Author: BloFin Source: medium Translation: Shan Ouba, Golden Finance

The rise in global uncertainty is one of the main reasons for the continuous improvement in the liquidity level of the crypto market in recent times, and it is also an important reason for the strong performance of BTC in recent times.

Due to the lack of safe-haven properties, the performance of non-BTC cryptocurrencies depends more on the changes in macro liquidity and the game status of funds in the market.

Altcoins have gained a certain advantage in the liquidity competition with ETH, which has further adversely affected the performance of ETH.

Bull market in geopolitical crisis

After the release of non-farm data and employment data last week, the "lower-than-expected interest rate cut" seems to have been gradually accepted and digested by investors.

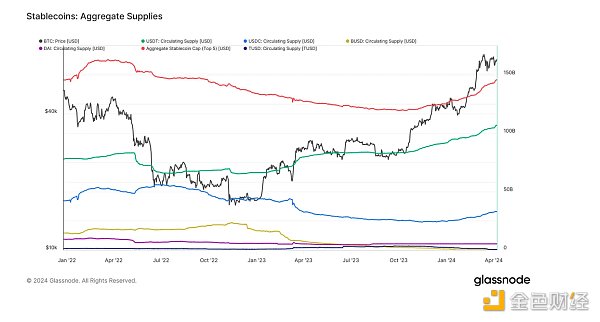

This week, many central banks, led by the European Central Bank, will also announce their latest interest rate decisions. Although Europe's performance in inflation is much better than that of the United States, and the European Central Bank has also shown a high expectation of interest rate cuts, considering that the influence of the European Central Bank is relatively weak compared to the Federal Reserve, it can be determined that the speed of global cash liquidity will slow down in the future. For the crypto market, the bull market may be more "mild and long." However, this does not seem to be the case. Since the beginning of April, the speed of cash liquidity reflux within the encryption market has significantly accelerated. In the past week, the entire crypto market has received nearly $3 billion in cash liquidity, and the overall cash liquidity scale has also returned to the same period level in Q3 2022. Affected by the above situation, BTC and ETH prices have risen, altcoins have received strong support, and market sentiment has also recovered significantly. What causes the abnormal changes in cash liquidity?

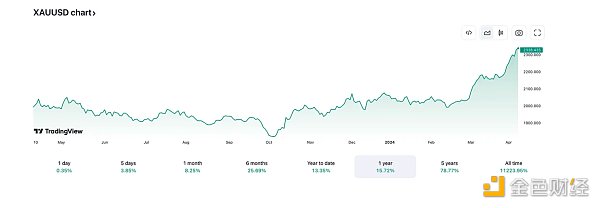

Let's take a look at the performance of other assets. While BTC hit a record high, the price of gold rose by more than 25% in 6 months, also breaking a record high. At the same time, the prices of silver and copper also reached their highest point in nearly a year. Rising gold prices are usually associated with risk aversion. As a long-standing "hard currency", gold is an important hedge when macro uncertainty rises, especially during periods of geopolitical tension.

However, when we look at the price trends of silver and copper, things become interesting. Silver and copper are important military strategic materials and are closely related to weapons production and the defense industry. Therefore, to some extent, the rapid rise in silver and copper prices is an additional manifestation of the risks of geopolitical conflicts and macro uncertainty.

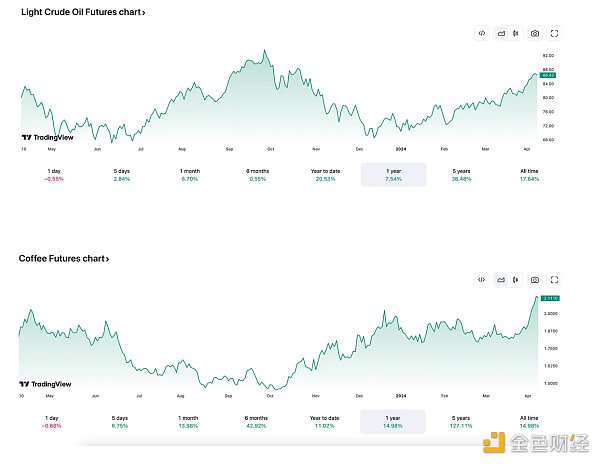

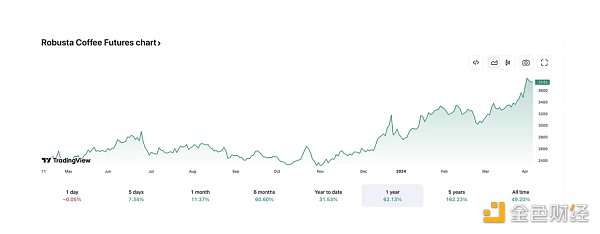

So, are there more clues like this? Of course! Since the beginning of 2024, crude oil prices have risen by more than 20%, and strategic commodities such as coffee have soared due to increased demand and supply chain tensions caused by geopolitical crises.

