Source: Chainalysis; Compiled by: Tao Zhu, Golden Finance

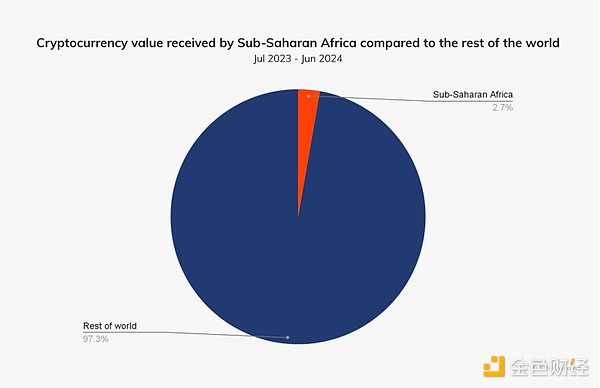

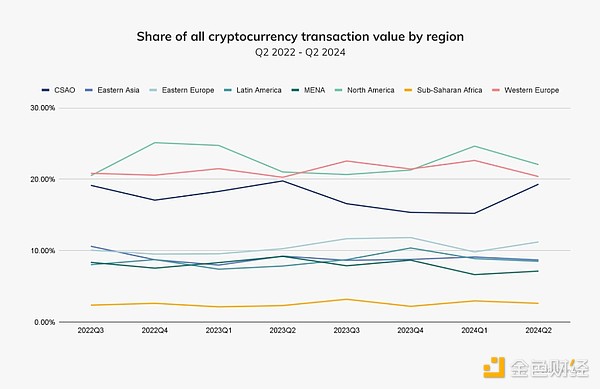

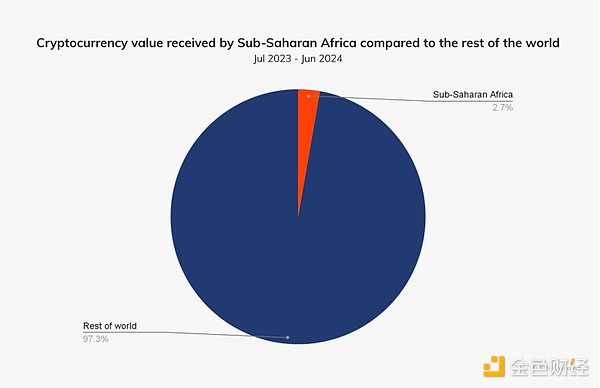

Sub-Saharan Africa accounts for the smallest share of the global cryptocurrency economy, accounting for 2.7% of global transaction volume between July 2023 and June 2024 - reflecting the region's small GDP relative to other regions. Despite this, Sub-Saharan Africa still achieved modest growth, with an estimated $125 billion in on-chain value during the period, an increase of $7.5 billion from last year.

Cryptocurrency is undoubtedly changing the financial landscape in the region, which is home to many of the countries that rank high in our Global Adoption Index. Nigeria maintained its position as a top global player, ranking second globally, while Ethiopia (26), Kenya (28), and South Africa (30) also made the top 30.

The real-world use cases for cryptocurrencies in Africa are particularly compelling. Africans are leveraging cryptocurrencies for commercial payments, as a hedge against inflation, and for more frequent, smaller (i.e. retail) transfers.

