The timing of Bitcoin couldn’t have been more perfect.

In 2008, during the global financial crisis, millions of families lost their homes in forced foreclosures and banks received tens of billions of dollars in government bailouts.

Just then, a white paper was quietly released. No one knew that this document, outlining a new peer-to-peer electronic cash system, would transform how we think about money, trust, and financial institutions.

When Satoshi Nakamoto launched Bitcoin in 2008, his original mission was clear: to create a decentralized and transparent peer-to-peer system. Bitcoin was designed to eliminate intermediaries such as banks or governments, empowering individuals to transact directly, providing a system that could potentially resist inflation and centralized control.

While the idea was groundbreaking, its impact took years to be felt. The rise of the cryptocurrency industry has been astonishingly rapid. Bitcoin, the original cryptocurrency, has always been at the forefront, spawning thousands of other digital assets, each offering a different form of innovation or alternative to the existing system.

As cryptocurrency has gained popularity, a large number of institutional investors, large companies and even governments have joined in, all wanting a piece of the action. What was originally "decentralized, borderless transactions, and a financial system that works for the people" has now become a gold rush.

The question is: has the entire cryptocurrency space gone off the rails? Has the relentless pursuit of profits and the desperate desire for mainstream acceptance turned the original dream into a hollow shell?

This selected long article is translated by Pao Ben Finance·Web3.0 Study Room from Jasir Jawaid's "Crypto's Crossroads: Has the Industry Lost Its Way?" As a practitioner who has experienced the crypto market from chaos to order, Pao Ben Finance has always insisted on exploring the value of the crypto world. The trauma of those carpet-pulling projects to the industry has not yet healed, and some innovators who have broken through are still sticking to the wheat field.

An emerging industry needs a hot market voice and positive guidance of rules. "Speculation" plays a role that is both good and evil. It is a connecting channel and a financial "lowland".

So, looking back on the past of the crypto industry, is the direction right?

This is a summary of expert opinions on this in-depth question. I hope you can gain the answer you agree with in reading.

Profit/Speculation vs. Original Goal

Cryptocurrency originated from the ideals of decentralization and financial autonomy, but it has increasingly become a profit-oriented speculative arena. This has caused a significant deviation from the original goal that drove its birth. The volatility of cryptocurrency prices has attracted a large number of speculators seeking quick profits, which in turn has led to market fluctuations driven by hype rather than fundamental value.

Just look at the meme coin craze! Dog Wif Hat (WIF), a dog wearing a hat, hit an all-time high of $4.83 in March 2024. It was all driven by speculation. One trader invested $310 and made $5 million.

Experts have different views on the impact of profit-driven speculation on the original ideals of cryptocurrency. Some believe it has driven growth and expanded its reach, while others express concerns that decentralization may be eroded.

Regardless, a consensus is gradually forming: financial motivations have been an intrinsic part of cryptocurrency since its inception and have evolved along with the technology itself.

Daniel Polotsky

Speculation is an important part of expanding the cryptocurrency market, and industry innovation requires financial support. Although speculation may lead to short-term fluctuations, it is through this process that strong companies and projects are likely to stand out in the long run.

CoinFlip founder Polotsky acknowledges that current development may deviate from the initial goal, but also sees speculation as a necessary catalyst for growth.

This view is echoed by Joe McCann, founder and CEO of cryptocurrency hedge fund Asymmetric. He believes that speculation is a means to expand access rather than weaken core principles, and emphasizes the role of open markets in achieving financial freedom.

Joe McCann

Cryptocurrency has always been about financial freedom, and open markets are key to achieving this goal, where people can speculate, invest, and accumulate wealth.

Mantle's Function CEO Thomas Chen believes that speculation is actively driving the evolution of financial sovereignty. Infrastructure development is key to realizing this potential.

Thomas Chen

Bitcoin's sovereignty is not weakened by financialization, but rather strengthened when BTC is held and actively used in a permissionless, trust-minimized environment.

However, Daniel Keller, CEO and co-founder of decentralized cloud infrastructure company InFlux Technologies, offered a very different view, worrying that the lure of quick profits has overshadowed the original decentralization goals. Projects with real decentralized value may be overlooked.

Daniel Keller

The only thing that moves faster than technology is the candlestick chart, so speculation quickly outpaced the development of blockchain technology.

Andrew Lunardi, head of growth at crypto gaming platform Immutable, believes that the birth of Bitcoin was a response to the failure of government policy during the Great Depression. At the same time, he also pointed out that there were financial motivations from the beginning, and mentioned Hal Finney's early price speculation.

Andrew Lunardi

Financial motivations have always been part of cryptocurrencies, but have only become more pronounced over time.

