Source: The Paper

Yang Qichao, a college student born in the 2000s, issued a virtual currency called BFF on an overseas public chain, and was jailed for withdrawing liquidity. The procuratorate accused him of issuing fake virtual currency. After others were misled to recharge 50,000 USDT coins, Yang Qichao quickly "withdrew funds", causing others to lose 50,000 USDT coins, and his behavior constituted fraud. On February 20, 2024, the People's Court of Nanyang High-tech Industrial Development Zone in Henan Province found Yang Qichao guilty of fraud at the first instance, sentenced him to 4 years and 6 months in prison, and fined him 30,000 yuan.

On May 20, 2024, the case was heard in the second instance at the Nanyang Intermediate People's Court. The Paper learned that in the second instance, Yang Qichao's defense lawyer still defended his innocence.

The defense believes that the virtual currency issued by the defendant Yang Qichao in this case has a unique and unalterable contract address, and there is no so-called "fake currency". The defendant and the reporter are both senior players in the currency circle. They have been engaged in virtual currency trading for a long time and have a clear understanding of the risks of speculating in virtual currency. In addition, the platform allows liquidity to be added or withdrawn at any time, and the defendant's behavior does not violate the platform rules. The BFF coins held by the victim appreciated due to increased liquidity after the incident. If the transaction can be exchanged for more USDT coins than before, the victim will not suffer any losses.

Related lawyers introduced that in the case where my country's laws and policies have not yet recognized the legality of virtual currency and "investment in virtual currency is at your own risk", this case of issuing virtual currency and withdrawing liquidity has been brought to court as a criminal case. This is the first case in China.

The case was tried in the second instance at the Nanyang Intermediate Court

Fraud case caused by "withdrawal of liquidity"

Yang Qichao, born in 2000, was a senior student about to graduate from a university in Zhejiang before the incident. Out of hobby, he got involved in virtual currency during college.

In early May 2022, he paid attention to a DAO community autonomous organization called Blockchain Future Force (BFF), which conducted preliminary publicity and preheating for the issuance of decentralized virtual tokens. The release date was scheduled for May 2 of that year.

At 4:41:46 p.m. (Beijing time) that day, Yang Qichao, out of curiosity, created a digital virtual currency "Blockchain Future Force" (BFF for short) on the Binance chain with the same English name as Blockchain Future. At 4:57:25 p.m., Yang Qichao added 300,000 BSC-USD and 630,000 BFF liquidity to the virtual currency he issued.

In decentralized virtual currency transactions, the "liquidity pool" is a key factor. First, liquidity providers (users) need to deposit "token pairs" (the token pairs in this case are two virtual currencies, BFF and BSC-USD) into smart contracts to create a liquidity pool, and set the token pair ratio according to a mathematical function through an automated market maker (AMM). The two tokens are exchanged to change the ratio of the token pair, and then the ratio is changed, and investors look for arbitrage space.

In the same second that Yang Qichao added liquidity, Luo spent 50,000 BSC-USD to exchange 85,316.72 BFF coins. Just 24 seconds later, Yang Qichao withdrew the liquidity in the BFF coin and obtained 353,488.115 BSC-USD and 508,069.878 BFF coins. The operation of withdrawing liquidity caused the BFF coins in the liquidity pool to depreciate significantly. Luo only exchanged 21.6 BSC-USD with 81,043 BFF coins.

This act of withdrawing liquidity is called "withdrawal of capital" in the indictment. According to several currency circle players, withdrawing liquidity is a common arbitrage method in virtual currency transactions. In the case of low liquidity, it can lead to large fluctuations in the exchange price of virtual currencies, earning ten or a hundred times the profit. Correspondingly, the virtual currencies held by the losers may depreciate significantly. Therefore, if the issuer withdraws within a short period of time after adding liquidity, it will be regarded as "unkind". Yang Qichao said, "I just took back the points that the big brother cut from me, and I was cut a lot."

However, there are no rules and restrictions on "whether it can be withdrawn" and "how long it takes to withdraw" when issuing virtual currencies on the public chain. Whether investors choose to exit at a loss or wait for new liquidity to come in and exchange after appreciation depends on personal judgment and choice.