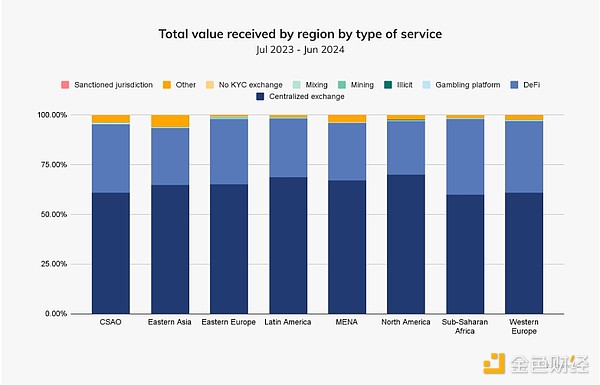

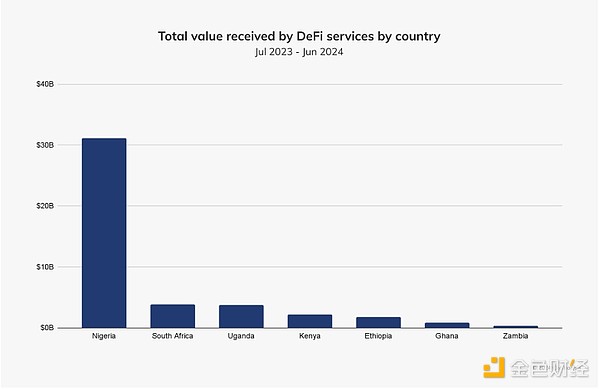

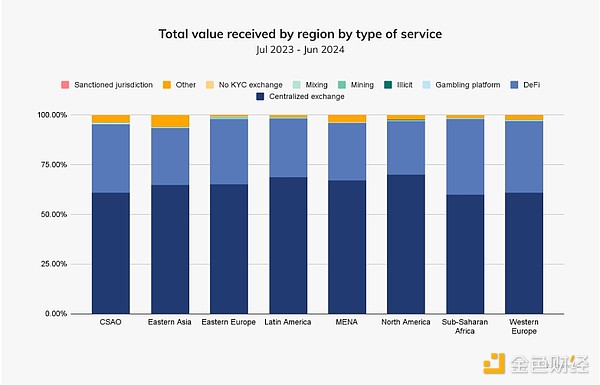

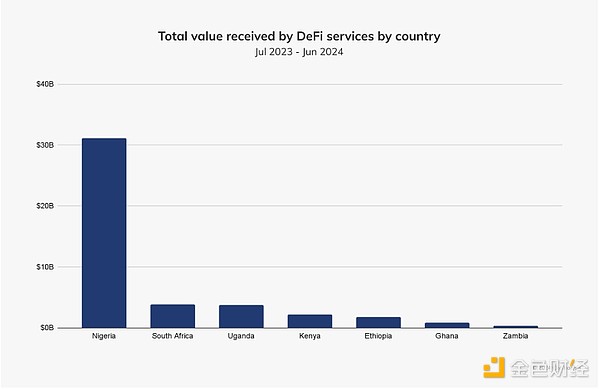

Notably, Sub-Saharan Africa leads the world in DeFi adoption, likely due in part to the region’s growing demand for accessible financial services, where only 49% of adults have a bank account as of 2021, according to the World Bank.

With its position as a leader in financial innovation and inclusion, Sub-Saharan Africa is becoming a global example of how cryptocurrency can drive real-world impact, particularly in regions underserved by the traditional financial system.

Stablecoins are driving economic resilience and global connectivity in Sub-Saharan Africa

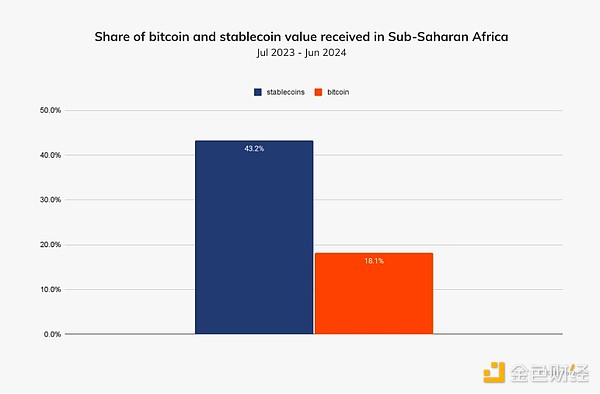

Stablecoins have become a key element of Sub-Saharan Africa's crypto economy. In countries where local currencies are highly volatile and the use of the U.S. dollar is limited, dollar-pegged stablecoins such as USDT and USDC have gained traction, providing businesses and individuals with a reliable way to store value, facilitate international payments, and support cross-border trade.

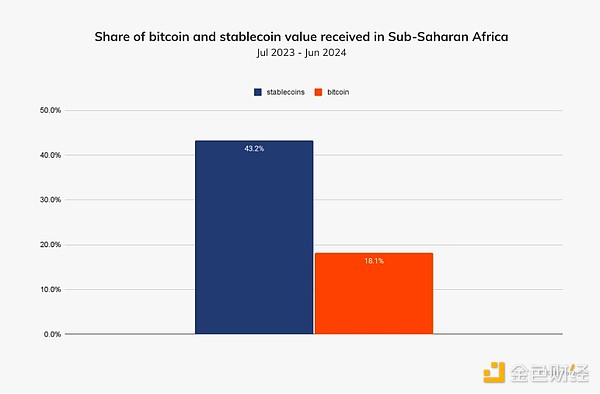

Stablecoins currently account for approximately 43% of total transaction volume in the region.

To further understand the growing prominence of stablecoins, we spoke to two key figures shaping the African cryptocurrency landscape: Rob Downes, Head of Digital Assets at ABSA Bank, CIB, a large African bank operating in 12 African countries, and Chris Maurice, CEO and co-founder of Yellow Card, one of Africa’s leading crypto asset exchanges operating in 20 countries on the continent.

The main driver for the adoption of stablecoins in Africa is the foreign exchange (FX) crisis facing many countries.