This view was echoed by Mukarram Mawjood, Chief Investment Officer of Blackstone Commodity Group, who directly linked this to the rise of memes, highlighting the continued drive for financial gains.

Mukarram Mawjood

Once people realized that prices and returns could grow many times over and the value increased significantly, the focus naturally turned to profits and speculation.

David Seroy, head of the ecosystem at Alpen Labs, said that profit and speculation have indeed overshadowed the original goal, but he sees this as part of human nature and Bitcoin's design.

David Seroy

Bitcoin is not a utopian ideal, but a system that relies on incentive mechanisms to work together, in which greed and self-interest are not flaws, but core features of the system that ensure sovereignty and decentralization.

Peer-to-Peer Cash and Digital Asset Narratives

Bitcoin was originally designed as a decentralized peer-to-peer electronic cash system. Its goal is to enable direct transactions between individuals without intermediaries such as banks. Over time, the focus on cryptocurrencies has shifted significantly towards viewing them as digital assets and investment vehicles.

*Store of value: Bitcoin’s scarcity (capped at 21 million) and inflation-resistant properties have led to it being likened to “digital gold.”

*Tokenization: Blockchain technology allows for decentralized ownership of real-world assets (RWAs).

People have different views on whether this shift to digital assets and investment vehicles is a natural evolution of Bitcoin’s initial vision or a deviation from its original purpose. Some see stablecoins as a modern realization of the original vision, while others emphasize the role of market forces and institutional influence. CoinFlip’s Polotsky recognizes the importance of fiat currencies and sees Bitcoin as a hybrid of growth stocks and digital gold. He observes the rise of stablecoins such as USDT and USDC as a solution to enable seamless global transactions. Polotsky believes that as cryptocurrencies mature, they will become more stable and thus more suitable for everyday payments. Daniel Polotsky Bitcoin currently combines the characteristics of growth stocks and digital gold, but its potential volatility prevents it from being used as a primary medium of exchange. This is why we see the rise of stablecoins such as USDT and USDC.

McCann further challenged the view that Bitcoin was once seen as pure peer-to-peer cash. He believes that Bitcoin has served more as a store of value and inflation hedge, and the market is more inclined to investable digital assets. He used Meme and Solana Network as examples to illustrate that cryptocurrencies have evolved into cultural and financial phenomena, a complete investment ecosystem rather than an everyday transaction system.

Based on this, some experts believe that Bitcoin's role as peer-to-peer cash is just a starting point, not the final form. He pointed out with historical analogies that assets usually evolve from value storage tools to collateral and then further to liquidity tools. Its evolution into a structured financial asset is not a departure from its origins - it is just a natural evolution process.

Keller further emphasized this major shift, pointing out that DeFi is all about bringing the basic elements of the stock market (perpetual contracts, futures and derivatives contracts) to the blockchain. While the peer-to-peer concept remains, he noted that the investment universe has expanded significantly.

Lunardi noted that people are beginning to view cryptocurrencies as investment vehicles, in part because Bitcoin’s volatility has hindered its use as a medium of exchange. He believes this volatility has led to Bitcoin being viewed more as “digital gold.” He also mentioned that stablecoins could potentially fulfill the vision of peer-to-peer cash, although he acknowledged that USDT’s fiat backing contradicts the original goal of reducing sovereign risk.

Seroy sees the shift toward digital assets and investment vehicles as a natural evolution. Bitcoin has the advantage of being a global store of value. The peer-to-peer cash vision is not dead, but further infrastructure and incentives are needed.

David Seroy

People don’t spend assets they expect to appreciate.

Institutional investors and traditional financial participation

The participation of institutional investors and traditional finance has conflicted with the original vision.

According to a survey of 352 institutional investors by Coinbase and EY-Parthenon, institutional investors are rapidly increasing their investment in cryptocurrencies, with more than three-quarters of respondents expanding their holdings in 2025. Improved regulation is a key catalyst for this trend.

The influx of institutional investors and traditional finance into the cryptocurrency field has called into question the original intention of decentralization.

Some experts believe that such participation is a necessary step to achieve global adoption and may even strengthen decentralization, but others have expressed concerns about the possible dilution of core principles and the introduction of regulatory influences.

Polotsky believes that institutional participation is a necessary step to achieve global adoption, even if it slightly weakens decentralization. He believes that large-scale participation by institutions and countries can strengthen decentralization through game theory and prevent any single entity from controlling the market. Decentralization will remain intact if more than 200 countries and thousands of institutions include cryptocurrencies in their asset allocation.

Daniel Polotsky

A slight reduction in decentralization is the price of global adoption. However, the participation of institutions and countries does not mean that decentralization will disappear completely.