Risk aversion is never reflected in just one asset; when uncertainty comes, people will exchange cash for "safe hard currency" or materials, which is an important reason for the rise in commodity prices such as gold, crude oil, coffee, and of course one of the reasons for the rise in stock prices. The price of cryptocurrencies such as Bitcoin has risen.

BTC: Continue to rise?

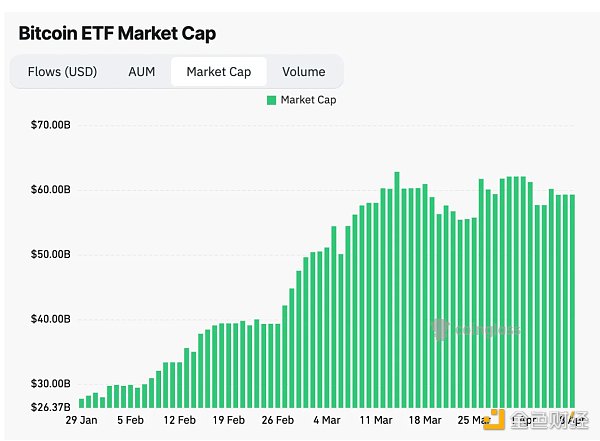

Considering the escalating geopolitical tensions in the Middle East and Eastern Europe, the risk aversion demand of global investors is unlikely to be effectively alleviated in the short term. Therefore, risk aversion will strongly support the demand for BTC. At the same time, although the liquidity return rate is expected to slow down, the tightening of liquidity is unlikely to happen again. Therefore, the liquidity scale of the "locked" spot BTC ETF will remain relatively stable. In the long run, the return of liquidity in the future will also drive the steady rise of BTC prices.

