Author: 1912212.eth, Foresight News

Once upon a time, Zhao Changpeng's words "If you can't hodl, you won't get rich" were regarded as the golden rule of cryptocurrency investment. Buy, hold and hold firmly, and then sell when the profit is huge to get huge returns. The HODL concept was once very popular in the circle.

Some investment institutions have obtained very generous returns by conducting in-depth research and betting. For example, the first-class warehouse has obtained hundreds or even thousands of times of returns on MATIC and AAVE in the last cycle. Various legendary wealth stories have made retail investors generally believe in the powerful power of diamond hands. However, if this investment concept was relatively effective in the last cycle, it is no longer believed in the market in this cycle, especially by players who are full of copycats.

Within a four-year cycle, the market structure has undergone significant changes. If the style cannot be adjusted in time, there is often a risk of standing guard on the top of the mountain. Does the market really no longer reward diamond hands?

1. Memes and AI have become the main theme, and the general rise cycle is no longer

In the past cycles of the crypto market, the general rise climax often came six months after the BTC halving. Market funds gathered from Bitcoin, and then began to spread to Ethereum after reaching a certain level, and then flowed into mainstream altcoins, and finally small-cap altcoins and meme coins were in chaos, and a typical bull market cycle was declared over.

In this cycle, the first wave of rising waves was brought forward due to the positive event of Bitcoin spot ETF. After BTC ushered in its own highlight moment, the crypto market has been silent for a long time. It was not easy to wait for the rise in Q4 of 2024, but it seemed quite short.

If you have embraced popular assets such as Bitcoin, SOL, Dogecoin, etc. earlier in this cycle, then the income of Diamond Hand is very considerable. But if the altcoin you choose is not favored by the market, such as re-staking, inscriptions, games, NFT and other tracks, then the book return you are waiting for is likely to be "terrible".

Recently, Binance, which has been criticized by the market, has launched new coins, which often peaked as soon as they were launched, and then fell all the way. Projects with better quality and popularity may usher in a period of rising, while projects with no popularity and uselessness and continue to unlock will see weak buying and continue to set new historical lows. If Diamond Hand unfortunately chooses an unpopular track and unpopular currency, and keeps holding it and not selling it, it will suffer huge losses.

In addition, compared with DeFi and NFT, which were relatively popular in the previous cycle, there has been no real innovation that can compete with them in this cycle, and market funds have stagnated in Bitcoin, memes, and AI concept coins for a long time.

