Filecoin 2024 Review and 2025 Outlook

Recap key milestones for 2024 and examine the key growth drivers for Filecoin’s development in 2025.

JinseFinance

JinseFinance

Source: Vernacular Blockchain

2024 is a year full of hope for the encryption market. All eyes are focused on new tracks worthy of attention in the encryption field, including leading institutions. Each institution has published its own research reports at the beginning of the year, looking forward to 2024 from a professional and detailed perspective, which is of great reference value.

Vernacular Blockchain reviewed research reports from 23 leading institutions (including Messari, a16z, Coinbase, MT Capital, etc.), trying to summarize and find "institutional consensus" in order to To improve certainty, we are now organizing it as follows:

After the launch of Ordinals (a digital content encoding method based on Bitcoin) in December 2022, it led to the inscription and Bitcoin ecological craze. In 2023, the Bitcoin ecosystem will develop strongly, and Bitcoin's dominance (Bitcoin's proportion of the cryptocurrency market value) will increase from 38% in January to about 50% in December, making it the most noteworthy ecosystem in 2024. one.

The predictions of institutions are also basically optimistic about the development of the Bitcoin ecosystem this year:

The mainstream U.S. crypto index fund management company Bitwise predicts that the Bitcoin trading price will be at Will exceed $80,000 in 2024;

Coinbase believes that at least in the first half of 2024, the main focus of institutional investment will continue to be on Bitcoin, because the adoption of ETFs will allow There is strong demand from traditional investors to enter this market.

The forecasts of other institutions are also optimistic. The main reasons are:

The U.S. Securities and Exchange Commission (SEC) has approved a spot Bitcoin ETF, and The next big event is the Bitcoin halving event in April, and supply and demand are expected to undergo major changes;

The Bitcoin ecosystem will undergo infrastructure upgrades and the addition of programmable functions, including basic protocols such as Ordinals, as well as the development of protocols such as Layer 2 and other extensibility layers such as Stacks and Rootstock.

In addition to the Bitcoin ecosystem, Ethereum, as the pioneer of smart contracts, the development of Ethereum Layer2 is also 2024 is a major event that various institutions predict is unanimously optimistic. Especially with Vitalik releasing the Ethereum 2024 roadmap and the Cancun upgrade approaching, Ethereum Layer 2 project tokens such as ARB and OP have experienced skyrocketing prices recently.

Competition in the public chain ecosystem has always been fierce. In 2023, public chain ecosystems such as Solana and Avalanche have developed rapidly, and their momentum has even surpassed Ethereum. However, Ethereum, as the leader, has also begun to exert its influence. Most of the forecasts of various institutions are based on the completion of the Cancun upgrade, gas costs will further drop significantly, which can drive the explosion of the Ethereum Layer 2 ecosystem in 2024. That Bitwise believes a major upgrade to the Ethereum blockchain will bring average transaction costs below $0.01, setting the stage for more mainstream uses.

If the upgrade is successfully implemented, some leading Ethereum Layer 2 projects (such as Optimism, Arbitrum, Base, etc.) can compete with other Layer 1 public chains in terms of performance.

In addition, according to Vitalik’s vision, in the long run, the direction of zero-knowledge proof is the future of Ethereum’s Layer 2. The two Layer 2 projects of zkSync and StarkWare are also favored by everyone.

In the past 2023, Solana public chain ecology has performed well, both in terms of technology accumulation and community. It has laid a solid foundation for the long-term development of the Solana ecosystem, and the explosion of the Solana ecosystem has also attracted a large number of users and funds.

Various institutions predict that in 2024, more projects will choose or migrate to the Solana public chain, and the Solana ecosystem will continue to explode. Because, whether it is TPS, gas fees, or community users, Solana is more resistant to attack.

The expectations of various market institutions for Solana in 2024 focus on the following aspects:

Solana’s technical upgrade, such as the development of light customers through Tinydancer terminal, allowing verifiers to complete verification work at lower costs and achieve a higher degree of decentralization;

Solana’s performance improvements include improving throughput and performance, improving user experience, and deploying new Token standards, etc., enhance its robustness;

The release of new products, the increase in on-chain liquidity, and the expansion of developer tools have promoted the prosperity of the Solana DePIN ecosystem.

