The cryptocurrency exchange ecosystem continues to rapidly evolve, reshaping the way individuals and institutions allocate digital assets. From global spot markets to regional derivatives platforms, exchanges have evolved into comprehensive financial hubs, competing across multiple dimensions: functionality, liquidity depth, and user experience. Traditional financial institutions such as BlackRock and Fidelity continue to expand their crypto businesses, while emerging platforms in Latin America and Southeast Asia are precisely tapping into this growing market. Meanwhile, decentralized exchanges, with their superior privacy protection and asset autonomy, are gradually eroding the dominance of centralized exchanges. This article will delve into the core data and trends shaping the current exchange market.

1 Recent Developments

Binance

Complete transition to a fully transparent Proof of Reserves system in March 2025, audited by Deloitte.

Kraken

Launched its own proprietary Layer 2 blockchain solution in April 2025, enabling on-chain swaps and accelerated withdrawals with zero gas fees. Gemini launched operations in Brazil and Argentina, expanding into Latin America. Over 3 million new users were added in the first quarter of 2025. Coinbase partnered with BlackRock to enable direct crypto trading integration for over 250 institutional clients. Bitfinex became the first major exchange to support native tokenization of real-world assets such as bonds and real estate. OKX launched its AI trading bot service in May 2025, gaining adoption from 480,000 users within three months. Limited Temporal Resolution: LPOC excels at observing weekly/monthly positions, but lags behind intraday/weekly movements. Future versions will enable a higher-resolution view of market positions. Furthermore, Hong Kong issued its first batch of cryptocurrency exchange licenses to five platforms, including HashKey and OSL, marking the further liberalization of institutional access to the Asian market. Decentralized exchanges such as Uniswap and dYdX have also begun offering institutional-grade data analysis tools to attract compliance-conscious traders. 2. Global Cryptocurrency Trading Platform Market Growth Trends The global cryptocurrency trading platform market reached US$43.8 billion in 2024 and is expected to grow to US$54.8 billion in 2025, achieving significant year-over-year growth. The industry is expected to achieve a compound annual growth rate of 25.9% between 2025 and 2029. By 2029, the total market size is expected to reach US$137.49 billion, reflecting accelerated global adoption and active institutional participation. This continued growth highlights the increasing market demand for regulated trading platforms, secure trading environments, and derivatives products. 3. Trading Volume Statistics Global cryptocurrency trading volume reached $4.27 trillion in September 2025, a year-on-year increase of 36%. Centralized exchanges still dominate global trading volume with a 78.3% share, but decentralized exchanges are rapidly catching up, with a current market share of 21.7%. Ethereum and Bitcoin account for over 61% of total trading volume across exchanges, highlighting their continued liquidity advantage. Binance: In the third quarter of 2025, spot trading volume reached $1.8 trillion, maintaining its leading position despite regulatory pressure. OKX: Average daily derivatives trading volume reached $42 billion, an 18% increase month-over-month. dYdX: In August 2025, it processed over $37.5 billion in decentralized derivatives trades, becoming the leading DEX in margin trading. Bybit: Trading volume surged 24% after the launch of zero-fee BTC/USDT trading, reaching $376 billion in the third quarter. KuCoin: Perpetual contract trading volume exceeded $110 billion (September), driven by participation from Asian retail investors.

Huobi Global Station:Affected by regulatory reviews in Southeast Asia, trading volume fell by 11%

4 Exchange trading volume ranking

Binance:In the third quarter of 2025, the spot trading volume was US$1.8 trillion, maintaining the top spot. OKX: Monthly trading volume reached $1.3 trillion in September 2025, surpassing Binance in the derivatives market. Coinbase: Quarterly trading volume reached $234 billion, ranking first in the United States and accounting for 41% of all crypto activity in North America. Bybit: Trading volume reached $376 billion in the third quarter, ranking third in global derivatives trading. Kraken: Processed $102 billion in trades in the third quarter of 2025, accounting for 3.6% of global trading volume (dominated by Euro trading pairs). Bitget: Driven by the Southeast Asian market, trading volume exceeded $250 billion in the third quarter, ranking fifth in derivatives trading. Upbit: With a quarterly trading volume of $75 billion, it is the leading exchange in South Korea and among the top ten globally. dYdX: Its average monthly trading volume reached $37.5 billion in the third quarter of 2025, making it the leading decentralized exchange. Uniswap: Its average monthly spot trading volume exceeded $22 billion, leading the DEX market (up 17% year-on-year). Gate.io: Its quarterly trading volume exceeded $120 billion, thanks to its expansion into the Middle East, placing it in the top ten. 5. User Size and Popularity Data By 2025, the number of global cryptocurrency users will exceed 580 million, a 34% increase from 2024. The number of users first exposed to cryptocurrency will increase by 19% year-on-year. The 25-34 age group is the main cryptocurrency user, accounting for 31%.