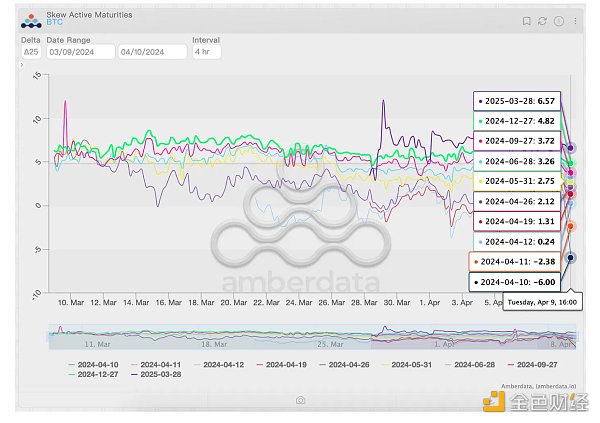

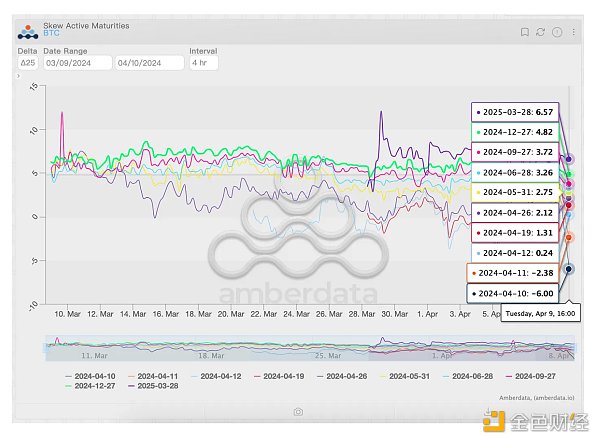

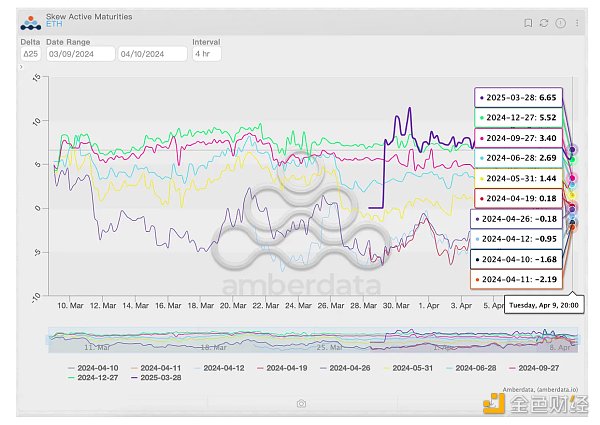

Traders in the options market also hold similar views. Although investors' intraday bullish sentiment has weakened due to short-term fluctuations, investors' bullish sentiment on BTC has remained stable and dominant in both near and far months. However, investors' expectations for BTC's medium- and long-term performance have slightly declined compared with the same period in March, and weakening expectations of interest rate cuts may be one of the reasons.

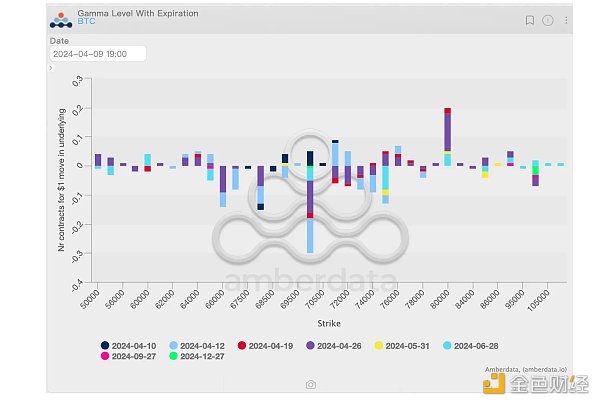

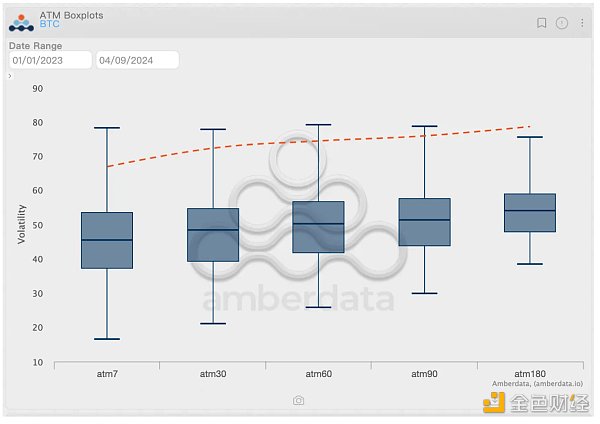

It is worth noting that the latest implied volatility data shows that traders remain relatively cautious about BTC's price performance. In the face of the upcoming BTC halving, although the level of macro uncertainty is relatively low and the pricing of tail risk levels has also declined, traders still expect BTC prices to have a 7-day price change of 9.27% and a 30-day price move of 20.74%.

Considering that investor bullish sentiment remains high, BTC prices ideally still have the potential to break through $80,000. However, volatility is never one-way; we cannot ignore the possibility of BTC falling below $65,000.

