Author: Tanay Ved Source: Coin Metrics Translation: Shan Ouba, Golden Finance

Key Points:

We expect Coinbase's total revenue to reach approximately $2 billion in the fourth quarter of 2024, up 65% from the previous quarter and 109% from the previous year, driven by a rebound in trading revenue and steady growth in subscriptions and services.

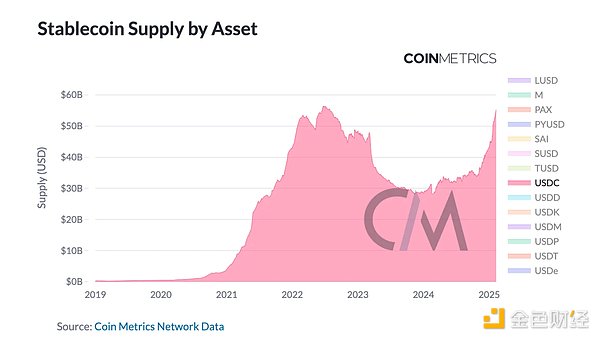

Driven by renewed market optimism after the US election, trading volume surged to approximately $430 billion, the highest level since the fourth quarter of 2021, while USDC supply increased by 23%, which could boost Coinbase's stablecoin revenue.

Base’s sequencer revenue was 8,047 ETH ($26.36 million) and profit was 7,417 ETH ($24.18 million), maintaining strong profitability as Ethereum’s low settlement costs maintained high margins.

Introduction

Coinbase Global Inc. (COIN) will announce its fourth quarter 2024 financial results on February 13. As the only major cryptocurrency exchange listed on the U.S. stock market and an increasingly diversified blockchain enterprise, its financial performance will be highly watched by crypto market investors and Wall Street.

The fourth quarter of 2024 was a strong bull market quarter, partly due to Donald Trump's victory in the election, which led to a rebound in market optimism. Investors now want to see how Coinbase can take advantage of this market momentum, especially against the backdrop of a easing regulatory environment and an expected increase in crypto company IPOs, which may usher in more new competitors in the industry.

This article will combine Coin Metrics' market data, on-chain data, and public information to conduct a forward-looking analysis of Coinbase's 2024 Q4 financial report.

Wall Street and Forecast Market Expectations

Entering the financial report stage, analysts expect Coinbase's total revenue in Q4 to be US$1.59 billion, an increase of approximately RMB 300 million from US$1.2 billion in Q3, and earnings per share (EPS) are expected to be 1.13 While this forecast shows Coinbase's quarterly revenue growth, we believe its actual revenue may exceed market expectations, mainly due to growth in trading revenue and subscription & services revenue, both of which are Coinbase's core revenue sources.

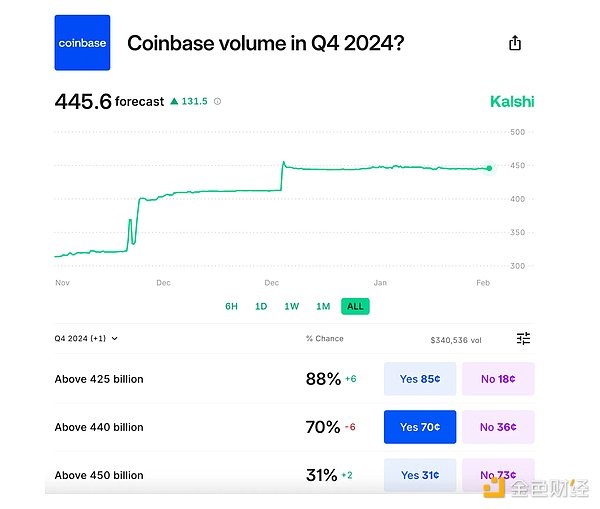

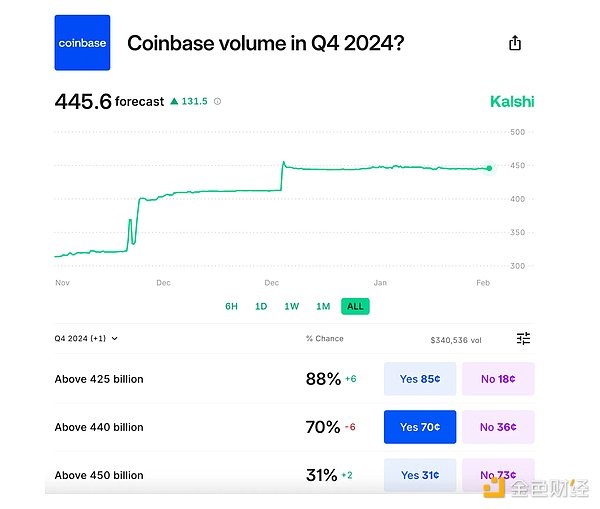

Prediction market Kalshi predicts that Q4 trading volume will reach $445 billion and gives a 70% probability. This data is a 140% increase from Q3, showing the market's high expectations for Coinbase's trading activities.

