Author: Tanay Ved Source: Coin Metrics Translation: Shan Ouba, Golden Finance On Friday, October 10th, macroeconomic news triggered a chain reaction, causing tsunami-level volatility in the cryptocurrency market, with the largest single day of liquidations in crypto history. From price dislocations to leverage wipeouts to a liquidity crunch, this article will analyze the entire process of this crash, revealing the structural characteristics and risk pain points of the current digital asset market. 1. The Trigger of the Crash: Macroeconomic Policies Triggering Market Panic On Thursday, China tightened its rare earth element export restrictions, sparking market concerns about supply chain disruptions and escalating economic tensions, and anxiety began to spread. At 3:00 PM (UTC) on Friday, President Donald Trump criticized China's restrictions on social media and warned of retaliatory action. A few hours later, at 20:50 (UTC), the official policy announcement was released: starting November 1st, a 100% tariff would be imposed on all Chinese imports. With traditional financial markets closed, cryptocurrencies, which trade 24/7, became a real-time barometer of global market sentiment. Source: Coin Metrics Reference Exchange Rate. After 21:00 (UTC), the price of Bitcoin fell to $107,000, while altcoins experienced even more dramatic declines. For example, tokens like SUI plummeted over 70% in a matter of minutes, a stark contrast to Bitcoin's relatively mild fluctuations. This discrepancy suggests that the sell-off wasn't driven solely by overall market sentiment. Differences in liquidity, leverage, and market structure across different assets and trading platforms likely amplified the price fluctuations. 2. Liquidation Spiral and Leverage Zeroing In the weeks leading up to the crash, open interest in the perpetual futures market surged. This surge in leverage, combined with thin liquidity and the impact of tariff news, laid the groundwork for the subsequent volatility. When prices began to fall, market pressure quickly built. When highly leveraged long positions hit the liquidation threshold, exchanges automatically liquidated them to prevent further losses. Within an hour, over $3.5 billion in futures positions were liquidated on centralized exchanges, further depressing prices. Simultaneously, automatic position-diminishing mechanisms activated, forcibly liquidating risky positions, creating a vicious cycle of liquidations, falling prices, and more liquidations. Total liquidations for the day ultimately exceeded $5 billion, roughly 17 times the daily average of $300 million over the previous three months, making it one of the most extreme forced liquidation events in recent memory. Source: Coin Metrics Market Data Professional Edition Although all assets were affected, the severity of liquidations varied across different platforms and assets: Asset Type: Altcoins were the hardest hit by liquidations. Between October 8th and 10th, open interest in non-BTC assets fell by over 25%, while BTC and ETH only fell by 15% and 25%, respectively. 24%;

Exchanges: Binance, OKX, and Bybit saw the largest liquidations, primarily involving long positions, indicating higher leverage trading activity on these platforms.

