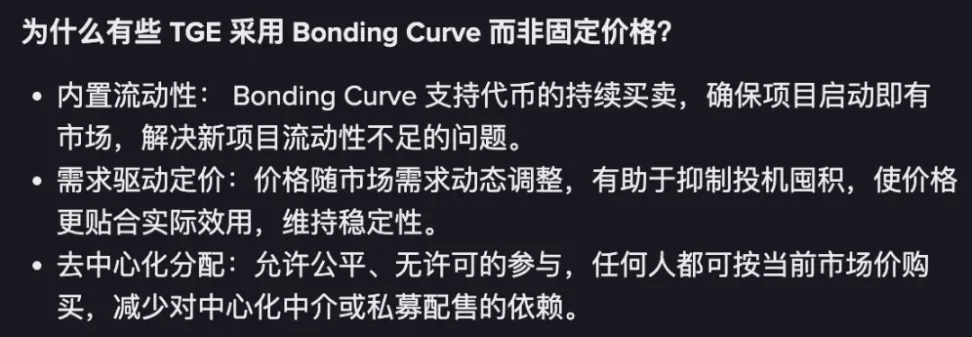

Choose Bonding Curve to Promote Initial Liquidity

According to the Binance announcement, the token of this Bonding Curve TGE is Aptos DEX Hyperion.

We will not introduce this project anymore, and this article does not involve token prices and other content. We only answer the logic of why Binance chose Bonding Curve, so that the Founder can think about future listing plans.

Image description: @hyperion_xyz/center, Image source: @BinanceWallet

After reading the announcement, you can withdraw the BNB you need to hold, resell it in the Bonding Curve system after successful subscription, and enter the normal Alpha trading system after the event ends. In essence, this is to encourage intra-market trading, as opposed to pre-market trading on the Alpha market.

After this, Binance's trading system has at least four layers, Bonding Curve trading -> Alpha trading -> Contract trading -> Spot trading, and it is an elective upgrade system, and it may not necessarily enter the Binance main site trading system in the end.

This can just cover up or solve Binance's current biggest liquidity crisis. By creating more initial liquidity mechanisms, looking back at history, Bonding Curve did not solve the liquidity creation problem, but artificially increased the number of candidates and collided with the most likely Meme tokens.

Looking back at the development history of DEX, LP Token is the real tool to solve the liquidity supply problem. AMM/order book mechanisms need to cooperate with it to support their own operation, but Binance's problem is a bit complicated. It is not an early project, but it has the biggest problem of early projects-liquidity is shrinking, and $BNB's value capture ability is declining.

In contrast, PumpFun is a Bonding Curve on the market + an AMM pool outside the market. There is a paradox in the Bonding Curve itself - the greater the demand, the higher the price. This is like the more demand there is for buying houses, the more the houses in Yanjiao appreciate in value. Once the turning point of the market arrives, it will immediately collapse, and there is no room for a smooth decline.

PumpFun did not solve this natural paradox, but extremely reduced the launch cost to attract more attempts. Will Yanjiao fall, will Dubai rise, and will the global liquidity of the currency circle and the possibility of any attempt make the inner market the cheapest launch site. 10 out of 1,000 inner markets will be listed on the outer market DEX, and 1 of them will be listed on CEX.

If the number of inner markets is increased to 10 million, the liquidity of the entire market will increase instantly, and from the inner market, the outer market DEX to the CEX will usher in overwhelming liquidity. Of course, it will eventually collapse.

We can make a prediction here: Binance Alpha Bonding Curve TGE events will increase in the next period of time, otherwise it will not have the effect of creating liquidity and guiding the main site and BNB.

Going further, Bonding Curve is actually more like a Rebase stabilization mechanism. The former is based on "the more demand, the higher the price -> the better the liquidity", and the latter logic is "the more you buy, the stronger the reserve + the more you sell, the more profit -> the more stable the stablecoin price".

The problems of the two are also highly similar. They are both based on the "conventional" part of the law of large numbers, that is, they don't consider the impact of extreme events. In terms of the 80/20 rule, they consider more 80% of the cases and don't care about the 20% exceptions. In the end, one died from the impact of Luna-UST and the other was drained of liquidity by $TRUMP.

Study psychological momentum and wait for the killing blow

There is a momentum phenomenon in the market, that is, it will rise higher than we predict, and vice versa, it will fall deeper than the market fair value.

The assumptions that Bonding Curve relies on are unreliable in themselves, but they are very consistent with Binance's actual needs:

Creating initial liquidity: Binance Alpha itself has sufficient market foundation, so it is not "built-in liquidity", but liquidity front-end, directing the Alpha liquidity after its own opening and other DEX/CEX trading liquidity to the Bonding Curve area;

Pricing expectations trigger demand: Just as the Pre-Market game is about pricing, Bonding Curve will also trigger a game on pricing, and then promote demand transactions. Only by selling tokens will users avoid becoming the watchers before the collapse of the Bonding Curve;

Digesting the listing effect: Bonding Curve It is a market game. Binance can avoid the weakening of the liquidity of the main site due to the decline in the listing effect, and theoretically get a fairer pricing.

Picture description: Reasons for choosing Bonding Curve, picture source: @BinanceWallet

So, what is the cost?

As mentioned earlier, the PumpFun version of Bonding Curve depends on a sufficient number of internal disks to give birth to super single products. There are still too few listing events in the Alpha activity area, and it is not enough even if all the project parties in the entire currency circle are pulled over.

However, Binance Alpha will assume the initial price discovery role of the project party. Refer to $JELLYJELLY in which Binance and OKX jointly sniped Hyperliquid. I personally feel that CEX will unite to target Hyperliquid, and Binance will bear the brunt.

The trick to grab liquidity is to discover prices. Retail investors hope to buy at the lowest cost and sell at the highest profit. If Binance directly increases the listing effect, it will inevitably pay a higher price, but in the name of helping retail investors discover the earliest price, liquidity will naturally come.

Then, wait for extreme black swan events to poke Hyperliquid in one fell swoop, just like Bybit was stolen and injured, CZ/Binance was fined 4.2 billion, just like Hyperliquid was reversed for extreme transparency, and Binance then went down to poke it, just like FTX was easily pushed down, and CZ came out as the big cousin.

Conclusion

Size is Binance’s biggest advantage, and flexibility is Hyperliquid’s offensive means. It is reasonable to wait and see and fight a war of attrition. Binance chooses price signals, and Hyperliquid moves towards the listing effect. Liquidity is the result of the competition between the two, not the cause.

It’s just pitiful for Alpha users. Who are they working for? Sugar is so sweet, but why do the people who grow it live so hard?

Jasper

Jasper

Jasper

Jasper Aaron

Aaron Jasper

Jasper Hui Xin

Hui Xin Kikyo

Kikyo Alex

Alex Jasper

Jasper Hui Xin

Hui Xin YouQuan

YouQuan Brian

Brian