Source: Coinbase Research; Compiled by: Jinse Finance

Summary:

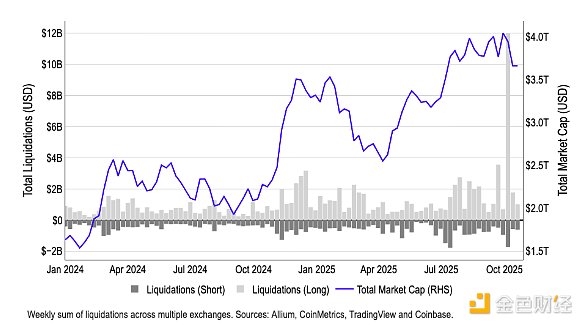

Following the massive liquidation event on October 11th, Coinbase believes the cryptocurrency market has bottomed out and rebounded, with a significantly clearer positioning structure. The market appears to have simply reset rather than crashed. We believe this sell-off has restored system leverage levels to a structurally healthier level, which may provide directional support in the short to medium term.Nevertheless, a slow recovery is more likely in the coming months than a surge to all-time highs.

Mechanically, the deleveraging event was more of a market mechanism adjustment than a test of solvency, although it did put pressure on the riskiest sectors of the cryptocurrency market, causing altcoins to plummet and market makers to withdraw their returns. On the positive side, we believe the technical drivers of this move indicate that the fundamentals of the cryptocurrency market remain robust.

Institutional investors—many of whom were not impacted by leverage—are likely to lead the next rally. We believe that despite a highly complex and riskier macroeconomic environment than at the beginning of the year, it still provides support for the cryptocurrency market. According to Nansen's report, "smart money" in the space has flowed into EVM stacks (e.g., Ethereum, Arbitrum), while Solana and the BNB chain have lost momentum. Nevertheless, we still use smart money flows as a screening criterion, not a buy signal, to identify market depth, incentive mechanisms, and clusters of developer/user activity across different protocols, decentralized exchanges (DEXs), and blockchains. Meanwhile, stablecoin data shows capital rotation rather than new capital injections, meaning that in the short term, the rally will still depend on strategic incentives and narrative-driven capital rotation. The Great Grain Robbery: Among commodity traders, there's a widely circulated anecdote often referred to as "The Great Grain Robbery." This event occurred in 1973, but despite the name, it wasn't actually a robbery. More accurately, it was the Soviet Union's methodical and secret withdrawal of massive amounts of wheat and corn from the open market over a month. This event initially went largely unnoticed until global food prices surged by 30% to 50%, at which point people realized the Soviet Union was suffering a massive crop failure, leading to dangerously low global food supplies. The October 11 tariff-triggered wave of cryptocurrency liquidations—causing many altcoins to plummet by 40% to 70%—bears a striking resemblance to the information dynamics of the time. In both events, information asymmetry during periods of illiquidity created massive market chaos, disproportionately impacting less liquid, high-beta assets.

Chart 1. The Largest Recent Liquidation in Cryptocurrency History

In 1973, US officials failed to recognize the global food shortage due to an inadequate agricultural monitoring system, leading Senator Henry Jackson to accuse them of either “gross negligence” or “deliberate concealment.” This incident spurred the development of satellite crop monitoring technology to prevent future information asymmetry.

In the case of cryptocurrencies, this sell-off is not merely due to an information gap, but rather a problem with the execution structure: altcoin liquidity is now scattered across multiple exchanges, and decentralized protocols automatically liquidate over-collateralized altcoin positions when health indicators deteriorate.

