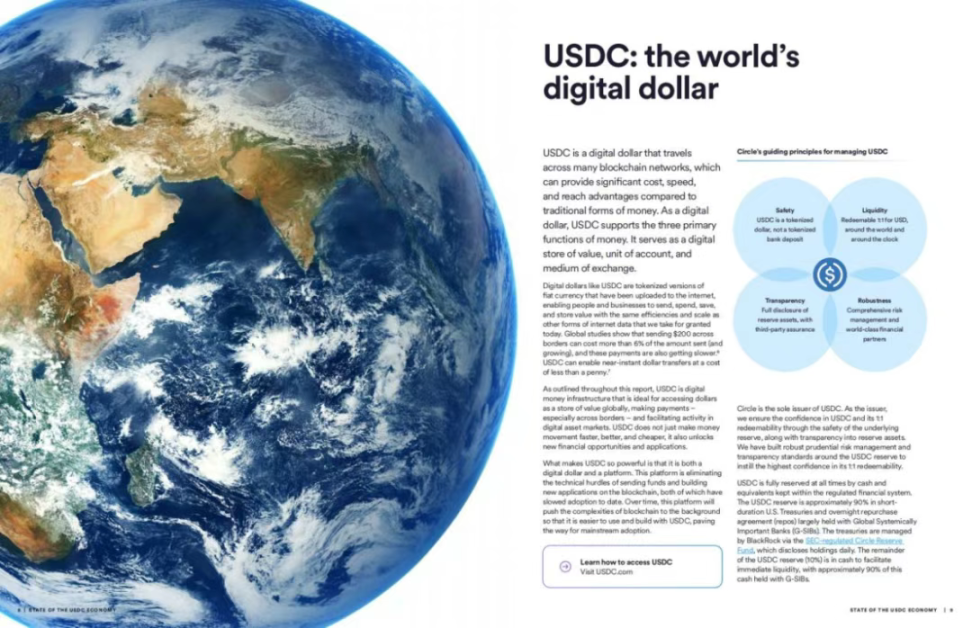

In the article "Digital Dollar on the Internet of Value - 2025 USDC Market Economic Report" released by Circle in early 2025, the three narratives of USDC were clearly defined: (1) Financial upgrade of the Internet; (2) Through the USDC Internet; (3) Using network effects to expand USDC application scenarios.

For Circle, which currently has a stablecoin market share of 26%, it is obviously no longer satisfied with the first two narratives. Then, the Circle Payments Network, which has just been launched, is its value capture of USDC or stablecoins in the global network as a globally compliant stablecoin issuer.

The US dollar and the Internet itself have strong network effects. In the real world and on the Internet, the US dollar is a currency with network effects. Blockchain technology gives USDC more powerful functions and new application potential than traditional US dollars, while relying on traditional Internet networks for implementation.

Circle is building an open technology platform based on USDC, building on the strength and widespread use of the US dollar today, and taking full advantage of the scale, speed and cost advantages of the Internet to achieve similar network effects and practicality for financial services.

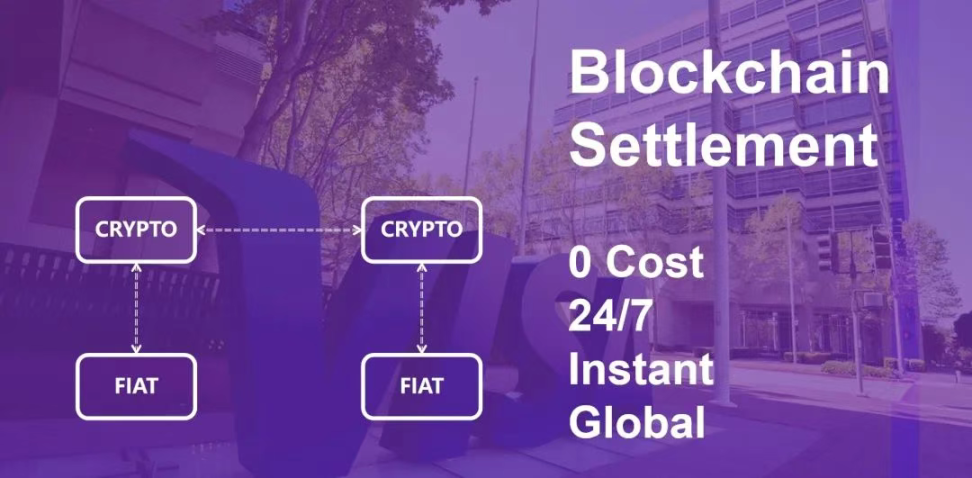

Circle Payments Network is a Circle that uses its strong compliance background to bring together financial institutions (USDC services) in a compliant, seamless and programmable framework to coordinate global payments of fiat currencies, USDC and other payment stablecoins.

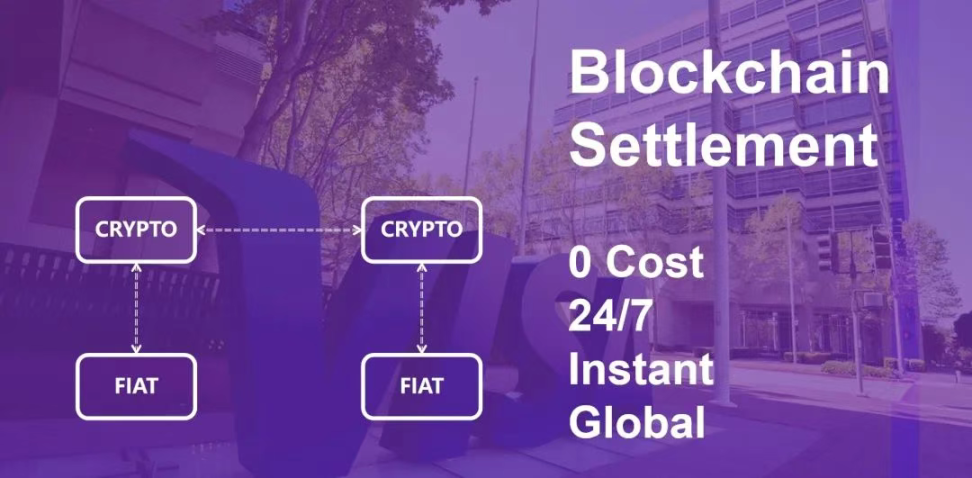

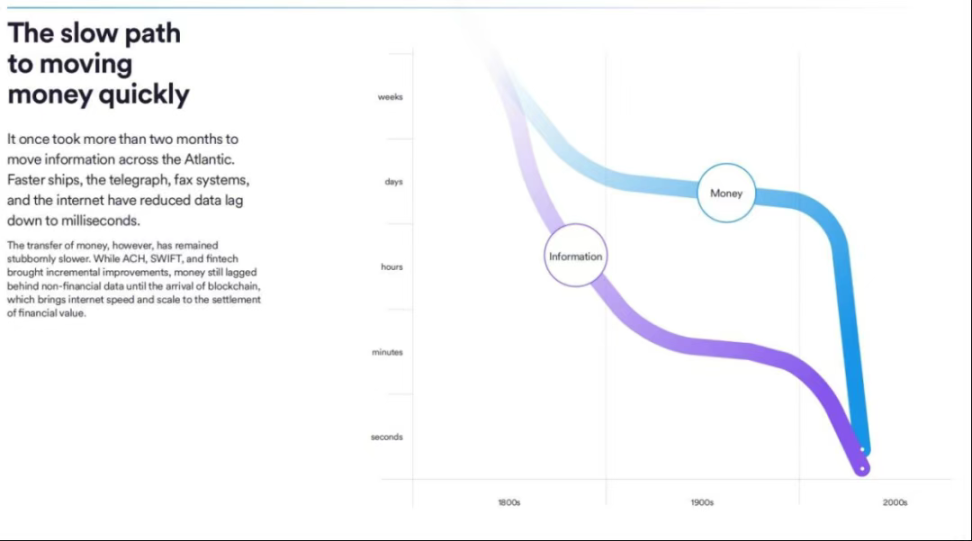

As a result, fiat currencies no longer need to circulate through the old traditional SWIFT system, and digital dollars using blockchain as the settlement layer will be its new channel.

