Author: Armonio, AC capital

This article is dedicated to the 14th Pizza Festival where BTC cannot buy pizza, and the cryptocurrencies where crypto culture is not the mainstream culture.

Fourteen years have passed, and in the blink of an eye, crypto-punks have ushered in the 14th Pizza Festival in the world.

This festival commemorates the legend of crypto pioneer Laszlo Hanyecz buying two pizzas with 10,000 BTC. This is not only the first transaction in the history of cryptocurrency, but also represents that BTC has realized all the functions of currency. This means that digital cryptocurrency has officially entered the historical stage of global currency. A brand new market is slowly opening up to adventurers around the world.

Fourteen years have passed. Even though the price of BTC has increased by hundreds of millions of times, Pizza still tastes the same. If you want to exchange BTC for Pizza, you still have to use legal currency (except El Salvador and the Central African Republic). BTC has made a lot of progress in value consensus, but in terms of application consensus, we have been hesitant since Satoshi left. The "peer-to-peer electronic cash system" in Satoshi's mind is still only technically feasible, and no product has been implemented.

It is precisely because of the slow implementation of BTC applications that the current situation has been created: BTC is surrounded by stablecoins and digital cryptocurrencies such as XRP. In traditional markets such as the global convenient and cheap remittance system, bearer currency in the black market, etc., BTC's share has been repeatedly eroded. Global currency is a great interest: in order to obtain it, the US government, in conjunction with Wall Street, wants to use the digital encryption payment market created by Bitcoin to further expand the hegemony of the US dollar.

At the beginning of the article, let me ask a question:

When did the habit of crypto organizations paying salaries with BTC come to an abrupt end? When did various airdrops giving away BTC become giving away US dollar stablecoins and altcoins?

With the loosening of crypto beliefs, the market liquidity logic of the currency circle has undergone a qualitative change. After 2021, how many people will still insist on the stubbornness of BTC and ETH when they enter the circle? When the trading intermediary status of BTC and ETH is shaken, the pricing of BTC and ETH is controlled by Wall Street, and the valuation of the entire cryptocurrency falls deeper into the hands of the United States.

The US dollar stablecoin has encroached on the original function of BTC and ETH as a trading intermediary, weakening the value capture of BTC and ETH.

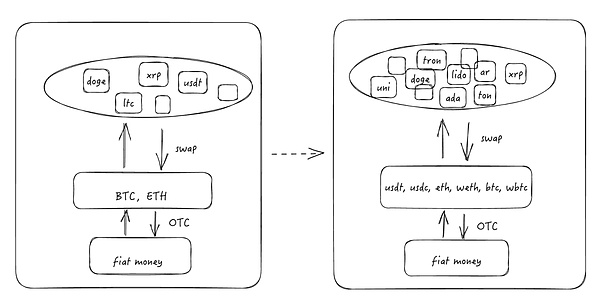

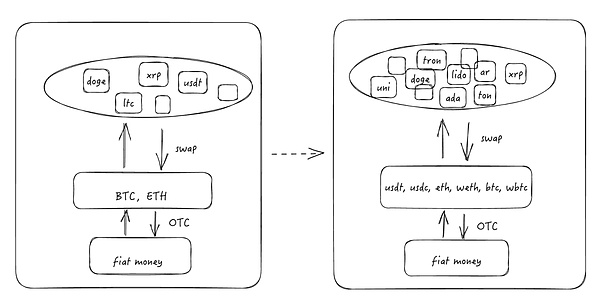

In decentralized exchanges, BTC and ETH can still hold the main market:

After arriving at centralized exchanges, a large number of trading pairs are calculated in US dollar stablecoins, and the number of trading pairs of US dollar stablecoins far exceeds that of BTC and ETH. The pricing power of cryptocurrencies has begun to be eroded before Wall Street puts BTC and ETH into ETFs.

In this way, the market that originally supported the prices of BTC and ETH has become a vassal of the US dollar hegemony. The identity of digital cryptocurrency holders and traders has changed from liberal crypto punks to short-sighted sources of US dollar liquidity and supporters of US dollar hegemony.

The current situation is inevitably a bit bleak.