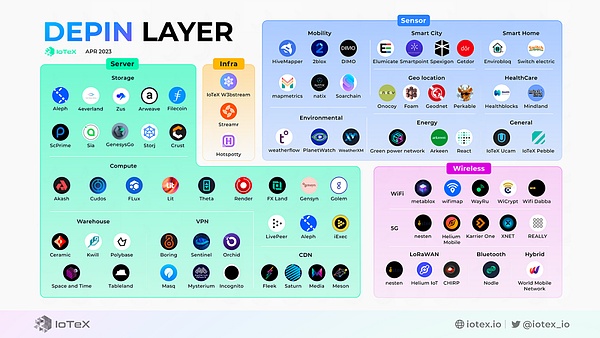

DePIN, the decentralized physical infrastructure network, is a network built and built in the real world. A new way to maintain infrastructure, aiming to build decentralized networks in industries such as telecommunications, energy, mobile communications and storage. In 2023, there are over 650 DePINs with a market cap of over $20 billion and annual revenue of over $150 million.

Overview of DePin development in 2023

In 2024, the cryptocurrency data platform CoinMarketCap has listed DePIN as The independent classification reflects the crypto market’s high focus on this area.

DePIN covers a wide range of fields, including server networks, wireless networks, sensor networks and energy networks. Currently, various companies predict that the DePin track has huge growth potential. For example, according to predictions by encryption research institute Messari, the overall industry size of DePIN is currently approximately US$2.2 trillion and is expected to grow to US$3.5 trillion by 2028. Messari also pays special attention to the following subdivided DePIN sub-tracks: cloud storage market, decentralized database, decentralized wireless network and combination with AI.

However, while making predictions, various institutions also believe that the maturity of DePIN will require long-term investment and operational development by the market, institutions and developers before it can gradually penetrate into people's lives and applications and be in line with the current situation. Some infrastructures range from complementary to parallel to substitute.

The rapid development of artificial intelligence (AI) in 2023 has also promoted the development of AI+ web3 services develop. In early January 2024, the market value of AI-related Tokens reached US$7.04 billion. Given the increasing popularity of artificial intelligence, forecasts are mostly optimistic about using AI as a core function to enhance the appeal of blockchain-based encryption platforms.

At present, the tracks that various institutions are more optimistic about are:

Direct applications of AI in the crypto field: The combination of trading robots, automated payment and arbitrage robots with blockchain. Integrated scenarios include AI Agent utilizing encrypted infrastructure for payment, smart contracts to securely schedule AI models, and Token rewards for personal fine-tuning of models and collection of valuable data. Messari believes that advances in AI will increase demand for cryptocurrency solutions.

Innovative applications of AI and encryption technology: Here AI is used to improve the user experience and efficiency of Web3, and more Blockchain technology is used as a guardrail and layer of transparency for AI. For example, we have seen research and new use cases on zero-knowledge and machine learning (ZKML), games that allow users to train AI agents using ERC 6551, etc.

Bankless analyst Jack Inabinet believes that crypto + artificial intelligence could be an explosive combination. While early activity was largely about promoting worthless projects to capitalize on the hype, the promise is still huge.

Encryption company DWF believes that in guiding social cognition and its limitations in centralized AI, decentralized AI has great development potential in 2024 and can lead through Web3 AI future.

6) The outbreak of GameFi and the development of blockchain games

Chain games in 2021 and 2022 will be full of flowers. From "Play to Earn" to "X to Earn", hit projects such as Axie and Stepn have emerged. In comparison, chain games in 2023 are relatively bleak. However, with the improvement of infrastructure, various institutions are still optimistic about the future development of chain games.

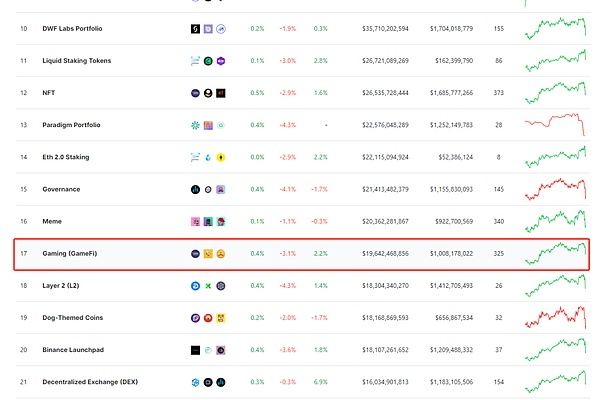

After all, from the perspective of the traditional Web2 market, games are a very potential market and have almost become a part of many people’s lives. And most traditional game users don’t have much knowledge about the GameFi (Gaming) field. From a TVL perspective, as of the time of writing this article (2024.2.1), the TVL of the GameFi sector in the figure below is only $19.6 billion.

