By Max Wong @IOSG

TL;DR

Infrastructure is saturated; consumer applications are the next frontier. After years of pouring money into new L1s, Roll-ups, and developer tools, marginal gains in technology are minimal, and users are not automatically flocking in just because the technology is “good enough.” Value is now created by attention, not architecture.

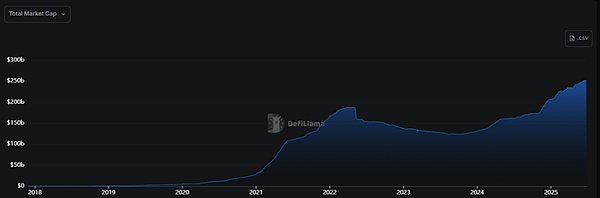

Liquidity is stagnant, and retail investors are absent. Total stablecoin market cap is only about 25% above its 2021 all-time high, with recent growth coming mainly from institutions buying BTC/ETH for their balance sheets, rather than speculative capital circulating within the ecosystem.

Core assertion

Regulatory friendliness will unlock the “second wave” of development. Clearer US policy (Trump administration, stablecoin bill) expands TAM and attracts Web2 users who only care about tangible applications rather than underlying technical architecture.

Narrative markets reward real use. Projects with significant revenue and PMF - such as Hyperliquid (about $900 million ARR), Pump.fun (about $500 million ARR), Polymarket (about $12 billion in trading volume) - far outperform infrastructure projects with high financing but lack of users (Berachain, SEI, Story Protocol).

Web2 is essentially an attention economy (distribution > technology) ; as Web3 and Web2 are deeply integrated, the market will be the same - B2C applications will make the cake bigger.

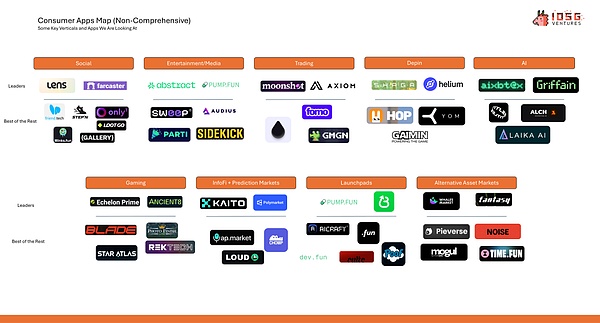

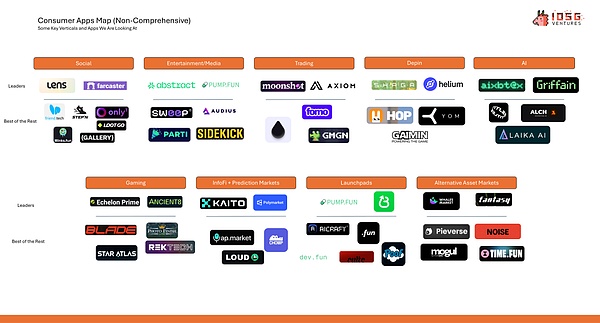

Trading/Perpetual Contracts (Hyperliquid, Axiom)

Launchpad/Meme Coin Factory (Pump.fun, BelieveApp)

InfoFi and Prediction Markets (Polymarket, Kaito)

One-stop deposit/withdrawal + DeFi super application-integrates wallet, bank, income, and trading in one (Robinhood-style experience but without ads).

Entertainment/socialplatform, replace ads with on-chain monetization (exchange, betting, prize pool, creator tokens), optimize UX and improve creator income.

AI and games are still in the pre-PMF stage. Consumer AI requires more secure account abstraction and infrastructure; Web3 games are plagued by the "wool party" economy. They will only break out after a chain game with gameplay as the core, rather than encryption elements, explodes.

Superchain theory. Activity is concentrating on a few consumer-friendly chains (Solana, Hyperliquid, Monad, MegaETH). Killer applications of these ecosystems and the infrastructure that directly supports them should be selected.

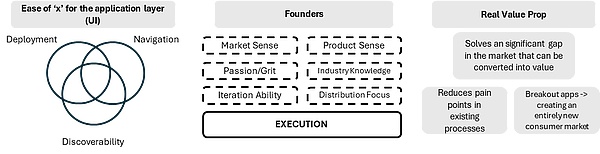

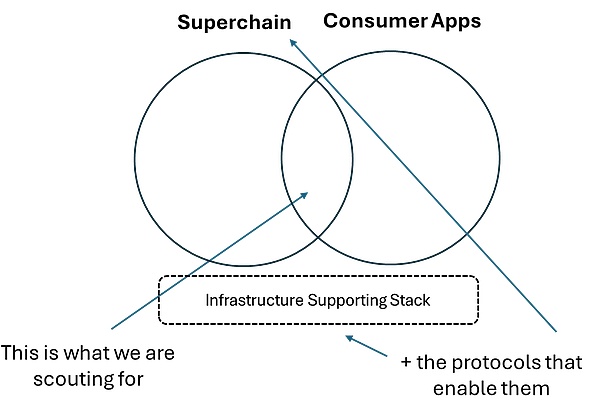

Investing in consumer apps from a perspective of:

Distribution & Execution > Pure tech (network effects, viral loops, brand).