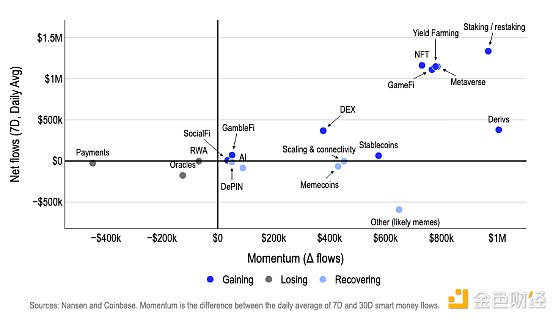

This often creates self-reinforcing selling pressure when prices begin to fall. Moreover, market makers now mostly hedge their risk by shorting altcoins (altcoins have a higher beta than large-cap cryptocurrencies, allowing them to maintain smaller positions). However, due to the Automatic Deleveraging (ADL) mechanism, many market makers suddenly liquidated their positions and completely withdrew from buying liquidity, exacerbating the sell-off. Both events highlight a timeless market truth: when liquidity disappears and information asymmetry intensifies, the sector with the highest beta and leverage in any market becomes a pressure release valve, leading to a concentrated forced sell-off. But what happens next? Recovery Pattern We believe that the deleveraging sell-off on October 11th was a necessary adjustment in the cryptocurrency market, rather than a cyclical peak, and may lay the foundation for a slow rise in the coming months. Before the October 11th event, our biggest concern was that the current bull market cycle might end prematurely. In fact, a survey we conducted between September 17th and October 3rd showed that 45% of institutional investors believed we were in the late stages of a bull market cycle. After the October 11th sell-off, we are actually more convinced of the cryptocurrency market's upside potential, although we believe that the cryptocurrency's performance in the coming months will depend more on the repair of market structure than on major events. The 1011 liquidation wave exposed vulnerabilities in collateral standards, pricing mechanisms, and the stability of transfers between different exchanges. Chart 2. The Short-Term Sudden Shock of Leverage Reshapes the Cryptocurrency Market Landscape. However, leverage has largely returned to normal. As can be seen from our systemic leverage ratio (based on the total open interest of derivative contracts divided by the total market capitalization of cryptocurrencies excluding stablecoins), the current leverage ratio is roughly slightly higher than at the beginning of the year (Chart 2). We believe this will be one of the key indicators to closely monitor in the short to medium term. We believe that the current leverage ratio indicates that the market may experience intermittent liquidity gaps and more pronounced tail volatility until risk control mechanisms are aligned and market maker depth fully returns to normal. Looking ahead, we expect future market strength to be primarily driven by institutional inflows, as institutional investors are largely unaffected by deleveraging events. Many institutions are either maintaining low leverage levels or primarily investing in large-cap cryptocurrencies, while retail investors' altcoins have been the first to bear the brunt of liquidations. We may see a cryptocurrency market rebound as institutional demand recovers, but this could take several months. Therefore, we anticipate Bitcoin's dominance will gradually increase over the next 2-3 months, which could exert downward pressure on the ETH/BTC and altcoin/BTC trading pairs before the eventual market rotation. It is worth noting that, based on the break-even points of straddle and strangle options, the implied market probability distribution of Bitcoin's price over the next 3-6 months is currently between $90,000 and $160,000, and there is an asymmetric upward bias in expectations (Chart 3). [Chart 3. Implied distribution of Bitcoin price expectations based on the break-even points of straddle and strangle options] [Image of Bitcoin price expected based on ... Following the recent deleveraging, we've seen prices overshoot while the market narrative has become blurred. To better understand positioning dynamics, we believe it's crucial to monitor the current (re)allocation of funds by "smart money"—including investment funds, market makers, venture capitalists, and consistently high-performing traders. Tracking these flows can help us understand which ecosystems are recovering depth, incentive mechanisms, and builder/user activity—that is, which sectors are clustering near-term investment opportunities, and which protocols, decentralized exchanges (DEXs), and blockchains should be monitored. That said, this doesn't necessarily mean market participants should buy the native tokens of these platforms, as on-chain activity may reflect yield farming, liquidity provider (LP) allocations, basis/fund arbitrage, or airdrop strategies. Furthermore, we cannot always clearly determine whether smart money bids are more strategic (incentive-driven) or more persistent. Therefore, we believe it's best to view smart money flows as a tool for screening specific investment opportunities. After October 11th, funds shifted to Ethereum L1/L2 contracts (such as Ethereum and Arbitrum), while Solana and BNB lost their upward momentum. Ethereum and Arbitrum led in net inflows over the past 7 days and have continued to grow over the past 30 days (Chart 4). Meanwhile, funds are withdrawing from the Solana and BNB chains; outflows from the BNB chain have eased but remain negative. Chart 4. Smart Money Flows – By Chain The catalysts for these fund flows are varied. For example, Arbitrum relaunched its incentive mechanisms and DAO projects in October (e.g., DRIP Phase 4 will reward lending/liquidity for Aave, Morpho, and gaming-related activities), restarting the money cycle while redeploying liquidity. We believe it might be wise to closely monitor tokens on the Base chain and look for potential inflection point trading opportunities. Activity on the Base chain surged on October 25-26, with the x402 ecosystem experiencing parabolic growth. Farcaster's acquisition of the Clanker launch platform also fueled new token issuance and user influx. This growth built on earlier catalysts, including continued Base token speculation, the open-source Solana bridge, Zora's launch on Robinhood, and Coinbase's acquisition of Echo, all of which expanded application reach and increased the rationale for liquidity inflows. Meanwhile, since October 11, the industry rotation trend has favored "utility + yield" strategies over speculative ones. As the market re-emerged from the financial crisis with double-digit, point-plus annualized returns (e.g., fixed/floating return combinations and funding rate arbitrage), yield-based protocols led the natural flow of funds; while the NFT/metaverse/gaming sectors regained vitality driven by strategy-driven mechanisms (e.g., PunkStrategy's deflationary NFT trading cycle) and blockbuster deals (e.g., Coinbase's acquisition of UPONLY).