01

Desire: The United States Devours Global Finance

This is the call of the great era of encryption

The blockchain system is a systematic technological revolution of Genesis. Decentralized payment not only replicates the function of Alipay, but also allows cross-border payment time to be measured in seconds instead of days. The birth of blockchain has created a low-cost multi-party trusted trading environment. This trust is used in transactions, which reduces transaction costs, and in organizations, a new organizational structure will be born. Although the vested interests of the old world are resisting in vain, the world's elites have never given up on integrating blockchain technology into the traditional financial system. BIS and WB have continuously given policy guidance on encrypted assets and even DCEP in documents.

Under the grand trend, all sovereign countries in the world, as long as they can issue legal tender, will think about how their own currencies can gain a foothold in the new monetary environment. The accounting method of blockchain solves the trust problem between financial entities and is the latest form of currency with productivity advantages. The issuance of digital legal tender in combination with blockchain technology has become the only choice for major countries. China and Europe are on the same path, introducing blockchain technology and rebuilding a payment and settlement system. In contrast, China is relatively ahead: China issues its own digital encrypted RMB in a self-built alliance chain. After two years of research, the European Central Bank found that their digital asset system can achieve concurrent transactions of TPS 40,000, laying a technical foundation for the further development of the digital euro. In comparison, the United States has adopted a more open attitude. Anyway, the currency in the history of the United States has also been issued by private banks, and the US government does not absolutely exclude digital dollars issued by private companies. Therefore, so far, the scale of centralized and decentralized stablecoins has exceeded 160 billion, and it has assumed the liquidity responsibility of the world's major digital cryptocurrencies. Although the digital dollar is not issued by the Federal Reserve, it is undoubtedly far beyond other competitors in terms of market acceptance.

Issuing crypto asset legal tender is the most effective and direct way to fight against native crypto asset tokens. This is something that neither the BIS nor the World Bank shy away from.

Not only will the currency be encrypted, but also the assets will be encrypted. The encryption of huge assets will form an integrated global financial market, commodity market, and service market. Whoever can keep up with the fast train of encryption development and occupy the largest market share will be able to obtain the greatest welfare.

This is the welfare of the world's currency issuers

During the epidemic, the base currency of the United States was over-issued in large quantities. The balance sheet of the Federal Reserve has expanded by more than doubled after the epidemic. In order to solve these over-issued credit currencies, shrinking the balance sheet is an inevitable choice. In addition, if a new market can be provided for the over-issued base credit currency, it can also support the over-issued credit from the demand level and support the valuation of the US dollar.

The encrypted dollar erodes the encrypted liquidity market. Looking at the encrypted world, it is not just a free land without an owner, and any currency can compete freely on it. The US dollar stablecoin deployed by Tether and Circle not only dominates the third and sixth place in the cryptocurrency market capitalization list, but is also an important general equivalent in the crypto world, with the highest level of liquidity. Because of the high volatility of native crypto assets such as BTC and ETH, the use of US dollar stablecoins as risk-avoiding assets has become a consensus among the natives of the crypto world. This undoubtedly lays a solid foundation for the US financial conquest of the crypto world.

The crypto dollar not only erodes the liquidity market of BTC and ETH in the crypto world. The crypto world spans traditional financial markets around the world. The decentralized nature makes it difficult for traditional power to regulate. Therefore, crypto finance not only borders the markets of various countries in the world, but also has a deep integration and penetration with these sovereign markets. The World Bank's report shows that cryptocurrencies have put forward higher requirements for supervision. Because of regulatory and demand factors, cryptocurrencies are more popular in emerging countries and poor areas. In areas where currency credit has collapsed, such as Turkey and Zimbabwe, digital currencies including US dollar stablecoins have entered the circulation field. OTC trading booths for cryptocurrencies can be seen everywhere on the streets of Turkey.