In essence, Circle's payment network based on blockchain as the settlement layer is a funeral invitation to traditional payment channels such as SWIFT/VISA/Mastercard, allowing us to enter a great era of change from postal mail to email, from horse-drawn carriages to trams, and from transatlantic cable telegraphs to blockchain Internet value transmission.

(Web3 Payment 10,000-word Research Report: The full-scale attack of industry giants is expected to change the existing encryption market landscape)

What is important is Circle’s positioning of the Circle Payments Network: a new protocol layer built on a comprehensive, open and Internet-based settlement system, with stablecoins at its core. Such a positioning can be compatible with various settlement layer public chains, rather than getting caught up in the battle for public chains to seize financial infrastructure.

Dr. Xiao Feng of Hashkey gave the public chain positioning based on the essence of finance: the new generation of financial infrastructure is not only a marginal improvement on the existing system, but also brings disruptive development in terms of transactions, clearing, and settlement, forming a new financial paradigm.

It is meaningful that Circle aims to build an open network based on blockchain, which already has the prototype of the VISA network. We may find some answers in the development history of VISA for subsequent evolution. This is in sharp contrast to the relatively closed-loop networks of Ripple & RippleNet, Stripe & Bridge.

In October 2023, when I shared Web3 payment with Ant, I was thinking: Is it a better solution to put legal currency assets on the chain at both ends and settle through stablecoins? Obviously, a year and a half later, Circle gave a clear answer and a clear use case.

Therefore, this article compiles Circle's Circle Payments Network Whitepaper to look at its design principles, real-world use cases, potential use cases and growth opportunities in the future, and the governance model of this VISA-like network organization.

I. White Paper Overview

Stablecoins have long been considered to have the potential to become the basis for payments and capital flows on the Internet. However, until recently, stablecoins, as digital cash, have been mainly used in the global digital asset market and decentralized finance (DeFi) field.

With the launch of Circle Payments Network (CPN), Circle is taking stablecoins one step further, giving them the potential to upgrade the global payment system - just as the previous era of Internet innovation changed media, commerce, software, communications, and other industries. These huge changes have greatly improved customer experience, reduced costs, increased speed, and driven economic growth for individuals and businesses around the world.

To realize this potential, Circle Payments Network (CPN) is an infrastructure designed to overcome many of the barriers that have so far limited the adoption of stablecoins in mainstream payments. These barriers include barriers to entry, vague compliance requirements, technical complexity, and concerns about the safe storage of digital cash.

Circle Payments Network (CPN) brings together financial institutions in a compliant, seamless and programmable framework to coordinate global payments in fiat, USDC and other payment stablecoins.

The business and individual customers of these financial institutions can enjoy faster and lower-cost payment services than traditional payment systems, which are often limited by fragmented networks or closed systems. Crucially, Circle Payments Network (CPN) provides the infrastructure foundation for this entire ecosystem, eliminating many of the technical complexities and operational barriers that have so far hindered the adoption of mainstream stablecoins, including the need for businesses to custody stablecoins themselves. Circle Payments Network (CPN) also opens the door to the breakthrough of programmable money, unlocking entirely new uses for money in global value exchange.

This white paper sets out the design principles of the Circle Payments Network (CPN), outlines initial and near-term use cases, and proposes potential future use cases and growth opportunities. This paper aims to help financial institutions, payment companies, application developers, innovators, and other stakeholders understand their role in building and leveraging the Circle Payments Network (CPN) - and how the network can enable them to innovate and pass on the benefits of stablecoins to their customers.

II. Introduction

2.1 Flaws in the Global Financial Payment System

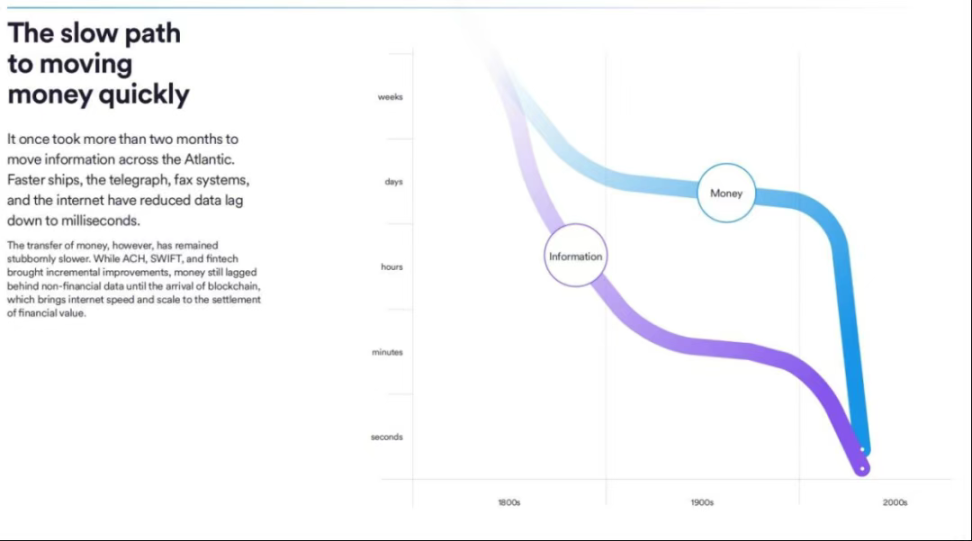

The current global economy is more closely connected than ever before, but unlike other economic sectors, the infrastructure that supports the flow of money still relies primarily on frameworks that predate the Internet era.

Previously, it was impossible to provide a "Money Protocol" that could transfer value in a completely native digital form over the Internet.

The U.S. Automated Clearing House (ACH) and other similar protocols are now core components of the fragmented global payments landscape, which emerged around the world in the early 1970s. Although recent developments, such as the Single Euro Payments Area (SEPA) in the Eurozone, and national real-time payment systems such as PIX in Brazil and the Unified Payments Interface (UPI) in India, have increased the speed of domestic transactions, they still lack a global interoperability standard and global scale, and do not leverage the openness and scalability of programmable money built on open blockchain networks.

Businesses and individuals around the world are paying a high price for relying on this traditional payment infrastructure. According to a McKinsey report (Global Payments in 2024), the global payments industry's revenue has exceeded $2.4 trillion per year. Most of this "revenue" is generated in the form of fees charged to senders and receivers, reflecting the operational complexity and intermediation of the traditional infrastructure - in effect a tax on global business and households.

The reality is that international wire transfers can cost up to $50 per transaction, and intermediaries along the way often charge additional fees. According to the World Bank, the global average cost of sending $200 was 6.65% in the second quarter of 2024. In addition, foreign exchange conversions further exacerbate these challenges, introducing expensive foreign exchange fees and price volatility.

The fragmented settlement process in the correspondent banking system continues to impose significant economic costs on businesses and society. For importers and buyers, waiting days for payments to clear can weaken their cash flow position and increase the complexity of liquidity planning. For exporters and sellers, unpredictable multi-day settlement windows mean they must rely more on expensive short-term working capital borrowing to maintain short-term operations. Recipients who rely on cross-border remittances for food, shelter and other basic needs may face the risk of eroding important revenue due to the involvement of traditional intermediaries, while also enduring payment delays and, in some cases, the inherent risks of handling cash in a crime-prone environment.

(Digital Dollar on the Value Internet-2025 USDC Market Economic Report)

2.2 Change has arrived

Change should have come long ago. Although the Internet has revolutionized almost every aspect of global commerce in the past few decades, the way funds flow still relies on fragmented traditional networks that lack transparency, efficiency, and innovation. Although some countries have successfully implemented national real-time payment systems, these solutions cannot be scaled globally and have limited access to developers.

In the half century since the advent of early payment messaging and settlement systems like ACH, global communications technology has advanced to connect people around the world in an instant. Today, billions of people can watch a movie on their phone while riding the subway, have instant access to all of human knowledge at virtually no cost, and can buy and sell nearly any product from around the world.

It’s time for a new way to move money around the world — one that works 24/7, is seamless, and is designed to eliminate the inefficiencies of the legacy payments system while building on and integrating the solid foundations of the traditional financial system.

