Written by: Happy Compiled by: TechFlow

The price of Bitcoin has exceeded $100,000; we have a president who supports cryptocurrency, but strangely, everyone seems angry.

The Overton Window has completely changed. This time, things are indeed different, but not in the way we expected.

Trump’s presidency brings a puzzling dilemma - what does this mean for my digital assets? Countless thoughts rushed into my mind.

On the one hand, he is the most powerful man in the world, but he is openly "posting" for our cryptocurrency.

But on the other hand, he used his power and influence to launch meme coins that dilute market value, profit for his family, and try to maximize capital extraction in this field.

Reality is often stranger than fiction.

Looking back at Bitcoin’s history, backers devised a game theory scenario predicting how Bitcoin would gradually take over the world. They argued that governments would fight us first, and we would eventually win. On the surface, that seems to be happening.

Bitcoin has indeed won. It has gone from being considered “money for evil people, used to fund illegal activities” to “free money,” now accepted and promoted by the world’s most powerful institutions, individuals, and even countries.

Celebrities like Larry Fink, Donald Trump, Stanley Druckenmiller, Ray Dalio, and Elon Musk have all spoken positively about Bitcoin at some point. This is a stark contrast to a decade ago, when the only use of Bitcoin might be to buy a pizza or have environmental protesters glue themselves to your driveway and accuse you of “destroying the planet.”

However, for those who spend 16 hours a day staring at a computer screen, chatting with friends on the Internet, and speculating wildly on virtual currencies: I think the future may become even more bizarre and more difficult.

Throughout the history of cryptocurrency, we have always imagined the changes that these technologies may bring about in the "future". "The whole world will be on the chain", "Everyone will trade in stablecoins", "NFTs will replace physical art", and "Decentralized Finance (DeFi) will replace the traditional banking system".

But historically, these visions have never really been realized. The technology is not mature yet, and the government is hostile to this field. They would rather we didn't exist, so they will do everything they can to suppress us.

As a result, many teams have to focus their energy on designing products that can avoid legal risks and maximize the price of the currency. And the design that truly focuses on user experience has long been ranked at the bottom of the priority.

In some ways, this situation was very good for us internet geeks. In order to drive up the price of coins and avoid legal risks, a major strategy adopted by many project teams was to directly distribute tens of thousands of dollars of "free money" to the likes of us in the form of airdrops.