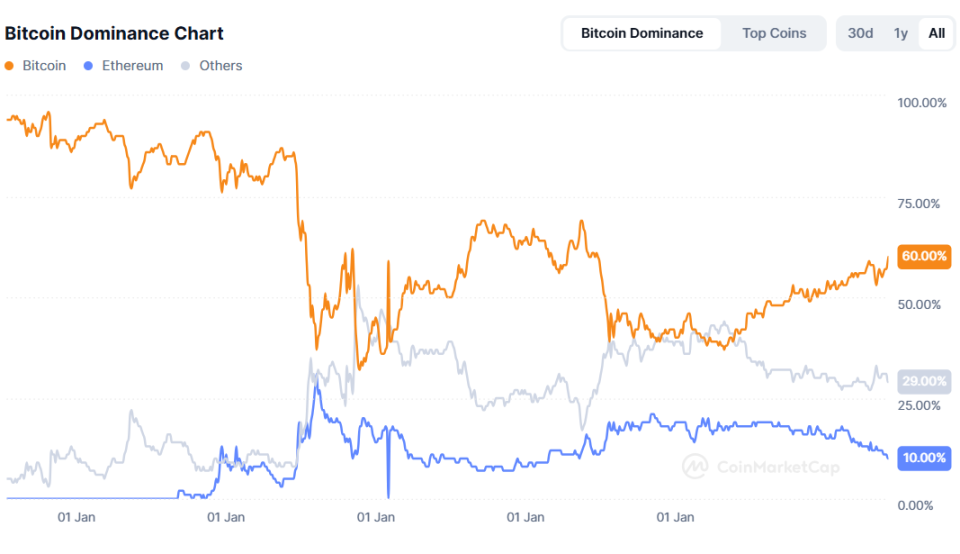

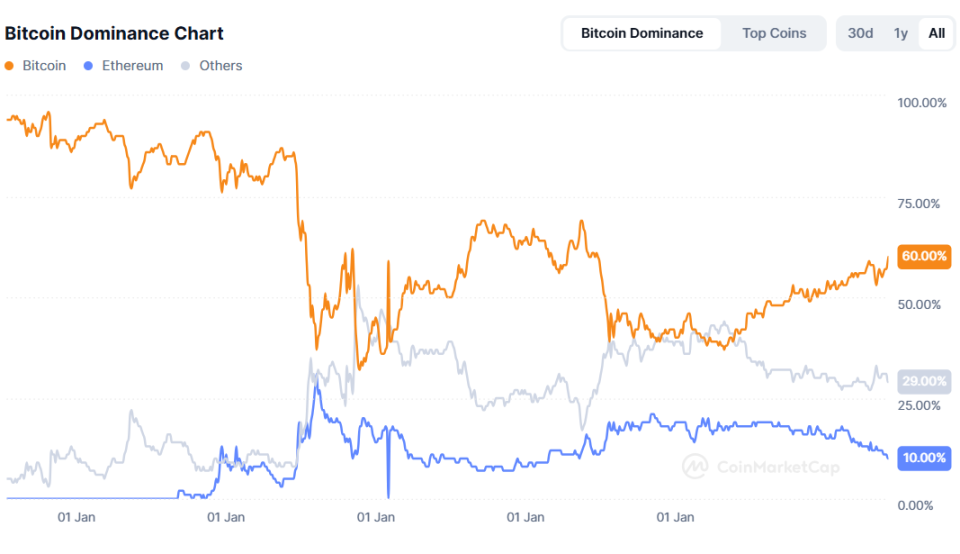

The figure below clearly shows that the market value share of Bitcoin has fallen sharply in 2017 and 2021, which is due to the general rise of cottages. In 2023, the market value share of Bitcoin began to rise all the way, from 38% to even more than 60%. In contrast, Ethereum has been plagued by multiple factors, and its market value share has begun to decline since the beginning of 2023.

Historically, it is difficult for the so-called general rise in the altcoin season to occur when the market value of Bitcoin continues to rise.

Today, the market seems to only reward diamond players who hold a very small number of coins such as Bitcoin.

Second, the performance of mainstream altcoins is not as good as expected

Compared with the previous cycle, the difficulty of this round of altcoin market is no longer the same. Taking L1 in the above cycle as an example, based on the lowest point after listing on Binance, DOT has a maximum return of more than 20 times, NEAR is nearly 40 times, AVAX is more than 40 times, SOL is more than 250 times, and UNI in the DeFi field has also returned more than 20 times. The wealth effect of the industry is very significant.

It is worth mentioning that after setting a record high, the above-mentioned tokens with rich returns all fell to the bottom range half a year or even a year later.

Among the infrastructure L1 in this cycle, except for SOL/SUI, which performed well, the rest performed poorly. In L2, OP recorded a maximum return of 10 times, and ARB recorded a maximum return of 3 times. After hitting new highs, both fell to the bottom range within 5 months. ARB even fell from a record high of $2.42 to a record low of $0.34. Stablecoins such as USUAL/ENA have recorded considerable returns, but from the bottom, they are all less than 10 times.

Some projects that are highly sought after by VC capital have performed sluggishly. EIGEN has a maximum return of 2 times, which has now hit a record low. ETHFI and RENZO, which have pledged and even started to hit new lows after listing on Binance, have a maximum return of 2 times. IO has also hit a record low.

More and more players are no longer willing to take over high-valuation VC coins. After taking over, market participation has reached a discount regardless of new or old projects.

In addition, data from CoinMarketCap and CoinGecko show that there are currently more than 20,000 altcoins (excluding memes with low market capitalization), which is 2-3 times as many as in 2021. The wide variety of tokens and the prosperity of memes will inevitably have an impact on the attention of mainstream altcoins, and the returns will also be relatively small.

Third, the MEME market is fast-paced and strong

The VC coins that have attracted much attention in previous cycles are no longer popular. After market players could not find the elusive wealth effect on CEX, they chose to dig for gold on the chain.

The trend of Solana rushing to the local dog swept the industry. It is undeniable that the wealth effect of memes such as WIF/BOME/TRUMP has attracted great attention from the market, but if you choose Diamond Hand and have not cashed out yet, the profit of the retracement will be several times more.

WIF has risen to around $4.8 since it was launched on Binance, and now it has fallen to $0.8. BOME has risen to $0.029 since it was launched on Binance, and now the price is $0.002. Although TRUMP has brought wealth effects to some players on the chain, if you do not choose to stop profit and leave the market at the peak of the market at $70, then in just a week or so, TRUMP will fall to a minimum of $16.

MEME seems fair, but it is actually not easy. The pace of growth and fall of market targets is getting faster and faster, and participants are very likely to be seriously trapped if they run slowly without paying attention.

Take the AI meme GOAT as an example. On October 23, 2024, trader Nachi tweeted that he had "acquired 4% of the total supply of GOAT. This will be the best deal of this cycle." At that time, the price of GOAT was around $0.5. On December 12, Nachi still said that he held GOAT, and the price of GOAT was $0.84 at that time. Since then, the situation has plummeted. First, it was overshadowed by ACT, and then it was overshadowed by AI agents such as VIRTUAL. The price of the coin once fell below $0.1, and the highest price of GOAT in history was once $1.37.