Male users still dominate, accounting for 61% of the total holders

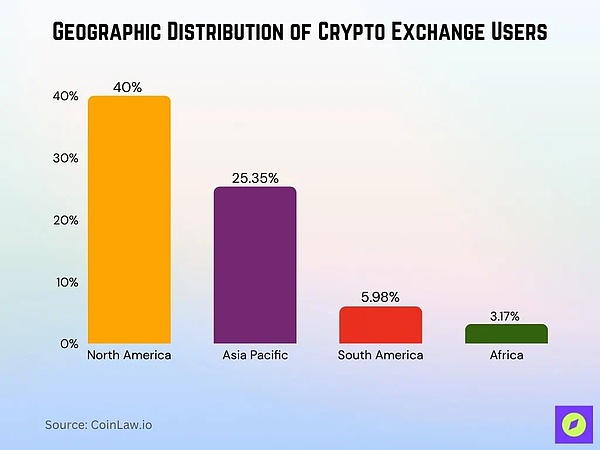

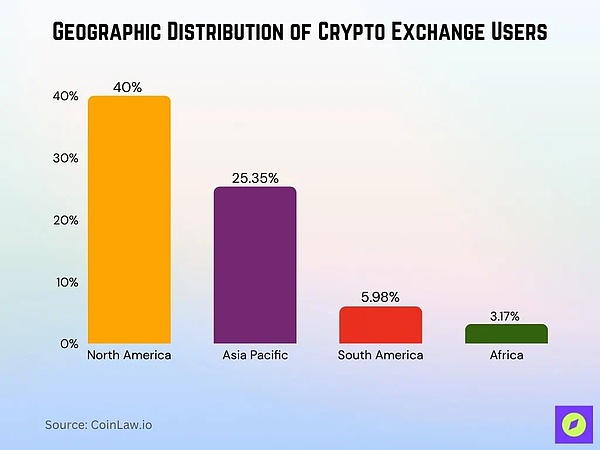

6 Geographic distribution of users

In 2025, India and the United States will rank at the top of the global cryptocurrency mass adoption index.

North America is expected to account for more than 40% of the global trading platform revenue share;

The Asia-Pacific region contributed approximately 25.35% of the trading platform revenue in the market report;

South America is expected to account for 5.98% of the trading platform revenue share;

The number of cryptocurrency users in Europe is expected to exceed 218 million.

7 Regional Market Share Analysis

In the second quarter of 2025, the trading volume of seven of the top ten exchanges declined, with Crypto.com experiencing the largest month-on-month drop of 61.4%. In July 2025, Binance held a 39.8% share of centralized exchange spot trading volume. During the same period, MEXC ranked second among CEXs with an 8.6% market share. Gate.io ranked third among CEXs with a 7.8% share. Coinbase's share fell to 5.8%, dropping it to ninth place in the global exchange spot volume rankings. Of the top ten CEXs in July 2025, the 4th to 10th-placed exchanges collectively held a 43.8% share. Forecasts indicate that DEX will accelerate its growth, with a compound annual growth rate of approximately 26.37% from 2024 to 2029. The DEX sector is expected to become the fastest-growing sector with a compound annual growth rate of approximately 26.37% from 2024 to 2029. So far in 2025, there have been 344 hacking or fraud incidents, resulting in losses of $2.47 billion; the cumulative amount of security breaches has exceeded $2.17 billion, exceeding the annual totals of some previous years. This has driven demand for non-custodial platforms. Furthermore, hybrid exchanges that combine CEX order books with DEX non-custodial execution are emerging, and centralized platforms are widely adopting proof-of-reserve audits and third-party verification to enhance user confidence. Large DEXes such as Uniswap and dYdX now offer institutional-grade data analysis tools, attracting professional users.

9 Global Cryptocurrency Exchange Market Share

Binance leads the global market with an absolute advantage of 20.9%

MEXC Global ranks second with a share of 5.2%, with strong momentum among retail traders and altcoin enthusiasts

Bitrue accounts for 4.7% of the market share, its growth is due to its deep participation in the small-cap and high-yield token markets

In February 2025, 400,000 ETH (worth $1.5 billion) was stolen from the ByBit exchange, the largest single loss in history

In July 2025, the hacking incident caused a loss of approximately $139 million, with a net loss of approximately $96.7 million after recovery

In the third quarter of 2025 alone, hacker attacks caused a loss of $306.7 million, bringing the cumulative losses for the year to approximately $2.55 billion

In September 2025, 16 security incidents exceeding $1 million were recorded in a single month, setting a record high

The staking rate of leading PoS chains such as Cosmos and Polkadot reached 56-59%, reflecting the deep support of exchanges

Ethereum's staked amount reached 33.84 million ETH, accounting for approximately 27.6% of the supply. The estimated staked amount in 2025 is between 35 million and 37 million ETH

Platform coins such as BNB, OKB, and CRO are still standard listing options, with high liquidity and practical scenarios

USDT and USDC stablecoin trading pairs still support 60-70% of trading volume

Anais

Anais