Author: Tanay Ved Source: Coin Metrics Translation: Shan Ouba, Golden Finance

Key Points

Pectra, the next major upgrade of Ethereum, introduces changes to the execution layer (Prague) and the consensus layer (Electra). It is expected to be launched on the testnet in February and March, and the mainnet activation is expected to take place in April.

The upgrade introduces key improvements to staking, Layer-2 scalability, and user experience (UX), laying the foundation for future changes.

Main changes include higher validator staking limits, flexible staking withdrawals, enhancements to account abstraction, and increased blob throughput, which will help improve the efficiency and security of the network.

Introduction

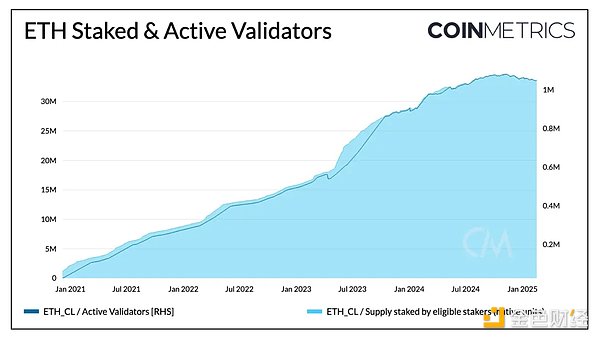

29 months after The Merge, 22 months after Shapella, and 11 months after Dencun, we are welcoming Ethereum’s next major upgrade, the Pectra hard fork. As the world’s largest proof-of-stake (PoS) blockchain, Ethereum currently secures approximately $90 billion in ETH stake, over $135 billion in stablecoins, and approximately $4 billion in tokenized assets, and is still evolving through incremental upgrades.

Pectra will be the largest hard fork in Ethereum’s history, with plans to include up to 20 Ethereum Improvement Proposals (EIPs). Building on last year’s Dencun upgrade, Pectra introduces features that improve user experience (UX), validator operations, and further support for Layer-2 expansion, foreshadowing its far-reaching impact on all Ethereum stakeholders. In this edition of Coin Metrics’ State of the Network Report, we’ll break down Pectra’s key changes and what they mean for users, stakeholders, and investors as we look forward to its progress ahead of mainnet activation in April.

What is Pectra and why does it matter?

Like previous Ethereum upgrades, Pectra makes changes to both the Execution Layer (EL) and the Consensus Layer (CL). Its name reflects this dual focus: ‘Prague’, named after the city where Devcon 4 was held, represents the upgrade to the Execution Layer, while ‘Electra’, a star in the constellation Lyra, represents the upgrade to the Consensus Layer.

Pectra began as an ambitious upgrade that was initially planned to include up to 20 Ethereum Improvement Proposals (EIPs). However, as development progressed, Pectra was split into two phases to better refine and manage its complexity. Now, Pectra is entering its final stages, with plans to go live on the Ethereum testnet in February and March, followed by mainnet activation in early April.

Before we dive into the individual EIPs, it’s important to understand the overall areas that Pectra aims to address, primarily covering staking and validator dynamics, user experience (UX), and L2 scaling.

Validator and Staking Improvements

There are three main EIPs that aim to improve the experience associated with validator operations in the Ethereum Proof of Stake (PoS) system:

EIP-7251: Increase Maximum Valid Balance

Currently, Ethereum’s staking design limits validator valid balances to 32 ETH, meaning that independent stakers must stake in fixed increments of 32 ETH, while a single validator can only stake up to 32 ETH. Any rewards above this limit will have no impact on their active stake. EIP-7251 increases this maximum valid balance (MaxEB) to 2048 ETH, meaning a single validator can now stake any amount between 32 and 2048 ETH. This is expected to provide the following benefits:

• Increased staking flexibility: Stakers can now reinvest rewards across their entire balance, rather than being limited to multiples of 32 ETH. For example, a validator with 33 ETH staked will have all 33 ETH counted towards rewards, improving capital efficiency and flexibility in staking operations.

• Reducing the number of validators: Ethereum currently has 1.05 million active validators on the consensus layer. This EIP will allow large operators to consolidate their validators, which is expected to reduce the number of validators and reduce the burden on the network caused by large validator sets.

• Reduce network load: While a large number of validators helps strengthen decentralization, it also increases bandwidth and computing requirements. Increasing MaxEB allows for a more efficient validator set, thereby reducing the overhead of peer-to-peer communication.

EIP-7002: Execution Layer Triggered Withdrawals

This EIP expands the capabilities of validators and complements the aforementioned EIPs. EIP-7002 enables validators to initiate exits and partial withdrawals directly from their Execution Layer (0x01) withdrawal voucher. Validators hold two keys: an active key for performing validator duties and a withdrawal key for accessing and managing staked funds. Previously, only the first key could trigger an exit, now the withdrawal voucher address can also initiate an exit, which allows for larger withdrawals and reduces reliance on node operators. This change increases validator control over funds and enables fully trustless staking pools, improving security and decentralization.

