Author: Nancy Lubale, CoinTelegraph; Compiler: Deng Tong, Golden Finance

Summary

On May 18, Ethereum prices rose 3% to $2,550, triggering $22 million in ETH short liquidations.

A bullish flag on the chart signals a $3,700 price target, with analysts predicting Bitcoin prices will rise to $5,000 in May.

On May 18, ETH prices rose, gaining more than 2.5% in the past 24 hours to trade at $2,536. The rally has boosted optimism among traders who believe ETH prices could reach $3,000 in May, citing strong technicals.

Ethereum wiped out $7.5 million in short positions in one hour

Data from Cointelegraph Markets Pro and Bitsamp showed that on May 18, the price of Ethereum rose by more than 4.5% from a low of $2,440 the previous day to an intraday high of $2,551.

ETH/USD daily chart. Source: Cointelegraph/TradingView

Today, in addition to the plunge in Ethereum, the cryptocurrency market also saw large-scale liquidations. According to CoinGlass, more than $158 million in leveraged cryptocurrency positions were liquidated in the past 24 hours, of which $95 million were long positions.

Ethereum short position liquidations totaled $22.25 million, with $7.5 million evaporated in the past hour alone.

Total liquidations in the cryptocurrency market. Source: CoinGlass

This means that Ethereum's return to $2,500 caught short sellers off guard.

Additional data from CoinGlass shows that sell-side interest has formed several bands above the spot price, with sell orders worth more than $384 million all the way up to $3,000. This suggests that a sustained rally could be limited at this level.

ETH liquidations chart. Source: CoinGlass

Market analysts believe that Ethereum’s recent decline is a technical pullback designed to retest key support levels before continuing to rise, targeting $3,000 and above.

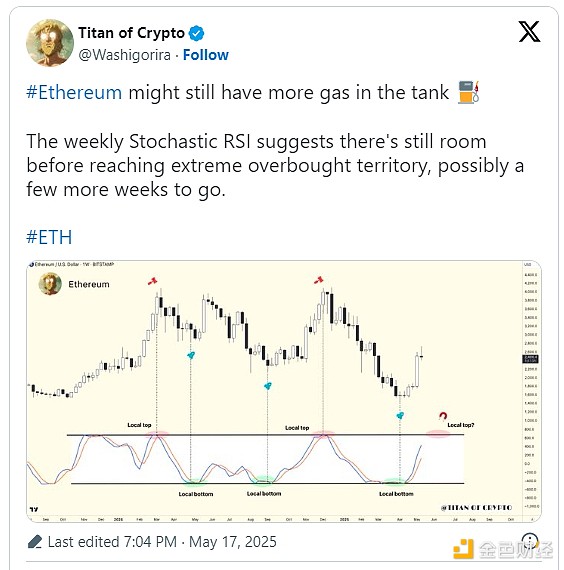

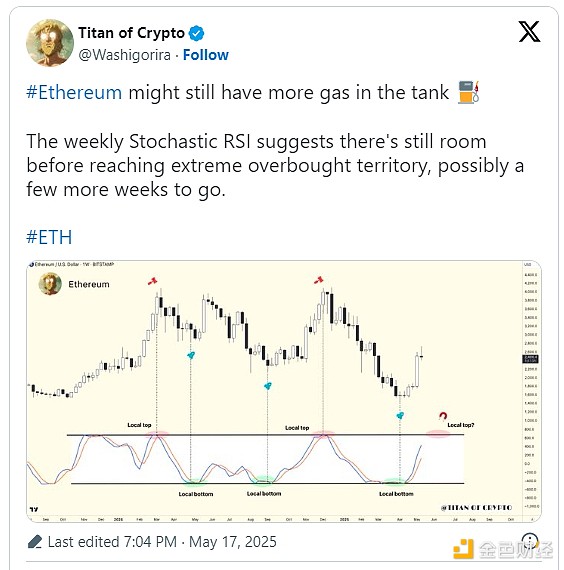

The “crypto titan” said the weekly stochastic RSI indicator is at 79, indicating that ETH “still has upside potential.”

According to anonymous analyst Chimp of the North, Ethereum’s downside may be limited to $2,400.

The analyst shared a chart showing that the altcoin may continue to pull back and retest the $2,400 support level before launching another rally with a target of $3,000-3,300.

Another analyst, Crypto Patel, predicts that Ethereum will see a deeper correction and said that the ETH price may fall to $1,800 before starting an upward trend.

“If price finds support, this area would be a high probability zone for a bullish re-entry,” the analyst wrote in a May 17 X post. “If demand persists, the next leg up could be towards $4,000-5,000,” he added.

ETH could hit a new all-time high of around $5,000, driven by AI adoption, spot ETF inflows, and the latest improvements brought by the Pectra upgrade.

Ethereum Price Bull Flag Still in Play

From a technical perspective, ETH price remains above a bull flag pattern on the four-hour timeframe, a bullish signal that forms after a significant price increase followed by a downward range consolidation.

The bull flag was confirmed on May 13 when the price broke above the uptrend line at $2,550. Currently, Ethereum is retesting the upper boundary of the flag, currently at $2,470, which constitutes an immediate support level.

If the daily chart closes above this level, the asset could resume its uptrend towards the bull flag’s technical target of $3,720, which would represent a 50% gain from the current price.

ETH/USD four-hour chart. Source: Cointelegraph/TradingView

On the contrary, the RSI has fallen from 60 to 42 in the past 24 hours, indicating that the current pullback may continue if profit-taking intensifies.

If the daily chart closes below the $2,470 support level, the probability of a drop to $2,400 and then to the lower limit of the flag at $2,300 will increase.

Kikyo

Kikyo