Luo chose to find a counterparty to recover his losses.

The issuance and trading of virtual currencies are anonymous, and it is usually difficult to find a counterparty. Coincidentally, when tracing the source, Luo found Yang Qichao through a common WeChat friend. Luo asked Yang Qichao to refund his losses, but was rejected.

On May 3, 2022, Luo reported to the Public Security Bureau of the High-tech Industrial Development Zone of the Nanyang Public Security Bureau, claiming that he was defrauded of more than 300,000 yuan (converted to 50,000 USDT coins) for investing in virtual currency. Soon, the police filed a criminal case on suspicion of fraud and arrested Yang Qichao in Hangzhou, Zhejiang in November of that year.

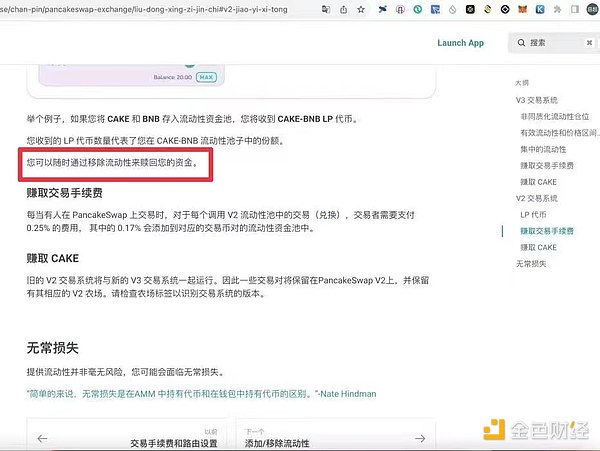

Pancake platform rules, liquidity can be removed at any time.

The dispute over "being deceived" and "god-level" speculators

The crime of fraud refers to the act of using deceptive methods to defraud a large amount of public or private property for the purpose of illegal possession. During the trial, the prosecution and the defense had different views on whether the virtual currency issued by Yang Qichao was true or false and whether Luo had fallen into a wrong cognition.

The People's Procuratorate of Nanyang High-tech Industrial Development Zone accused that the defendant Yang Qichao created a fake BFF coin with the same name and the same promotional materials as the virtual currency issued by Qudong Future, and recharged 300,000 USDT coins as bait, luring the victim Luo to recharge 50,000 USDT coins. After that, Yang Qichao withdrew a total of more than 350,000 USDT together with the 300,000 USDT he recharged, defrauding Luo of RMB 330,000.

In the defense lawyer's opinion, first of all, although the virtual currency issued by Yang Qichao has the same English name as District Future, this does not mean that it is a fake BFF coin, because the BFF coin issued by Yang Qichao has a unique and unalterable contract address and can be exchanged normally. On the virtual currency platform, there are many coins with the same name. In this case, before Yang Qichao issued the BFF coin, relevant entities had already issued multiple BFF coins with the same name. In fact, District Future did not issue BFF coins, but BFFT and BFFA coins.

"When buying virtual currency, you must first check the contract address. The contract address is a bit like a URL. It is a key composed of a string of letters and numbers. It is unique and cannot be tampered with. It is also the most core element for identifying different virtual currencies." A blockchain financial expert who did not want to be named said, "With the development of virtual currency today, the issuance threshold is already extremely low. Anyone can issue coins at any time, because the code is open source, and you can issue it by copying the code at will. For example, there are many virtual currencies that copy Bitcoin, and virtual currencies with the same name, copycat coins, and imitation coins are very common." The expert also introduced that in 2021, due to Musk's endorsement, Dogecoin became popular, and thousands of virtual currencies named after various animals were issued on the platform, and currency speculation became popular.

Did Luo's behavior of recharging 50,000 USDT coins to exchange for BFF coins fall into a wrong cognition?

In the defense lawyer's opinion, Luo is a senior player and should have a clear understanding of the gambling nature and risks of virtual currency transactions. He said in the transcript: "Generally, when new coins are issued, whoever buys it first and the people who buy it later will increase the value of my coins." "The disadvantage is that there is no supervision. Anyone can issue virtual coins on the platform, which has investment risks."