(Digital Dollar on the Value Internet - 2025 USDC Market Economic Report)

2.3 Internet-based Currency Settlement Layer - Circle Payments Network

This vision is becoming a reality with the launch of Circle Payments Network (CPN). Circle Payments Network (CPN) is a new protocol layer built on a comprehensive, open, and Internet-based settlement system, with USDC, EURC, and other regulated payment stablecoins as its core. By connecting open platforms with global scale and reducing intermediaries, CPN enables the flow of funds in a way that traditional closed networks cannot.

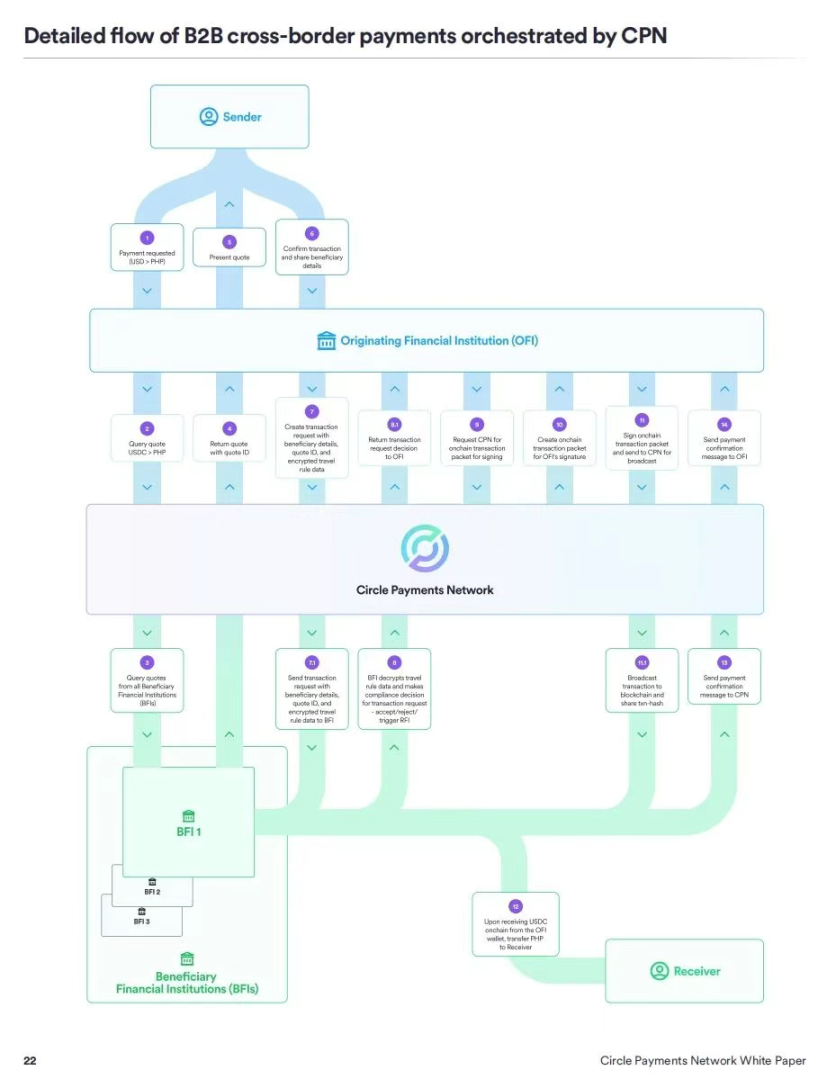

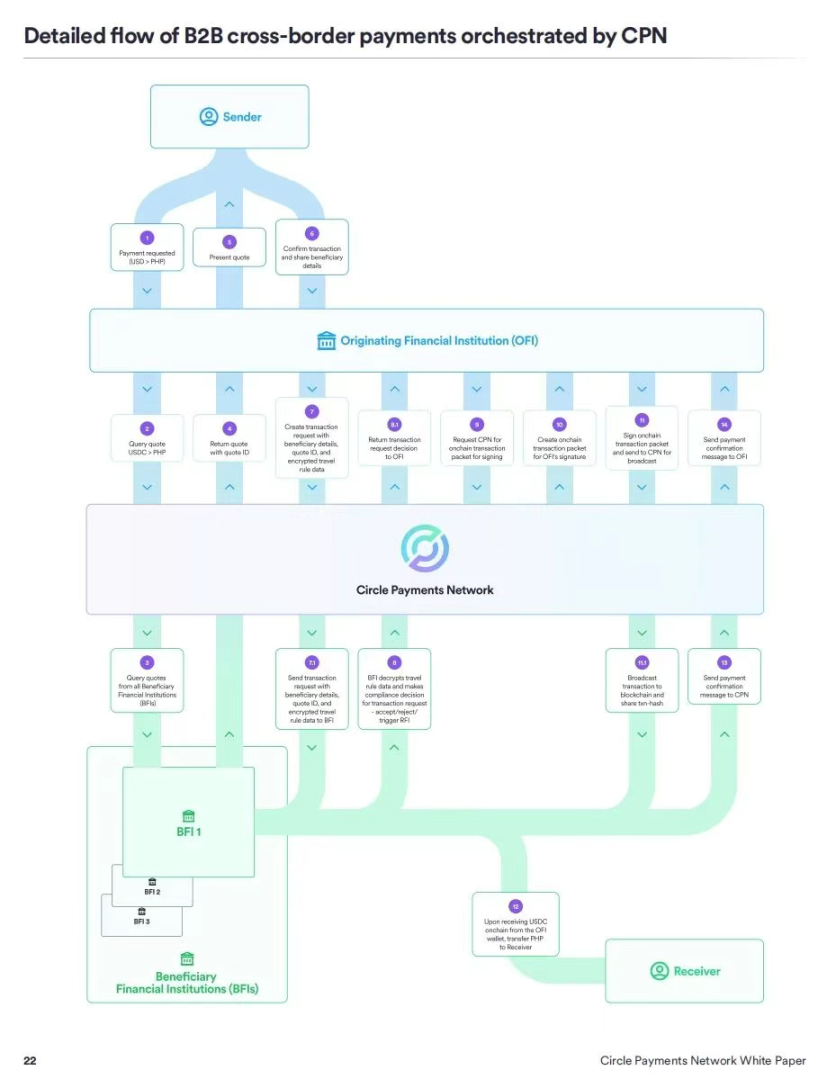

Importantly, CPN does not transfer funds directly; instead, it serves as a marketplace for financial institutions and acts as a coordination protocol to coordinate global capital flows and the seamless exchange of information.

CPN marks the first time that a regulated settlement asset (in the form of a stablecoin) has been combined with a coordination and governance layer designed specifically for financial institutions. This integration connects traditional payment systems with assets such as USDC and EURC, while establishing a trusted counterparty framework for more efficient, less intermediary global settlement methods.

By introducing a new "Clearing Layer" based on a compliant, 24/7 digital dollar, CPN lays the foundation for cross-border settlement at internet scale.

(https://x.com/circle/status/1914411337683480654)

2.4 Benefits of Circle Payments Network

A. Internet Financial Payment Services

CPN will benefit billions of people and tens of millions of businesses by enabling them to access funds and other financial services in the same way as other transformative global Internet services. Payers can choose to initiate payments using either fiat or stablecoins, while recipients (whether businesses or individuals) can choose to keep stablecoins or convert them into local currency upon receipt. CPN will make near-instant, borderless payments a universal reality.

The launch of CPN makes it easier to imagine a future where international suppliers are able to receive cross-border payments almost instantly and at low cost through a modern, compliance-first platform that supports global supply chains; small merchants are able to receive payments in near real time without high fees eating into sales margins; global sellers are able to directly enter new markets; content creators are able to receive small payments from consumers through the cost efficiency of stablecoins; and remittance recipients are able to receive a larger portion of the remittance amount, thereby increasing purchasing power where it is most needed.

B. Reduced Technical Complexity

In addition to being an upgrade to many of today’s inter-institutional payment networks, which are often burdened by legacy infrastructure, closed ecosystems, and slow or expensive settlements, the CPN is designed to scale as a modern payment orchestration layer based on stablecoins and blockchain.

While blockchain-based payments have gained some traction, they are not inherently frictionless or trustworthy, especially in an inter-institutional setting where features such as settlement guarantees, reversibility, compliance, standardized protocols, and strong security are essential requirements. The CPN further reduces technical complexity and minimizes the operational and financial challenges that have so far prevented stablecoins from entering mainstream payments and commerce, paving the way for a more efficient, inclusive, innovative, and transparent financial ecosystem.

