Author: Tanay Ved Source: Coin Metrics Translation: Shan Ouba, Golden Finance

Key Points Overview:

dYdX v4 has migrated from the Ethereum ecosystem to the independent Cosmos application chain, realizing decentralized trading infrastructure while improving performance and sovereign control.

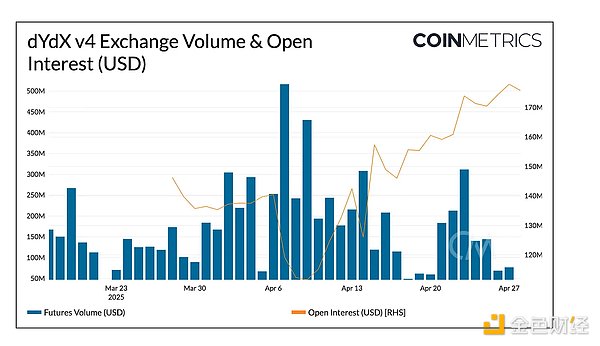

Currently, dYdX v4's average daily trading volume is about $200 million, and open interest has gradually increased to $175 million, showing healthy growth momentum in a highly competitive market.

Although dYdX's perpetual contract trading volume still lags behind mainstream centralized exchanges, it still has broad room for development as demand for on-chain derivatives platforms grows.

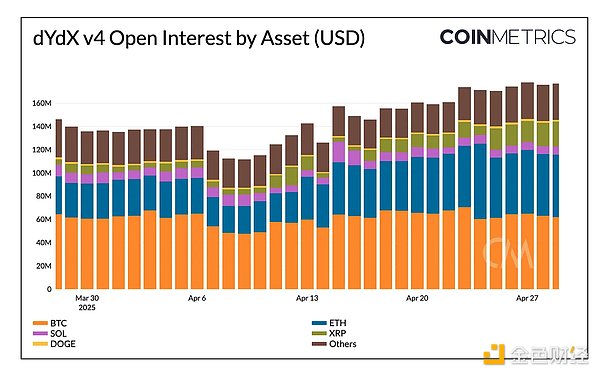

The latest market data shows that BTC and ETH continue to dominate trading activities; open positions, funding rates and liquidation behavior reveal the dynamic changes in trader sentiment and positions.

Introduction

Exchanges are the core pillars of crypto infrastructure, supporting various activities such as liquidity acquisition, asset allocation, and spot and derivatives trading. Centralized exchanges (CEX) such as CME and Binance process trillions of dollars in trading volume each year, especially in the derivatives market. However, as the scalability of blockchain increases, decentralized exchanges (DEX) are working hard to narrow the gap and try to achieve an efficient trading system on the chain that is closer to the centralized experience.

This article will focus on dYdX v4 — an order-book-based perpetual swap DEX — and explain its transition from Ethereum to Cosmos AppChain, its architecture changes, and core trading metrics such as trading volume, open interest, and market activity.

About dYdX

What is dYdX?

dYdX is a decentralized exchange that supports perpetual swaps, allowing users to trade derivatives without custody of their assets. Perpetual swaps (Perps) allow users to speculate on prices without holding spot assets, have no expiration date, and can be held for a long time as long as margin is sufficient. Centralized exchanges such as Binance, Deribit, and Coinbase International also offer similar products.

Unlike the automated market maker (AMM) model like Uniswap, dYdX uses a traditional order book and matching mechanism, mainly serving high-frequency traders and institutional users, providing more refined order control and liquidity depth.

dYdX v4: From Ethereum DApp to Cosmos Application Chain

dYdX has experienced a unique development journey as an exchange, constantly adapting to changing user needs and making trade-offs in blockchain scalability. It was originally launched on the Ethereum mainnet in 2017 as a decentralized application that provided margin trading, lending and borrowing services. This period is often referred to as the "Summer of DeFi", and DeFi protocols have flourished, and the emergence of protocols such as Uniswap, Compound, and Aave has created a competitive environment.

