Chen Yulu's latest speech:

The rise and challenges of cryptocurrency

The topic I want to share today is "The rise and challenges of cryptocurrency". Cryptocurrency is a digital currency that operates through a computer network. The ownership of each cryptocurrency unit is recorded and stored in a digital ledger or blockchain. Blockchain is the most basic technology of cryptocurrency, and its core is consensus mechanisms such as proof of work (PoW). Cryptocurrency mainly includes three types: one is payment cryptocurrency, such as Bitcoin and Ethereum; the second is stablecoins, the most famous of which are the US dollar stablecoins USDT and USDC; the third is the digital currency of the central bank, also known as sovereign digital currency, and larger-scale representatives such as my country's digital RMB. There are seven main characteristics of cryptocurrency, namely: distribution; security; scarcity; anonymity; high volatility of price transactions; large amounts of energy consumption generated by the mining process; instant transactions on a global scale, without considering the global nature of currency exchange costs and international transfer time costs.

Since Satoshi Nakamoto (team) mined the first block of Bitcoin (Genesis Block) in January 2009, cryptocurrency has gradually occupied a place in the financial ecosystem from a niche virtual currency experiment. At present, more than 130 countries and regions have begun to include different forms of cryptocurrency in the discussion of the mainstream financial system. Against the backdrop of intensified global geopolitical turmoil, high US fiscal deficits, and sharp rises in US national debt, cryptocurrency assets represented by Bitcoin are receiving widespread attention. The latest developments show that the US government is accelerating the construction of a trinity of "digital dollar hegemony system" from three aspects: national strategic reserves, cryptocurrency legislation, and crypto-financial infrastructure, and is trying to extend its global hegemony in the traditional financial field to the digital economy era. Based on the above background, I will focus on the global situation and risk challenges of cryptocurrency development.

1. The latest trend of global cryptocurrency development

(1) The cryptocurrency market is experiencing breakthrough progress

In January 2024, the Bitcoin spot platform trading fund ETF was approved for official launch, becoming a landmark event in the integration of crypto assets and traditional financial assets. In December of the same year, the price of Bitcoin exceeded $100,000 per coin, driving the total market value of cryptocurrencies to rise sharply from $800 billion to $3.4 trillion in just two years. At the same time, the liquidity ratio of the total market value of crypto assets to the world's six major central banks (G6) has risen rapidly from less than 1% in 2009 to 12% by the end of 2024. In the mainstream market, Bitcoin investment attributes are switching from niche risk assets to mainstream major assets. The establishment of a strategic Bitcoin reserve plan (SBR) proposed by the new Trump administration has further stimulated and strengthened this switching process.

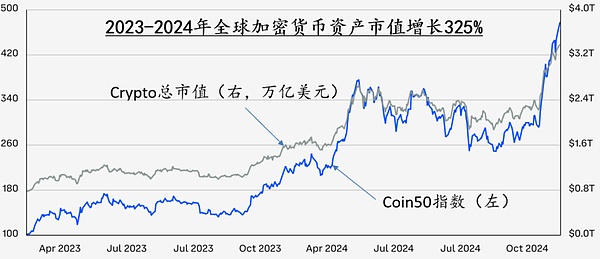

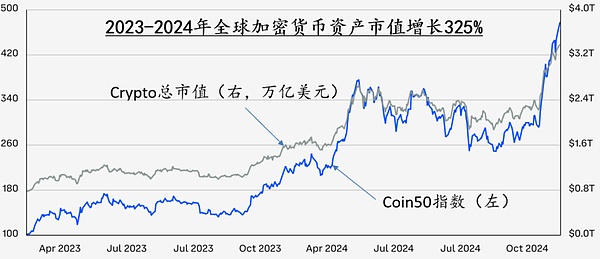

Figure 1 After the second half of 2023, global funds began to pour into the cryptocurrency market

Data source: Coinbase: Crypto Market Outlook 2025.