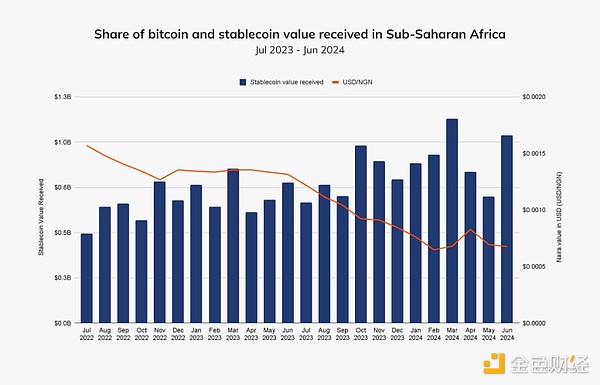

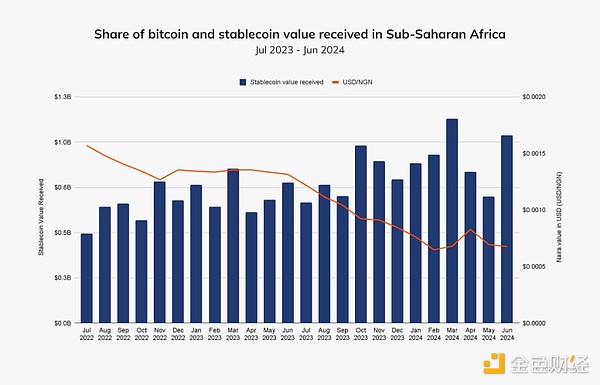

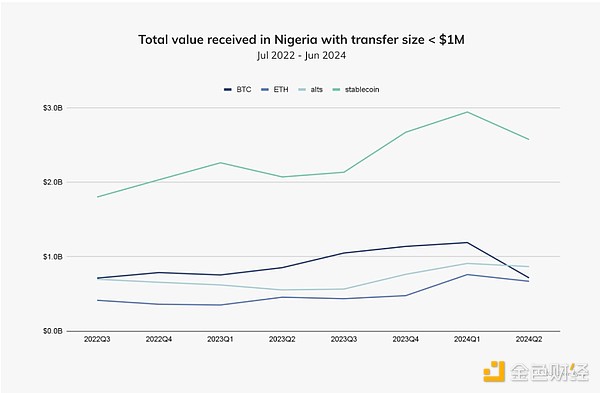

“Around 70% of African countries face foreign exchange shortages, and businesses are struggling to obtain the dollars they need to operate,” explained Maurice. “Stablecoins offer these businesses the opportunity to continue operating, grow, and strengthen local economies.” Small and medium-sized stablecoin inflows (the amounts we measure are less than $1 million) tend to align with naira depreciation, as shown below.

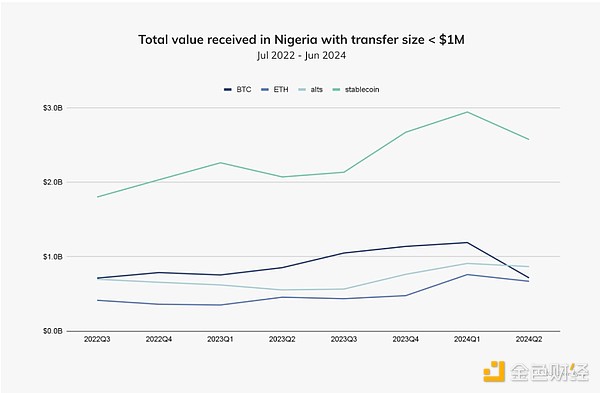

As the naira depreciates, we can see an increase in stablecoin inflows for transactions under $1 million, with this activity being more pronounced during periods of large currency depreciations.

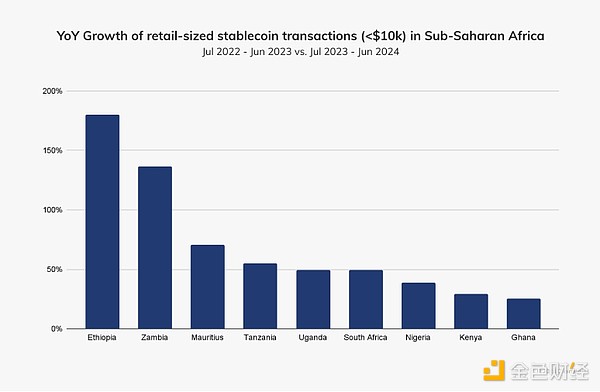

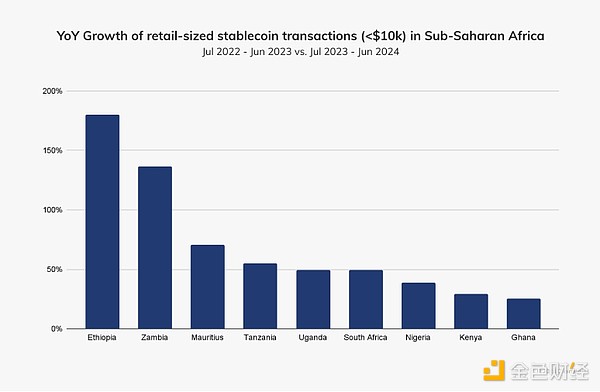

Ethiopia, Africa’s second most populous country with a population of 123 million, is currently the fastest growing market for retail-scale stablecoin transfers in the country, growing 180% year-on-year.

