Author: Matías Andrade Cabieses & Tanay Ved Source: Coin Metrics Translation: Shan Ouba, Golden Finance

Key Points:

Prediction markets provide real-time, market-driven insights into event probabilities, offering a more dynamic alternative to traditional polling methods.

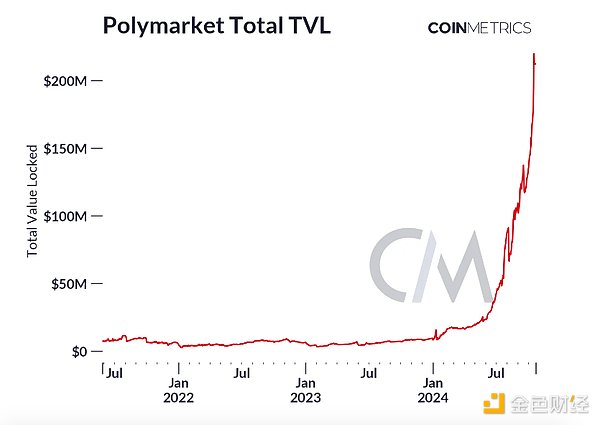

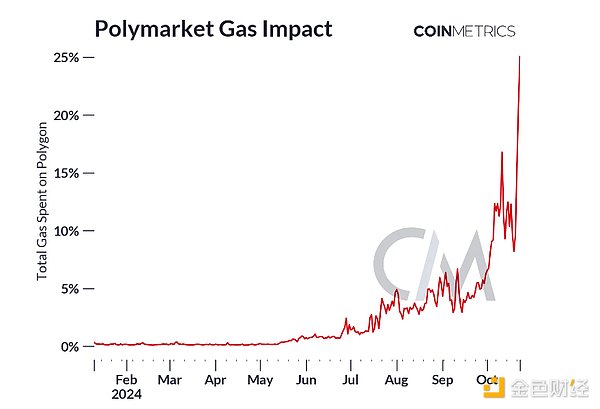

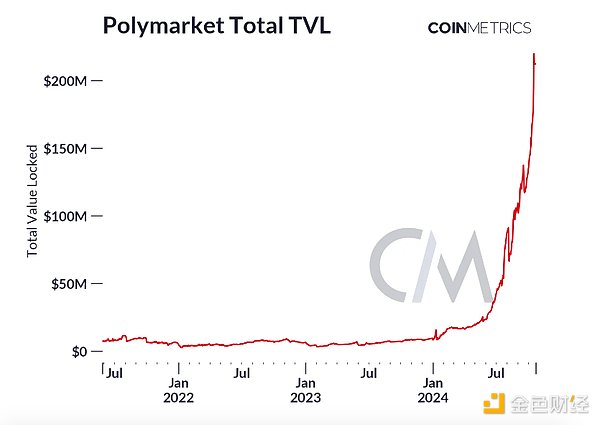

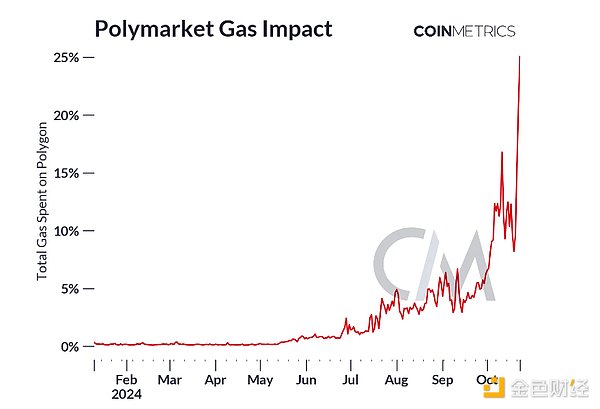

Polymarket has become one of the most widely adopted prediction market platforms, built on the Polygon Layer-2 blockchain. It has accumulated over $200 million in TVL and consumes 25% of the gas on Polygon.