Since the second half of 2023, the US government's regulatory stance on the field of cryptocurrency has shifted significantly, and its strategic intention is likely to try to extend the traditional US financial hegemony to the field of digital finance. Against the backdrop of the US government's high debt and high inflation, this US strategy can not only ensure the centralized position of the US dollar in the wave of digital financial changes, but also reversely support and ease its increasingly severe federal debt situation. This strategy may include three-stage goals: in the short term, the US government is trying to build a preliminary framework for global digital currency hegemony through three major means: strategic reserves of cryptocurrencies, encouraging the expansion of US dollar stablecoins, and controlling the core infrastructure of crypto asset transactions; in the medium term, it will continue to attract (or coerce) the world's leading crypto companies to migrate to the United States or be included in the US government regulatory system through a relaxed regulatory environment, tax incentives, and long-arm financial sanctions, promote industrial agglomeration, employment, and economic growth, and maintain the United States' leading position in blockchain technology research and development; in the long term, the United States will dominate the formulation of global digital financial infrastructure and rules to ensure that the United States always holds centralized power in the wave of decentralization of the digital economy and ensure that the US dollar always maintains a centralized position in global investment and transactions in the digital economy era.

Figure 2 After the second half of 2023, the scale of cryptocurrency will surge and enter the mainstream asset market

Data source: Coinbase: Crypto Market Outlook 2025.

(2) The shift in the U.S. political and business circles' stance on cryptocurrencies and their strategic intentions

1. Since the second half of 2023, the U.S. government and industry have undergone five landmark changes in the field of cryptocurrency

First, the stance of U.S. financial regulatory authorities has shifted from "severe suppression" to "guided supervision." Paul Atkins, the new chairman of the Trump administration, is a long-term supporter of cryptocurrencies. After taking office, he actively promoted the compliance path of crypto assets. In addition, his close relationship with the new Treasury Secretary Scott Bessent reflects the new US government's active support for crypto assets and the trend of finding a new balance between financial innovation and financial investment protectors. In December 2024, the SEC approved Franklin Templeton's Crypto Index ETF (EZPZ) to be listed and traded on the Nasdaq, which is an important sign of the overall shift in the US financial regulatory stance.

Second, from legislative suppression to legislative support. The U.S. Congress is actively promoting the "two pillars" of crypto regulatory legislation - the 21st Century Financial Innovation and Technology Act (FIT21) and the Guidance and Establishment of a National Innovation for Stablecoins in the United States (GENIUS). The FIT21 Act will comprehensively lay the foundation for crypto regulation, solve many classification and jurisdiction issues, clarify the regulatory boundaries between the SEC and the CFTC (U.S. Commodity Futures Trading Commission), formulate standards for the identification of digital asset commodities and securities attributes, and establish a legal framework for institutional digital asset custody business. GENIUS is committed to establishing a comprehensive regulatory framework for stablecoins, and will include two major currencies, USDT and USDC, which account for 90% of the total market value of global stablecoins, within the scope of regulation. FIT21 was passed by the House of Representatives in May 2024 with bipartisan support, and is expected to be passed by the Senate and finally signed and implemented in 2025. GENIUS plans to vote in the Senate in March this year. After the passage of these two bills, the United States will form the world's most complete crypto regulatory system, which will significantly affect the innovation direction and market structure of the cryptocurrency industry.

Third, the policy shift from a severe crackdown to a strategic assetization policy. The Trump administration plans to launch a strategic bitcoin reserve of 1 million and include it in the Treasury Department's foreign exchange stabilization fund. In January this year, Trump signed the presidential executive order "Strengthening America's Leadership in Digital Financial Technology", the main contents of which include preparing to establish a strategic bitcoin reserve (SBR) and prohibiting the establishment, issuance, and promotion of any form of central bank digital currency in and outside the United States, thereby combating any potential competitors to the dollar stablecoin.

Fourth, the industry has shifted from hesitant wait-and-see to a more active response. A large number of star companies such as Apple, Tesla, and MicroStrategy have already or plan to include crypto assets in their company asset allocation. Traditional large financial institutions (such as BlackRock, the world's largest asset management financial group) are also accelerating their holdings of Bitcoin and increasing production. Global Bitcoin ETF fund assets have exceeded 1.1 million BTC. Among them, BlackRock Bitcoin ETF (IBIT) accounts for 45% (market value of approximately US$153 billion in February 2025). Spot Bitcoin ETF attracted more than US$108 billion in funds in 2024, and the crypto market and traditional financial market are accelerating integration.

Fifth, adjustment of tax policies. The IRS allows taxpayers to flexibly choose the accounting method of crypto assets in the temporary tax relief in 2025, which relieves the tax pressure of CEX users in the short term, but in the long run it may drive crypto investment to concentrate on platforms that are controllable by US regulatory authorities.