Transaction Revenue Analysis

Coinbase's transaction revenue mainly comes from retail and institutional transactions, as well as its Layer-2 Base ecosystem and payment business (this part was reclassified as "other transaction revenue" in 2024 Q1).

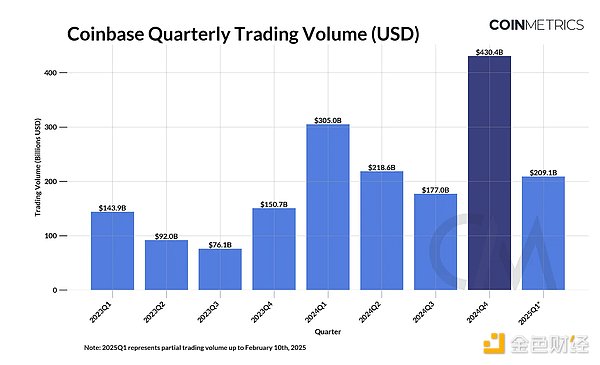

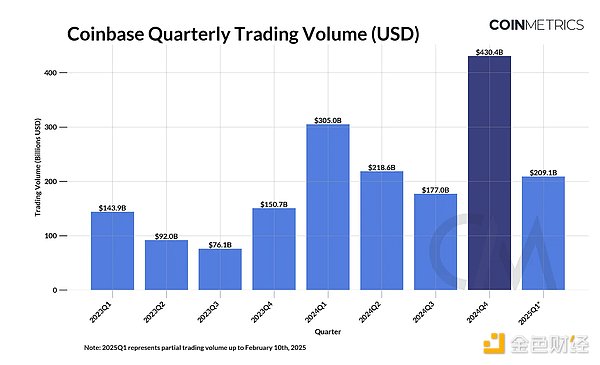

Resampling Coinbase's daily transaction volume to the past eight quarters, 2024 Q4 transaction volume was approximately US$430.4 billion, setting a record for the highest quarterly transaction volume since 2021 Q4. The main reason for the growth is that Trump won the US election in November 2024, which led to a significant increase in Coinbase's transaction activity. This growth should come from both consumer and institutional groups and be driven by improving sentiment, increased cryptocurrency volatility, and momentum for crypto-friendly government regulation, all of which are expected to boost both retail and institutional participation in cryptocurrency markets and operations.

Based on $440 billion in quarterly trading volume, we estimate Coinbase's trading revenue to be approximately $1.4 billion in Q4 2024, up 175% year-over-year. Drivers include:

Consumer trading contributes approximately $1.3 billion, based on 20% of total trading volume and a 1.5% take rate assumption.

Institutional trading generates approximately $102 million in revenue, based on 80% of total trading volume and a 0.03% acceptance rate assumption.