UX, speed, fluidity, narrative fit determine the winner.

Evaluate as a “business” not a “protocol”: real revenue, scalable model, clear path to industry dominance.

Introduction

In the past, the industry focused heavily on technology/infrastructure, focusing on building “rails” - new Layer-1s, scaling layers, developer tools, and security primitives. The driving force was the industry creed of “technology is king”: as long as the technology is good enough and innovative enough, users will come naturally. However, this is not the case. Look at projects like Berachain, SEI, Story Protocol, etc., which have raised ridiculous valuations but are touted as "the next big thing."

In this cycle, as consumer application projects have entered the spotlight, the discussion has clearly turned to "what are these tracks used for". When the core infrastructure reaches a "good enough" maturity and marginal improvements tend to decrease, talent and capital begin to chase consumer-oriented applications/products - social, games, creators, business scenarios - to show the value of blockchain to retail and everyday users. The consumer application market is essentially an attention economy, which also makes the entire crypto market a battlefield for narrative and attention.

This insight report will explore:

1. Overall market background

2. Types of consumer applications in the market

a. Tracks that already have PMF

b. Tracks that can be upgraded with the help of encryption tracks and eventually reach PMF

3. Propose a framework and investment theory for consumer applications - How do institutions identify winners?

Narrative - Why now?

This cycle lacks the 2021 level of retail FOMO and NFT/Alt hype. In addition, the tightening macro environment has restricted the capital investment of VCs and institutions, and the growth of new liquidity has fallen into a "stagflation" situation.

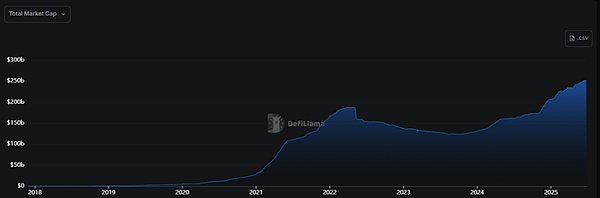

▲ Stablecoin market value trend chart

As shown above, the total market value of stablecoins increased by about 5 times from 2021 to 2022, while this round (second half of 2023-2025) only increased by 2 times. At first glance, it seems to be an organic and healthy steady growth, but it is actually misleading: the current market value is only ~25% higher than the 2021 high, which is a low speed for any industry in a 4-year dimension. This is still in the context of the most clear regulatory tailwind for stablecoins and the emergence of a strong pro-coin president.

The growth rate of capital inflows has slowed significantly, and it mainly started after Trump’s election in January 2025. So far, new capital is not speculation or real "live water", but more due to institutions adding BTC/ETH to their balance sheets, and governments and companies expanding stablecoin payments. Liquidity is not due to market interest in new products/solutions, but regulatory benefits; these funds are non-speculative and will not be directly injected into the secondary market.

This is not free capital, nor is it driven by retail investors, so even if prices hit highs, the industry has not yet reproduced the 2021 frenzy.

The overall analogy is that after the .com bubble in 2001, the market looked for the next growth direction - this time the direction will be consumer applications. Past growth was also driven by consumer applications, but the products were NFTs and altcoins, not applications.

Core Conclusion

In the next five years, the crypto market will usher in a second wave of growth driven by Web2/retail investors

Strong positive sentiment at the political level has a greater impact on consumer applications than on infrastructure, because consumer applications can attract a large number of Web2 users

Web2 users only care about the application layer that they can interact directly with and that can bring them value - they want the "Robinhood" of Web3, not the "crypto AWS"

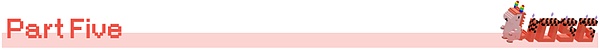

Robinhood

Google/YouTube

Facebook

Instagram

Snapchat

ChatGPT

Market maturity → Focus on real users + revenue + PMF > infrastructure + technology

Hyperliquid

Pump.fun

Polymarket

Significance: Technology is important, but good technology alone will not attract users; good technology must be implemented → the easiest path is consumer application

Method: Projects with unified extreme UX + value capture mechanism will attract users. Users don’t care whether the technology is slightly better unless they can "feel" it

Builders are shifting from "Technology is King" to "User First" in 2019-2023. Only chains with actual demand, rather than just subsidized ecosystems or available tools, can attract developers

In the past, the market made developers write extensions for Firefox for subsidies instead of acquiring real users on Chrome