C. Cost Reduction and Efficiency Improvement

From a cost and efficiency perspective, CPN is a powerful alternative to traditional cross-border payments. Although there are fees associated with purchasing stablecoins and exchanging them back to fiat, in many markets outside the United States, the costs of these “in and out currency acceptances” are falling and may be lower than the cost of obtaining dollars through a bank.

Traditional dollar transfers can be expensive and slow for both senders and receivers, making both parties more dependent on short-term working capital financing (as described above). By enabling near-instant settlement and reducing reliance on intermediaries, CPN can unlock significant cost efficiencies.

In addition, as an open platform, CPN has the potential to facilitate a competitive market for in and out currency acceptances, foreign exchange, and other services, further reducing costs and improving access conditions.

D. Transparent, Secure and Scalable

CPN is a transparent, secure and scalable infrastructure designed to help financial institutions better serve their corporate and individual customers. Crucially, CPN will be able to unlock these efficiencies without sacrificing compliance. Circle has established a rigorous governance framework for CPN, requiring participating financial institutions to comply with global anti-money laundering and counter-terrorism financing (AML/CFT) standards and economic sanctions requirements.

E. Open Infrastructure Promotes Innovation

Importantly, CPN does not directly transfer funds; instead, it serves as a marketplace for financial institutions and acts as a coordination protocol to coordinate global capital flows and the seamless exchange of information. As the network operator, Circle defines the CPN protocol and provides application programming interfaces (APIs), developer software development kits (SDKs), and public smart contracts to coordinate global capital flows.

CPN’s growth and success is not limited to the Circle ecosystem, but will rely on participants outside of Circle to jointly unlock economic value. The network will provide a fertile ground for banks, payment companies, money acceptance services, application developers, and other regulated stablecoin issuers to co-innovate to provide greater value and better experiences for their own customers.

It is based on this open public blockchain infrastructure that CPN and regulated payment stablecoins provide a strong foundation for builders to launch on-chain applications that use these networks to seamlessly move funds.

CPN provides building blocks for innovators and builders to develop new user experiences and support a wide range of payment use cases. Over time, builders will be able to create a vibrant ecosystem of modules and application services on top of CPN - building a third-party functional market for participants and end users of CPN to benefit them, and unlocking a new and powerful distribution platform for fintech developers.

III. Circle Vision

Through the Circle Payments Network (CPN), Circle is building a new platform and network ecosystem that will create value for every stakeholder in the global economy and help accelerate the benefits of this new Internet-based financial system to society:

Enterprises:

Importers, exporters, merchants and large enterprises: can use financial institutions that support CPN to eliminate significant costs and frictions, strengthen global supply chains, optimize fund management operations, and reduce reliance on expensive short-term working capital financing.

Individuals:

Remittance senders and receivers, content creators, and other individuals who frequently send or receive small payments: will gain greater value, and financial institutions using CPN will be able to provide these improved services faster, at a lower cost and more simply.

Ecosystem builders:

Banks, payment companies and other providers: can use CPN's platform services to develop innovative payment use cases, leveraging the programmability of stablecoins, SDKs (software development kits) and smart contracts to build a thriving ecosystem. Over time, this will be able to fully unleash the full potential of stablecoin payments for businesses and individuals. In addition, third-party developers and businesses can introduce value-added services to further expand the functionality of the network.

All participants and end users of the CPN network will be able to benefit from an open and continuously upgradeable funds circulation infrastructure, which will not only reduce the cost and increase the speed of cross-border payments, but also ensure the technical readiness of the Internet financial system.

IV. Use Cases

Circle Payments Network (CPN) is designed to support a wide range of payment and value transfer use cases by enabling seamless, efficient and secure transactions on supported blockchain networks using regulated stablecoins.

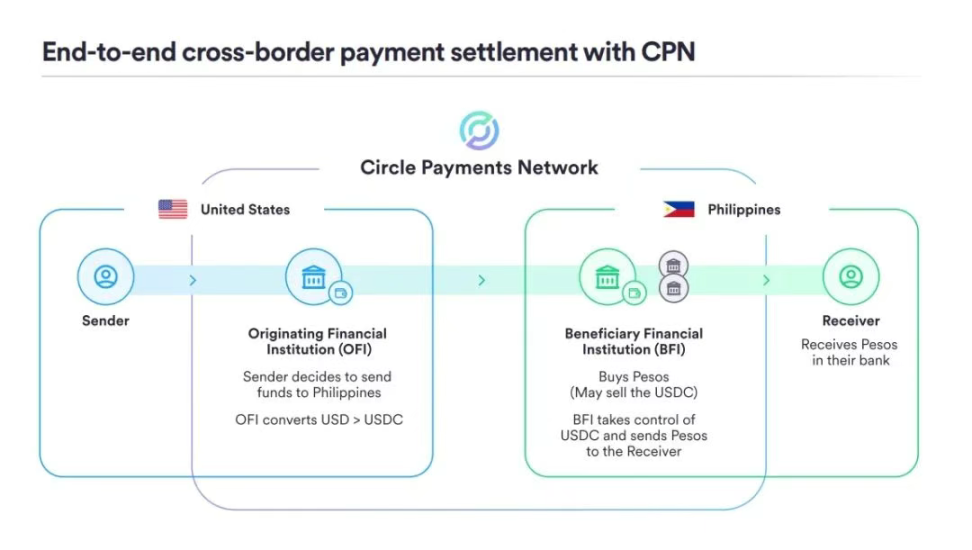

Its compliance-oriented architecture allows Originating Financial Institutions (OFIs) to discover and connect to Beneficiary Financial Institutions (BFIs) through CPN, while empowering ecosystem builders to develop innovative solutions for individuals, businesses and institutions.

(www.circle.com/cpn)

4.1 Business Payments

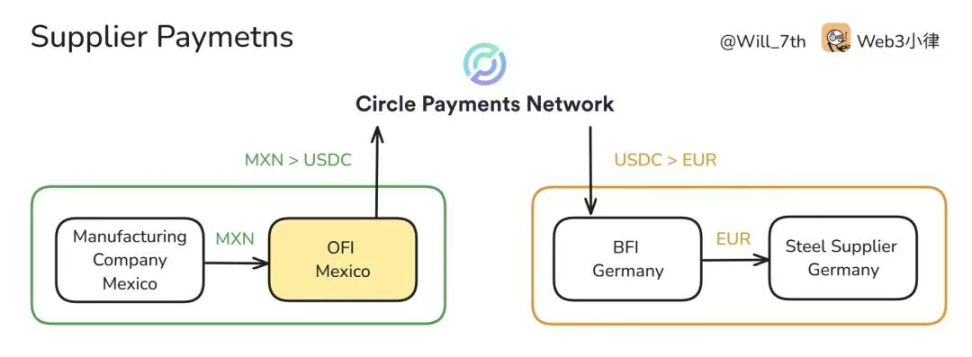

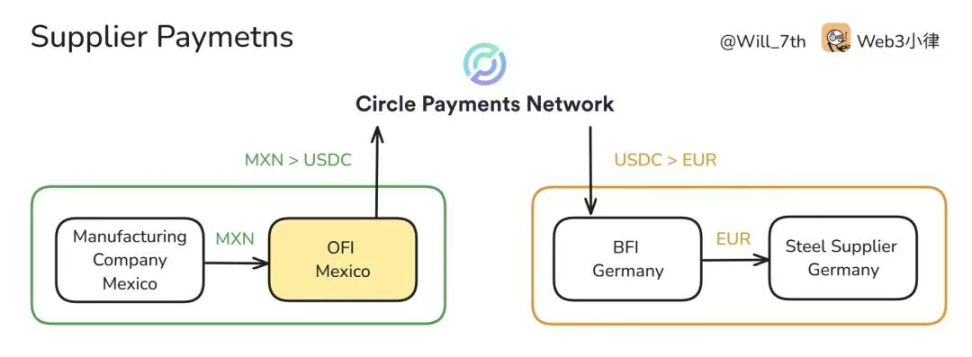

A. Supplier Paymetns

Speed up and simplify cross-border payments between companies by shortening settlement times and eliminating intermediaries.