Overview of TVL of each track, source: coingecko.com

Overview of TVL of each track, source: coingecko.com

From the perspective of GameFi’s development space, what is mentioned more often is that GameFi is expected to have a larger narrative in 2024-2025. And will get more attention.

For example, Azuki researcher Wale Swoosh believes gaming will be one of the big trends that will define 2024. Gaming has been and will always be a great Trojan horse when it comes to cryptocurrency applications, and there is no doubt that the Web3 gaming trend seen at the end of 2023 will not only continue next year, but become even more pronounced.

Spartan Capital co-founder and chief information officer Kelvin Koh believes that a number of AAA Web3 games will be launched in 2024, and believes that these games will bring millions of new Web3 users .

In general, institutions are currently optimistic about GameFi mainly because of two points:

First, in 2024, the number of blockchains focusing on games will continue to increase. . In addition to some traditional old public chains, new public chains such as Oasys and Sui have also joined;

Second, the participation of large traditional game companies. For example, Oasys has attracted many well-known publishers to join its ecosystem, such as the well-known Ubisoft Entertainment (Ubisoft game software), Square Enix (a Japanese game software production, development company and publisher), Activision Blizzard (Activision Blizzard) , Epic Games and more.

In 2023, modular blockchain and zero-knowledge proof (ZKP) All have been quite fully developed, such as Celestia, zkEVM, etc. And an obvious phenomenon is that these two narratives have begun to show a trend of integrated development. Projects in the ZK field have begun to combine specific vertical fields (such as co-processors, privacy layers, proof markets, and zkDevOps) for "modular" development.

Spartan Managing Director Leeor Groen believes that privacy and security will be key drivers in Web3, and as technology develops, we will see users becoming aware of zero-knowledge proofs and modules Exploiting the value of blockchain, users don’t even know they rely on these zero-knowledge proofs and modular blockchains on the backend of applications ranging from digital identities to games.

A16z believes that the rise of modular technology stacks brings the greatest advantages of open source, modular technology stacks, as tools inspired by formal methods are widely adopted by developers and security experts , the next wave of smart contract protocols are expected to be more robust and less susceptible to expensive hacks. The mainstreaming of SNARKs technology will become a trend.

As for the outlook for 2024, various institutions and researchers also expect this trend to continue. Zero-knowledge proofs will become the interface between different components of the modular blockchain stack. . This provides greater flexibility for developers to build dapps while lowering the barrier to entry for blockchain stacks; for consumers, ZKP may be seen as a way to protect identity and privacy, such as in ZK-based decentralized form of identity.

Another important point to mention is that SNARKs can provide corresponding proof for calculations that generate specific outputs, making the speed of verifying proof much faster than the speed of executing corresponding calculations. It will become a key focus in 2024. s project.

No matter what kind of crypto ecosystem it is, if it wants to develop in the long term, its ultimate goal is to attract new users and encourage existing users to become more active participants. With the recovery of the market, the improvement of infrastructure and the layout of various institutions, institutions generally believe that there will be a large influx of crypto users in 2024.

Like a16z CTO Eddy Lazzarin believes that although user experience in the encryption field has been criticized, developers are actively testing and deploying new tools to reset the encryption front-end users Experiences such as multi-party computation, passing passwords to simplify login to apps and websites, embedded wallets, and more. These innovations will enable users to experience a better and more secure environment when using encrypted applications.

However, in general, the reasons for the optimism of various institutions mainly lie in the following two points:

On the one hand, a major theme that has emerged in the recent bear market cycle is a focus on how to make cryptography more user-friendly and easier to use. The added responsibility of managing cryptocurrency and all that goes with it (wallets, private keys, gas fees, etc.) is not for everyone, making it difficult for the industry to mature unless it can overcome some key challenges related to user experience. For example, around the development of account abstraction, etc., to promote the development of wallet recovery mechanisms and better create failsafes against simple human errors (such as losing private keys).