The local currency, the Ethiopian birr (ETB), depreciated 30% in July after the government eased currency restrictions in order to obtain a $10.7 billion loan from the International Monetary Fund and the World Bank. This depreciation could further stimulate demand for stablecoins.

For many African businesses, access to stablecoins through platforms such as Yellow Card offers an alternative to traditional financial institutions (FIs) that are unable to meet their dollar needs. “Stablecoins are an alternative to the dollar,” Morris said. “If you can get USDT or USDC, you can easily exchange it for hard currency somewhere else.” This reality makes stablecoins indispensable for companies involved in international trade. From small-scale importers buying goods overseas to large multinationals importing raw materials from Europe — stablecoins are facilitating transactions that would otherwise be stalled by currency shortages.

Stablecoins are also revolutionizing cross-border payments across Africa. “People don’t care about cryptocurrencies,” said Morris, who stressed that the focus in the region is on real use cases for cryptocurrencies. He cited businesses served by Yellow Card, such as a large food producer that uses stablecoins to pay overseas suppliers. In addition, many African fintechs rely on stablecoins to manage large amounts of local currency, which are then exchanged into stablecoins to facilitate cross-border payments.

Absa Group’s Rob Downes pointed out a similar trend among institutional clients in South Africa. “Our institutional clients are particularly interested in using stablecoins as a tool to manage liquidity and reduce exposure to currency volatility,” Downes told us. In countries where the value of the local currency fluctuates, stablecoins can be an attractive option for businesses looking to hedge currency risk.

Downes also noted the growing use of stablecoins for remittances and international payments. “We think stablecoins are going to be a game changer,” he said. For individuals sending money to family members overseas or paying for expenses, stablecoins offer a faster and more affordable alternative to traditional remittance services.

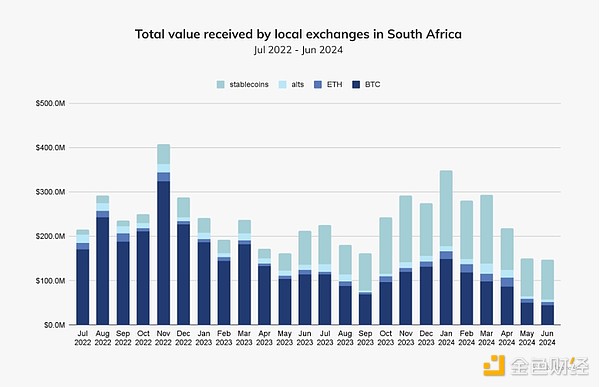

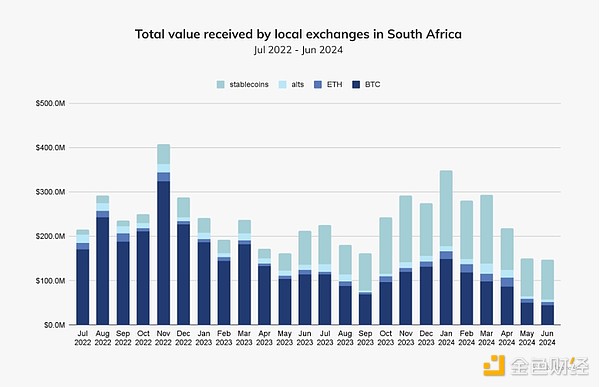

Starting at the end of 2023, stablecoins have continued to grow on local exchanges in South Africa – growing by more than 50% month-on-month in October 2023. Stablecoins have replaced Bitcoin as the most popular cryptocurrency in recent months.

While the use of stablecoins is rapidly expanding across Africa, the regulatory landscape is also gradually evolving. In South Africa, the Financial Sector Conduct Authority (FSCA) has provided regulatory clarity by classifying crypto assets as financial products, although there is no specific regulation for stablecoins. "We are working closely with regulators such as the [South African] Reserve Bank to ensure that we are prepared for any developments in stablecoin regulation, which we expect will soon become a major area of focus," Downes added. Maurice pointed out that in many cases, stablecoins are in a "grey area" where they are neither clearly regulated nor banned. He stressed the importance of working with regulators to ensure that stablecoin users remain compliant. "We do a lot of work with local regulators," said Maurice. “We are working with central banks and financial authorities in 20 countries to help them understand how to use stablecoins safely and effectively.”

Looking ahead, both Downes and Maurice believe stablecoins will continue to play a central role in African economies. “I think stablecoins will be the main use case for crypto in South Africa over the next three to five years,” Downes said.