A manufacturing company in Mexico needs to pay a steel supplier in Germany, but wants to avoid high foreign exchange fees and multi-day bank transfers. The company’s originating financial institution (OFI) converts Mexican pesos (MXN) into USDC, connects to a beneficiary financial institution (BFI) in Germany through CPN and sends USDC, which then seamlessly converts USDC into Euros and instantly settles the payment to the supplier’s account.

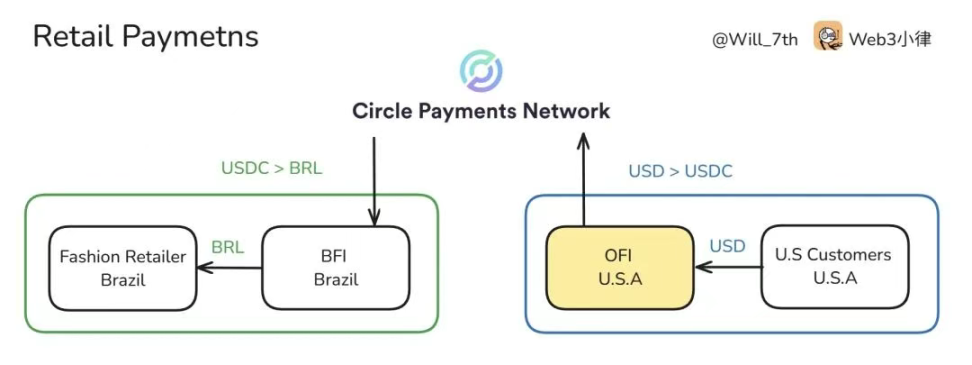

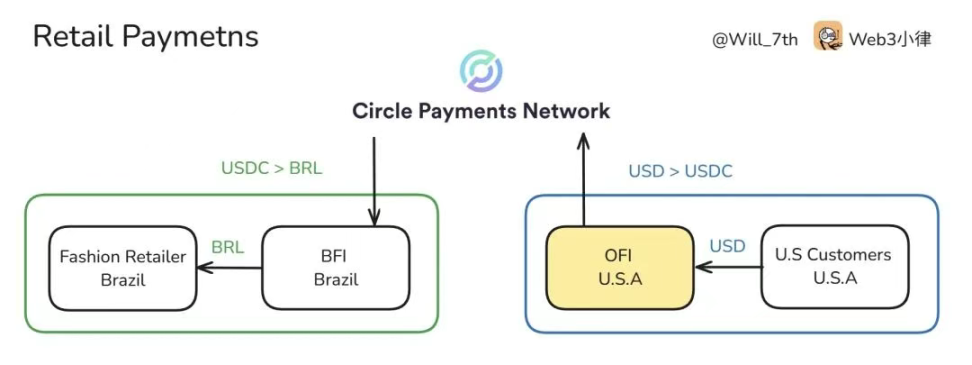

B. Retail Payments

Enhance global online commerce with secure, efficient, and flexible payment options.

A fashion retailer based in Brazil sells goods to customers in the United States. The retailer’s BFI connects to an OFI through CPN to receive payments in USD. The OFI converts USD into USDC and sends it to the BFI, which then seamlessly converts USDC into Brazilian Real (BRL) or holds it as USDC in a digital asset custodian on behalf of the retailer, who receives funds instantly, faster than traditional payment processors, and has the option to keep working capital in digital dollars.

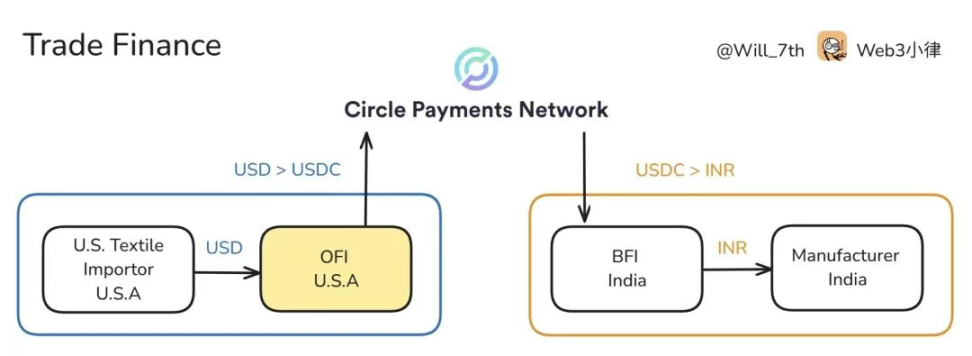

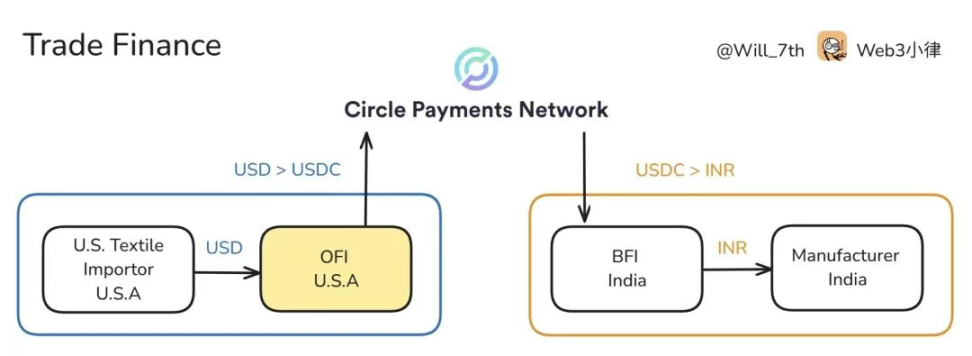

C. Trade Finance

Simplify and secure international trade payments.

A US textile importer places an order with an Indian manufacturer, hoping to reduce the time and cost of traditional trade financing. The importer’s OFI converts U.S. dollars (USD) into USDC and connects to a BFI in India through CPN to transfer the funds. The BFI manages the custody of the USDC through smart contracts and settles the Indian rupees (INR) to the manufacturer after verifying the shipping documents. This approach enables faster settlement and reduces counterparty risk while providing escrow services using the innovation of smart contracts.

D. Payroll and Salary Disbursements

Enables companies to process global payroll payments with minimal fees and instant settlement.

A multinational company pays salaries to remote employees in multiple countries. Instead of relying on traditional banking channels, the company converts local currency into USDC through its OFI and instantly distributes wages to employees through multiple BFIs discovered by CPN. These BFIs receive USDC from the OFI and complete the final payment in each employee's local currency.

E. AI payments

In the future, CPN will support autonomous AI agents (AI Agents) to send and receive payments on behalf of users or systems, supporting real-time value exchange.

A logistics company uses AI agents to book freight services across borders. When the agent selects a service provider in Singapore, it uses the OFI integrated with CPN to convert US dollars (USD) into USDC and automatically sends the payment to the BFI in Singapore, which then converts it into Singapore dollars (SGD). The entire payment process is executed programmatically through smart contracts, minimizing manual steps and enabling intelligent cross-border machine-to-machine payments.

4.2 Consumer Payments

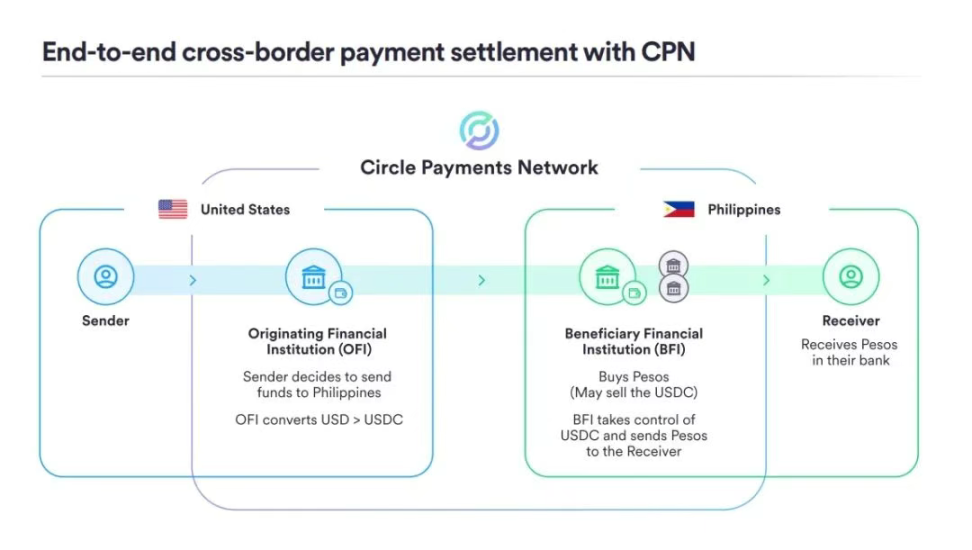

A. Remittances

Empower individuals to send money quickly and cost-effectively, without high fees and delays.