On the other hand, the Ethereum Cancun upgrade may reduce rollup transaction fees by 2-10 times, and it is believed that more Dapps may pursue the "Gas-free transaction" path, effectively allowing users to only focus on for advanced interactions.

In the past year, the entire encryption industry has faced intensified regulation. As the development of the encryption industry expands, regulatory compliance is an unavoidable question.

Many institutions predict that in the new year, with the election of leaders in various countries, other regulatory policies will continue to be introduced.

Digital AssetsJi Kim, general counsel and global head of policy at the Council for Crypto Innovation (CCI) believes one of the bigger stories in 2024 will be jurisdictions’ continued battle for top status , competing to become the key hub of digital assets and the future financial system.

Gemini EU head Gillian Lynch believes that although opinions on cryptocurrency and blockchain technology are still divided, the vast majority of people will agree that the encryption industry needs to focus on customer protection. A core regulatory framework, while striking a balance between creating a clear and consistent rulebook, ultimately helps foster innovation.

Ripple Chief Legal Officer Stuart Alderoty It is expected that the SEC’s lawsuit against Ripple Coin will end in 2024, but its regulatory strategy may continue to target other high-profile individuals. The U.S. Congress will work to reach an overall agreement on cryptocurrency regulation, but still needs to determine the best approach.

The more controversial tracks are RWA and NFT, some predict Some are bullish, some are bearish, and relatively few are mentioned.

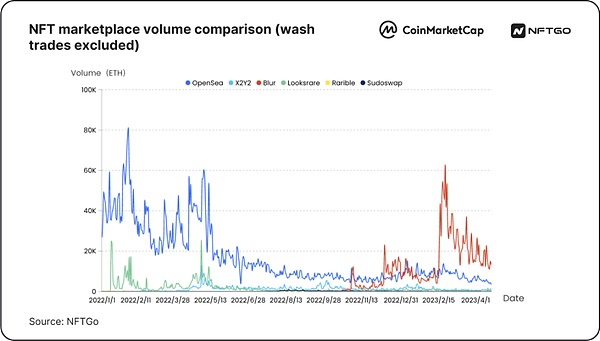

Compared with the popular inscriptions, NFT has been in a downturn in 2023. With the exception of individual projects, the leading blue-chip projects have all fallen into a rebound rather than a reversal. Take BAYC as an example. The average price at the beginning of the year reached 71 ETH, but by the end of the year, the floor price dropped to less than 30 ETH.

The structure of the NFT market has also undergone tremendous changes. Blur competed fiercely with Opensea at the beginning of 2023, and by the end of 2023, Blur almost monopolized the market share. Trading volume accounts for only 20% of the market. Although Opensea has made product and community feedback to try to resist the impact of Blur, it has had little effect. With the rise of Blur, the zero-royalty debate has gradually disappeared, and the discussion about "whether creators should receive royalties" has gradually faded away.

NFT trading platform market share comparison in 2023

Some institutions believe that consumer brands will use NFT to generate new models of user participation, and NFT can continue to promote the liquidity of the collectibles and art markets. Especially if GameFi develops, NFT, as an important basic accessory, can also develop along with it. Like A16z, more and more well-known brands have begun to launch digital assets in the form of NFTs to mainstream consumers. Entering 2024, the conditions for NFTs to become ubiquitous digital brand assets are already in place.

Some institutions believe that it is difficult for NFT transaction volume to replicate the booming scene in 2021, because most NFT projects are more hyped and lack real cumulative value. NFT creators need to adjust their strategies to improve Competitiveness.

Compared to NFT, there are more institutions that are optimistic about RWA:

Researcher of The Block It is believed that Bitcoin spot ETF has triggered a surge in institutional interest, and the bridge between DeFi and TradFi continues to widen. In turn, RWA is bullish as tokenized real-world assets see greater adoption as more types of traditional financial elements enter the on-chain environment.

Bitwise believes that RWA will set off a new trend. At the request of Wall Street, JPMorgan Chase will tokenize the fund and put it on the chain.