Typical counterexample: Cardano

Web2 has always been an attention economy (distribution > technology); the same will be true after the deep integration of Web3 and Web2 - B2C applications will expand the overall market

Viral spread and attention are the deciding factors → Consumer applications are the easiest to implement

Because network effects are easily embedded in consumer applications → such as binding to Twitter and receiving protocol rewards for posting (Loudio, Kaito)

Therefore, consumer application content is easy to generate → easy to spread virally and occupy the mind

B2C applications can also easily create topics through user behavior, incentives or communities (Pump.fun vs Hyperliquid)

Viral spread brings attention, and attention brings users → Viral applications will attract new retail investors and expand the market

Types of consumer applications in the market

Vertical track that has reached PMF – Crypto Coded

Transactions

Launchpad

InfoFi + Prediction Market

Projects on this track should be paid special attention to.

Comparison:

Berachain: Since the launch, the cost is only 165,000 US dollars; financing 142 million US dollars; from ATH down 85% +

SEI: Annualized cost is only 68,000 US dollars; financing 95 million US dollars; down 75% +

Story Protocol: Since the launch, the cost is only 24,000 US dollars; financing $134 million; down 60%

Pure technology/infrastructure without real use cases is no longer a solution. Institutions can no longer rely on such targets to replicate 2021-style excess returns.

From these platforms, most are more Web3 native, which is in line with their encryption function positioning. But there are also traditional consumer tracks (see below) that have been subverted by the encryption track and are moving towards the masses.

Vertical track that can be upgraded with "crypto technology" and eventually reach PMF - Web2 Coded

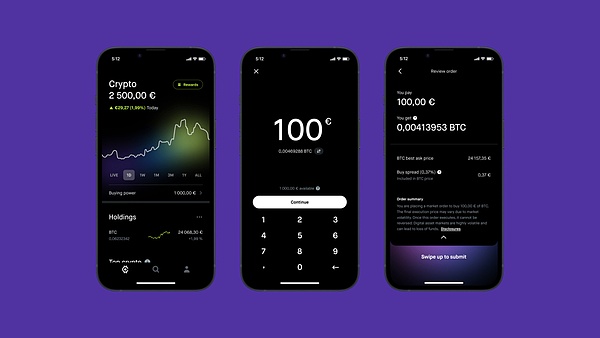

Web2⇄Web3 deposit/withdrawal + DeFi front-end

As Web2 users continue to pour into Web3, it's time for one or two mainstream solutions that everyone uses to achieve deposit/withdrawal and access DeFi. The market is highly fragmented and the user process is clumsy.

The pain of the current situation

Hopscotch-style on-chain:75-80% of first-time coin buyers still buy coins on centralized exchanges (Binance, Coinbase) first, and then transfer to self-custodial wallets or DeFi protocols, resulting in 2 KYCs, 2 sets of fees, and at least 1 cross-chain bridge.

Difficulty in withdrawing:US licensed CEX can freeze fiat currency for 24-72 hours; EU banks increasingly mark outbound SEPA transfers as "high risk".

High fees:Deposit spreads ~0.8% (ACH) to 4-5% (credit card); stablecoin withdrawal fees fluctuate between 0.1-7% depending on region and volume.

Lack of aggregated yield solutions:There is no one-stop DeFi module for users to centrally obtain yield stacks.

Payment giants are rushing to the beach

PayPal now allows US users to withdraw PYUSD directly to Ethereum and Solana and refund to any debit card within <30 seconds (fee rate 0.4-1%).

Stripe will open the "crypto withdrawal" API to all platforms in April 2025, allowing instant withdrawal of USDC to local channels in 45 countries.

Last year, MoonPay processed $18.6 billion in transactions for 14 million users, and achieved a year-on-year growth of 123% due to the addition of instant withdrawal services covering 160+ countries.

Portrait of PMF

A global super application that allows users to deposit/withdraw seamlessly, has a simple interface, and access all DeFi functions on the same platform.

Only large amounts require KYC

No high fees or withdrawal delays

Similar to a savings account but denominated in crypto

Covering mainstream spot/perpetual trading interfaces

The closest to this North Star is Robinhood: minimalist UI/UX, plus bank and wallet integration; it may be the leader in this field.

Entertainment/Media/Social

Current content platforms (YouTube, Twitch, Facebook) mainly rely on grabbing user attention and selling it to advertisers through display ads. However, this conversion chain is inherently inefficient and loses potential customers at multiple stages of the funnel. More importantly, display ads "force" content, which naturally destroys UX.

The encryption paradigm can completely rewrite and optimize the traditional Web2 entertainment platform structure.