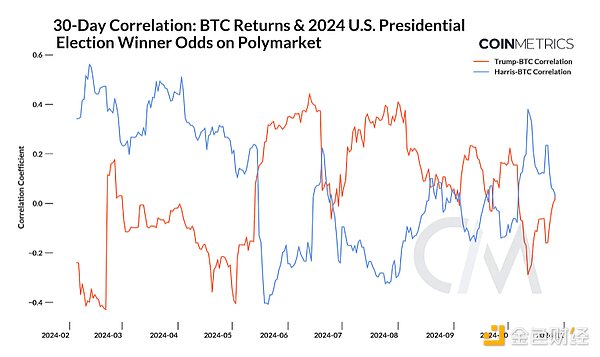

Polymarket’s 2024 US presidential election market has gained significant traction, with Bitcoin returns showing a moderate positive correlation with election odds, suggesting an intermittent link between cryptocurrencies and political sentiment.

Introduction

Traditionally, opinion polls guide decision-making in areas such as political forecasting and consumer behavior. However, traditional polling methods and mainstream media have faced increasing skepticism due to concerns about bias and lack of transparency. Against this backdrop, prediction markets like Polymarket have emerged as a compelling alternative. By leveraging digital infrastructure and public blockchains (in Polymarket’s case), these platforms enable market-driven, real-time predictions that capture collective wisdom—qualities that have fueled significant interest in prediction markets, especially in the run-up to the 2024 US presidential election. Polymarket is now at a unique crossroads, where political outcomes and market sentiment are intertwined with digital asset dynamics.

In this article, we take a deep dive into how Polymarket’s prediction markets work on Polygon and analyze the data behind the 2024 presidential election market to understand the potential impact on digital assets.

What are prediction markets?

A prediction market is a platform where users can buy and sell “contracts” on the outcomes of future events. Similar to a stock exchange, where participants buy and sell shares of publicly traded companies, prediction markets enable users to trade based on the probability of a specific event occurring. These events can range from the Premier League title to the next interest rate adjustment by the Federal Reserve. The price per share, typically expressed as a “yes” or “no,” reflects the overall probability of an event occurring, and prices adjust based on new information and changing sentiment. Unlike traditional polls, which provide a valuable but momentary snapshot of public opinion, prediction markets are unique in that they dynamically reflect information from a wide range of fields.

The concept of prediction markets dates back several years, when various modern platforms emerged, from Kalshi and PredictIt to Augur and Polymarket. While they share the common goal of leveraging collective intelligence to predict outcomes, they differ in terms of underlying technology, degree of decentralization, accessibility, and regulatory status. Recently, however, Polymarket has become one of the most widely adopted prediction market platforms, leveraging blockchain rails for global accessibility, transparency, and low-cost settlement.

How does Polymarket work?

Architecture Overview

At its core, Polymarket is a blockchain-based prediction market, leveraging the Polygon Layer-2 network. It enables users to purchase “shares” that represent different outcomes of future events. The platform operates as a hybrid on-chain application, with certain components located off-chain to support larger transactions at a greater scale, while settlement is performed on-chain in a non-custodial manner.

Polymarket uses a Central Limit Order Book (CLOB) to facilitate trades between ERC-20 collateral assets (currently only USDC) and Gnosis conditional ERC-1155 assets (Multi-Token Standard). In practice, a user’s USDC collateral unit is split into binary outcome tokens (“yes” or “no”) that maintain a market price equal to one collateral unit. Users can also acquire these tokens through direct trades on the order book or by interacting with AMM liquidity pools. “Operators” are the participants responsible for matching, ordering, and submitting trades to exchanges for on-chain settlement.

Polymarket also integrates with the UMA protocol's oracles to determine the correct outcome of an event. If there is a dispute over the outcome, UMA token holders will vote to decide the final resolution. This hybrid approach combines the Polygon network, Gnosis Conditional ERC-1155 tokens, CLOBs with off-chain order matching, and the UMA protocol's oracles, allowing Polymarket to operate with higher scalability and performance than purely on-chain solutions. Thanks to recent momentum, Polymarket has accumulated over $200 million in total locked value and contributes over 25% of Polygon's gas consumption.