Maurice agreed, adding that stablecoins are helping open up African economies to global markets. “Stablecoins are actually developing a market for African currencies that have never had a place internationally,” he said. By providing businesses with a way to transact in non-volatile currencies, stablecoins are increasing price transparency and encouraging foreign investment. “It’s creating a more open economy that actually encourages investment,” Maurice added.

Nigeria is a hub of cryptocurrency activity in sub-Saharan Africa

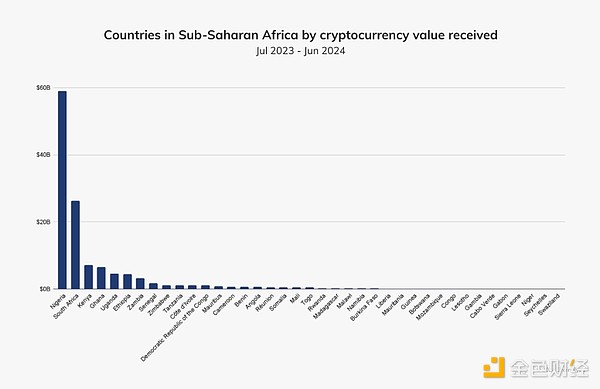

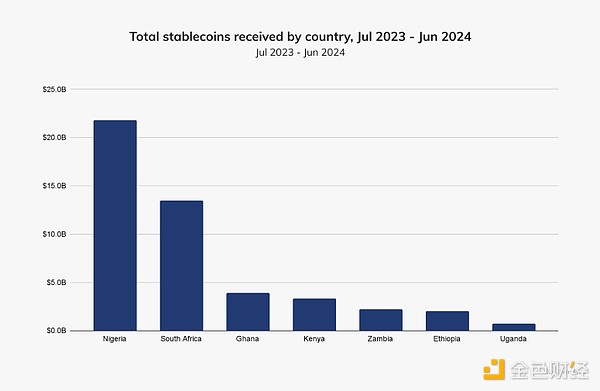

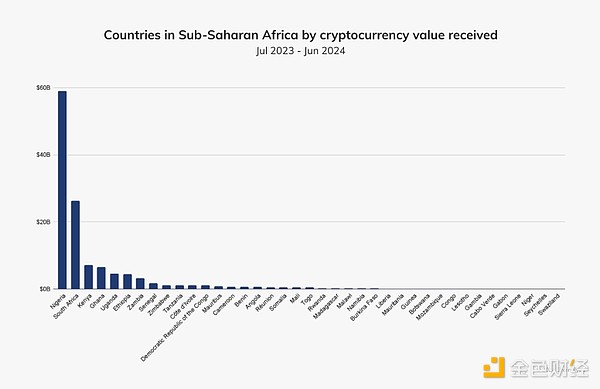

In recent years, Nigeria has become a global leader in cryptocurrency adoption, thanks to innovative use cases that address economic challenges. The country ranks second overall in our Global Adoption Index, receiving approximately $59 billion worth of cryptocurrency between July 2023 and June 2024.

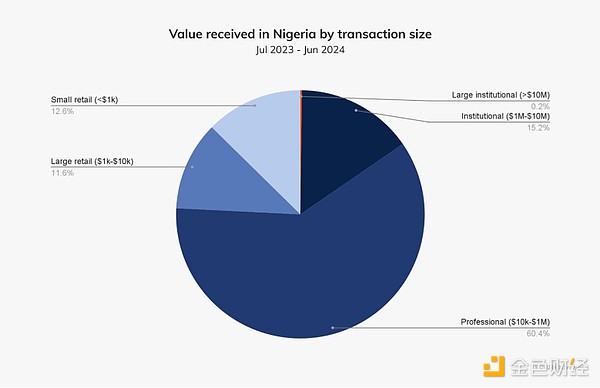

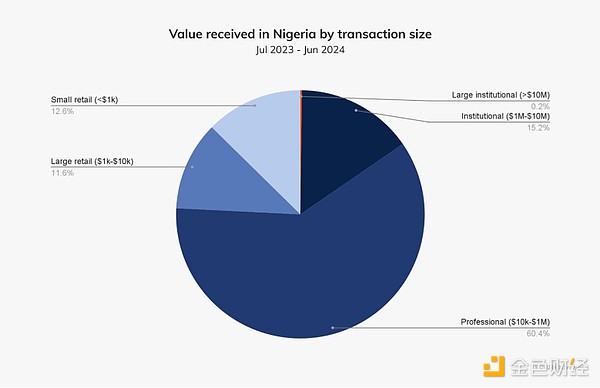

Crypto activity in Nigeria is primarily driven by small retail and professional-sized transactions, with approximately 85% of transfers valued at less than $1 million.

We spoke to Moyo Sodipo, COO and co-founder of Nigerian cryptocurrency exchange Busha, to get a glimpse into the realities of cryptocurrency adoption in the country. Sodipo said that everyday activities such as bill payments, mobile phone top-ups, and retail shopping are increasingly being driven by cryptocurrencies. “People are starting to see the real-world utility of cryptocurrencies, especially in everyday transactions, as opposed to the previous view of cryptocurrencies as a means to get rich quick,” he explained.