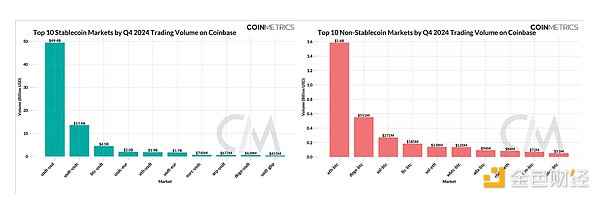

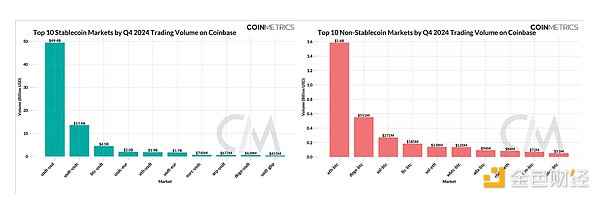

If achieved, trading revenue in Q4 2024 would exceed Coinbase's $1.2 billion in total revenue in Q3 2024. With only one month completed in Q1 2025, it also indicates a strong start, reversing the trend of sluggish trading revenue in recent quarters. We can also analyze the market composition and trading volume of Coinbase exchange in depth. Using the K-line data of Coin Metrics, we can see the main stablecoin (or fiat currency) trading market and non-stablecoin trading market ranked by trading volume this quarter. Among the stablecoin-fiat currency trading pairs, USDT-USD ranks first with a trading volume of US$49.4 billion, indicating that Tether has strong demand as the main on/off ramp for the US dollar. Meanwhile, USDC-EUR ranked fourth with $2 billion in trading volume, reflecting the growing adoption of USDC in the euro market, which may be related to its compliance with MiCA (Markets in Crypto-Assets in Europe) regulatory requirements. In terms of crypto asset trading, BTC, ETH, XRP and DOGE were in high demand, while the ETH-BTC trading pair was the highest-volume non-stablecoin trading market this quarter, reaching $1.6 billion.

Since November, Coinbase has gradually relaxed its prudent token listing strategy and added new meme coins such as PEPE and dogwifhat (WIF), which may further drive the growth of retail trading volume.

Base Layer-2: Volume and Profitability

Base is the Ethereum Layer-2 (L2) network launched by Coinbase. Built on Optimism’s OP Stack, it has become a key part of Coinbase’s on-chain ecosystem. Base has proven that running L2 on the Ethereum network is a profitable and viable business model, which explains why companies such as Kraken, Sony, and Deutsche Bank have entered the field.

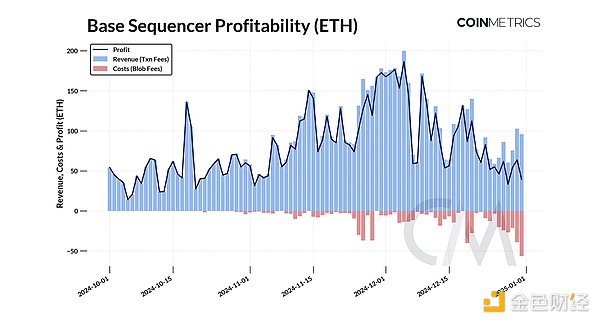

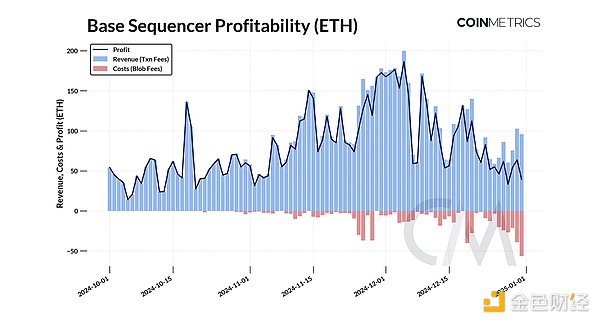

As the only sorter of Base, Coinbase charges fees for sorting and processing transactions, and pays blob fees to Ethereum Layer-1 for settlement.

In the fourth quarter of 2024, Base generated a total revenue of 8,047 ETH (US$26.36 million), of which 630 ETH (US$2.18 million) was paid in blob fees, and finally a profit of 7,417 ETH (US$24.18 million) was realized. For most of the quarter, Base's profit margin remained between 80%-100%, but fell to about 45% at the end of December due to rising settlement costs (blob fees). Overall, 2024 Q4 was a strong quarter for Base, mainly due to the continued growth in L2 transaction demand and the surge in overall on-chain activity, further consolidating its position as Ethereum's leading L2.

Subscription and Services Revenue

In recent quarters, Coinbase's Subscription and Services Revenue (including blockchain rewards from staking, USDC stablecoin revenue from its partnership with Circle, and custody revenue from US spot ETFs) accounted for 30%-50% of its net revenue. In previous analysis, we found that this part of Coinbase's revenue showed a growing but volatile correlation with variables such as stablecoin supply or staking balance. In the third quarter of 2024, this part of revenue was $556 million, most of which came from stablecoins and blockchain rewards.