Understanding Events, Markets, and Odds

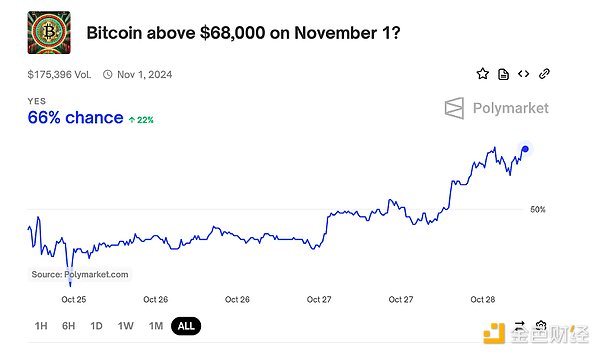

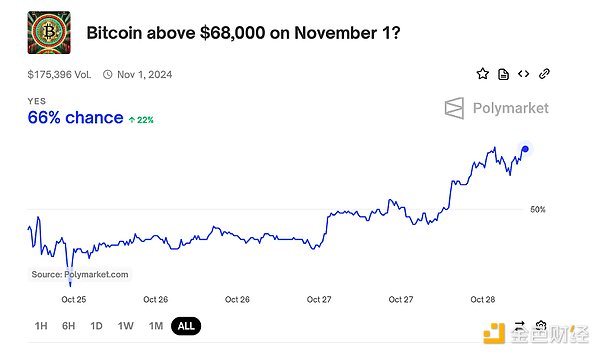

At the heart of Polymarket are events, markets, and odds, which work together to make the system work. An event is a specific outcome, also known as a question, that users are trying to predict. These outcomes can be political events, such as election results, or real-world events, such as weather or sports results. Markets are platforms where users can bet on potential outcomes of these events. Polymarket offers two types of markets: Single Multiple Outcome Markets: These markets allow users to bet on multiple possible outcomes of a single event. For example, which movie will be the "highest-grossing movie of 2024?". The outcomes include the names of multiple movies, such as Inside Out 2 or Deadpool 3, and the sum of the probabilities of all outcomes is 100%. 2. Mutually exclusive binary markets: These markets are structured as simple “yes” or “no” propositions where users can only bet on one of two possible outcomes. For example, “Will the price of Bitcoin exceed $68,000 on November 1?”.

Users deposit USDC as collateral into the Polygon Network to participate in these markets, which are split into binary outcome tokens that represent a yes or no stance on an event. Users can trade these tokens through a centralized limit order book or on-chain AMM contracts, and the token price (or "odds") reflects the market's collective assessment of the probability of each outcome. As market conditions change, the token price will also fluctuate, allowing users to adjust their positions.

Once an event is resolved, anyone can use UMA to propose a resolution by posting a USDC bond, which can earn rewards if the outcome is undisputed. During the Challenge Period, when the outcome of an event is disputed, UMA token holders vote to decide. Poorly worded markets can lead to such disputes, such as the recent event over whether Israeli forces would invade Lebanon. After the event is resolved, owners of winning outcome shares can trade them one-to-one for USDC collateral, while losing shares become worthless.