The transaction records show that Luo bought BFF coins in the same second that Yang Qichao added liquidity. "This cannot be achieved through manual operation, but is automatically completed through scripts, without involving human verification and identification processes." The defense lawyer said.

However, Luo denied that he wrote a script in advance to automatically buy.

The case materials show that when Luo reported the case, he said that he bought the virtual currency on the PancakeSwap virtual currency trading platform on his mobile phone in a supermarket parking lot in Nanyang High-tech Zone. "If you can buy the virtual currency in the first batch, as the number of people buying the currency increases, the price of the currency will increase, and there is a lot of room for appreciation after selling it." However, the legal opinion issued by Luo's lawyer stated that Luo operated it on a computer.

A senior person in the currency circle who did not want to be named analyzed that virtual currency can only be traded after the issuer adds liquidity. To manually buy virtual currency, you need to go through the steps of connecting the wallet, entering the name of the currency, the exchange quantity, choosing which currency to exchange with, and entering the contract address. It takes at least five or six steps and it is impossible to complete it within one second.

The person in the currency circle introduced that there is a way to play in the currency circle called "rushing the earth dog". "Dogs" mostly refer to those who invest in virtual currencies on decentralized public chains that usually have no formal publicity and no white papers. Those who rush in first may get ten or a hundred times the return, but if they withdraw too late, they may suffer a huge loss due to insufficient liquidity. In fact, there is a kind of people called "coin circle snipers". They write program scripts in advance, buy newly issued virtual currencies first, and withdraw quickly when they appreciate. Such people are also called "money-pulling", which means "same as cutting leeks".

After checking Luo's operation records, the above-mentioned people in the coin circle found that his multiple transactions were bought and sold in extremely short periods of time such as 6 seconds, 9 seconds, 12 seconds, and 18 seconds. The fastest one was sold after holding for 6 seconds, making a lot of profit. "This operation is extremely professional and belongs to the god level in the coin circle."

BFFA virtual currency issued by District Dynamic Future

Not protecting virtual currency and criminal accountability

Another controversial point in the trial was whether the lost virtual currency was property that should be protected by the criminal law.

As early as the beginning of the case, the public security organs also informed Luo that due to the prohibitive provisions of national laws, there was no institution in China that could identify the value of the USDT currency involved in the case. The first instance court also stated that since it is currently impossible to conduct price appraisals on virtual currencies such as Tether in China, it is impossible to determine the specific amount of this type of fraud crime.

Luo's loss was 50,000 USDT coins. USDT, known in Chinese as "Tether", is a virtual currency anchored to the US dollar and can generally be exchanged 1:1 with the US dollar. However, since USDT cannot be used directly on the Binance chain, it can only be exchanged for BSC-USD coins commonly used on the Binance chain using the USDT cross-chain bridge, and then BSC-USD can be exchanged for other virtual currencies on the chain. After multiple exchanges and conversions between BSC-USD and USDT, USDT and USD, and USD and RMB, the prosecutor accused Yang Qichao of defrauding Luo of RMB 330,000.

The first instance court held that "according to relevant policies of our country, the virtual currency does not have currency attributes, but in real life, based on its stability, it can be traded on many international trading platforms and bring economic benefits, and its property attributes are undeniable", so it recognized the conversion of the 50,000 USDT coins involved in the case into RMB value as a sentencing circumstance.

The defense lawyer believes that according to the current laws and regulations of our country, virtual currency investment behavior is not protected by law, both parties are illegal financial activities, and investors should not be protected by law even if they suffer losses. The first instance court's determination is "disguised support for the redemption transaction between virtual currency and legal currency", which runs counter to national laws and regulations.

As early as December 3, 2013, the People's Bank of China, the Ministry of Industry and Information Technology, and the three major regulatory commissions of China's banking, securities, and insurance industries issued a "Notice on Preventing Bitcoin Risks", which clearly stated that "Bitcoin does not have the same legal status as currency, and cannot and should not be circulated and used as currency in the market." On September 4, 2017, the People's Bank of China and seven other ministries and commissions issued the "Notice on Preventing the Risks of Token Issuance and Financing", which clearly stated that "token issuance and financing is essentially an act of illegal public financing without approval" and "token issuance and financing and transactions involve multiple risks, including the risk of false assets, the risk of business failure, the risk of investment speculation, etc. Investors must bear the investment risks themselves."