A user living in the United States wants to send money to his family in the Philippines. As a U.S. originating financial institution (OFI), Remittance Company converts U.S. dollars (USD) into USDC, and simultaneously converts USDC into Philippine pesos (PHP) through a local beneficiary financial institution (BFI) in the Philippines dynamically discovered by CPN, delivering funds to his family in near real-time at a fraction of the cost of traditional remittances.

B. Subscriptions

Support recurring payments for digital services through programmable stablecoin billing.

A digital media platform provides premium subscription services to users around the world. Each month, a user’s digital wallet initiates a USDC payment through an originating financial institution (OFI), which is routed through the platform’s beneficiary financial institution (BFI) discovered by CPN. The BFI receives the funds and holds them as USDC at a digital asset custodian on behalf of the media platform, or converts them into local fiat currency as needed and credits the media platform’s account.

C. Micropayments and Content Monetization

Enable instant, low-cost micropayments for content creators and digital services.

A Brazilian content creator receives microdonations from fans around the world through CPN, using a local originating financial institution (OFI) and a beneficiary financial institution (BFI) that supports CPN. Instead of facing long delays and high platform fees, fans can send stablecoins instantly - enabling fast and low-cost monetization.

D. E-commerce

Expand consumer access to global online marketplaces through fast payment experiences.

A customer in the UK purchases electronics from a seller in South Korea through an international e-commerce platform. At checkout, the customer pays in British Pounds (GBP) through a local originating financial institution (OFI), which converts the funds into USDC and transfers it to a beneficiary financial institution (BFI) in South Korea. The BFI converts the USDC into Korean Won (KRW) and deposits it into the seller's account.

4.3 Institutional Payments

A. Capital Markets Settlement

Improve transaction efficiency by enabling faster and more transparent settlements between financial institutions, reducing counterparty risk and operating costs.

A US asset manager executed an over-the-counter (OTC) bond transaction with a European investment bank, but wanted to avoid the T+2 settlement delay, the capital inefficiency and counterparty risk that it brings. The asset manager's sponsoring financial institution (OFI) converted US dollars (USD) into USDC and connected to the European beneficiary financial institution (BFI) through CPN and transferred USDC. The BFI then settled the transaction for the investment bank in euros (EUR) instantly.

B. Foreign Exchange (FX)

Simplify currency conversion by improving the efficiency of multi-currency operations, solving the high FX rates of traditional providers and the complexity and delays of multi-currency management.

A European investment company wants to finance a real estate acquisition in Japan, but wants to avoid high FX fees and delays. The investment company's OFI converts Euros (EUR) into EURC, and Japan's BFI receives it and seamlessly converts it into Japanese Yen (JPY) at a competitive FX venue on the chain and settles it instantly.

C. Treasury Services

Simplify capital repatriation by efficiently converting overseas income back to the company's home market.

A US-based enterprise software provider provides cloud-based solutions to numerous businesses in Southeast Asia. To repatriate revenue from the region to the US, the company’s US-based Beneficiary Financial Institution (BFI) found a local Originating Financial Institution (OFI) in the Philippines through CPN. The OFI collects Philippine Peso (PHP) payments from corporate clients, converts them into USDC, and transmits them to the US-based BFI. The BFI then converts the USDC into US Dollars (USD) and deposits it into the company’s treasury management account, enabling faster and compliant global revenue consolidation.

D. Government and Humanitarian Payments

Provide a secure, reliable, and efficient channel for large-scale payments, from disaster relief funds to institutional transfers.

An international non-governmental organization (NGO) uses stablecoins to distribute disaster relief funds. The NGO initiates payments through its Originating Financial Institution (OFI), which converts local fiat into USDC and transfers it to the Beneficiary Financial Institution (BFI) operating in the recipient region. The BFI then either delivers the funds directly to the beneficiary’s digital wallet or converts the USDC into local fiat and deposits it into their bank account, ensuring transparency, accelerating the delivery of funds, and enhancing accountability for aid distribution.

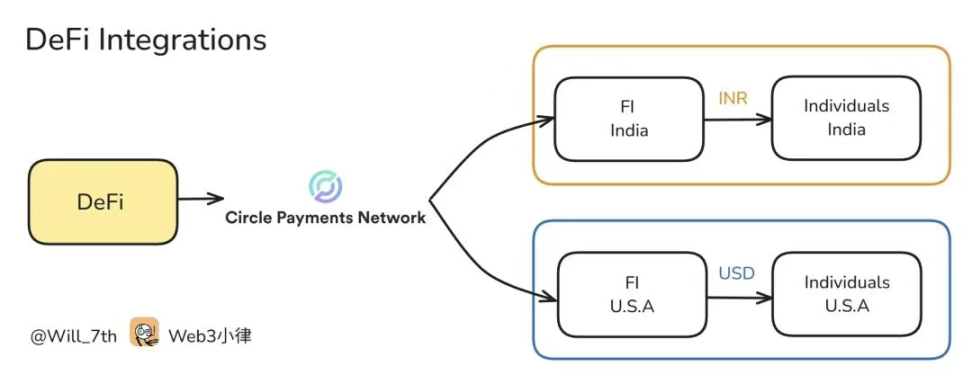

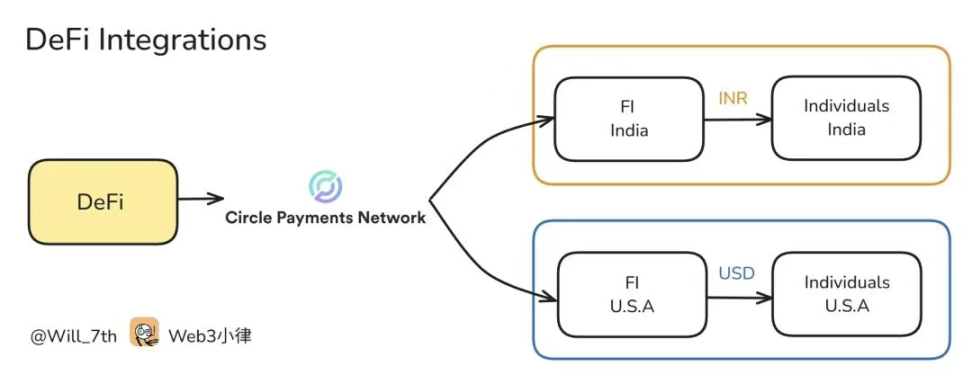

E. Decentralized Financial Integrations (DeFi Integrations)

Support DeFi innovators and unlock the potential of mainstream-scale on-chain finance by providing a foundation for lending, borrowing, saving, and more.

A properly licensed and regulated DeFi lending platform integrates USDC and EURC to provide loan and savings products. With CPN’s infrastructure, the platform can facilitate seamless cross-border transactions, reduce volatility, and support compliant institutional client flows while building trust among a diverse user base.

V. CPN Ecosystem Stakeholders and Roles

The CPN ecosystem is composed of ecological stakeholders and participants who play an important role in promoting global payments, driving technological innovation, and promoting network governance, economic value creation, and network adoption.

5.1 CPN Governance

Circle serves as the main governance and standard-setting body of CPN and is also the network operator.

Circle’s primary responsibilities include:

Develop and maintain the Circle Payments Network Rules (“CPN Rules”), which govern the eligibility, operations, and compliance of all participants.

Develop and maintain core infrastructure – smart contracts, APIs, and SDKs – to enable seamless payment settlement (send/receive transactions) across blockchain networks.

Operate coordination protocols for payment routing and settlement between members and price discovery, counterparties.