2024 Presidential Election Market Outlook

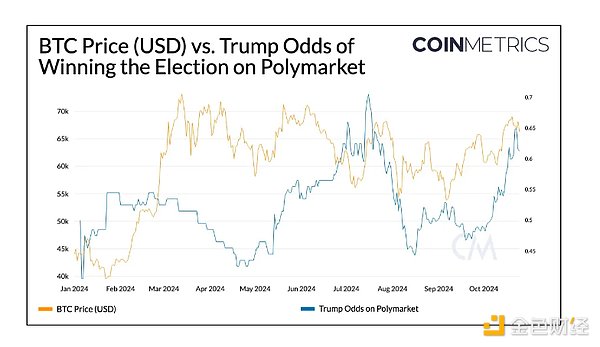

The political category, especially “2024 Presidential Election Winner” has been the largest and most active market on Polymarket. As of October 28, the market has accumulated $2.5 billion in trading volume since its inception. Each candidate’s share price (or odds) fluctuates widely throughout the year, capturing changes in public perception and market sentiment as real-world events unfold. Trump’s odds hovered around 50% at the start of the year and have risen to over 65% in recent months, while Harris’ odds have risen since Biden dropped out of the race in July. Given Trump’s pro-crypto stance, analyzing the relationship between candidate odds and Bitcoin prices can provide insight into potential correlations between political and crypto market sentiment.

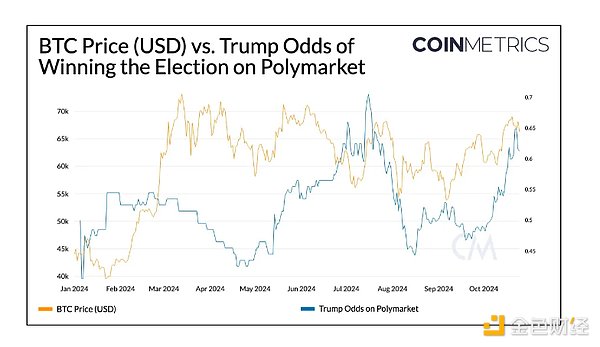

Since Bitcoin’s price has been largely range-bound over the year, its relationship to Donald Trump’s odds of winning on Polymarket is currently unclear. However, they show consistent periods, especially during major trend reversals — such as Trump’s rally of more than 50% in May, its fall below 70% in July, and its most recent climb to 65% in October.

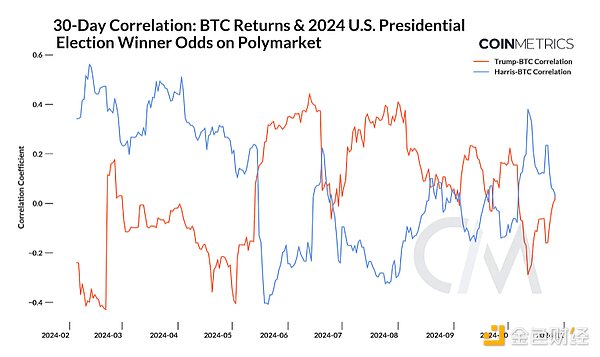

As shown below, the 30-day rolling correlation between BTC returns and odds changes provides a clearer picture. Trump’s odds showed a moderate positive correlation with Bitcoin returns between May and August (peaking at 0.4), while Harris’ odds showed a weaker, generally negative correlation, reflecting perceptions of her stance on the digital asset. Both correlations have recently trended toward zero, suggesting that while there is a short-term relationship, BTC’s long-term prospects are currently unrelated to the success of either candidate. Instead, the market may be waiting for the election results before making a decisive move, with global factors such as money supply driving BTC’s broader movements.

Looking Ahead

As a widely used blockchain-based prediction market, Polymarket has gained undeniable attention for the role it played in the run-up to the election. However, it has also faced certain challenges in dispute resolution and regulatory scrutiny. The platform was recently hit with accusations of market manipulation by “whales” amid rising odds of Trump’s victory. It appears that the cause of this disagreement was a single user controlling four accounts with a total of $46 million in election bets. Notably, other prediction markets and polls have also shown similar trends. While this is not an indication of market manipulation, Polymarket may continue to face regulatory hurdles as an offshore platform, though a recent court ruling in favor of US prediction market Kalshi may provide a precedent.

As the 2024 US election enters its final stages, it remains to be seen whether Polymarket and similar platforms can maintain their dominance in decision-making. But they have a clear and unique advantage, providing a dynamic, transparent, free-market driven “source of truth” that complements traditional models and proprietary data. The election results may further validate Polymarket’s predictive power and value in making informed decisions.

Weatherly

Weatherly