I never expected that January 1 would usher in the first brutal "bloodbath" of 2024, and the market was wailing!

In this silent battle, the dealers still use the classic tactic of pump-and-dump. Many users may not know the tricks. Let me introduce it. Let me give you a detailed analysis.

1. TRB is a strong currency

First of all, we must clearly understand that TRB It is the currency that Qiangzhuang controls!

So how to identify this kind of strong banker currency? The best way is to use on-chain data, because bookmakers will not put a large number of coins on the exchange and must be on the chain.

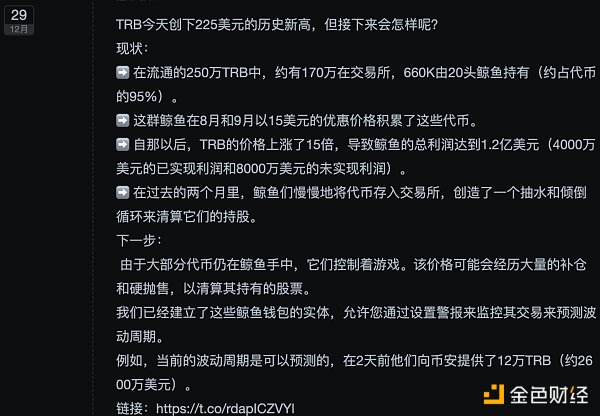

On December 29, spot on chain sent a tweet, which Speaking of TRB, about 95% is in the hands of bankers. The statement here is that 20 whale addresses hold it, but we can think that the chips are highly concentrated

Then take a guess Guess, compared to the 21 million BTC, what is the total amount of TRB?

TRB circulation Amount

The answer is that the supply is only 1.95 million pieces!

">21 million BTC can be raised to 40,000 US dollars, and TRB can be raised to 1,000 US dollars. Logically speaking, this is not excessive. If 1,000 US dollars is not enough, then 500 dollars can always be done!!! (Last night on OKX, TRB has been raised to 1,000 US dollars.) 700 US dollars)

But just knowing that this is a strong banker coin is not enough, why?

Because we don’t know how the dealer will operate, whether to pull the market or to sell it, it all depends on the dealer’s idea, it is difficult to follow

So we have to use the following methods. A tool

2. Market sentiment

How to analyze market sentiment?

Here, the editor provides 3 indicators: ① Position; ② LSUR; ③ Funding fee.

(1) Open interest

How to analyze open interest?

This is a blowout Before, the position trend:

The price has risen, the position has increased, and the trend is very good, indicating that big funds are in Open long.

So how to distinguish whether the banker opens long or retail investors open long?

;">This requires combining the second indicator-LSUR.

(2) LSUR

LSUR is a very practical indicator. LSUR >1 means retail investors are long, and LSUR <1 means retail investors are short.

The picture below shows that TRB is rising During the process, LSUR rose simultaneously, which means that retail investors are following suit.

So now you are the bookmaker of TRB, what will you do?< /p>

Yes, I know how to wash dishes. The extent of washing dishes depends on your conscience!

Then it appeared The first classic scene last night, a sharp drop of 30% in a few minutes!

This market wash is very brutal! A 30% drop corresponds to 3 times leverage, that is to say, in this wave, even if you open 3x long, it still won’t work!

Why is it 3x?

Because a long time ago, the leverage area of okcoin was 3x by default. Later, everyone used 3x leverage for arbitrage, and I felt that 3x was very safe.

At this time, the dealer has finished washing the market. How many positions were liquidated in this washing? You can see how much the position has dropped. It is generally not bad. It is estimated that the liquidated position is 30 million US dollars.

What happened after TRB fell sharply by 30%?

Yes, the major media Everyone is reporting that TRB plummeted by 30%. It was the front page of all media for a while, and the discussion was very high!

What does this mean? It means that TRB has entered the market. It caught everyone’s attention. There may have been many people who didn’t watch TRB at all before and didn’t know what TRB was. Many users knew about this promotion, and then everyone started trading!