III. Order Book Liquidity Drain: A Driver of Exacerbated Volatility

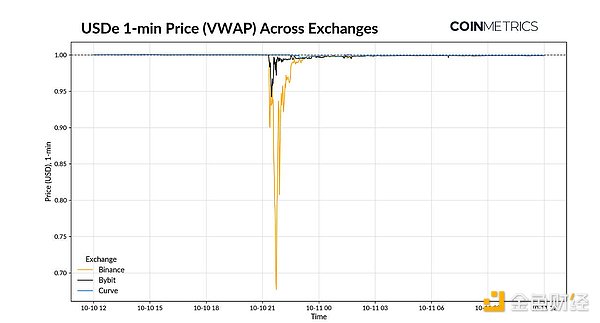

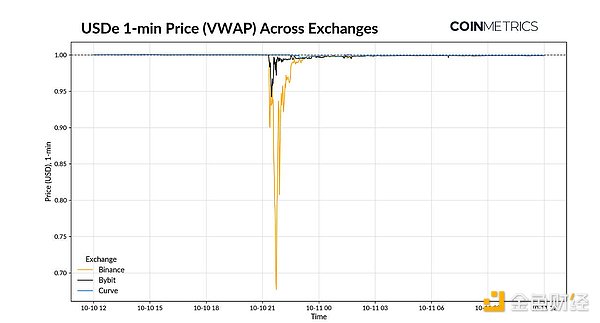

The dramatic wave of liquidations was further amplified by thin market liquidity, a fact clearly observed in Binance's BTC/USDT order book depth data. The chart below compares the order book depth of BTC/USDT within ±2% of the mid-price during the crash week (October 6-13) with the year-to-date (YTD) period. Data Source: Coin Metrics Market Data Pro. Under normal market conditions (dashed line), BTC order book depth remains relatively stable, with both buy and sell liquidity remaining around $40 million. During the crash (solid line), liquidity on both sides of the order book dries up significantly. When liquidity is insufficient, even moderate selling pressure can trigger far greater-than-expected price volatility, accelerating the downward trend. For Bitcoin, this liquidity squeeze, while severe, remains manageable. For altcoins, already thin order book depth has almost completely evaporated, leading to even greater price fluctuations and wider bid-ask spreads. Fourth, a special case: Ethena's USDe price dislocation. One of the most notable casualties of this crash was USDe, the synthetic USD stablecoin issued by Ethena. Unlike fiat-collateralized stablecoins like USDT and USDC, USDe maintains its peg through delta-neutral basis trading—that is, holding a long spot position while simultaneously establishing an equal short position in a perpetual swap. USDe is primarily used as margin collateral on centralized exchanges like Binance (Binance previously promoted USDe through a high-yield incentive program). Its staking counterpart, sUSDe, is widely used as collateral in lending protocols. This unique risk structure, coupled with its cross-chain and off-chain use cases, makes USDe's stability highly tied to the overall leverage environment. During the crash, USDe's price plummeted to $0.67, while fiat-collateralized stablecoins like USDT and USDC traded slightly above $1 parity. The platform with the most severe price misalignment is Binance, where USDe leverage exposure and trading activity are likely the highest. In contrast, the USDe price on Bybit is closer to parity (around $0.94), and on decentralized exchanges like Curve, the price is even maintained around $0.99, suggesting deeper USDe liquidity or lower leverage exposure on these platforms. Although USDe prices subsequently recovered rapidly, this incident highlights the importance of comprehensively assessing secondary market liquidity and the impact of cross-platform pricing fragmentation.

Data source: Coin Metrics market data feed

This incident did not fundamentally threaten Ethena's design logic—USDe remained overcollateralized, and minting and redemption functions continued to operate normally. However, it exposed the risks behind platform-specific oracle pricing and leverage zeroing. V. Key Points for the Future This weekend's crash reminds us that when leverage, insufficient liquidity, and macroeconomic shocks converge, market fragility can quickly become apparent. While this incident exposed some structural flaws, it did not alter the fundamental basis for the market's long-term development. 1. Leverage and Liquidity The accumulation of leverage in the perpetual futures market, coupled with thin liquidity, created conditions for rapid deleveraging. Following price declines, liquidations and a liquidity crunch formed a mutually reinforcing cycle, becoming the core driver of volatility. 2. The Reflexive Nature of 24/7 Trading Cryptocurrency's 24/7 trading allows market shocks to be transmitted in real time. The lack of traditional market circuit breakers further amplifies volatility, especially on weekends when liquidity is already thin. 3. Platform Fragmentation: Differences in liquidity and pricing across exchanges exacerbate price disparities. This suggests the market urgently needs improved cross-platform liquidity aggregation, cross-platform risk management, and more reliable pricing infrastructure. 4. Synthetic Asset Risk: USDe's price disparity demonstrates the potential for risk transmission between on-chain and off-chain markets when synthetic and tokenized assets become more correlated with traditional markets. 5. Network Resilience: Despite record volatility, the on-chain network has remained resilient: block generation, throughput, and transaction fees have remained stable even as demand for block space has surged. 6. Structural Maturity Despite significant price dislocations among most altcoins, Bitcoin and other mainstream assets have performed relatively resiliently. This reflects both the improved resilience of the market structure and the positive impact of institutional participation. This large-scale deleveraging was essentially a stress test, not a systemic failure. While it caused short-term disruptions, it helped the market eliminate excess leverage and laid a healthier foundation for subsequent development.

Catherine

Catherine