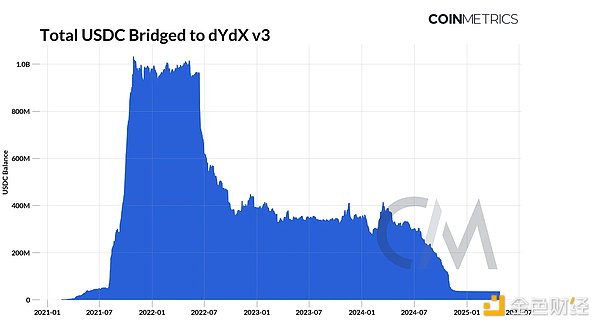

By 2021, dYdX transitioned to the StarkWare Layer-2 solution, becoming one of the first mainstream applications to migrate from the Ethereum mainnet to the Layer-2 network. High gas fees during congestion and limited throughput of Ethereum Layer-1 became bottlenecks for user experience and scalability, prompting the release of dYdX v3, which is built on StarkWare's StarkEx (a ZK-rollup-based Layer-2).

This move significantly improved dYdX's competitiveness and made high-frequency trading use cases more viable. By 2022, the balance of USDC (dYdX's main margin and collateral asset) locked in the dYdX protocol has reached $1 billion, making it one of the top DeFi protocols by total locked value (TVL) and derivatives trading volume.

Although the v3 version has taken an important step forward, dYdX still faces many limitations: the order book and matching engine are still centrally operated. This prompted dYdX to undergo a second major transformation at the end of 2023, becoming an independent, application-specific Layer-1 chain (app-chain) built with the Cosmos SDK and the Proof of Stake (PoS) consensus mechanism. Transactions are now settled on the dYdX chain, and margin collateral (USDC) is minted natively by Cosmos.

The move to Cosmos AppChain aims to bring the following key improvements:

Full Decentralization:By moving to its own public chain, dYdX was able to decentralize core components such as the order book and matching engine into the hands of validators. In addition, it also achieved a shift to community governance, adding staking and governance capabilities to the DYDX token.

Increased Throughput:Cosmos’ architecture provides significantly higher throughput (10,000 transactions per second), which is critical to providing better trade execution to compete with centralized exchanges, but at the cost of giving up Ethereum’s massive liquidity base.

Full Stack, Customizability, and Control:Building with the Cosmos SDK gives dYdX full control over its infrastructure. This includes customizing parts of the stack (e.g. off-chain, in-memory order books) to optimize performance, validator operations, fee structure, and address maximum extractable value (MEV) risk, albeit with reduced compatibility with EVM-based tools.

Architecture Overview

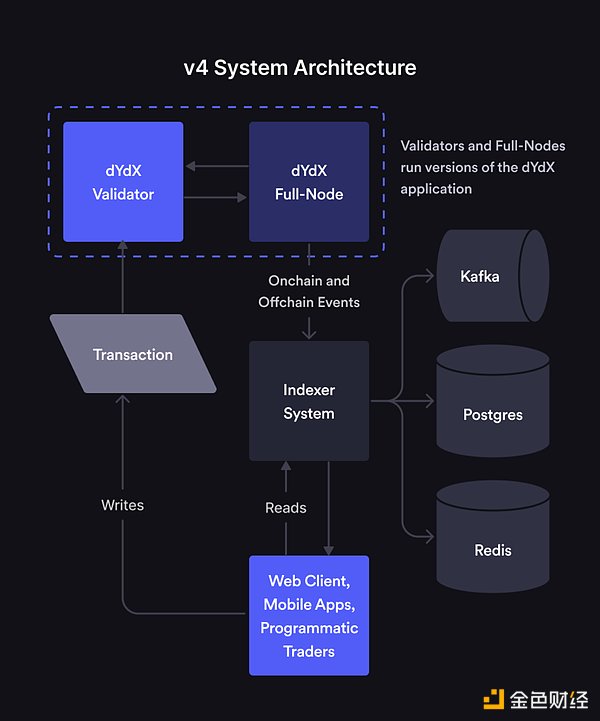

Ultimately, dYdX v4 (aka dYdX Chain) consists of three main components: the protocol layer, indexer, and frontend. Some of these components run on-chain and some off-chain, aiming to strike a balance between decentralization and performance.

Protocol (Application):The protocol or open source application is dYdX Chain, an L1 blockchain built on Cosmos SDK and CometBFT consensus.

Validators:Validators store orders off-chain in a memory order book, propagate transactions to other validators, and generate new blocks for the dYdX chain through a consensus process (based on DYDX stake weight).

FullNodes: Full nodes run the open source dYdX chain but do not participate in consensus (zero stake weight). They connect to validators, propagate transactions, process committed blocks, and maintain the full history of the chain to support Indexers.

Indexers: The Indexer is a read-only service that indexes real-time data from the dYdX chain and serves it over websockets and a REST API. Most of the market data analyzed in the next section comes from Indexers.