EIP-6110: On-chain Supply Validator Deposits

EIP-6110 simplifies the validator onboarding process by improving the way deposits are handled between the Ethereum Execution Layer (EL) and the Consensus Layer (CL). Currently, when a new validator makes a deposit at the Execution Layer, it must wait for the consensus layer to confirm and process it before it can be activated, which causes delays. EIP-6110 allows the execution layer to pass validator deposits directly to the consensus layer, eliminating the additional verification process, thereby reducing activation latency from about 9 hours to about 13 minutes.

Expanding Blobs and Layer-2

EIP-7691: Increasing Blob Throughput

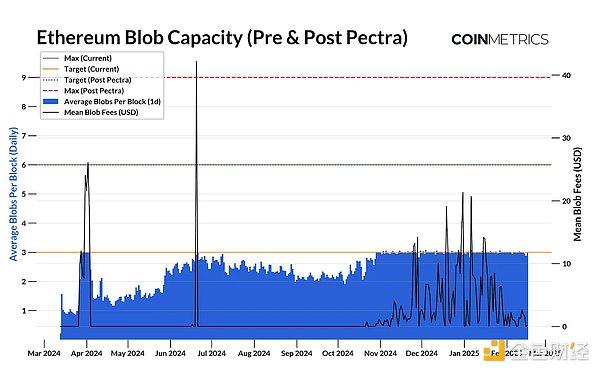

In addition to validator improvements, Pectra has also made key changes to Ethereum's data availability and scalability. Last year's Dencun upgrade introduced Blobs as an efficient way to store data, especially for Layer-2 Rollups. Blobs are now widely used in Ethereum's Layer-2, with an average of about 21,000 Blobs released per day. However, Blob usage has continued to reach capacity limits, causing fees to rise and limiting throughput.

Currently, the network targets an average of 3 blobs per block, with a maximum of 6. EIP-7691 raises this target to 6, with a maximum of 9, increasing the capacity to store data, improving throughput and scalability. Data storage costs will be reduced, which means Ethereum's Layer-2 will reduce Blob fees, thereby reducing transaction fees for end users.

EIP-7623: Increase calldata costs,This is another EIP that supplements Blob adoption. Prior to the introduction of Blobs, Layer-2 used calldata to store data on Ethereum, although it is still used at some point because it can be more cost-effective than Blobs. By increasing the cost of calldata, this change will encourage Layer-2 to focus more on using Blob space, making Rollup transactions more efficient.

User Experience (UX) Enhancements

EIP-7702: Set EOA Account Code

EIP-7702 is a highly anticipated change as it will bring Ethereum closer to account abstraction. It is expected to greatly improve the user experience (UX) and wallet functionality by allowing Externally Owned Accounts (EOAs), i.e. user wallets, to temporarily act as smart contract wallets. This enables EOAs to execute smart contract-like logic, providing greater flexibility to users and greater programmability for wallets and applications.

After the Pectra upgrade, users and developers can use EIP-7702 to achieve:

• Bundled transactions: Combine multiple transactions or user operations into one transaction (for example, approve and exchange tokens in one transaction).

• Gas-free transactions: Allow account X to pay transaction fees on behalf of account Y, or a "payer contract" to pay gas fees for users.

• Conditional or sponsored transactions: Implement spending controls, automated operations, or sponsored transactions based on set conditions.

While we discussed the most impactful changes in Pectra, there are several EIPs that also contribute to improvements in the network, including EIP-2513, EIP-2935, EIP-7549, EIP-7865, and EIP-7840, all of which focus on optimizing efficiency and reducing network resource consumption.

Conclusion

Ethereum is once again ready for a major upgrade—this time with a record number of EIPs. Pectra aims to advance several key priorities for Ethereum, including the transition to account abstraction, improving validator operations, increasing network efficiency, and gradually expanding the use of Layer-2 blobs. At the same time, as Vitalik Buterin highlighted in a recent blog post, Ethereum is still expanding Layer-1 despite the focus of its roadmap on Rollups. With the recent increase in the gas limit to 36 million, future expansions are expected to further improve censorship resistance, throughput, and scalability.

While Pectra’s changes are primarily technical, many may wonder how they impact ETH’s valuation. ETH has historically seen measurable price movements in response to previous upgrades, but market sentiment — both within crypto markets and in broader financial markets — often plays a larger role in influencing the Ethereum economy than direct changes. Nonetheless, Pectra is set to advance Ethereum adoption, and as we move beyond this upgrade, we’ll revisit its impact on key network metrics, ecosystem stakeholders, and ETH as an asset.

Kikyo

Kikyo

Kikyo

Kikyo Anais

Anais Alex

Alex Miyuki

Miyuki Alex

Alex Miyuki

Miyuki Weiliang

Weiliang Alex

Alex Miyuki

Miyuki Catherine

Catherine