On February 3, the crypto market experienced a waterfall-like decline. Bitcoin once plunged to $91,000, and Ethereum plunged to below $2,100, reaching its lowest level since November. Other altcoins fell even more severely, with an average drop of more than 15%. Just as investors were panicking, funds flowed back during the North American trading session, and the market rebounded in a V-shaped manner. In the early hours of this morning, Bitcoin once hit $102,500, completely recovering yesterday's losses.

Before and after the Spring Festival holiday, Bitcoin has experienced short-term sharp declines many times. But it is worth noting that despite the large decline, Bitcoin has been quickly repaired every time, showing amazing market resilience.

DeepSeek has hit the market hard

On the eve of the Lunar New Year, the download volume of the domestic AI large model DeepSeek surpassed ChatGPT and topped the US APP Store, attracting the attention and coverage of the global technology, investment industry and media. Because the model is extremely low-cost, but its effect is comparable to that of AI products of American companies such as OpenAI, it has brought great shock to the global market, shaking the foundation of the AI industry that has always believed that "great effort can produce miracles". A stone stirs up a thousand waves, and US technology stocks are immediately hit hard. Nvidia's stock price once fell by nearly 17%. The crypto market was also not immune to the impact. Bitcoin and Ethereum also fell by 6% and 7% respectively, and some altcoins lost double digits. However, after the plunge, the market rebounded quickly, and mainstream currencies such as Bitcoin and Ethereum quickly recovered their losses, showing strong market bullish confidence. Trump's tariff policy caused market panic. During the Spring Festival, the tariff stick promised by Trump during his campaign for the US presidency has gradually been implemented in recent days. On February 2, US President Trump signed an order to impose a 25% tariff on Mexican and Canadian imports and a 10% tariff on China. The trade volume between the United States and these three countries is about 1.6 trillion US dollars. The relevant countries have also vowed to take retaliatory actions. The official start of the tariff war has shocked the global financial market.

The market is worried that a full-scale trade war will disrupt the global supply chain, raise inflation, cause the Federal Reserve to raise interest rates again, and drag down the economy. Cryptocurrencies have fallen like waterfalls. Bitcoin once plunged to $91,000, Ethereum plunged to below $2,100, and many altcoins hit an all-time low.

After the great turmoil in the global financial market, Trump said on Monday that after talking with the leaders of Canada and Mexico, he agreed to postpone the plan to impose a 25% tariff on the two neighboring countries for one month and continue negotiations. Market sentiment eased, and the crypto market rebounded in a V-shaped pattern. Bitcoin once reached $102,500, completely recovering yesterday's losses.

Is the bull market still on the way?

During this period, Bitcoin has experienced sharp declines many times. Although each decline can be quickly repaired, these fluctuations are also constantly shaking investors' confidence, making market sentiment increasingly weak, triggering a debate on whether the bull market is still there. Overall, this round of bull market is still sustainable, mainly based on the following points:

1. Tariff policy may only be a negotiating tool. During Trump's first term, tariff policies changed frequently and capriciously, and tariff threats were more of a bargaining chip than a long-term strategy. After Trump announced the imposition of tariffs on Mexico and Canada, the limited decline in technology stocks was a reaction to this. The market believed that Trump's "false shot" was intended to allow the Mexican and Canadian governments to crack down on drugs and illegal immigrants entering the United States. Sure enough, the next day, Trump said on social media that Mexico agreed to send 10,000 soldiers to the border to control illegal immigrants and drugs, and Canada would also take corresponding measures. The suspension of the tariff policy once again supported this view. Now it seems that Trump's wishful thinking is going well, and the negotiations with Mexico and Canada have yielded results.