Frontends: dYdX provides open source frontends to access the exchange through a web app, iOS app, and Android app.

The order lifecycle on dYdX covers all of these links. Orders and matching occur off-chain, propagate between validators and full nodes, and are ultimately settled on-chain. This structure optimizes block space usage while maintaining decentralization.

Several other decentralized exchanges, such as Hyperliquid (an independent layer-1), are also pursuing high-performance order book models, reflecting the industry's momentum in replicating the centralized platform trading experience using decentralized infrastructure.

Diving Deeper into dYdX Market Data

With an understanding of the background and architecture of dYdX, we can dive into the market data of dYdX v4 to understand the usage and activity of the exchange. Over the past two months, we have been able to observe the market against the backdrop of increased market volatility and rising macroeconomic uncertainty. dYdX v4’s volume averaged $200 million, peaking at $500 million on April 6, and has steadily risen to $175 million as market conditions and sentiment have reversed.

In terms of volume, derivatives exchanges like dYdX are still smaller than centralized exchanges like Binance. With the growing demand for on-chain trading infrastructure, dYdX has a lot of room to grow and is expected to close the gap with the more established exchanges. The chart below shows the perpetual swap volume of dYdX compared to other major exchanges. The chart below shows the top ten markets by trading volume on dYdX (March 13 to April 28). Trading activity is concentrated in large-cap and liquid assets, with BTC ($3.2 billion), ETH ($2.3 billion), and SOL ($840 million) having the highest total trading volume, followed by major altcoins and meme coins. By asset class, 35% (about $65 million) of open interest is concentrated on BTC, followed by 30% (about $53 million) of ETH. XRP ranks third, with its share steadily growing to 11%.

Hourly Liquidation and Funding Rates

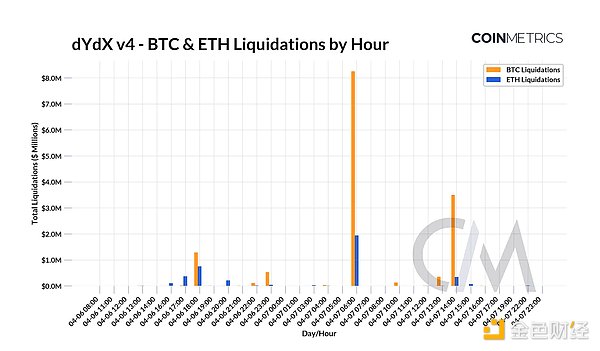

To get a more detailed look at how traders position around key market events, we can explore dYdX market data at a 1-hour frequency. As the impact of Donald Trump’s “Liberation Day” tariff policy rippled through the market, long and short positions on BTC and ETH were liquidated on April 6th, with positions reaching $8 million and $2 million for BTC and ETH, respectively.

In addition to liquidation, funding rates are an effective reflection of trader sentiment on perpetual swap exchanges such as dYdX. Funding rates are an important mechanism in the perpetual swap market that helps keep the price of perpetual swaps in line with spot market prices. When funding rates are positive, it indicates bullish market sentiment, and traders with long positions pay commissions to traders with short positions. When funding rates are negative, it indicates bearish market sentiment, and short positions pay commissions to long positions, effectively keeping the contract price close to the spot price. Tracking funding rates can reflect current market sentiment and the conditions under which traders are long or short. The chart below shows the 1-hour funding rates for major assets on the dYdX v4 platform. BTC funding rates have remained largely neutral, while SOL has dropped significantly around April 13-14, reflecting heavy shorting. In contrast, ETH funding rates rose significantly on April 23, indicating an increase in long positions as ETH open interest briefly surpassed BTC to become the dominant asset on the dYdX platform.

Conclusion

dYdX's transition to an application chain architecture marks a bold step towards providing a more decentralized, higher-performance trading experience. While the scale of perpetual contracts on dYdX is still small compared to leading centralized platforms, its model enables it to fully leverage the market's growing demand for on-chain derivatives infrastructure. Market data shows that trading activity is relatively active in major assets, and trends in trading volume, open interest, liquidation volume, and funding rates indicate that its usage is becoming more mature.

YouQuan

YouQuan

YouQuan

YouQuan YouQuan

YouQuan YouQuan

YouQuan YouQuan

YouQuan Alex

Alex Kikyo

Kikyo Alex

Alex Kikyo

Kikyo Alex

Alex Kikyo

Kikyo