On September 15, 2021, the People's Bank of China, the Supreme People's Court, the Supreme People's Procuratorate and ten other departments issued the "Notice on Further Preventing and Dealing with the Risks of Virtual Currency Trading Speculation", which clearly stated that "any legal person, non-legal person organization or natural person investing in virtual currency and related derivatives, which violates public order and good morals, the relevant civil legal acts shall be invalid, and the losses caused thereby shall be borne by themselves; if suspected of disrupting financial order and endangering financial security, the relevant departments shall investigate and deal with it in accordance with the law."

In addition, in the "Guiding Case 1" issued by the Supreme People's Court on December 27, 2022 99", the Supreme People's Court confirmed that in this case "the arbitration award ordered the respondent to compensate the US dollars equivalent to the value of Bitcoin, and then converted the US dollars into RMB, which was a disguised support for the redemption transaction between Bitcoin and legal tender, which violated the state's regulations on virtual currency financial supervision and violated the public interest. The People's Court should rule to revoke the arbitration award."

The Paper found that a civil case published on the official website of the Nanyang Intermediate People's Court in Henan Province also mentioned that "the USDT digital currency involved in this case is a virtual currency similar to Bitcoin. According to the notices and announcements issued by the People's Bank of China and other departments, virtual currency is not issued by monetary authorities, does not have monetary attributes such as legal compensation and compulsion, is not a real currency, does not have the same legal status as currency, cannot and should not be circulated and used as currency in the market, and citizens' investment and trading in virtual currency are not protected by law."

The relevant controversial topics have also caused controversy in the academic community. On May 16, 2024, the People's Court Daily published a theoretical article entitled "An Analysis of the 'Criminal Law Property Theory' of Virtual Currency". The author, Ye Zhusheng, an associate professor at the School of Law of South China University of Technology, believes that "recognizing virtual currency as criminal property violates the principle of unity of legal order". The reason is: "Neither our country's civil laws nor financial policies protect activities related to virtual currency, do not encourage or even crack down on activities related to virtual currency, and civil law generally identifies virtual currency activities as invalid civil legal acts that violate public order and good morals. If the criminal law protects virtual currency as property, it will in disguise guarantee the security of virtual currency transactions and indirectly promote activities such as virtual currency transactions, which is contrary to the goals of civil law and financial policies." In addition, the defense lawyer pointed out that the transaction records showed that Luo redeemed 21.6 BSC-USD coins in less than 7 minutes, and "bottomed out" the BFF coins issued by Yang Qichao three times, but then Luo reported to the public security organs that he was cheated. As of the trial, the BFF coins issued by the defendant had greatly appreciated due to increased liquidity. Luo's wallet with the last number 3A22 still held 72381.7198 BFF coins, which could be exchanged for 64065.7134 USDT coins. "Regardless of whether virtual currency is property or not, Luo Jiayuan suffered no losses in terms of the increase in the number of USDT." The first-instance judgment stated, "As to whether the victim later bought and sold the BFF coin, and whether the coin still has value according to the trading rules of the BoBian platform, and how much it is, it does not affect Yang Qichao's fraud crime." In the first-instance trial, the judge clearly required that Luo could not buy and sell before the judgment came into effect.

In the second trial, the defense lawyer said, "The essence of this case is the investment behavior of virtual currency, not the criminal behavior. Similar to stock speculation, investing in virtual currency is a process. In this process, the price of virtual currency goes up and down with the amount of liquidity. Whether it is profitable or not depends on the time of buying and selling. Now it seems that in the whole process of investing in BFF coins, Luo did not lose "money", but made "money". The starting point of the logic of this case is the loss of transaction. If the victim can obviously trade back more virtual currency, how can this be called fraud?"

JinseFinance

JinseFinance

JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance CaptainX

CaptainX CaptainX

CaptainX CaptainX

CaptainX Davin

Davin Catherine

Catherine