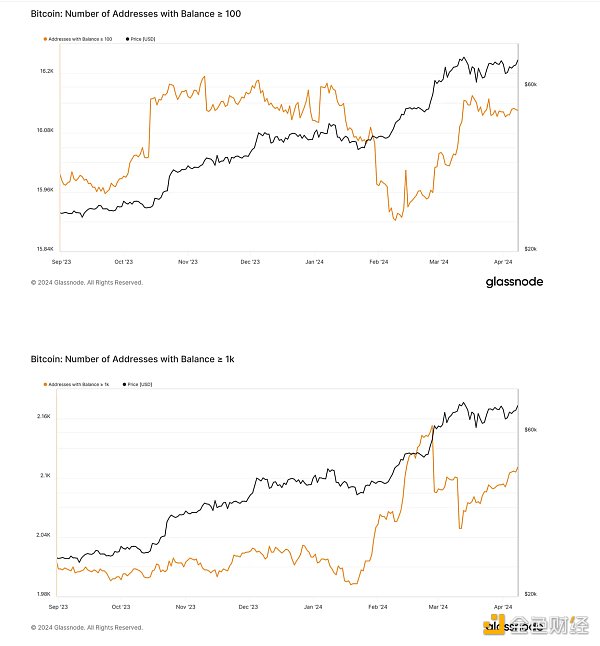

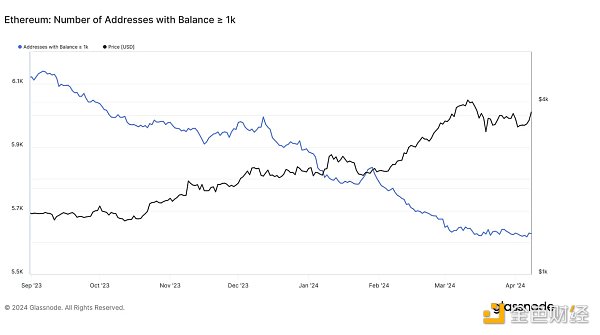

Traders' caution seems to be justified. In the spot market, although the number of whales holding more than 1k BTC is still increasing, overall, the growth of whales holding more than 100 BTC has stagnated, which means that purchasing power is weakening. Overall, although holding BTC is still a better choice in the medium and long term, with the temporary end of the "asset allocation period", the price increase of BTC may gradually stabilize.

Non-BTC Cryptocurrency: Internal Game

Compared with BTC, ETH is not so lucky. The probability of the spot ETH ETF passing is gradually getting smaller. Even the most optimistic ETH investors have gradually accepted that the negotiations and games around the spot ETF will be long-term. ETH's performance depends more on the redistribution of liquidity within the crypto market and the changes in the macro liquidity level within the crypto market.

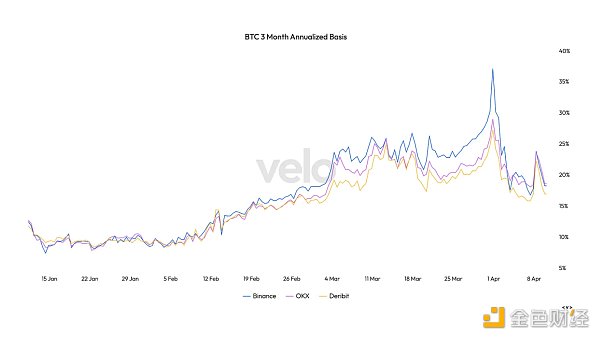

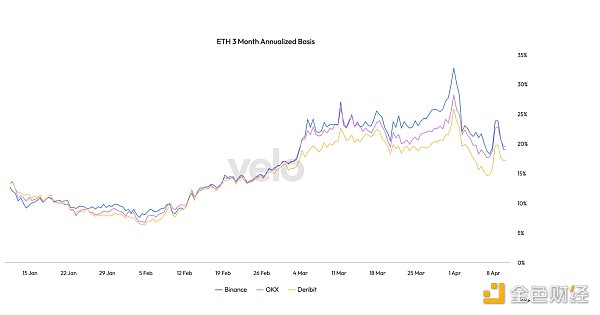

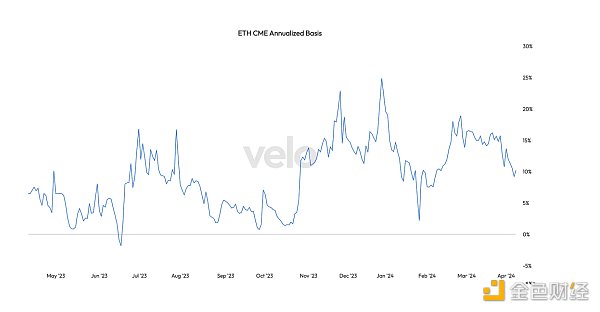

From a macro perspective, benefiting from the expectation of interest rate cuts, traders remain bullish on ETH's long-term performance. But similar to BTC, the weakening expectations of interest rate cuts have also had a negative impact on ETH's future performance expectations, which is reflected in the changes in the annualized premium of ETH futures.

