Deng Tong, Golden Finance

On September 15, 2025, Base protocol lead Jesse Pollak stated at BaseCamp that Base is exploring the possibility of issuing a network token.

Subsequently, Coinbase CEO Brian Armstrong clarified on the X platform: "Base Network Tokens are indeed being explored, and we hope they can be an excellent tool to accelerate decentralization and expand the growth of creators and developers in the ecosystem." However, it should be noted that there are no firm plans for the tokens at this stage, and this disclosure is only for the purpose of publicly updating our thinking. There are no specific details regarding the timing, design, or governance of the Base Network Tokens.

Why is Base considering issuing a token? What impact will this have?

I. A Quick Overview of Base's Current Status

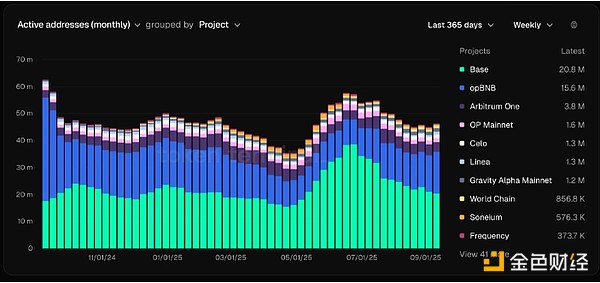

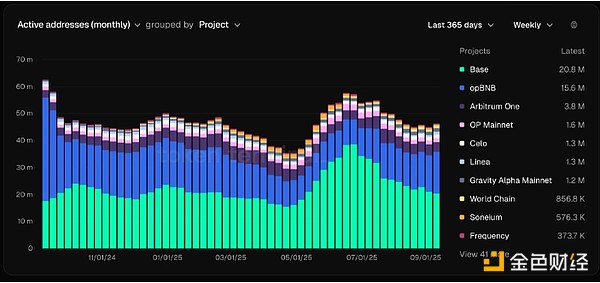

Base has grown rapidly since its launch in 2023. Base is a Layer-2 blockchain based on Ethereum, incubated by Coinbase. The Base Network processes transactions off-chain and then settles them on Ethereum. Base currently uses ETH to pay gas fees. According to L2Beat data, it is the second largest Layer-2 network (measured by TVL) after Arbitrum. Base's user operations per second (UOPS) are seven times that of Arbitrum. In the past 30 days, Base sent 328 million transactions, compared to Arbitrum's 77 million. Currently, the total value locked in the Base network is approximately $5 billion, of which $1.7 billion was added this year. Data from Token Terminal shows that the number of monthly active addresses in the past 12 months was approximately 20.8 million.

2. Why is Base considering issuing a coin?

In November 2024, Pollak praised Hyperliquid for prioritizing product development over token incentives, stating at the time: "We're focused on building. We want to solve real problems and enable you to build better. I want your feedback so we can do better."

Recently, a Base spokesperson explained why Base was considering issuing a token: "Initially, considering launching a token was not a priority for us as we felt we needed to focus on our core product first.Now that we've achieved sub-second, sub-US-grade transaction speeds and expanded into an open stack, we're exploring a network token to further decentralize and make the ecosystem more open, accessible, and community-driven. Base is for everyone, and a network token can help more people participate in Base's on-chain economy."

Issuing a token also aligns with Base's broader vision of building a decentralized layer on Ethereum, as any token can be a native token of Ethereum. "Base is a bridge, not an island." Secondly, since Trump took office, the crypto market has been raising expectations regarding regulatory policies. Some analysts believe that a more relaxed regulatory environment could alleviate policy concerns for US-based crypto projects like Base, making it easier to launch their own tokens. Pollak stated that Base is committed to building a token on Ethereum and will work with regulators on the issuance and distribution of the token. "As a US company, we are committed to working with regulators and legislators to do this correctly." Former Coinbase employee Youngblood said he was "very surprised" to learn that the company was exploring issuing a token for Coinbase. When he was in charge of Coinbase's staking product, he felt the company's legal team was particularly conservative. "I think everything changes with the change of government." III. The Impact of Base's Coin Issuance What impact would Base have if it actually issued a token? First, it will directly increase Base network activity. Once word of Base's potential token issuance spread, speculation about whether Base users would receive airdrops hastened. The increased likelihood of a token issuance fuels anticipation for potential airdrops, staking programs, and other incentives. Users' eagerness to qualify for token distributions will directly drive increased activity on the Base network. As mentioned above, Base ranks second in TVL, and the launch of its native token will further accelerate network adoption. Developers will be more actively involved, increasing Base network liquidity. Nick Tomaino, founder of the crypto venture capital firm 1confirmation, noted, "If executed correctly, BASE will instantly become a top-five cryptocurrency by market cap. With no VC, no insider trading, and transparent airdrops to developers and users based on usage, it's the most successful tokenless chain in history, and airdrops will be rocket fuel." Second, it will accelerate Base's decentralization. Base stated, "Exploring a network token is one path to realizing our vision of a global on-chain economy. The Base network token has the potential to accelerate Base's decentralization and expand opportunities for builders and creators across the ecosystem." The token issued by Base will serve as an incentive tool, encouraging more developers to participate in building the Base network and reflecting the will of a wider range of participants in network governance and validation. Third, it will reshape the L2 competitive landscape. Currently, Optimism, Arbitrum, and Starknet have launched native tokens for ecosystem management and to provide incentives for validators and users. Launching a native token will put Base on a par with competitors and directly increase its market competitiveness. Furthermore, Coinbase can leverage its significant advantages to quickly capture capital and user resources in the Ethereum L2 ecosystem. However, Base also has a consideration: regulation. Coinbase is based in the US and has close ties with regulators. Any move to issue a Base token would face strict oversight. Industry insiders believe that how Base addresses these challenges will be crucial in determining the structure, issuance method, and long-term effectiveness of its proposed token. They will likely pay particular attention to ensuring that any offering complies with securities laws and provides a transparent governance model. Failure to adequately address regulatory concerns could expose the network and Coinbase to significant legal risks. Going forward, even if Base successfully launches its token, investors will need to closely monitor its ability to strike a balance between innovation and regulatory compliance. IV. Conclusion Base has sent a clear signal: preparations are underway for its token launch. The launch of the Base token will mark a turning point in a significant shift in the Ethereum Layer 2 landscape. While it's difficult to predict whether the Base token will focus on paying transaction fees or providing rewards or staking-related incentives, anticipation is high. Market discussion about Base's token launch will continue to intensify over time, and each new announcement from Base will directly impact short-term crypto market sentiment and Coinbase's stock price.

Kikyo

Kikyo