Facilitate standardized and automated information sharing between members to ensure compliance with the Travel Rule.

Verify the qualifications of financial institutions, approve their participation in the network, and issue certificates confirming compliance with CPN standards regarding licensing, anti-money laundering and counter-terrorist financing (AML/CFT), sanctions compliance, and financial strength.

Monitor members’ compliance with regulatory requirements, including AML/CFT and sanctions, through ongoing risk-based reviews.

Plan and manage cybersecurity, incident response, and infrastructure to ensure operational integrity and resilience.

Introduce pre-vetted third-party service providers and modular applications that meet CPN compliance, security, and performance standards.

5.2 CPN Members

Members, also known as Participating Financial Institutions (PFIs), are the backbone of the CPN. They act as counterparties to transactions, originate, facilitate or receive payments in the network and execute transactions in accordance with CPN rules and governance standards.

PFIs include virtual asset service providers (VASPs), traditional and crypto-native payment service providers (PSPs), and financial institutions such as traditional or digital banks. Depending on their role in the transaction, PFIs may act as originating financial institutions (OFIs), initiating payments on behalf of senders; or as beneficiary financial institutions (BFIs), receiving stablecoin payments and facilitating the last mile fiat payment through local payment systems, or providing stablecoin custody services on behalf of receivers.

Core responsibilities of CPN members include:

Maintain appropriate licensing and ensure ongoing compliance with applicable regulations in all relevant jurisdictions, including anti-money laundering and counter-terrorism financing (AML/CFT) and sanctions requirements, while complying with CPN rules.

Participate in Circle’s qualification process and maintain up-to-date verification of legal entity information, compliance status, jurisdictional coverage and risk profile.

Perform risk-based assessments of counterparties and transactions in accordance with their compliance obligations, using information collected and oversight performed through the CPN.

Execute payments through a range of technical services and protocols detailed in the CPN Rules, depending on their role as an OFI or BFI.

Comply with the CPN’s technical and infrastructure requirements, including security integration, service level agreement (SLA) performance, transaction monitoring and data protection protocols.

Share necessary originator and beneficiary information as required by the CPN’s Travel Rule compliance framework, Requests for Information (RFIs) and other oversight requests.

Monitor transactions to detect and report suspicious activity in accordance with applicable regulations.

Participate in CPN governance through structured feedback, operational reviews, and member reputation scoring to enhance transparency and support continuous improvement.

Provide timely support and resolution to queries from other members or end users regarding the network.

Develop and deliver innovative payment use cases leveraging CPN’s developer SDK, regulated stablecoins, and smart contract infrastructure.

5.3 CPN End Users (Businesses and Individuals)

End users are the ultimate initiators and beneficiaries of payment transactions – while they do not interact directly with CPN, they benefit from lower costs, faster settlements, greater transparency, and continuous innovation. The sender initiates the payment through the Originating Financial Institution (OFI), while the beneficiary receives the payment through the Beneficiary Financial Institution (BFI).

5.4 CPN Service Providers

These entities include financial institutions (FIs) and non-financial institutions (non-FIs) that provide value-added technology solutions and financial services to CPN members and end-users.

They include:

Liquidity Providers and FX Venues: These entities provide efficient market making, price discovery, and currency exchange services for stablecoin transactions within the CPN. They provide liquidity for cross-border stablecoin settlements and ensure competitive foreign exchange rates.

Stablecoin Issuers: These institutions issue regulated payment stablecoins, which are the main medium of exchange within the CPN. Stablecoin issuers ensure transparent reserves, regulatory compliance, and underlying fiat liquidity that supports seamless cross-border transactions.

Technology Solutions and Financial Services Providers: These service providers provide CPN members with a range of services, including fraud and risk management, wallet infrastructure, custody solutions, billing and invoicing, and compliance and transaction monitoring solutions to support their business and operational needs.

(www.circle.com/cpn)

VI. CPN Governance, Qualification and Network Operations

CPN operates under a collaborative and transparent governance framework that prioritizes compliance, security and trust within the network. The framework covers three key aspects of governance:

Qualification Review and Supervision: Circle, as the primary governance body, is responsible for establishing strict qualification standards, which are detailed in the Circle Payments Network Rules and promote the integration of regulated payment stablecoins into the network.

Network Functionality and Operations: Core functions support seamless and compliant transactions while ensuring operational rigor and continuous improvement.

Transparency and Stakeholder Engagement: By actively engaging with diverse stakeholders, including financial institutions, regulators, businesses and builders, CPN aligns with global standards to enhance trust, accelerate adoption and promote sustainable network ecosystem growth.

Network Operations:

Legitimately authorized financial institutions only;

Mandatory Anti-Money Laundering and Counter-Terrorist Financing (AML/CFT) and sanctions compliance;

Secure transaction data sharing, including the Travel Rule;

Continuous audit and oversight.

6.1 Qualification Review and Supervision

CPN’s governance framework defines qualification criteria, certification protocols, and the integration of regulated stablecoins to ensure trusted participation in the network by financial institutions, regulated stablecoin issuers, and service providers, among others.

A. Strict Qualification Criteria

Members must meet comprehensive qualification requirements before being granted access to the network. This includes holding all necessary licenses, implementing sanctions and anti-money laundering (AML) programs consistent with local regulations and global norms, maintaining reasonable security controls, and demonstrating sufficient financial strength. As the network operator, Circle assesses all potential members before granting access and reassesses them regularly based on risk. Members licensed under a robust regulatory regime established by international compliance standard-setting bodies, such as the Financial Action Task Force (FATF), will be subject to a standard review, while other members will be subject to a more in-depth assessment. Eligibility criteria are published, and Circle’s assessments can also serve as input to members’ own counterparty due diligence processes.

B. Member Certification and Access

Upon successful qualification verification and approval, the CPN issues unique network certifications to eligible members. These certifications enable counterparties to identify each other and retrieve counterparty information in a secure manner, promoting transparency, facilitating informed risk assessments, and increasing the efficiency of counterparty due diligence. The certification contains a set of clearly defined attributes—including membership status, jurisdictional coverage, and eligibility information—that are continuously monitored and updated to reflect changes in the risk landscape.

C. Integration of Regulated Payment Stablecoins

The CPN’s governance framework outlines a structured assessment and approval process for integrating new regulated payment stablecoins into the CPN. Potential stablecoins must undergo a rigorous assessment based on the CPN's strict eligibility criteria, including regulatory compliance, transparent reserves and audit proofs, availability of bank payment channels, underlying fiat liquidity, risk management standards, information and network security capabilities, and reporting practices. Only stablecoins that fully meet these standards and are approved by the governance body can operate within the network, ensuring that they contribute to a stable, secure and efficient network ecosystem.

6.2 Network Functionality and Operations

CPN enables members to conduct secure, real-time transactions through a robust operational framework that ensures consistency, scalability and resilience. The framework includes transaction coordination, operational support, incident response and infrastructure management.

A. Transaction Coordination and Risk Management

Transactions within the CPN are coordinated through a series of technical services and protocols to ensure seamless execution between participating members. In addition, network members continuously monitor transaction flows using automated alerts provided by the CPN, as well as regular risk assessments, focusing on transaction anomalies and partner performance, such as assessing failed transaction rates and service level agreement (SLA) violations. Together, these measures proactively mitigate operational risks and help maintain the reliability and efficiency of the network.

B. Member Operational Support

The CPN provides clear operational guidance, including service level agreements (SLAs) defined in the CPN Rules, covering expectations for uptime, transaction speed, dispute resolution, and timely information sharing. The network also standardizes the exchange of transaction and counterparty data, streamlining operations by reducing the need for customized coordination.

C. Incident and Crisis Management

The CPN has detailed protocols in place for managing security incidents, regulatory compliance issues, and system outages. These protocols include pre-defined communication channels with members and a transparent and impartial resolution process, ensuring prompt action and effective management of disputes, whether involving compliance or transactional issues.

D. Infrastructure Scalability and Planning

CPN’s infrastructure is continuously monitored through observability tools that track throughput, latency, and error rates. Automated performance monitoring and regular load testing enable the network to scale with demand. Circle works with vetted infrastructure and cloud partners to ensure the provisioning of elastic compute and storage resources. Scalability reviews and corridor-level stress testing validate the network’s readiness for increased transaction volumes and network expansion.