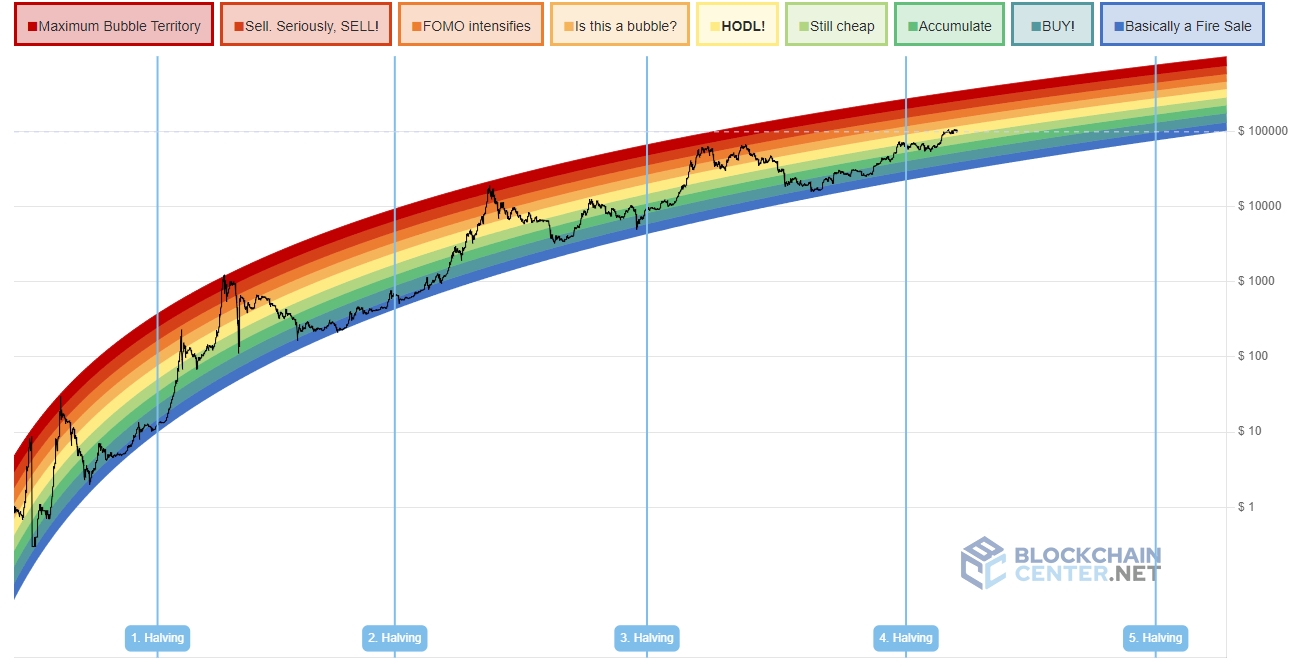

2. Trump's campaign promises are being fulfilled. Trump's crypto-friendly policies are being promoted and have been partially realized, such as the appointment of cryptocurrency-friendly officials and the issuance of executive orders, and the market's most concerned about the national strategic reserve of Bitcoin has also received further news. On Monday, Trump signed an executive order instructing the Treasury and Commerce Departments to submit a plan for a new U.S. sovereign wealth fund within 90 days and establish the fund within the next 12 months. Although Bitcoin was not explicitly mentioned when it was signed, the fund could become a tool for the government to purchase and hold cryptocurrencies. Cynthia Lummis, who first proposed that the United States establish a strategic reserve of Bitcoin and was appointed by the Trump administration as chairperson of the U.S. Senate Banking Subcommittee on Digital Assets, posted on X and used the Bitcoin symbol, implying that it was related to the Bitcoin strategic reserve. 3. Multiple BTC escape indicators did not appear. In every bull market, Bitcoin has shown obvious indicators of escaping the top. None of the 30 indicators currently recognized by the mainstream market, including the rainbow chart, ahr999 and other core indicators, has hit the target. In addition, the tops of all bull markets in history are not flat, but a needle, which does not give retail investors too much time to think. Now Bitcoin has stayed near $100,000 for more than a month, which is usually a sign that the bull market is still continuing.

On the whole, although the market volatility in early 2025 is intense, there are many signs that the current bull market still has the possibility of continuing to rise. Investors should remain cautiously optimistic and pay attention to policy changes and market indicators to cope with possible fluctuations and opportunities.

![]()

Catherine

Catherine