Blockchain Rewards, Stablecoins & Custody Revenue

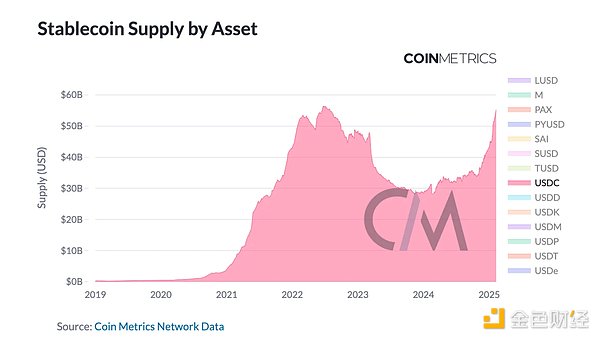

Coinbase earns revenue through the USDC stablecoin, mainly from reserve interest and through a revenue sharing agreement with Circle. In the fourth quarter of 2024, the supply of USDC increased by 23% to 43.2 billion, and is now close to 55 billion, which may further drive the growth of USDC balances on the Coinbase platform. With further integration of USDC, global users can earn about 4.5% APY (annual yield) or borrow USDC against Bitcoin, increasing the utility of USDC.

However, the impact of USDC supply growth on Coinbase revenue may be limited due to lower Treasury yields than in previous quarters. Therefore, we expect stablecoin revenue to be approximately $250 million, a slight increase from previous quarters.

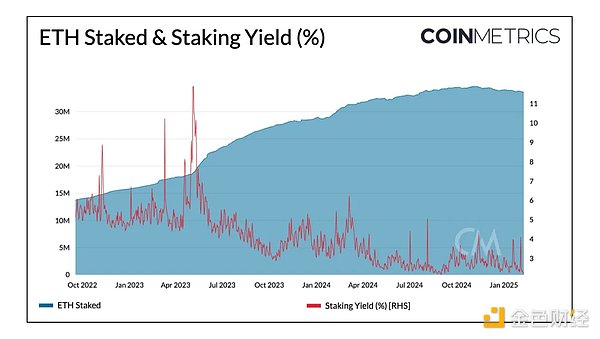

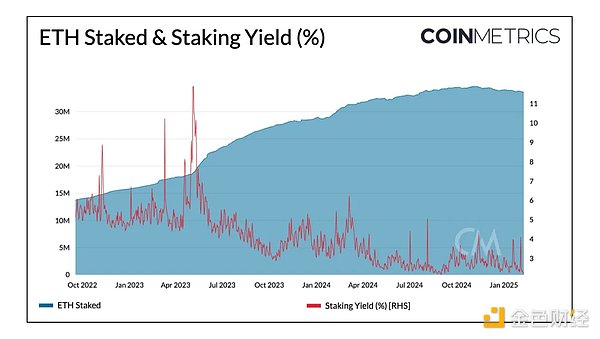

Blockchain rewards are the second largest source of Coinbase's Subscription & Services Revenue, contributing $154 million in Q3 2024. Although the ETH and SOL staking balances did not change much between quarters, its revenue in US dollars may have increased due to the rise in asset prices.

Coinbase also earns fees through custody services, with a Bitcoin custody balance of more than 1.1 million BTC on its platform, and is also the main custodian of spot Bitcoin and Ethereum ETFs, with an estimated custody revenue of more than $35 million. Additionally, the U.S. Financial Accounting Standards Board (FASB) allows public companies to report crypto holdings at fair value, which could further boost Coinbase’s earnings in the event of rising asset prices.

In addition to custody services, Coinbase continues to expand its product suite, including:

• cbBTC — a tokenized version of Bitcoin that can be used in the Ethereum and Solana ecosystems.

• Offering Bitcoin lending through Morpho, strengthening its financial infrastructure capabilities.

• Upgrades to Coinbase Wallet, further solidifying its role as the infrastructure layer of the crypto ecosystem.

Overall, including other revenues such as corporate interest income, we expect subscription and services revenue to be between $570 million and $600 million.

Conclusion

Coinbase performed strongly in all its businesses and is expected to continue to expand its market leadership. Trading revenue rebounded, subscription and services revenue remained stable, and Coinbase is expected to report approximately $2 billion in total revenue, up 65% from the previous quarter and 109% from the previous year.

COIN's current share price is around $280, with a moderate correlation to the NASDAQ. With the growth of trading revenue, Coinbase's strong distribution capabilities, stablecoin business expansion, and Base's leading position in the Layer-2 ecosystem give it long-term growth potential in the crypto market and further deepen its integration in the industry.

As Coinbase's diversified revenue model matures, it is gradually blurring the boundaries between banks, brokerages, and payment companies, and consolidating its position as the core platform of the global crypto market.

Weiliang

Weiliang