Deng Tong, Golden Finance

More and more listed companies are entering the field of cryptocurrency. The stock price fluctuations of these companies are also a barometer of the rise and fall of the crypto market. This article focuses on the stock price dynamics of large listed companies related to cryptocurrency. Why is the crypto vault plan strongly positively correlated with the stock price? What are the investment implications?

I. The relationship between the stock prices of large listed companies related to cryptocurrency and market news

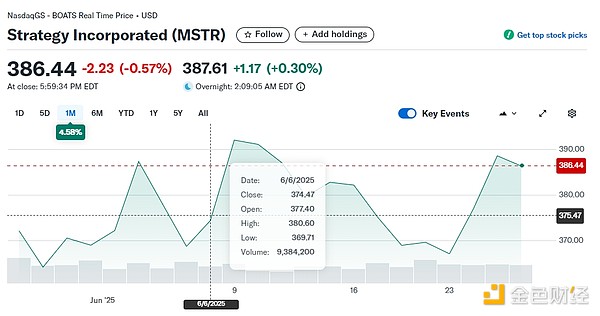

1.Strategy (formerly MicroStrategy) (MSTR), BTC

On June 6, Strategy announced the pricing of the initial public offering of STRD shares, namely 11,764,700 shares of 10.00% Series A Perpetual Stride Preferred Stock, with a public offering price of US$85.00 per share. Strategy estimates that the net proceeds of this offering will be approximately US$979.7 million after deducting underwriting discounts, commissions and Strategy's estimated offering expenses. Strategy plans to use the net proceeds of this offering for general corporate purposes, including the acquisition of Bitcoin and as working capital.

As soon as the news that MSTR raised funds to buy Bitcoin by issuing stocks, convertible bonds and preferred stocks was released, the stock price fluctuated: on June 6, the low was $369.71, and on June 9, MSTR's stock price reached a high of $394.79, an increase of 6.7%. The market viewed this type of financing as the company's long-term confidence in Bitcoin, pushing the stock price up in the short term.

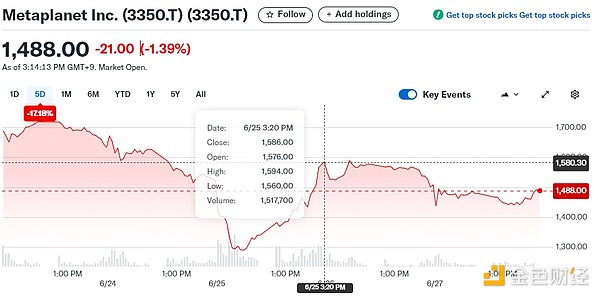

2.Metaplanet Inc.(3350.T), BTC

On June 25, Metaplanet, a Japanese listed company that adopts a Bitcoin reserve strategy, announced that it would issue 54 million shares by exercising the 20th stock acquisition right, raising 74.9 billion yen (about 515 million US dollars). The next day, Metaplanet CEO Simon Gerovich announced on the X platform that Metaplanet purchased 1,234 BTC at a price of approximately $132.7 million, an average of approximately $107,557 per BTC, and achieved a 315% return on Bitcoin so far in 2025. As of June 26, 2025, we hold a total of 12,345 BTC, with a total purchase cost of approximately $1.2 billion and an average purchase price of $97,036 per BTC.

Affected by this, Metaplanet's stock price climbed from a low of 1,260 yen to 1,594 yen, an increase of 26.50%.

3.SharpLink Gaming(SBET), ETH

On June 24, Ethereum reserve listed company SharpLink Gaming announced that it had increased its total ETH holdings to 188,478, including an additional 12,207 ETH at US$30,674,829 between June 16 and June 20, 2025 (average price of US$2,513). In addition, SharpLink Gaming also disclosed that it raised approximately $27.7 million by selling 2,547,180 shares of the company's common stock during the same period, and as of June 20, the company had generated 120 ETH in staking rewards through Ethereum staking.

It rose from $9.40 on June 24 to a high of $11.53 on June 25, an increase of 22.65%.

4. SRM Entertainment, Inc. (SRM), TRX

On June 16, entertainment company SRM Entertainment, Inc. announced that it had signed a securities purchase agreement ("SPA") with a private investor in the form of a $100 million equity investment, which SRM will use to launch a TRON token (TRX) treasury strategy. In addition, TRON blockchain founder Justin Sun has been appointed as an advisor to the company. In addition, the company plans to change its name to Tron Inc. The value of this strategic investment will reach $210 million if all warrants are exercised.

As soon as the news was released, SRM soared, from a low of $1.03 on June 13 to a high of $12.80 on June 20, an increase of 1142.71%.