You must know that traders’ attention is a very important aspect, because without popularity, it is impossible to sell goods if the price rises. But when the popularity rises, the next operation can officially begin!

Here we still use the LSUR indicator, why? Because this indicator is really easy to use, and it can accurately judge the general direction of bankers and retail investors!

Bankers and retail investors are opposites. Only when there are more retail investors can the bankers have enough to eat. We can see how retail investors view the TRB currency.

After TRB plummeted, everyone thought it would rebound, so it must be long. After it fell last night, retail investors began to obviously go long because the LSUR indicator showed a significant rise.

Our ideas and LSUR data support this judgment, so TRB has risen Expected.

What’s next?

At this time we need to use our main force Single indicator!

$250 is a dividing point, because the large order data shows that after After reaching this position, the main force began to place a lot of buy orders below the current price.

Why do we do this?

Because it is necessary to attract market-making robots or some high-frequency robots, robots that rely on the OBI (orderbook imbalance) trading strategy help them actively buy to push up prices, and constantly use large-amount buying orders to push the robots to buy at market prices. Pushing the market price upward was a classic operation technique last night.

At 23:00 last night, after the TRB market price returned to its original point, something happened What?

The price is sideways, open interest fell, and LSUR fell. What does this mean?

It means that everyone thinks that TRB has reached its peak, and they start not to be long on TRB, so they close their positions and start to fall, and retail investors start to go short, causing LSUR to fall.

TRB has been trading sideways for a long time since it came to around 290 last night. At this time, we will definitely think that the previous high is high!!

So a series of data It shows that retail investors are not optimistic about this position. If the price goes up, retail investors will still be resolutely short

At this time, the consciousness of bankers and retail investors has changed significantly. , bankers are bullish, retail investors are bearish

The hunting time begins!!!

And Oh, it's late at night, and it's still New Year's Day. Everyone can't help but spend time with their families, New Year's Eve, and sleep... This is why the explosion started in the early morning and ended in the morning, because it was targeted at the friends in the East Eighth District! < /p>

This picture is very classic, the main force’s crazy buying of large orders supports the price, LSUR Keep falling.

Why can’t the price fall?

Because the dealer feels that you want to buy If you enter, the dealer will buy it in advance, and then wait for you to increase the purchase price before selling it to you.

From US$250 to US$464, an increase of 80% , can you guess how much money the banker used?

The answer is 40 million U.S. dollars! By placing a large order of 40 million U.S. dollars, the price was completed from 250 U.S. dollars A feat of pushing it up to US$464! When it went up again later, it was actually the top shipment. The main rising wave was from US$250 to US$464. At this stage, the banker only used about US$40 million in funds. .

The banker’s control of the market is basically to suck, wash, pull and release, and now the pulling stage has been At the end, we have come to the shipping stage. In the shipping stage, what is the best shipping method? Pump and dump!!!

The editor simply drew a pattern. After the banker’s pull-up was completed, It started its own shipping phase. After trading sideways, it suddenly rose, attracting the technical analysts to buy, and then fell rapidly and hit the stop loss. This wave tested the psychological quality of the technical analysts. This time the decline returned When it reaches around 464, it is actually very clear to ship. At this time, the deep correction will attract retail investors to buy again, thus continuously pushing up the price. However, because the market makers have been selling and shipping, the price moves slowly and cannot break through. Previous high.

But it should be noted that many times the second top in the currency circle will break through the previous high, hit the short stop loss, and then fall. . So this time the dealer has a kind heart, otherwise he will stop the loss at a high price before the breakthrough, and then plummet again, which will make you cry without tears.

There is kindness, but not much, because he gave a wave of 70% drop!!! This drop is basically beyond 99% of people’s expectations!

Why can it be operated like this? Because this is a capital control The currency can be explained not by fundamentals but by technical aspects.

So how did retail investors operate during the decline?