Delphi Digital believes that RWA is one of the most successful areas of cryptocurrency in 2023 and will continue to develop in 2024.

In summary, their reasons are as follows:

It is helpful to build a bridge of communication between traditional institutions and the crypto world. RWA tokenizes off-chain assets and converts them into blockchain digital assets that are easy to understand. Stablecoins are a common RWA application because of their tokenized expression based on fiat currency.

Many large institutions have increased their investment in the field of RWA. At the same time, crypto projects like Chainlink are also cooperating with the world’s largest traditional financial institutions to introduce a large amount of RWA into the crypto industry and tokenize it. . .

RWA is building a financial ecosystem where digital tokens represent tangible assets that are more accessible and scalable to public users, not just Be a privileged investor or an institutional investor. RWA has a wide scope and can be divided into various categories such as private credit, treasury bonds, real estate, commodities, stable coins, insurance, etc., and has great application potential.

But less optimistic institutions believe:

As interest rates reach their peak, on-chain government bond yields appear. Cryptocurrency is pursuing the same or even greater returns that traditional financial investors pursue, but everyone's needs need to be further explored, and this will require a long development process, but it will be difficult to achieve major development in 2024.

SocialFi is the integration of social media and DeFi. From a macro perspective, Web2 has shifted from social to financial, while Web3 has shifted from financial to social. the trend of.

Looking back at social media in Web2, it took Twitter 5 years to attract 100 million users, and Facebook 8 years to reach 1 billion. SocialFi is still a relatively new concept in comparison.

The SocialFi track has attracted the attention of investors in the second half of 2021. Many projects such as Whale, Chiliz, Rally, BBS network, Showme, Mirror.xyz have become popular, and even registration invitation codes have appeared on some platforms. A rare occasion. However, as the overall market went bearish, SocialFi also died down.

It became popular again because in August 2023, friend.tech was on Base Layer 2 Creating a new form of social experience, users can buy and sell other people's "shares" on X (Twitter). It reached a peak of 30,000 ETH TVL in October and inspired several copycat projects. Friend.tech pioneers a new Tokenomics model for the SocialFi space by financializing Twitter profiles.

However, in these institutional forecasts, SocialFi’s development prospects in 2024 are rarely mentioned. Occasionally, it is because with the continuous spread of the concept of decentralization, more decentralized social networking Media networks and tools will be launched, but we can wait and see whether they can really break out of the circle.

Overall, in 2023, the entire crypto industry has gone through the trough and despair of the bear market and has begun to Start a bull market. The development of the public chain ecosystem led by Bitcoin has entered a new stage, with new narratives and new tracks taking turns to appear on the stage, laying the foundation for the next bull market.

Recap key milestones for 2024 and examine the key growth drivers for Filecoin’s development in 2025.

JinseFinance

JinseFinanceOn July 18, 2024, more than $230 million was stolen from a multi-signature wallet of the Indian cryptocurrency exchange WazirX. The multi-signature wallet was a Safe{Wallet} smart contract wallet.

JinseFinance

JinseFinanceCoinbase rebounds from technical disruptions; zero balances incident attributed to traffic surge amid Bitcoin's spike.

Xu Lin

Xu LinZero-knowledge proofs are nothing new. Definitions, foundations, important theorems and even important protocols were established from the mid-1980s.

JinseFinance

JinseFinanceAccording to NYAG Letitia James, CoinEx falsely represents itself as a crypto exchange and sells securities and commodities without a permit.

cryptopotato

cryptopotatoThe Singaporean investment fund said it conducted 8 months of due diligence on FTX in 2021 before buying a 1% stake in the exchange.

Coindesk

CoindeskCrypto staking rewards Thanks to its high yields, crypto staking, a way to earn passive income, has quickly become popular ...

Bitcoinist

BitcoinistThe cross-chain liquidity protocol has put special focus on user experience with a simple user interface without them having to deal with complex virtual networks.

Cointelegraph

CointelegraphFutures traders heavily rely on Contract Data to determine market trends and formulate trading strategies. Contract Data is needed by ...

Bitcoinist

BitcoinistWhat are the ways to buy CET? Today, we will introduce the specific steps of how to buy CET on ...

Bitcoinist

Bitcoinist