Author: Aaron Wood Source: cointelegraph Translation: Shan Ouba, Golden Finance

The Federal Reserve will adjust interest rates on Wednesday, and broader changes within the central bank could have a significant impact on the crypto market.

The Federal Reserve is expected to cut interest rates tomorrow. Traditionally, such a move often foreshadows a rally in the crypto market: lower yields on assets like bonds make riskier assets like cryptocurrencies more attractive.

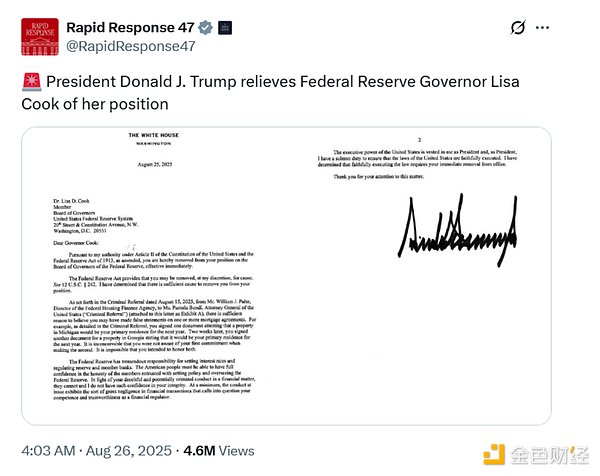

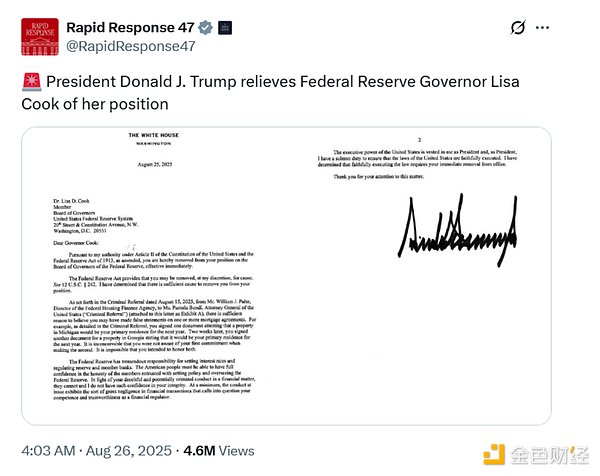

The expected rate cut coincides with a political game and new appointments at the Federal Reserve. US President Donald Trump's administration has accused Federal Reserve Governor Lisa Cook of mortgage fraud and is seeking to remove her from her position. Meanwhile, the Senate has confirmed White House economic advisor Stephen Milan to the board. The allegations against Cook, along with the appointment of someone with close ties to the administration, could mean a weakening of the Fed's independence, which is crucial for shaping cryptocurrency policy. What does a "politicized" Federal Reserve mean for crypto policy? The Trump administration is trying to remove Cook, a Biden appointee, in an effort to exert greater control over the Fed. On August 25, the White House's X-Page published a letter in which Trump fired Cook, accusing her of making false statements in one or more mortgage agreements. Cook has denied the allegations and refused to resign. Her legal team said the charges were politically motivated and that the White House was "scrambling to invent new excuses for its overreach." Cook herself called this "unprecedented and illegal." On Monday, a Washington appeals court blocked the White House's removal of Cook from her Fed position, allowing her to remain in office while the case is pending.

Image source: Rapid Response 47

Millian was confirmed by the Senate this morning. Millan, an economist and chairman of the Council of Economic Advisers, has previously made some pro-cryptocurrency remarks.

His term is temporary and will end in January 2026. But Millan refused to commit to resigning from his position as White House adviser if his term is extended beyond January 31. This has led Democratic lawmakers to worry that the Fed and its monetary policy agenda will become more beholden to Trump’s political goals.

Aaron Brogan, founder of Brogan Law, a cryptocurrency-focused law firm, told Cointelegraph: “The Fed has a lot of power over banks, and the banks ultimately become quasi-regulators of the crypto industry by deciding who can and cannot access financial services.”

“That influence is unlikely to diminish as the Fed’s independence diminishes, but its policy is likely to change. My bet is that policy will become more mutable and more susceptible to the whims of the public.”

A “politicized” Federal Reserve is relatively uncharted territory. Asked what a less independent Federal Reserve would mean for U.S. monetary policy, Brogan said, "Nobody knows." There's an assumption that a Fed beholden to the government would pursue a freer, more wasteful monetary policy because it would be more responsive to public opinion, which can be fickle. But since we've never seen that happen, that's pure speculation. At least in this administration, Trump will cut interest rates. Crypto Markets Prepare for a Fed Rate Cut As lawmakers in Washington wrangle over the fate of the central bank, crypto markets are gearing up for tomorrow's Federal Reserve meeting, where they're expected to cut interest rates. Kevin Rusher, founder of RAAC, a real-world asset (RWA) lending ecosystem, told Cointelegraph that “the market is nervous.” A renewed interest rate-cutting cycle would begin to unlock the $7.2 trillion sitting in money market funds and trillions in outstanding mortgage debt. He predicts this liquidity will flow into alternative, interest-bearing investments like decentralized finance (DeFi) and real-world assets. Alice Liu, head of research at CoinMarketCap, told Cointelegraph that "high-beta" Layer 1 chains like Ethereum (ETH) and Solana (SOL) are particularly affected by changes in Federal Reserve interest rates. "They trade similarly to growth tech stocks and are more sensitive to liquidity and risk appetite than Bitcoin," she said. "In particular, rate cuts could trigger additional capital inflows into risky assets, and investors may consider allocating more funds to Ethereum's 'digital oil' narrative or Solana's growing adoption." She said that DeFi tokens are "relatively more attractive" when interest rates fall, boosting tokens related to lending/DEX activity. Bitcoin remains a high-quality crypto asset with low sensitivity to interest rate changes, but it can still fluctuate due to "major policy surprises and liquidity shifts." The Kobeissi Letter states: "When the Fed cuts interest rates within 2% of its all-time high, the S&P 500 typically performs well. While short-term results have been mixed, the S&P 500 has closed higher a year later in each of the past 20 times this has occurred." They expect the same outcome this time around. Short-term volatility will be greater, but long-term asset holders will revel in the excitement. Gold and Bitcoin have already anticipated this. The linear gains we've seen in both asset classes are pricing in what's to come. Both gold and Bitcoin understand that lower interest rates will only further inflate asset prices amidst an already volatile market. Now is a good time to hold onto long-term assets. The political battle over the Federal Reserve remains unresolved, but low interest rates are good news for traders, regardless of who's at the helm.

Joy

Joy