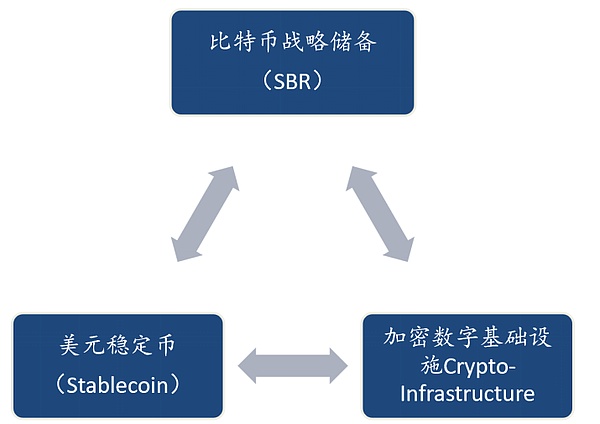

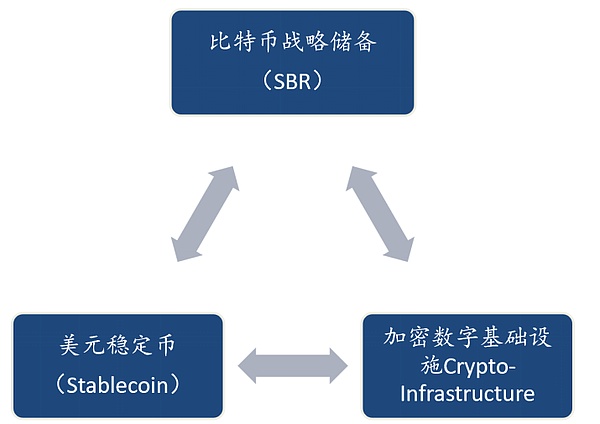

2. The latest developments in various fields of crypto assets show that the strategic direction behind the change in the positions of the US political and business circles is likely to be to build a "trinity" digital era dollar hegemony system

The three cornerstones of this system are the Bitcoin Strategic Reserve (SBR), the US dollar (anchored) stable currency, and the US controllable digital financial infrastructure. In this system, the Bitcoin Strategic Reserve may play the role of the gold reserve in the 1944 Bretton Woods Agreement. As "digital gold", Bitcoin occupies the core value anchor position and will bring five potential strategic advantages to the United States.

First, it is the first-mover advantage. As the most widely recognized cryptocurrency in the world, Bitcoin's unique position is conducive to its becoming a safe haven for funds during periods of global geopolitical turmoil and high inflation. The United States took the lead in incorporating Bitcoin, which accounts for more than 60% of the entire cryptocurrency market value, into its national strategic reserves. This first-mover advantage is conducive to attracting international capital to continue to gather on-chain and off-chain assets of the US dollar in the future.

Second, it serves as a new tool for financial stability. During the outbreak of the financial crisis, the low correlation with traditional assets makes Bitcoin reserves the second financial stability tool of the US government in addition to traditional dollar quantitative easing, which can help support the balance sheet of US systemic financial institutions in some emergency situations and protect the international status of the US dollar.

Third, enhance the competitiveness of the US dollar system in the digital age. Stablecoins pegged to the United States currently account for 95% of the total market value of global stablecoins. In addition, crypto asset transactions that are not pegged to the US dollar but mainly settled in US dollars will further consolidate the central currency status of the US dollar in the digital age, thereby helping to expand the dominance of the US dollar in the global monetary system from traditional finance to the digital financial field.

Fourth, strengthen the voice of American standards in the digital financial era. After dominating the crypto market through strategic reserves and US dollar stablecoins in the future, the United States will lead the formulation of global crypto asset rules, and export and solidify the dual-pillar American standards based on GENIUS and FIT21 through international platforms such as G7, IMF, and BIS, and promote a global crypto asset regulatory framework that is in line with its own interests, thereby ensuring its top-level voice in the formulation of international digital asset rules.

Fifth, curb the development of crypto assets of potential competitors. Restrict the development of digital assets in competitor countries through financial sanctions and legislation, and prohibit any institution from establishing, issuing and promoting CBDC in the United States through executive orders and legislation. Attract emerging markets to adopt the payment system led by the United States through technical assistance, squeezing the internationalization space of competitors' digital currency assets.