McCann supports this view, emphasizing that institutional participation is an extension rather than a weakening of the cryptocurrency vision. The entry of traditional finance has brought increased transparency to the industry and positioned it as an alternative rather than a replacement.

CoinFlip founder Daniel Polotsky

Cryptocurrency is still an open system - institutions are just endorsing it.

Chen further refined this view, arguing that institutional participation is testing the resilience of decentralization rather than compromising it. He emphasized that the goal is to integrate Bitcoin into the global market while maintaining its self-sovereignty. The real danger lies in restricting Bitcoin to a centralized, opaque structure.

Thomas Chen

The real question is not whether institutions should participate, but under what conditions they participate.

Keller advocates for institutional participation and says it can reinforce the original vision of decentralization because it brings regulation and greater awareness, further enriching the narrative. He argues that as traditional financial players enter the cryptocurrency space, they are forced to adopt its values of privacy and decentralization. The presence of these institutions brings new investors and holds the crypto space accountable for its values.

However, Andrew Lunardi makes a nuanced point. He likens institutional participation to a "double-edged sword." While it boosts legitimacy and drives regulation, it conflicts with Bitcoin's original vision of avoiding government and regulatory influence.

Mawjood expressed concern that institutional participation has diluted the original vision of a decentralized system. While acknowledging that increased legitimacy and trading volume are positive aspects, he expressed concern about the market's increasing reliance on ETFs and government actions, and also expressed the hope that the market can adapt and find a balance.

Mukarram Mawjood

This is a positive development, but it has led to the crypto community being highly dependent on ETFs and government actions to drive price fluctuations, which has introduced volatility and disrupted typical seasonal trends.

Seroy acknowledged that institutional participation is inevitable, and that control-oriented practices may weaken decentralization, and that it is extremely important to maintain free choice.

David Seroy

The fight is not to exclude them, but to ensure they don’t close off their escape routes.

Scams, hacks and public trust

The prevalence of scams and hacks in the cryptocurrency space poses a significant threat to public trust, hinders widespread adoption of cryptocurrencies, and undermines the legitimacy of the industry as a whole.

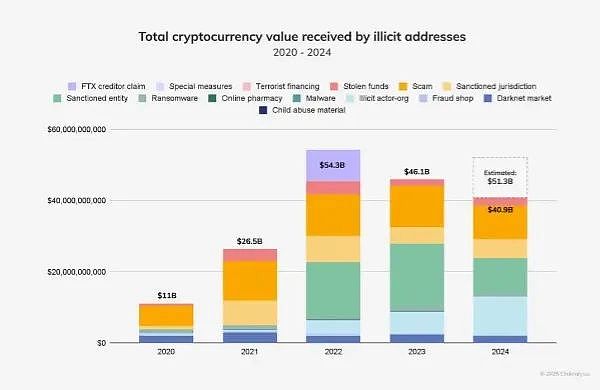

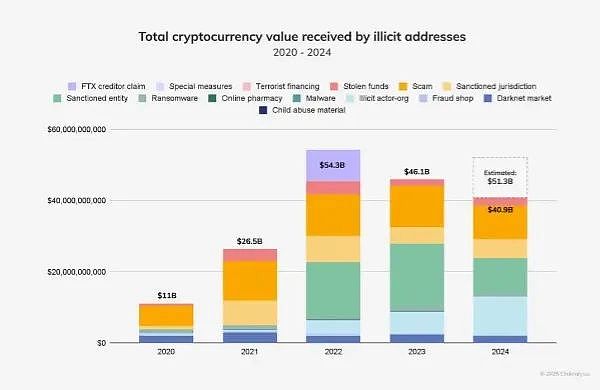

The total amount of funds received by illicit cryptocurrency addresses fell to $40.9 billion in 2024, according to Chainalysis. Chainalysis expects that number to rise as it identifies more illicit addresses.

The prevalence of scams and frauds in the cryptocurrency market has seriously affected public trust and raised concerns about the legitimacy of digital assets.

Some experts believe that these problems are an inevitable product of the emerging financial system, but others emphasize the significant damage such behavior has caused to investor confidence and call for strong regulatory measures to rebuild trust.

CoinFlip's Polotsky acknowledged the existence of the scam problem, but insisted that this does not mean that the blockchain technology itself is denied. He emphasized that the transparency of the blockchain can assist law enforcement agencies and work with industry leaders, regulators and consumer advocates to protect users.

Daniel Polotsky

Scams and scams do not diminish the value of cryptocurrencies or blockchains, but rather, by creating a transparent public ledger, expose those who exploit it for personal gain.