6.3 Transparency and Stakeholder Engagement

CPN’s governance is built on transparency, which helps build trust and confidence among all participants. Circle, as the governing body, takes strategic advice to strengthen the governance framework, with the advice of the Advisory Board. The CPN regularly conducts surveys, focus groups, and structured reviews to gather member feedback and assess service quality. These inputs drive continuous improvement and help ensure that the network evolves to meet participant needs. Independent audits and regular public reporting of transaction volumes, system uptime, and member compliance further reinforce operational integrity and accountability.

Representation of CPN members and end users, as well as engagement with regulators, play a vital role in the development of the network. CPN members are encouraged to actively participate in the development of the network’s rules and technical standards by providing advice and operational insights that help shape the network’s strategy and growth. In addition, Circle’s Financial Services division has a strong track record of ongoing engagement with global regulators, which can be leveraged to ensure that the CPN is aligned with international standards—particularly international Anti-Money Laundering and Counter-Terrorist Financing (AML/CFT) and Financial Action Task Force (FATF) Travel Rule standards—and operates in a secure, trusted, and compliant environment.

VII. CPN Core Services

As a coordination protocol designed specifically for stablecoins, CPN enables seamless, compliant, and programmable global transactions.

CPN leverages public blockchain networks for final settlement while optimizing payment coordination, compliance-related data exchange, and smart routing between payment stablecoins and network members. Stablecoins are a fundamental digital asset class within CPN, providing the stability, interoperability, and programmability required for high-trust financial applications.

At launch, the network supports USDC and EURC, and plans to expand to other regulated payment stablecoins that meet CPN's strict governance and eligibility standards. Over time, CPN will serve as a foundation for builders to develop interoperable modules and application services that will expand the utility of the network and unlock new use cases for global payments and financial innovation.

7.1 Payments through Smart Coordination

CPN’s payment protocol is built on a hybrid architecture that combines off-chain and on-chain systems to help aggregate liquidity and facilitate price discovery among network members. As more payment stablecoins join the network, CPN will evolve into an on-chain FX routing infrastructure, enabling efficient and instantaneous exchange between stablecoins, while still coordinating the settlement of transactions between originating financial institutions (OFIs) and beneficiary financial institutions (BFIs).

In the initial version of CPN, coordination occurs through an off-chain API system that generates transaction requests. OFIs sign these requests to initiate USDC or EURC transfers to designated BFI wallets. At this stage, Circle (as the network operator and governance body) broadcasts the transaction to the appropriate blockchain. This process verifies the payment details, ensuring that the correct amount and tokens are delivered to the BFI and that all associated fees are covered within the agreed settlement time.

Subsequently, CPN will transition to a smart contract protocol architecture, enhancing the composability of the network and introducing more efficient, value-added features. The CPN Smart Contract Payment Protocol is designed to enable seamless on-chain payments between members using stablecoins, including USDC and EURC. By leveraging smart contracts, the protocol will enable transactions with minimized risk of errors, automatic reconciliation, and efficient fee collection, while maintaining a non-custodial design.

Under the protocol, OFIs initiate payments through smart contracts deployed on public blockchain networks supported by CPN. The contract validates key transaction parameters (such as token type, amount, recipient address, and expiration date) before executing payments. Unlike traditional transfers, which are prone to errors and require separate invoicing of transaction fees, smart contracts enforce precise payments and efficiently route transactions to different BFIs in situations involving multiple bids and offers.

To enhance transparency and security, each transaction is uniquely identified and timestamped, ensuring clear auditability for compliance and reconciliation purposes. In addition, the protocol will include an optional "revocation" function in the future, allowing the sender to cancel an erroneous transaction within a short window before final confirmation.

(www.circle.com/cpn)

7.2 Optimizing Foreign Exchange (FX) through Intelligent Discovery and Routing

CPN enables participating originating financial institutions (OFIs) to discover beneficiary financial institutions (BFIs) and send stablecoins for payment settlement. During the discovery process, CPN allows OFIs to query the network for specific stablecoin or fiat currency pairs. The system allows OFIs to discover network participants and request corresponding exchange rates and liquidity. Initially, the platform will integrate USDC and EURC with local fiat liquidity order books and private liquidity sources. Over time, the system will transition to a fully on-chain foreign exchange (FX) routing, aggregation and settlement architecture - providing direct access to on-chain FX pools, order books and private liquidity. The network's discovery capabilities will include order routing, while the Request-for-Quote (RFQ) system will further optimize FX execution to meet the performance standards of traditional payment systems.

While the network is initially focused on discovering liquidity between BFIs, it will gradually expand to include whitelisted on-chain venues - such as automated market makers (AMMs), on-chain order books and other liquidity providers - to expand access to stablecoin liquidity. Once discovered, CPN will intelligently match orders from these sources, enabling direct stablecoin FX exchanges with built-in security measures and transparent execution, coordinated by Circle as the network operator.

7.3 Seamless cross-chain settlement of payments

CPN supports native settlement of stablecoins on multiple blockchains, providing a seamless cross-chain payment transfer mechanism. Participating Financial Institutions (PFIs) bring their preferred blockchains to the network, and CPN coordinates transactions between the selected source and target blockchains to achieve efficient payment settlement. With Circle's Cross-Chain Transfer Protocol (CCTP version 2), CPN provides fast and secure cross-chain transfers for permissioned stablecoins, ensuring that transactions maintain speed and integrity in the blockchain network. Initially, the platform will support a limited number of blockchains at launch and expand to more blockchains in the future based on the preferences of network members.

7.4 Protecting confidentiality through selective transparency

CPN will introduce advanced confidentiality enhancements on public blockchains to protect transaction data and help members meet privacy and operational obligations. These mechanisms allow users to designate certain transactions as confidential, ensuring that sensitive payment information is not permanently visible on the public blockchain. This capability supports a wide range of use cases, enabling enterprises to maintain confidentiality for critical activities such as corporate payments, trade finance, and payroll through the CPN.

In addition, the CPN will adopt a confidentiality agreement (which will be defined separately and not included in this white paper) to enable selective disclosure. Under the agreement, transaction details will only be visible to authorized parties (including counterparties, law enforcement agencies, regulators, and auditors) when required for compliance or legal purposes.

7.5 Expanding Capabilities through Composability and Trusted Interoperability

To expand the value of the network ecosystem, the CPN allows pre-vetted third-party protocols to integrate and interoperate with its core infrastructure, enhancing the utility and versatility of its payment capabilities. Circle envisions a diverse range of integrations - including protocols for lending and credit, liquidity aggregation, institutional yield, custody, subscription services, and more. Participation is limited to Circle whitelisted, audited and rigorously reviewed protocols that meet strict regulatory compliance, security and liquidity management standards. Through this composable architecture, CPN aims to unlock a secure, programmable foundation and third-party ecosystem for global payments, financial services and technology-driven solutions.

Eight. CPN Economic Model

CPN's economic model and incentive mechanism are designed to drive early and rapid adoption while building a sustainable long-term revenue strategy for all network members. It aligns incentives between all network members, end users, builders and service providers to promote network growth and sustainability.

Transactions processed through CPN incur three main fees:

Payout Fees: Compensate for the fees of local fiat payments and processing by beneficiary financial institutions (BFIs).

FX Spreads: Reflect liquidity risk and currency conversion costs.

CPN Network Fee: A tiered variable basis point charge based on country groupings to support the core functions of the network, including compliance, security, infrastructure, and development.

As CPN grows and Circle and third-party developers introduce new value-added services through select marketplaces, additional usage-based fees will be implemented to support and sustain these services. These services may include fraud detection tools, risk management, wallet infrastructure, custody, billing, and advanced compliance capabilities, among others. First-party (1P) and third-party (3P) service fees will create revenue opportunities for providers and enable financial institutions to customize the payment experience through modular, plug-and-play solutions.

A portion of the network and marketplace fees will be strategically reinvested in core priorities such as infrastructure upgrades, R&D, network operations, user acquisition incentives, and developer ecosystem growth – including funding for CPN integrations and new applications. This reinvestment approach is designed to strengthen the platform’s resilience, drive innovation, and accelerate long-term network expansion.

Alex

Alex