Chart 5. Smart Money Flows – By Sector

With Grayscale launching the first ETH and SOL staking ETP in the US, institutional investors flocked to the market, and the staking/re-staking theme remained strong.

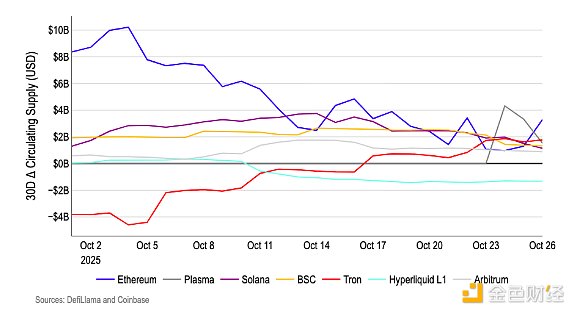

In short, savvy investors are flocking to areas with clearer yield paths, more reliable incentive mechanisms, and closer ties to institutional investors, selectively redeploying risk using stablecoins (Chart 5). The liquidity of stablecoins also suggests that what we're seeing is a rotation of funds, rather than a large influx of new capital. Over the past month, except for Tron (Chart 6), the 30-day growth rate of stablecoins on most major blockchains has declined. We believe this means that post-crash fund flows are a redistribution, not an increase—liquidity is selectively shifting between protocols with active catalysts, but there hasn't been a general surge in stablecoin supply. In fact, this means that until there is a more significant increase in the circulating supply of stablecoins, the rebound will likely still rely on strategic incentives and narrative-driven fund rotation, and a significant increase in the circulating supply of stablecoins is what will truly drive the rise of most tokens. Chart 6. Stablecoin Supply Momentum – By Chain

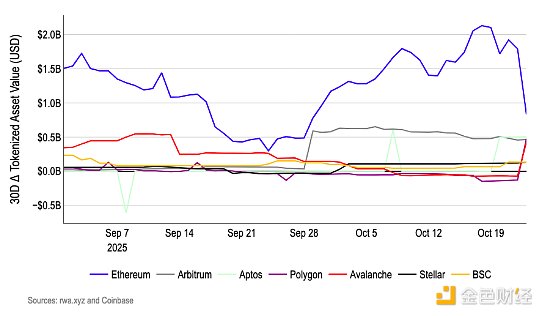

Tokenized assets are a key area of focus for institutional investors. In October, BlackRock's BUIDL invested approximately $500 million in Polygon, Avalanche, and Aptos (Chart 7). This total of approximately $1.5 billion highlights the resilience of real-world assets (RWAs), enabling them to attract traditional financial institutions during periods of market volatility because they offer stable yields (tokenized Treasury yields are 4-6%) and liquidity, avoiding the speculative bubble wiped out in the October 101 crash.