Platform layer unlocking:

Remove ads and improve user retention

No longer rely on external stakeholders

A new profit-sharing method with creators

Exchange fee sharing

Event fee sharing

Under this new paradigm, the platform itself is a distribution channel, not a monetization product. There are precedents for Web2: Twitch → Amazon, Kick → Stake, Twitter → Membership Subscription + GrokAI; Web3 also has its prototype, such as Parti and Pump.fun live broadcasts.

User layer unlocking

Creator layer unlocking

Exchange fee sharing

Event fee sharing

Creator tokens realize direct value flow from fans to creators

Removing advertisements improves user retention

The platform model brings about user growth, and creators benefit

Why not AI or games?

At present, AI consumer applications are still early. It will not explode until the emergence of applications that can truly realize "one-click DeFi/account management"; the current security and feasibility infrastructure is still insufficient.

In terms of games, it is difficult for blockchain games to break through the circle, because most of the core users are "farmers" who chase money rather than game fun, and the retention rate is low. However, in the future, there may be games that implicitly use encryption paradigms (such as economic and item systems) at the bottom layer, and the focus of players/developers is still playability - if CSGO had used the on-chain economy, it might have been very successful.

In this regard, there are certain successful cases of small games using encryption mechanisms (Freysa, DFK, Axie).

Arguments and Frameworks

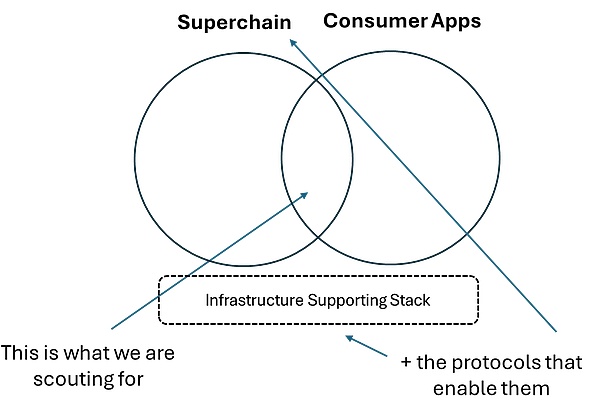

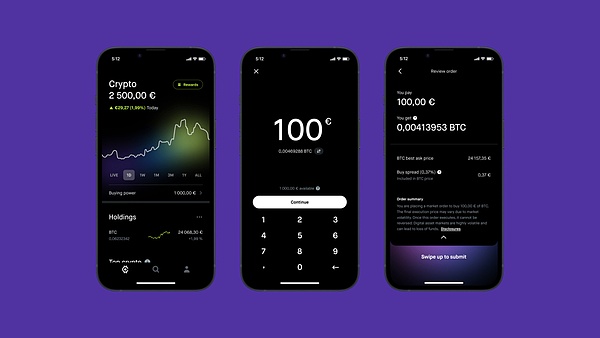

Overall view: Market maturity → Inter-chain fragmentation reduction → A few "super chains" win → Institutions should bet on the next generation of consumer applications and their supporting infrastructure on these super chains.

This trend is already happening, and activity is concentrating on a few chains rather than being scattered across more than 100 L2s.

Here, "super chains" refer to consumer-centric chains that optimize speed and experience, such as Solana, Hyperliquid, Monad, and MegaETH.

Analogy:

Hyperchain: iOS, Android

Apps: Instagram, Cash App, Robinhood

Supporting stack: AWS, Azure, Google Cloud

As mentioned earlier, consumer applications can be divided into two key categories:

Web2 Native: Apps that attract Web2 users first, unlock new behaviors using the crypto paradigm - focus on products that seamlessly integrate crypto on the backend, but don’t call themselves “crypto apps” (e.g. Polymarket).

Web3 Native: Proven determining factors are better UX + ultra-fast interface + ample liquidity + one-stop solution (breaking fragmentation). The new generation of Web3 users care more about UX > revenue or technology, and only care about the latter two after exceeding a certain threshold. Teams and applications that understand this deserve a valuation premium.

Generally, the following elements are also required:

Conclusion

Consumer investment targets do not have to rely entirely on differentiated value propositions (although they can). Snapchat is not a technological revolution, but a recombination of existing technologies (chat module, camera AIO) to create new unlocking. Therefore, it is biased to evaluate consumer targets from the perspective of traditional infrastructure; institutions should consider: whether the project can become a good business and ultimately generate returns for the fund.

To do this, evaluate:

Distribution capabilities are better than products themselves - can they reach users?

Are existing modules effectively recombined to create new experiences?

Funds can no longer drive returns on pure infrastructure. It’s not that infrastructure is not important, but they must have real appeal and use cases in a market where narrative is king, not value propositions that no one cares about. In general, most investors are too "right-biased" for consumer targets - too literally pursuing "first principles", while the real winners are often better brands and UX - these qualities are implicit but critical.

Alex

Alex