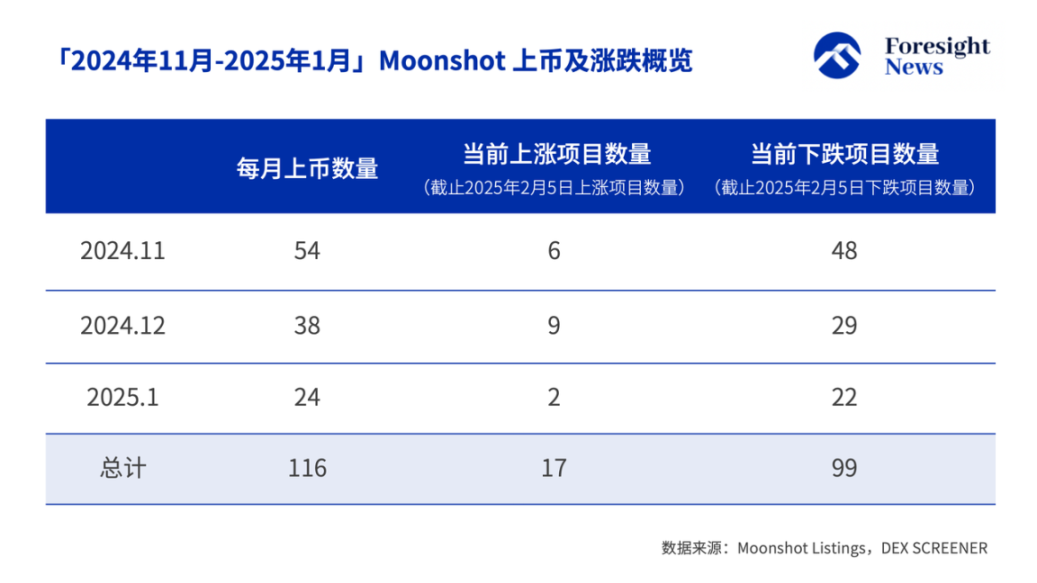

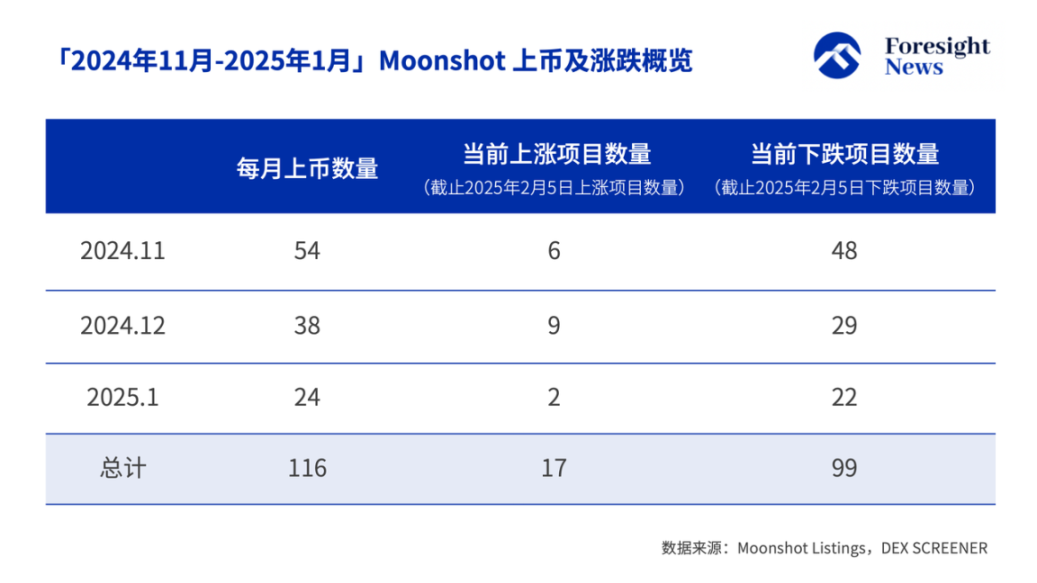

Foresight News selected the tokens launched on the Moonshot platform from November 2024 to January 2025 as research samples, taking Moonshot, which is famous for its meme coins, as an example. Among the 116 listed tokens, only 17 are currently priced higher than their listing prices, accounting for less than 15%. The vast majority of projects are currently in a downward state, and the proportion of falling projects exceeds 85%.

The real and cold data tells market players that it is not easy to pick a good target and get a high return at a low cost. It is normal for MEME to fall by more than 80% or even return to zero.

MEME's fast pace and high intensity have also spread to some altcoin markets where liquidity is already precarious. A number of altcoins with low narrative ceilings, no heat, and high valuations have ushered in a "dark moment".

Fourth, what to do?

From a macro-cycle perspective, the market's requirements for diamond hands are getting higher and higher. First, you need to judge the market sentiment and the top profit-taking range. If you make the mistake of not selling, all your profits may eventually vanish. Secondly, you need to carefully select the target, and you need to be very cautious about which targets are worthy of diamond hands. Once you choose the wrong target track, even if the bull market comes again, it may have nothing to do with you.

Generally, don't be a diamond hand in the meme coin track.

Timely cashing out and leaving the market to improve your life is also one of the better ways. Reducing positions helps reduce the pressure of subsequent holdings. Once a sharp retracement occurs, the realized profits can ensure that there are still funds to capture opportunities in the future.

YouQuan

YouQuan