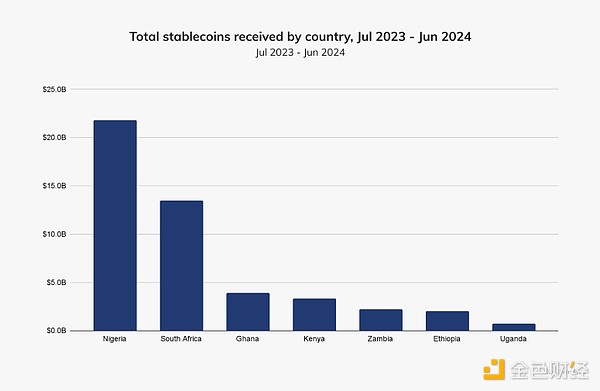

As in Ethiopia, Ghana, and South Africa, stablecoins are a big part of Nigeria’s crypto economy, accounting for about 40% of all stablecoin inflows in the region — the highest in Sub-Saharan Africa.

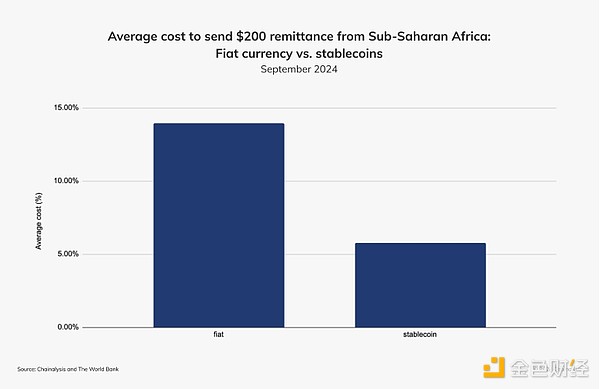

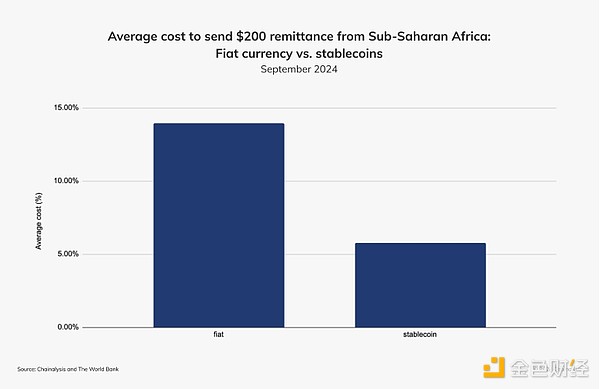

Due to the inefficiency and high cost of traditional remittance channels, many Nigerians rely on stablecoins for cross-border remittances. Sodipo pointed out: "Cross-border remittances are the main use of stablecoins in Nigeria. It is faster and more affordable."

As shown in the figure below, the average cost of sending $200 from sub-Saharan Africa using stablecoins is about 60% lower than traditional remittance methods using fiat currencies. 1

As with other African countries, the main drivers for stablecoin adoption in Nigeria are inflation and the depreciation of the naira, which hit an all-time low in February 2024. We can see the impact of this trend by looking at the size of transfers under $1 million. In the first quarter of 2024, stablecoins were worth nearly $3 billion, making stablecoins the largest segment of transactions under $1 million in Nigeria.

While Bitcoin and altcoins remain significant, representing billions of dollars in value, stablecoins are clearly becoming the medium of choice for small and medium-sized transactions, suggesting widespread adoption.

In addition to the growing prominence of stablecoins, DeFi is also experiencing a major moment in Nigeria, echoing a broader trend of Sub-Saharan Africa as a global leader in DeFi adoption. Nigeria is at the forefront of this trend, with DeFi services valued at over $30 billion last year.

In addition to the traditional financial system, DeFi platforms offer Nigerians new opportunities to earn interest, take out loans, and participate in decentralized exchanges. "DeFi is a key growth area as users explore ways to maximize returns and access financial services that would otherwise be inaccessible," said Sodipo.

In December 2023, the central bank lifted a ban on banks that provide services to cryptocurrency companies, which also played a key role in this momentum. "Since the banking ban was lifted, it has opened up a lot of possibilities for collaboration and smoother transactions," explained Sodipo. Building on this, in June 2024, the Nigerian Securities and Exchange Commission (SEC) launched the Accelerated Regulatory Incubation Program (ARIP), which now requires all virtual asset service providers (VASPs) to register and undergo an assessment before being fully approved. "The industry is optimistic about the ARIP; it is a shift away from uncertainty and a positive step towards regulatory clarity," said Sodipo.