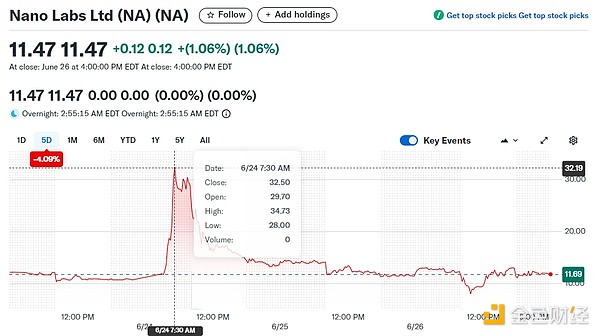

5. Nano Labs (NA), BNB

On June 24, Nano Labs, a Chinese blockchain infrastructure provider, announced a short-term plan to purchase $1 billion worth of BNB. The company plans to store the huge amount of tokens in the company's treasury and said it eventually plans to hold 5% to 10% of the total circulation of BNB - this astonishing amount of tokens is worth between $4.7 billion and $9.4 billion at current prices. The low of $10.89 on June 24 climbed to a high of $34.73 on the day, an increase of 218.91%. It then fell back and is currently trading at $11.47.

6. Lion Group Holding (LGHL), HYPE, SOL, Sui

On June 18, Nasdaq-listed Lion Group Holding (LGHL) announced that it was establishing a $600 million cryptocurrency treasury reserve with Hyperliquid (HYPE) tokens as its main asset. Hyperliquid tokens will serve as the "primary reserve asset" of the company's L1 treasury reserve assets, which will also include Solana and Sui tokens.

It rose from $2.715 on June 17 to $4.84 on June 18, an increase of 78.26%.

The stock price changes of the above six listed companies are as follows:

To sum up, the following conclusions can be drawn:

1. The announcement of treasury plans by the above six listed companies will boost stock prices, including mainstream currencies such as BTC and ETH, as well as other cryptocurrencies such as HYPE.

2. Strategy, Metaplanet, SharpLink Gaming's treasury plans involve BTC and ETH. Affected by the good news, the stock price changes by more than 20%, and the current stock price is close to the stock price after the good news is released.

3. SRM Entertainment, Nano Labs, Lion Group Holding's treasury plans involve TRX, BNB, and HYPE. Affected by the good news, the stock price changes significantly, and after the good news is released, the current stock price falls sharply.

2. Why is the encrypted treasury plan strongly positively correlated with the stock price?

The above cases all show that the company's encryption strategy is strongly positively correlated with the stock price. The reasons are as follows:

For almost all companies, financing the purchase of coins by issuing stocks, convertible bonds, and preferred stocks is often regarded as a long-term confidence in cryptocurrencies in the short term. As the crypto market continues to improve, embracing new narratives with bright prospects will inevitably drive up the company's stock price.

Related to hype. For example, when entertainment company SRM Entertainment, Inc. announced that Justin Sun would serve as a consultant to the company, SRM's stock price rose by more than 1,000%. However, the hype narrative lacks long-term actual value support and is very easy to fall back after reaching a high point.

III. Investment Inspiration

1. Pay attention to the impact of the high volatility of the crypto market on the company's stock price: water can carry a boat but can also overturn it. The positive crypto market will drive up the stock price. Similarly, the decline in the crypto market will also be bearish on the stock price. For example, when Bitcoin fell below $103,000 due to geopolitical conflicts, Metaplanet's stock price fell 5.2% that day.

2. Pay attention to long-term value investment: There is no shortage of favorable information suitable for short-term speculation in the crypto market, but the market without real narrative support is very easy to trap investors. Investors can pay more attention to the development trends of large companies. Although the information that many companies announced the establishment of altcoin vaults caused stock prices and certain altcoins to soar, there are greater investment risks due to the lack of narrative and low liquidity.

3. Invest rationally and plan investment allocation appropriately: When the company releases major positive or negative news, adjust the stock position in time; when there is a technological breakthrough or black swan event in cryptocurrency, it is necessary to adjust the cryptocurrency holdings. And appropriately allocate stock and cryptocurrency holdings according to your own risk tolerance.

The stock price of a crypto treasury company is closely related to the crypto market and the company's strategic planning. Short-term influencing factors include the company's financing situation, the crypto market, whether there is hype, etc., and long-term influencing factors include crypto policy formulation and the long-term development trend of the crypto market. Investors need to pay attention to long-term value and invest rationally.

Alex

Alex

Alex

Alex Kikyo

Kikyo Hui Xin

Hui Xin Joy

Joy Brian

Brian Kikyo

Kikyo Joy

Joy Alex

Alex Hui Xin

Hui Xin Joy

Joy