Figure 3 The "Trinity" of the US digital currency hegemony system

3. The EU's policy direction in the field of cryptocurrency is unified market supervision and green financial transformation

This is mainly reflected in the following three aspects: First, the EU's "Market Regulatory Framework for Crypto-Assets" (MiCA) will take full effect on December 31, 2024, with the goal of establishing a unified and clear regulatory framework for crypto assets throughout the EU. It divides all crypto assets into three categories and conducts differentiated supervision, while strengthening compliance requirements for the issuance of stablecoins and the operation of crypto asset exchanges. Promote innovation while managing risks, and ensure consumer rights and financial stability. Second, the unified regulatory framework has laid the foundation for the EU to strive for the initiative and voice in the global cryptocurrency market competition. Third, it guides the establishment of a green financial development path for cryptocurrencies. MiCA imposes higher carbon emission taxes on energy-intensive blockchains, and promotes the cryptocurrency industry to shift from the PoW mechanism to low-carbon consensus mechanisms such as PoS, thereby reshaping the regional pattern of the mining industry.

4. Other economies around the world face competition between stablecoins and sovereign digital currencies

This is mainly reflected in three aspects. First, the number of economies exploring and promoting CBDC continues to increase. Currently, more than 130 countries and regions around the world are exploring and promoting CBDC. In recent years, my country's digital RMB has continued to expand domestic and cross-border pilots, making it the world's largest sovereign digital currency. 18 G20 member countries including Japan, South Korea, India, and Russia are also accelerating the layout of CBDC or Bitcoin strategic reserves, actively striving for digital financial sovereignty and rule discourse power. Second, the competition between sovereign digital currencies and stablecoins. The CBDC model has sovereign advantages, but the US dollar stablecoin already has scale advantages. Between 2020 and 2024, the market value of USDT surged 5.52 times, while USDC rose 11.35 times, and the two together accounted for 90% of the total market value of global stablecoins. The settlement volume in 2024 has reached 15.6 trillion US dollars. Third, digital currencies face regionalization and fragmentation risks in the future. The United States is trying to strengthen the digital financial hegemony of the US dollar through three means: establishing SBR reserves, stablecoin legislation, and restricting the issuance and circulation of CBDC. The EU's MiCA framework will objectively restrict the development of non-euro stablecoins. Intensified competition means that the global digital financial payment system may face the risk of market segmentation and fragmentation in the future.

5. Stablecoins are becoming a frontier area for the integration of crypto-financial assets and traditional financial assets

This mainly presents two typical facts. On the one hand, stablecoins enhance the resilience of off-chain US dollar assets. In 2023-2024, the market value of stablecoins increased rapidly and exceeded the growth rate of US M2, which strongly supported the demand for US dollars and US Treasury bonds in the uncertain financial environment of continued high deficits in the United States. On the other hand, stablecoins have gradually become mainstream payment channels. In the first 11 months of 2024, the stablecoin market completed $27.1 trillion in transactions, including a large number of P2P and cross-border B2B payments, which means that companies and individuals are increasingly using stablecoins to realize commercial value while meeting regulatory requirements, and are closely integrating with traditional payment platforms such as VISA and Stripe.

II. Risks and challenges posed by the new development trend of cryptocurrency to China

1. Objectively view my country's current advantages and disadvantages in the field of blockchain and cryptocurrency

The advantages mainly include three aspects:

II. Risks and challenges posed by the new development trend of cryptocurrency to my country

mp-original-font-size="16" mp-original-line-="">First, the layout of digital RMB and blockchain industry is leading. In the field of central bank digital currency, digital RMB is currently the world's largest CBDC project and has received national strategic support. Since its research and development in 2014, it has steadily advanced and has covered multiple fields such as retail, wholesale payments and cross-border settlement. Since 2021, the research and development and practical progress of the cross-border digital currency bridge project (mBridge) have also been leading the world. These foundations make it possible for digital RMB to become a financial transaction tool and asset carrier that competes with the US dollar stablecoin in the future. In the blockchain industry, my country has incorporated blockchain technology into the national strategy in the early stages of the industry's germination, and has clearly proposed the development direction of integrating blockchain with the real economy. The industry market size and growth potential are large. It is estimated that the scale of China's blockchain market will exceed 100 billion yuan in 2025. It has been widely used in many fields such as finance, supply chain, government and business services. The number of registered companies continues to grow, and there will be 63,300 companies by the end of 2023. Second, there are rich application scenarios. The scenarios of digital currency have expanded from the initial retail, transportation, government affairs and other fields to wholesale, catering, entertainment, education, medical care, social governance, public services, rural revitalization, green finance and other wider fields. The blockchain industry has many mature cases in many fields such as supply chain finance, cross-border trade, and e-government. Third, strict risk prevention and control. my country has implemented strict supervision on cryptocurrency transactions and initial coin offerings (ICOs), which effectively prevents the risks of the virtual economy and provides a more controllable and stable industrial environment for the compliant development of digital currencies.