Despite Nigeria's progress with initiatives such as the ARIP, many financial institutions remain reluctant to fully engage in the cryptocurrency space due to lingering regulatory ambiguity. "Banks remain cautious and are waiting for clear signals from the central bank and the Securities and Exchange Commission before fully entering the market," explained Sodipo.

Nevertheless, Nigeria's cryptocurrency market continues to thrive. Looking ahead, Sodipo is optimistic about the future of cryptocurrency in Nigeria, especially with the ongoing regulatory reforms. "Open dialogue with regulators is key. We hope that further clarity will drive more banks and financial institutions to enter the space," said Sodipo.

South African Crypto Market Booms, Driven by Institutional Activity and Growing TradFi Participation

As Africa’s largest economy, South Africa has become one of the continent’s largest cryptocurrency markets, garnering approximately $26 billion in value over the past year. South Africa has seen significant growth in the number of licensed firms and increasing institutional-scale activity.

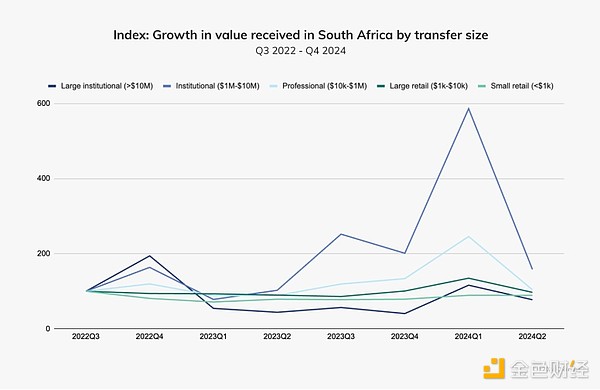

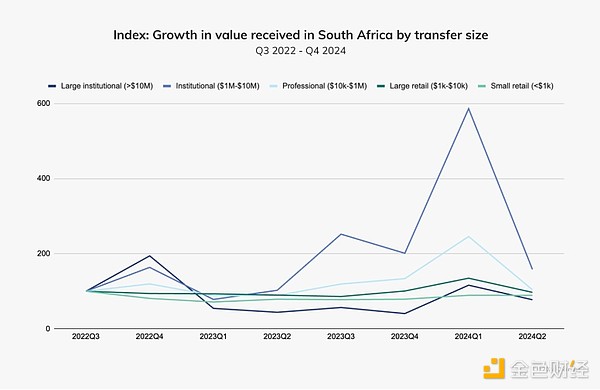

The chart below shows the growing influence of institutional and professional-scale trading in South Africa, which has become the largest contributor to total index value, particularly from the end of 2023 to the first quarter of 2024. 2

This connection between traditional finance and cryptocurrency is particularly active in South Africa. According to Rob Downes of the Absa Group, South Africa is at a critical juncture where traditional finance and digital assets are beginning to merge. “We are seeing growing interest from institutional clients, particularly in digital asset custody solutions, which will play a key role in supporting the crypto ecosystem here,” said Downes.

While institutional players drive the majority of market activity, retail and professional participation remains steady. To gain insight into the business environment, we spoke to Carel van Wyk, founder of MoneyBadger, a company focused on integrating crypto payments for retailers. Van Wyk noted that South Africa’s crypto market has been steadily maturing, particularly in the payments space. “In the past, people have tried to do payments on-chain, but this is impractical because blockchain transactions can get expensive and are not suitable for small, fast transactions.” He spoke of advances in layer2 technology and payment APIs that are making crypto payments more suitable for everyday use, allowing retailers to accept crypto while settling in fiat currency.

The FSCA’s decision to regulate crypto assets under existing financial laws has been a major catalyst for market growth. This has provided much-needed clarity for businesses and investors, enabling licensed firms to grow responsibly and encouraging financial institutions to explore crypto services. “The regulatory environment here is relatively favorable compared to other regions. This gives us the confidence to explore more robust solutions like custody and payments,” said Downes.

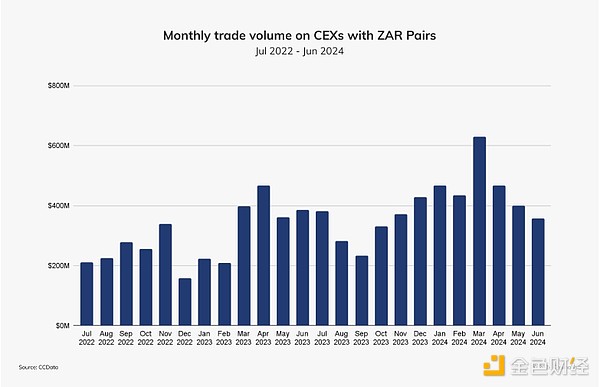

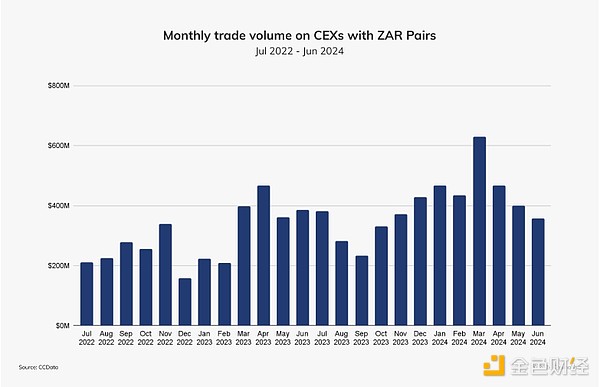

Trading pairs with the South African rand (ZAR) have also flourished, with hundreds of millions of dollars traded each month.