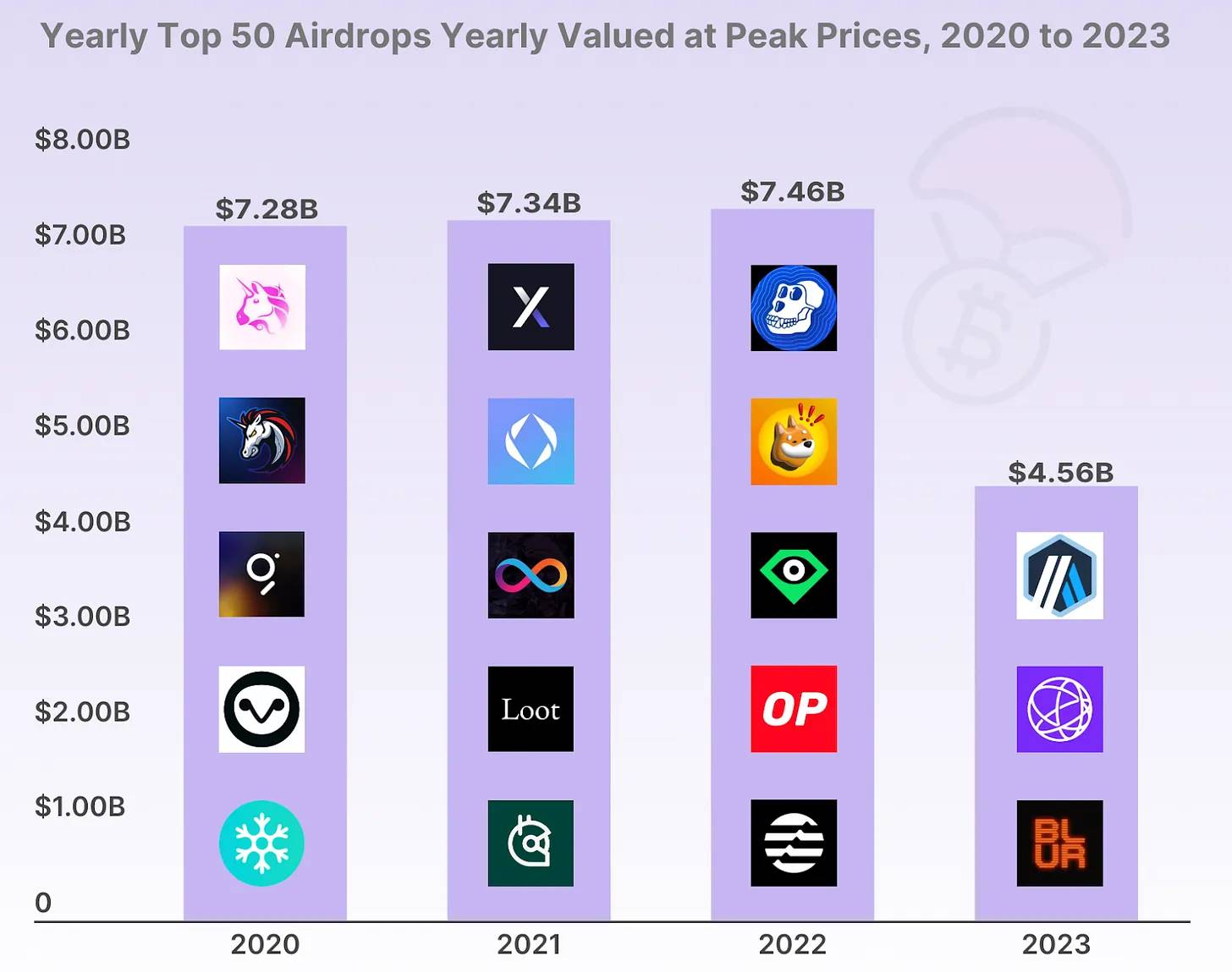

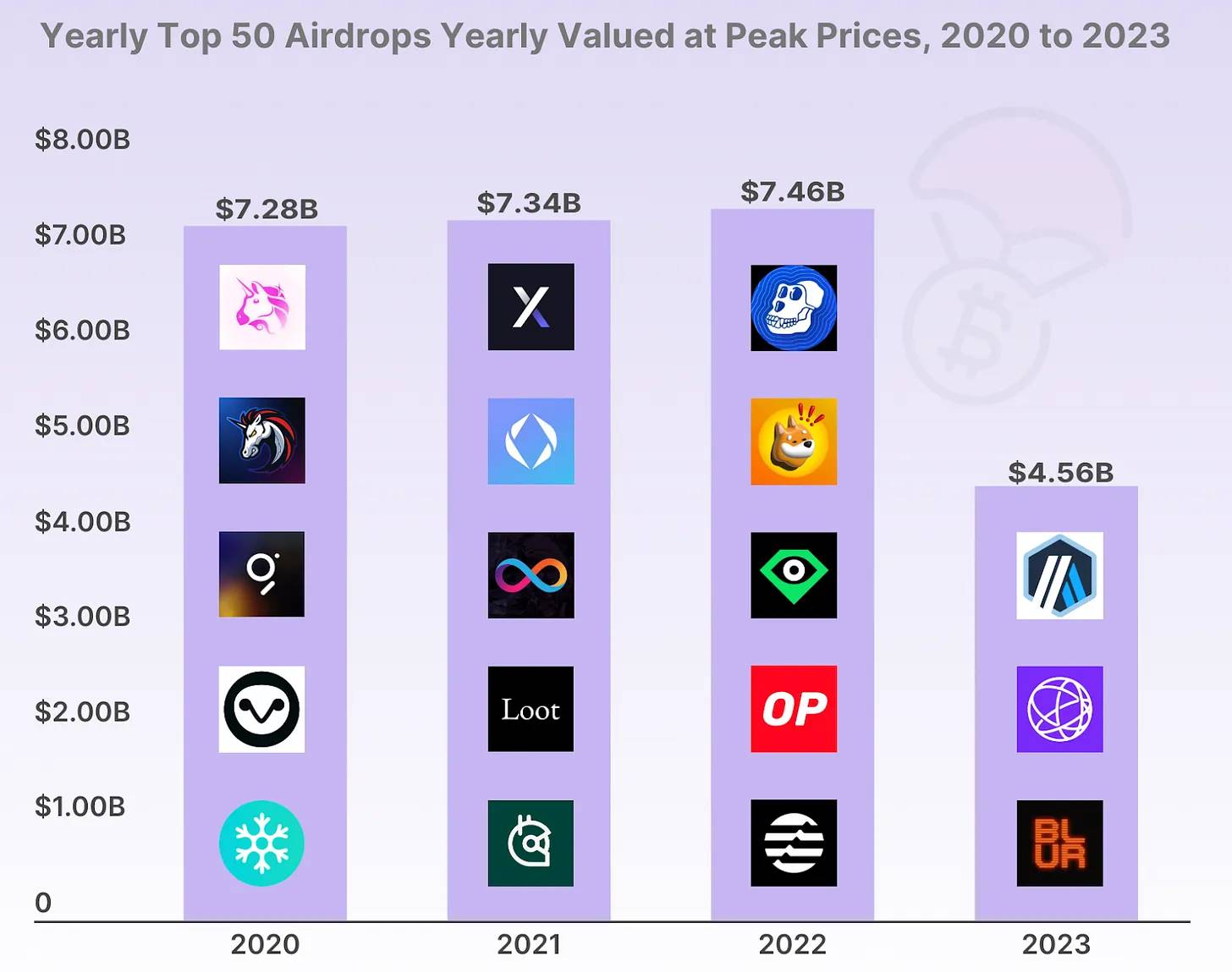

According to CoinGecko statistics, the total amount of the top 50 airdrops reached 26 billion US dollars.