Chen takes a broader view, arguing that the presence of scams is a sign of growth and is commonplace in the emerging financial system. He emphasizes that the industry’s response to these issues is critical, pointing to the move toward regulated stablecoins and institutional-grade custodial services.

Thomas Chen

The presence of bad actors is not a sign of failure — it’s a sign of growth.

However, the impact of these scams on public trust cannot be ignored, with InFlux Technologies' Keller noting that "legislators cite the risk of absconding as the primary reason against investing in cryptocurrencies." He said this has had a negative impact on the ability of new projects to gain traction in the early stages.

Lunardi expressed similar views, pointing out that scams and absconding have seriously damaged public trust, especially in the field of NFTs. He pointed out that this is the main factor in the slow development of NFTs. Although the previous round of NFT cycles has demonstrated practicality in multiple fields and application scenarios, it still leaves a bad impression on most people.

Mukarram acknowledged that scams have been an ongoing problem in the cryptocurrency space, pointing to early examples such as Mt. Gox and Silk Road. He stressed that mainstream adoption has exacerbated the impact of scams, which in turn has led to larger market declines and increased volatility. Experienced cryptocurrency investors are able to understand the inherent volatility, while new investors are more likely to panic.

Seroy agreed that scams have seriously eroded public trust. He observed the growing gap between idealistic builders and speculative elements, and advocated for restoring legitimacy to the industry by building credible use cases. “Over time, hopefully, these issues will be isolated rather than lumped under the same industry umbrella.”

Restoring the original vision

Restoring the original vision of decentralization and financial sovereignty requires a multi-pronged approach. Experts stressed the importance of education, self-custody, and transparent infrastructure, while acknowledging the need to accommodate mainstream adoption and mitigate the impact of fraudulent practices.

The way forward lies in balancing core principles with practical solutions for a sustainable and inclusive future.

Polotsky stressed the importance of education and self-custody. He stated that “if you don’t have your keys, you don’t have your coins.” This maxim is key to maintaining decentralization and recommended decentralized storage of assets. It is important to “think about decentralized storage of your assets.”

Cryptocurrency security requires a balanced approach. Do not rely entirely on any single storage method, whether it is an exchange, a fund or self-custody.

Daniel Polotsky

The principles of decentralization and self-custody need to be emphasized to every new entrant to maintain the essential spirit of cryptocurrency history.

On this basis, Chen defines decentralization as a set of evolving principles that advocate for building more efficient, transparent and inclusive alternatives to traditional finance.

Thomas Chen

Financial sovereignty is not just about keeping Bitcoin out of the system, but ensuring it can flow freely in an open, trustless, and modular system.

Keller further emphasized the importance of supporting projects that prioritize financial sovereignty. He called for increased investment in fair token issuance, user anonymity, and decentralized governance initiatives, and urged the community to remain focused on core principles in the face of a clamor of scams and negative headlines.

While acknowledging the challenges, Immutable’s Lunardi expressed a long-term optimistic view. He pointed out that cryptocurrency adoption is continuing to grow, especially in developing countries. The current hesitancy will eventually fade and people will gradually adapt to the technology, just as it did in the early stages of the Internet.

Mawjood explored the nature of decentralization and the evolution of financial sovereignty. He argued that the original ideals of decentralization are evolving, especially in the area of financial sovereignty. The challenge for the crypto industry is to reconcile these ideals with mainstream acceptance, which requires adapting to new market trends and improving risk management capabilities.

Seroy stressed the importance of building practical tools (such as privacy solutions and self-custody infrastructure). He emphasized user responsibility and reiterated the mantra of "no private keys, no tokens." He believed that the best way to achieve this goal is to continue to build and support these tools.

Conclusion

So, has cryptocurrency lost its way? The answer is not a simple "yes" or "no", but "it's complicated."

Cryptocurrency, which began as a rebellion against centralized power, has grown into a vast and often contradictory ecosystem. The dream of financial sovereignty still flickers, but it is surrounded by the noise of memecoins, institutions, regulatory crackdowns, and scammers and hackers.

However, this evolution does not necessarily mean the end of Satoshi’s vision. It may just be a process from chaos to maturity. Experts believe that despite the chaos of speculation, it has funded innovation.

Institutions have accelerated the legitimization of the cryptocurrency space while introducing traditional financial dynamics. Hacks and scams have shaken trust, but they have also led to the emergence of better crypto investment tools, more comprehensive education, and more informed users.

The way forward lies not in guarding purity, but in building resilient infrastructure, championing self-custody, supporting people-first projects, and ensuring crypto is open to anyone, anywhere — not just whales and insiders.

The original vision is not gone. It’s just been obscured by too much hype and dollar signs. We need to rediscover it and shape the next chapter.

Weatherly

Weatherly