These deployments are no longer limited to Ethereum (BUIDL's original platform), but rather fully leverage the strengths of various chains—Polygon offers Ethereum-compatible scalability and low fees, Avalanche provides a high-throughput subnet ideal for institutional DeFi integration, and Aptos provides Move language security for handling complex assets. While this may appear to be a selective expansion by a single player (BlackRock), we believe that BlackRock's commitment to expanding RWA access channels amidst increased uncertainty in the overall cryptocurrency space highlights the significant potential of the RWA space as a future growth driver. Chart 7. Real-World Asset Flows – By Chain

Don't Forget the Macro Environment

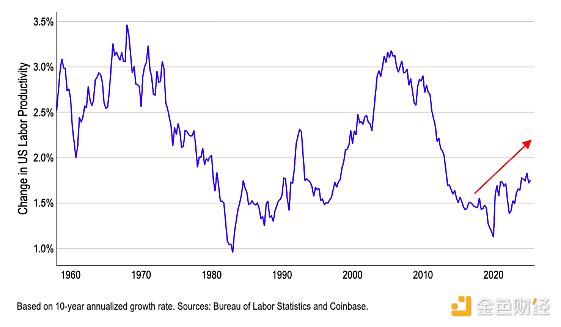

Finally, don't forget that cryptocurrencies are still trading in a highly complex and increasingly risky macro environment. The sell-off eliminated the excessive leverage often seen in the later stages of a bull market. However, numerous macro factors have exacerbated investor uncertainty: trade tensions (such as tariffs), geopolitical conflicts (such as US sanctions against Russian oil producers), soaring fiscal deficits (including in the US and other countries), and overvaluation in other asset classes. Despite the Federal Reserve's accommodative policies, the 10-year U.S. Treasury yield has remained stable around 4.0%, fluctuating between 3.5% and 4.5%. This stability partly explains why we are not overly concerned about the steepening of the yield curve (typically, the yield curve flattens during periods of prolonged accommodative policy). However, we believe the steepening trend is likely to continue, and if yields surge, riskier asset classes such as U.S. stocks and cryptocurrencies could face a downside correction. This could happen, for example, if the fiscal buffer is weakened. On the other hand, if long-term yields do rise with U.S. economic growth, this reflects stronger economic fundamentals rather than policy considerations. Faster nominal growth and productivity gains can withstand higher discount rates and provide good support for risk assets, including cryptocurrencies. In this regard, we believe economists are currently generally underestimating productivity, partly because factors such as artificial intelligence are increasing the speed and efficiency of the workforce, a fact not fully reflected in official statistics.

Chart 8. US Labor Productivity Growth (10-Year Annualized Growth Rate)

If this is true, it indicates that the impact of macroeconomic fluctuations on risk assets through the discount rate channel may be weakening. This will allow the drivers of cryptocurrencies to refocus on endogenous factors such as liquidity, fundamentals, positioning, and favorable regulatory developments for cryptocurrencies (e.g., the US Cryptocurrency Market Structure Act).

Conclusion

Overall, the current cyclical phase of the cryptocurrency market remains a hotly debated topic, but we believe that the deleveraging and bubble-bursting event a few weeks ago laid the foundation for a steady rise in the coming months. We believe that macroeconomic positives such as the Fed's rate cuts, loose liquidity, and favorable regulatory measures for cryptocurrencies, such as the GENIUS/CLARITY Act, continue to support the bullish market and could extend the cycle into 2026. However, the fund flows after October 11th appear more like selective risk-taking rather than a resurgence in riskier sectors. These funds have shifted to EVM technology stacks (such as Ethereum and Arbitrum) and "utility + yield" sectors, while flows to Solana and BNB chains have cooled, and the growth rate of stablecoins has slowed. This suggests that funds are being reallocated to specific verticals rather than a systemic injection. Meanwhile, the significant inflow of RWA funds indicates that institutional investors intend to expand their on-chain businesses, but they will do so cautiously and in a diversified manner. In fact, we believe the short-term rally will continue to focus on areas where incentives, product launches, and institutional support converge, although a more sustainable cryptocurrency price movement may require a restoration of overall liquidity first. Despite the persistent "panic" sentiment in the cryptocurrency market, we believe the recent deleveraging is actually a harbinger of a medium- to long-term upside, laying the foundation for further gains in the first quarter of 2026.

Kikyo

Kikyo

Kikyo

Kikyo Jasper

Jasper Catherine

Catherine Jasper

Jasper Davin

Davin Jasper

Jasper Davin

Davin Jasper

Jasper Jixu

Jixu Jasper

Jasper