The performance of the ZAR pair indicates the maturation of the South African crypto ecosystem, which Downes believes will drive further institutional participation. "We are seeing exchanges becoming more sophisticated, which is important in building trust with both retail and institutional investors," he explained.

South Africa's regulatory clarity and market growth have attracted the interest of financial institutions. Absa Group Bank, one of South Africa's largest banks, is actively exploring blockchain and cryptocurrency initiatives. Downes stressed that Absa Group's main focus is on providing institutional-grade crypto custody services, which they see as a key near-term opportunity. "The thing I'm most excited about - and our biggest near-term revenue opportunity - is custody," Downes shared. Absa Group sees secure custody services as fundamental to institutional adoption of crypto, providing security and compliance to exchanges, investment firms and other large market participants.

Absa Group and other South African banks are increasingly interested in participating in the crypto industry, although challenges remain in risk management and compliance. Downes acknowledged that banks need to build trusted relationships with cryptocurrency exchanges and service providers to facilitate services such as banking and payments. Downes said Absa Group has taken a "learn and experiment" approach and has the support of leadership. "We have deliberately positioned our efforts to be relatively light-hearted, focusing on learning and engaging with the market," Downes explained. This exploratory approach has enabled Absa Group to participate in regulatory sandboxes and work closely with regulators to ensure compliance while advancing its blockchain initiatives.

Client demand for crypto-related services is growing steadily. "Inquiries have tripled in the past 18 months," Downes noted, adding that the interest covers banking services for cryptocurrency payments, investments and exchanges. Institutional clients, especially family offices and asset managers, are beginning to explore how to integrate digital assets into their portfolios. Downes added: “It’s still relatively early days for traditional financial institutions in the crypto space, but client demand is pushing us to move faster.”

As banks like Absa Group continue to innovate and explore blockchain technology, they are helping to bridge the gap between traditional finance and cryptocurrencies. “Traditional financial institutions are uniquely positioned to leverage our regulatory expertise and controls to help usher in blockchain-based finance,” Downes said. As the technology becomes more integrated, both corporate and consumer adoption will accelerate, further cementing South Africa’s place in the global crypto economy.

Sub-Saharan Africa’s Key Node

Despite Sub-Saharan Africa’s relatively small share of the global crypto economy, the region is seeing strong momentum. Nigeria and South Africa are leading the charge, driving significant on-chain activity and positioning the region as an increasingly influential hub for cryptocurrency adoption and financial technology.

Stablecoins have become a big part of Sub-Saharan Africa’s crypto story, a popular hedge against long-term inflation and currency debasement, and currently account for the majority of crypto transactions across the continent. Meanwhile, DeFi is booming, with the region leading the way in global adoption of decentralized platforms.

While countries such as South Africa, Nigeria, Ghana, Mauritius, and Seychelles have made significant progress in establishing regulatory frameworks, others are exploring regulatory pathways to cope with growing transaction volumes and demand for crypto. As various market participants, including banks and other financial institutions, deepen their involvement, the need for clear regulation has never been more urgent.

Africa’s real-world crypto use cases offer valuable lessons for global markets. With a thriving fintech landscape, expanding mobile penetration, and the potential for collaboration between regulators, traditional finance (TradFi), and crypto companies, the continent is poised to become a global cryptocurrency leader and is expected to drive innovation and financial inclusion at scale.

Notes

1 Fiat remittance prices are derived from World Bank data for the first quarter of 2024 and are used to represent the average cost to remittance senders, which include banks, money transfer operators (MTOS), mobile operators, and post offices. For stablecoin remittances, the total cost calculation includes exchange deposit fees, trading fees, transfer fees, and on-chain transactions for exchanges in Sub-Saharan Africa. Both methods take into account the FX margin, reflecting the percentage difference between the remittance service provider's exchange rate and the interbank rate. For stablecoins, the FX margin is calculated using the price difference between the closing price on September 18 and the mid-market rate at 12:00 am UTC on September 19 provided by Wise.

2 The surge in institutional inflows from late 2023 to the first quarter was likely driven by the broad market rally sparked by the approval of a Bitcoin ETF in the United States and the news that South Africa will issue its first Crypto Asset Service Provider (CASP) license, boosting sentiment that investments are regulated and protected.

WenJun

WenJun