my country's current disadvantages are mainly reflected in the lack of international competitiveness in some areas. First, the influence of technical standards is relatively lagging. Due to differences in regulatory laws and regulations, the United States currently has a dominant position in underlying technologies such as ZKP and Layer2 expansion, and the European Union has also set technical barriers through the MiCA framework, resulting in my country's lack of voice in core protocols and global standard setting. Second, the development of the public chain ecosystem is relatively lagging. my country's blockchain industry is dominated by alliance chains and private chains. The lack of public chains has led to a scenario gap in innovation capabilities with Europe and the United States in areas such as decentralized finance (DeFi) and Web3.0.

2. The US-led crypto asset hegemony strategy poses multiple threats to my country's financial security

First, capital outflow and exchange rate pressure. The long-term appreciation trend of crypto assets represented by Bitcoin against international currencies such as the US dollar, as well as the rapid expansion of the scale of US dollar stablecoin transactions, have further strengthened the dominant position of the US dollar in the global monetary system through cross-border payment convenience and value storage functions, which will undoubtedly squeeze the valuation and internationalization space of the RMB. In addition, the US dollar-dominated crypto channel has become a new path for capital flight. In recent years, the large-scale allocation of Bitcoin by leading US companies and the large-scale financing wave of on-site cryptocurrency ETFs have produced a strong "demonstration effect", which may attract some domestic capital to flow out through gray channels.

Second, DeFi regulatory arbitrage has formed a cumulative industrial competitive advantage. The relatively loose regulatory and tax policies in the United States attract the inflow of global DeFi innovation resources, and then reap more full-chain technology dividends from the underlying standards to the application layer. After long-term accumulation, it will form a competitive advantage over my country's digital financial infrastructure technology in the future.

The third is the competition for underlying technical standards and innovation capacity resources. On the one hand, the United States is currently in a leading position in innovation in ZKP, Layer2 and other fields, while the European Union is also obtaining the network effect of a unified large market after integrating supervision through MiCA, while setting up technical barriers. my country needs to be vigilant and guard against the risk of losing the right to formulate standards in the crypto asset industry. On the other hand, my country faces the pressure of blockchain industry innovation resources moving outward: the EU encryption industry carbon emission policy and the US mining tax incentives have made Chinese mining companies and blockchain venture capital companies tend to move to Central Asia, the Middle East and the United States, which is objectively not conducive to the innovation ability and computing power security of the domestic blockchain industry.

Fourth, the threat of US encryption asset hegemony. First, the United States is accelerating the gradual incorporation of mainstream cryptocurrency assets into its financial hegemony system. Once this trend is established, it will inevitably squeeze my country's strategic development space in the field of digital finance in the future. Secondly, after the conflict between Russia and Ukraine, the US government, together with the United Kingdom, the United Arab Emirates and other countries, imposed large-scale long-arm financial sanctions on the Russian government, institutions and individuals in the field of cryptocurrency, seized and confiscated a large number of cryptocurrency assets, and arrested relevant practitioners. The power of its digital financial hegemony is initially showing. Finally, the Trump administration promoted the Bitcoin strategic reserve plan and resisted foreign sovereign digital currencies, which also intensified the confrontation between China and the United States in the field of digital currency.

Of course, crypto assets represented by Bitcoin are currently in a serious market bubble state, and continued appreciation is unsustainable. Once the bubble bursts, it will be a huge blow to the US crypto asset hegemony strategy. In this regard, we must maintain a clear understanding and strategic determination, adhere to the value concept of financial services for the real economy, and firmly follow the path of a financial power with Chinese characteristics. ■

Kikyo

Kikyo