Author: MARTIN YOUNG Source: cointelegraph Translation: Shan Ouba, Golden Finance

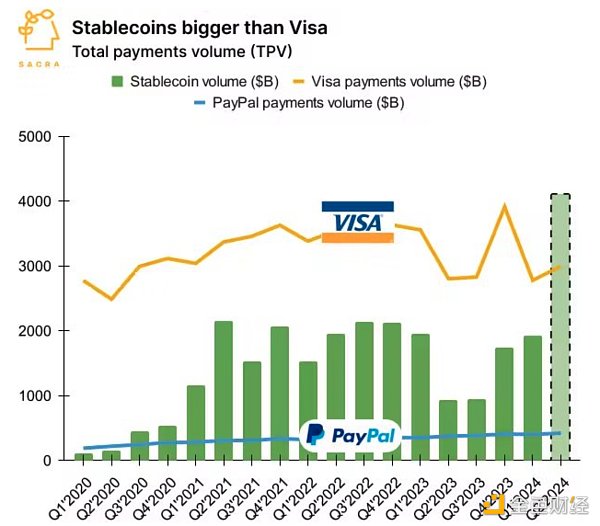

Research firm Sacra predicts major disruption in the payments industry, claiming that stablecoins will surpass Visa's total payment volume this quarter. However, Visa's head of cryptocurrency remains skeptical.

Sacra co-founder Jan-Erik Asplund said that the applicability of stablecoins for cross-border transactions makes them likely to dominate the market. He believes that stablecoins have advantages in convenience (24/7 operation), speed (minutes versus hours) and cost (a few cents versus $12) compared to traditional systems. Asplund further claimed that major banks are actively exploring the integration of stablecoins into their internal payment networks.

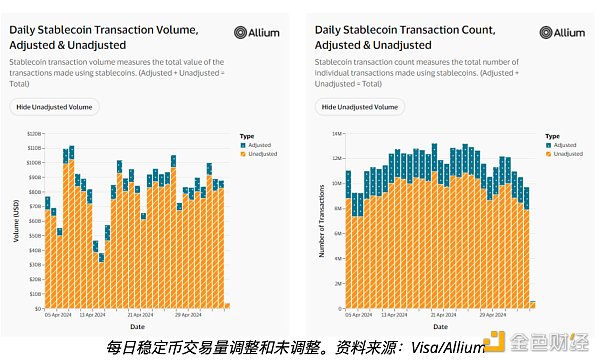

Cuy Sheffield, head of cryptocurrency at Visa, countered these arguments, arguing that there are discrepancies in stablecoin data. Sheffield believes that on-chain transactions involving robots and automation do not represent actual settlements. Visa's recently launched dashboard claims that up to 90% of stablecoin transactions last month involved non-human users.

While the total volume of stablecoin transactions reached $2.2 billion in April, Visa, in partnership with Allium Labs, classified less than 10% ($14.9 billion) as real transactions, with the rest attributed to robot activity and internal exchange operations. According to Visa’s dashboard, this adjusted metric is designed to remove “inorganic activity and other artificial inflationary practices.”

The conflict highlights the ongoing debate around stablecoin adoption and data transparency. While Sacra paints a picture of a future dominated by stablecoins, Visa has raised concerns about the validity of the current metric. The true impact of stablecoins on traditional payment giants remains to be seen.

Visa’s dashboard applies two filters to the stablecoin data: a one-way volume filter that only counts the maximum stablecoin amount transferred in a single transaction; and a non-organic user filter that aims to remove bot activity and automated trading from large entities such as centralized exchanges.

However, the dashboard reports that total monthly stablecoin transaction volume (whether real or fake) has almost doubled since the beginning of 2024, with most of the transactions using Tether and Circle's USD Coin.

Meanwhile, other payment giants have also joined in. PayPal launched its PYUSD stablecoin in 2023, and Stripe said in April that it would allow merchants on its platform to accept stablecoins for online transactions.

Also in April, Ripple announced plans to launch a dollar-backed stablecoin to compete with the market leader.

The total stablecoin market value is currently around $161 billion, with daily trading volume of $37 billion, according to CoinGecko.

Alex

Alex

Alex

Alex Xu Lin

Xu Lin

Cointelegraph

Cointelegraph Nulltx

Nulltx Bitcoinist

Bitcoinist Cointelegraph

Cointelegraph Cointelegraph

Cointelegraph Cointelegraph

Cointelegraph Cointelegraph

Cointelegraph