Let's go back to the analysis of LSUR and position. We retail investors like to buy the bottom + carry orders. Then during the decline, the position increases and LSUR rises, which means that retail investors are buying more.< /p>

Also, you can pay attention to the highest price of US$555, right? Very humorous? (It can be understood as a handicap language, 555 means crying, that is, I am going to smash it, you go ahead and cry. This situation has also appeared on Ouyi BTCUSDT Perpetual, 44444 US dollars )

Starting here, we need to mention the explosive funding rate!

3. Funding rate

What happened last night was that Binance charges a funding fee every 4 hours, and the upper and lower limits of TRB funding fees are plus or minus 2%. Funding fee -2 %, collected once every 4 hours, this temptation is very big.

The capital fee of -2% means that most people in the contract market are Shorting TRB means everyone is selling TRB, causing the price of TRB to be lower than the spot price.

Retail investors are all shorting, so the main force must be long, and LSUR also reflects this With such data characteristics, we can verify one judgment point from multiple data sources.

However, generally unilateral traders rarely care about it Funding fees, so which users care about funding fees?

By the way, they are arbitrage traders!

What arbitrage opportunities appeared last night? The TRB funding fee is negative, and reverse arbitrage can be opened, but reverse arbitrage requires coins, but the banker usually borrows all the coins in advance to avoid someone who has chips in his hand to interfere with him operation, so reverse arbitrage generally does not work, so arbitrageurs generally use double contract arbitrage.

Applying to TRB here is: Binance TRB USDT contract Go long, short OKX TRB USDT contract.

Why do you do this? The reason is to eat the funding fee that is settled every 4 hours:

< p style="text-align: left;">Binance funding fee is -2% (settled once every 4 hours) = -8%

OKX funding fee is -1.5% (settled once every 8 hours) = -1.5%

Then let’s calculate the income. The 8-hour income is 6.5%, and because it is arbitrage, There are long and short positions, and it should be relatively safe, so last night most arbitrageurs saw this trading opportunity and ran to do arbitrage.

But arbitrage There are risks, especially cross-exchange arbitrage. The core risk is that the exchange will close the currency withdrawal, and then the currency price difference between the two sides will be out of control. There is also a risk that the currency will be pulled too hard, causing one side to explode. If the position is closed quickly after the explosion, the loss will not be particularly large. However, if the position is left unilateral after the explosion, it will cause unilateral risks.

Then we saw the price of OKX over 700 US dollars. Because OKX was shallow, arbitrageurs opened short orders on OKX, so there was a series of short positions, which finally pushed the price of OKX far away. Far higher than the Binance price, OKX’s contract price of more than 700 is caused by arbitrageurs’ serial liquidation of positions.

Of course, there is also a kind of arbitrage that takes advantage of the price difference. If you can do it well, it is also very profitable.

Arbitrage is an important participant in the market, but improper risk management will cause big problems, but last night’s TRB was a nightmare for arbitrageurs, and many people were exposed The warehouse is empty. Therefore, you must pay attention to risk control when trading, set a stop loss position resolutely, and do not let a small loss turn into a catastrophe. At the same time, if you can combine the main large orders and trade with the banker last night, the harvest will be very rich.

Now TRB has completed the process of placing stocks and selling down. Because there are so many users who have liquidated their positions in this wave, it is expected that there will be no new market prices in a short period of time. , even if there is to be a new market, it still needs to go through another wave of fund-raising and washing.

Summary

TRB’s review of this round of bloodbath is basically over. Let’s summarize. , if we want to make money in this wave, we need to make full use of the following tools and methods:

1. Discover Qiangzhuang Coin

2. Found abnormalities in capital fees, LSUR, and positions

3. Combined with the main large orders (or large transactions ) Carry out main capital analysis

4. Set strict stop loss levels

Combined with the main force Just grasp the best choice for banker's capital control. Whether buying or selling, it will be reflected on the market in the end. As long as there are orders and transactions, we can monitor it, so everyone must make good use of these tools!

JinseFinance

JinseFinance

JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance Xu Lin

Xu Lin JinseFinance

JinseFinance Kikyo

Kikyo Brian

Brian Bitcoinist

Bitcoinist