Source: Blockchain Knight

Hong Kong is about to take a breakthrough move in the BTC field.

According to a recent report by Bloomberg, the SFC (Hong Kong Securities and Futures Commission) is expected to approve a spot BTC ETF to be created and redeemed in physical form in the upcoming second quarter< /strong>.

This development may significantly change the landscape of Crypto asset investment and potentially make Hong Kong the leader in the global BTC ETF market.

Noelle Acheson, a well-known figure in the Crypto asset industry and author of the newsletter, expressed her views on the potential impact of the move: “The Asian Crypto asset market is much larger than the U.S. Crypto asset market in terms of trading volume. .”

She elaborated on two possibilities: the existing high trading volume may indicate that the market is saturated, or it may indicate that the Asian market is more familiar and familiar with Crypto assets.

Acheson added: "ETFs listed in Hong Kong may bring significant amounts of money into 'approved' portfolio allocations."

This suggests There may be significant shifts in investment flows.

Bloomberg ETF expert Eric Balchunas emphasized during the discussion the importance of Hong Kong’s approval of physical BTC ETFs for physical subscriptions and redemptions, which is in sharp contrast to the United States, which only allows cash subscriptions.

Balchunas said: "This will help stimulate the region's rapidly growing asset management scale and transaction volume, and Hong Kong may gain considerable strategic advantages."

Founder of Custodia Bank Caitlin Long, CEO, also weighed in, highlighting another key aspect of Hong Kong’s proposed ETF structure: the ability to withdraw BTC directly. This ensures that investors don’t just hold “paper BTC.”

Long expressed excitement about this development: “If it is true that the spot BTC ETF is approved in Hong Kong, it would be huge and ironic. Banks in the United States will watch themselves being eliminated. Out.”

Concussion around the potential of a Hong Kong BTC ETF has expanded beyond industry experts to the broader crypto asset community.

Bitcoin Munger, a well-known X analyst, believes that the catalyst effect of Hong Kong ETFs is far greater than that of US ETFs.

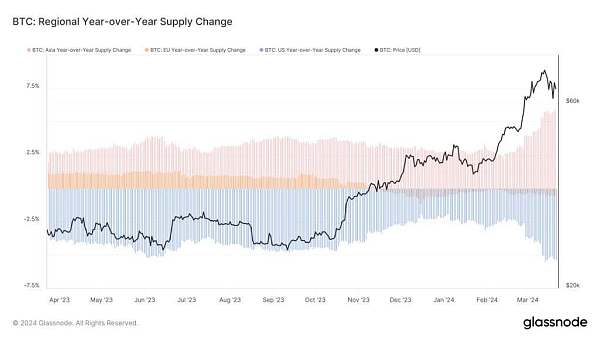

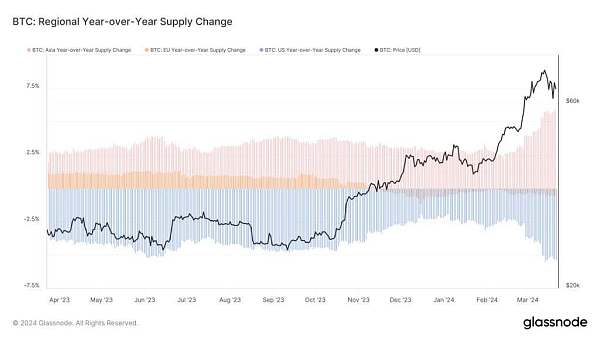

Munger cited data from Glassnode and said that BTC supply has been shifting from the west to the east year by year. He believes that this trend strengthens the reason why Hong Kong ETFs surpass U.S. ETFs.

Munger added: “BTC has been moving from West to East, which is strong evidence that Hong Kong ETFs will be a more bullish catalyst than US ETFs.”

However, not all Everyone believes that Hong Kong ETFs will have a significant impact.

Eric Balchunas warned during the heated exchange: "Don't overestimate the market size of Hong Kong relative to the United States."

"Let's not be too crazy now. Hong Kong is relatively small compared to the United States." Too small."

Bitcoin Munger countered: "The success of the Hong Kong ETF may not be fully appreciated, and any positive surprises may surprise analysts including Balchunas."

When a user asked a question about whether mainland Chinese investors could buy these ETFs, Balchunas responded negatively: "No."

This blow has aroused the enthusiasm of some people, because in the context of the real estate crisis and the tilt towards gold, the important Chinese market may become a strong supporter of BTC through these ETFs.

JinseFinance

JinseFinance