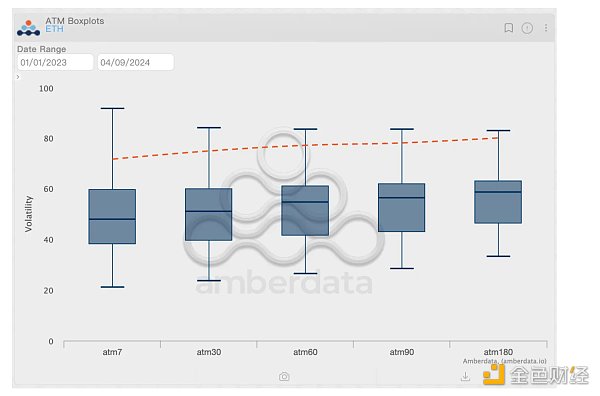

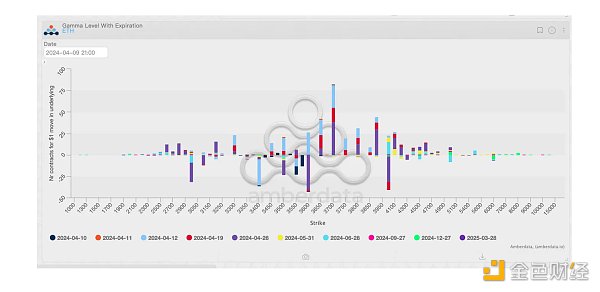

Although investors are pricing in relatively high price changes for ETH (9.94%/7 days, 21.5%/30 days), judging from the latest gamma distribution, investors are more likely to worry about the volatility brought about by price declines rather than the volatility brought about by price increases. If the price of ETH shows a downward trend, it will only gain some support after falling to around $3,300.

At the same time, the support on the downward path appears "insignificant" compared to the resistance in the upward range. Unless there are enough positive events in the current market operation mode based on "liquidity reconfiguration", the hedging behavior of market makers will make it difficult for ETH prices to break through and stabilize above $3,700.

Fortunately, ETH whales seem to have slowed down the pace of selling spot. Under the influence of projects such as Ethena, staking spot profits has become a relatively more profitable business, and the traditional Covered Call strategy has become popular again as price increases have slowed down. However, this only means that whales remain "neutral" in the price game for the time being.

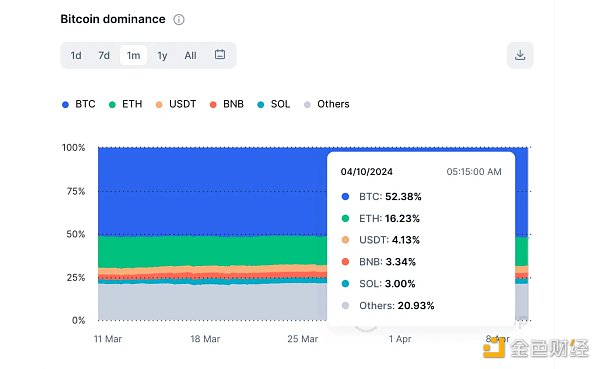

For speculators, it seems more appropriate to invest in other coins with greater growth potential in the case of weak ETH prices, which has a further adverse impact on ETH's performance. ETH's market share once fell below 16%; although it has recently rebounded, ETH's market share has still shrunk significantly compared with last month. Considering that BTC's market share has not changed significantly in the past month, it is clear that altcoins have a certain advantage in the liquidity competition with ETH.

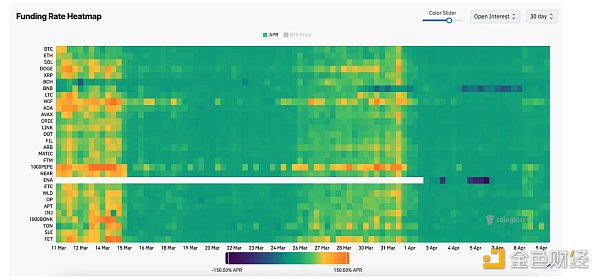

Overall, holding ETH is not a "bad strategy"; for whales, ETH's rich interest-bearing channels can still bring relatively stable and considerable returns. However, for warriors seeking breakthrough returns, considering the current leverage level and the relatively low speculative sentiment of altcoins reflected in the funding rate, following the pace of liquidity reconfiguration in the crypto market seems to be a more appropriate choice.

JinseFinance

JinseFinance

JinseFinance

JinseFinance Coinlive

Coinlive  Bitcoinist

Bitcoinist Cointelegraph

Cointelegraph Cointelegraph

Cointelegraph Nulltx

Nulltx 链向资讯

链向资讯 Nulltx

Nulltx Bitcoinist

Bitcoinist Cointelegraph

Cointelegraph