Since the environment at that time made it almost impossible to produce truly high-quality products, we pretended that these projects had achieved their goals and valued them accordingly.

As a result, we have witnessed many strange phenomena: Layer 1, which has no users, has a higher valuation than most traditional technology companies; the valuation of "Ponzi stablecoins" that rely on new capital injections to maintain their value has even exceeded the GDP of some countries; the transaction price of ape pictures is even higher than some real estate.

What I want to express is that the foundation of this entire crypto industry is built on a seriously problematic incentive mechanism.

In this system, it is as easy to get rich just by talking about building something as it is to actually build it. Although many of us criticize this phenomenon, we actually benefit directly from it.

However, I think this situation may be about to change.

With the emergence of government and regulatory policies that support cryptocurrency, we finally have the opportunity to design serious, practical products for people who really need them.

This is great news for the industry as a whole, but I have no idea what this means for us “speculators”.

In a world where legal clarity drives real innovation, will innovators continue to give us “free money” through airdrops?

When the legal environment is clearer, will more professionals enter the on-chain ecosystem, thereby weakening the current “speculative spirit”?

If crypto projects achieve technological breakthroughs and attract “real users”, what will be the fate of those applications that still have no users?

If the government changes from hostility to support, will we blindly turn to using more centralized blockchains?

When the threshold for creating a token drops to zero, will all tokens be diluted and lose value?

As higher quality applications continue to emerge, will we see a large influx of actual users entering the on-chain economy and spending money? Will these funds stay on-chain for a long time, or will they be extracted back into the traditional economy?

Ultimately, will we be heading towards a situation similar to Web 2.0, where a few companies make all the money and other projects pale in comparison?

Does your family's future really depend on whether you buy those seven coins? If you miss them, are you doomed to poverty because you held Ethereum for too long?

Will Michael Saylor sell (FSH) all his Bitcoin on impulse? It sounds ridiculous, but if it really happens, we may still end up with nothing.

Will the Ethereum Foundation suddenly dissolve and we can only watch Vitalik frantically create a new blockchain with his "Milady spirit"?

What will happen if Trump decides to launch an "American chain" and airdrop tokens to every citizen while imposing heavy taxes on other chains and tokens?

Will these changes make the price of coins rise, or will they cause the market to crash?

Honestly, I have no answer at all. This is probably the most confusing moment I have felt in the past five years.

The only thing I know for sure is that everything will change and the cryptocurrency world in four years will be completely different from what it is now.

So how do I deal with these changes?

To be honest, I am not smart and I just made some money by chance in the past few years. Therefore, I decided to reduce my investment risk and withdraw some of my funds from the crypto market.

I can no longer afford to bet 95% of my net worth on those "virtual currencies" that plummet 95% every few years.

I can't bear to tell my girlfriend that I bet our future on Trump fulfilling his campaign promises. Before that, I had already bet everything on him winning the election.

However, I think I may perform better in the future. After all, now I know that even if I screw up, I will not end up on the street because I have already transferred some of my assets to "real assets".

At the same time, I am also quite scared of the advanced scams and phishing that may appear this year. Now that we have AI that can write better content than most humans, I think it's only a matter of time before these bots are designed specifically to trick you into giving away your private keys.

I'm also considering hedging in anticipation of future risks. It's more important than ever to have a decentralized strategy with multiple devices, multiple wallets, and multiple chains, and I'm using a hardware wallet.

I'm going to hold on to all my Bitcoin. It's the only asset in crypto that I really trust, and I believe it still has huge growth potential over the next decade.

As for my plan, I'm going to take things as they come. The future is going to be full of surprises and innovation. Crypto is going to see huge growth, and with it, countless opportunities.

I hope to stay flexible. I want to have some stablecoins on hand so I can participate in all the exciting new projects - whether they are experimental, seemingly ridiculous, or those based on meme culture.

I don't want to take any of this too seriously, I want to have fun, make some money, and have a good time.

This is my plan: take profits when appropriate, make sure my life is stable, continue to hold (HODL) my Bitcoin, and then wait and see what happens, and then try to profit from the next opportunity.

The future may be full of unknowns and unusual, but no matter what, make sure you at least have fun.

Final reminder: Don't take this article as financial advice, I'm just a human being, and I may even be stupid. If you sell your coins, they may go to a trillion dollars, and if you hold on, they may go to zero. So close this page and don't read it anymore. Don't follow me, I'm just talking nonsense.

Weatherly

Weatherly