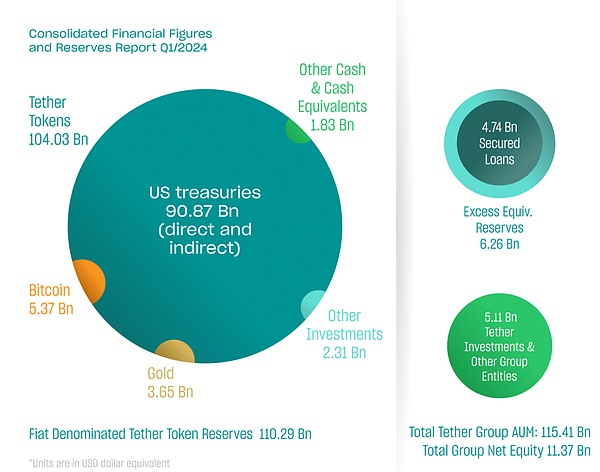

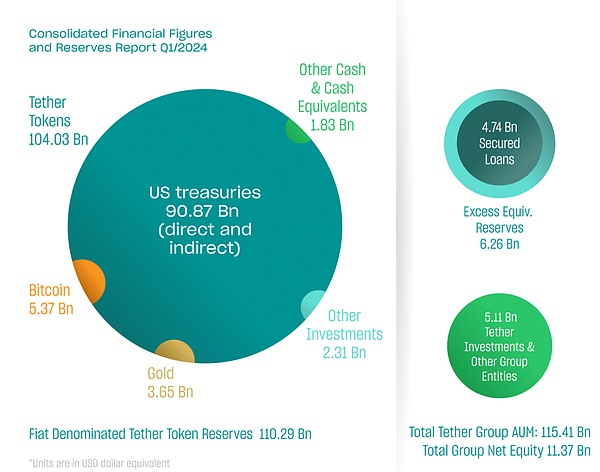

"Erosion" represents huge benefits. Behind every centralized stablecoin are nearly 90% of U.S. Treasury bonds.

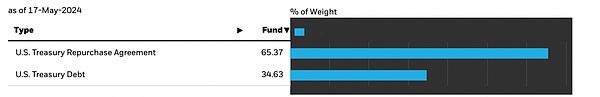

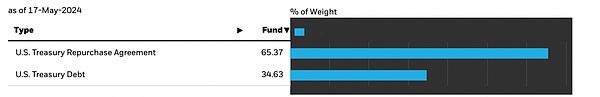

More than 90% of USDC are money funds managed by Blackstone, and this fund only holds the repurchase terms of U.S. Treasury bonds and the U.S. Treasury bonds themselves.

Behind every U.S. dollar centralized stablecoin is 0.9 U.S. dollars of U.S. Treasury bonds. The U.S. dollar stablecoin provides a better value scale and transaction medium for the digital encryption world. The liquidity demand of the digital encryption world also provides the value capture or value support that any token economist dreams of for the U.S. Treasury bonds behind it.

This is Wall Street's meal ticket

We must know that the predecessor of the Federal Reserve was the commercial bank cartel. In the early days of the Federal Reserve, the right to issue currency was swinging between core commercial banks and the government. Most financial institutions died of insufficient liquidity. Having their own water pipes can guarantee that their own private plots will be able to make a profit regardless of drought or flood. This is why Wall Street in the United States has always harvested the global market. However, how can it be more comfortable to put the credit power in the hands of the government than to hold it yourself? Today's mainstream centralized stablecoins are tricks to turn commercial bills and money market funds into US dollars. Taking USDC as an example, only 10% is cash reserves, and the rest are assets in the money market managed by Blackstone Fund.

(https://www.blackrock.com/cash/en-us/products/329365/)

This ability to directly cash out assets can be said to turn stones into gold. In the past, only the Federal Reserve had such capabilities. Now, as long as you can become the issuer of stablecoins, you can share the seigniorage that provides credit to emerging markets.

In addition, with the faucet in your own hands, you can really buy at the bottom with unlimited ammunition.

The tokenization of the financial industry is a broad picture that is slowly unfolding. It is a revolution in the financial industry.

In the current situation, RWA puts real assets on the blockchain, which can not only sell US dollar assets to the world at low cost and expand the buyer's market, but also promote the financial services dominated by the United States to the world. So far, global investors need intermediary brokers to enter the US capital market. After KYC is completed and the account is opened, the currency needs to be converted into US dollars and remitted to the designated account of the broker. Personal cash accounts and investment accounts are fragmented and cannot be connected. The operating qualifications of brokers need to be obtained in each country. This cumbersome cross-border financial market structure will be replaced by a simple wallet + front-end and token + blockchain. As long as the money is on the chain, combined with decentralized KYC, you can participate in all financial transactions that meet the conditions. RWA can even use American financial services to finance projects in developing countries.

The financial industrialization and standardization of tokens will inevitably introduce more service industries. When Silicon Valley in the United States leads industrial innovation, we use US dollar stablecoins to participate in token financial instruments regulated by the SEC and provided with liquidity by Wall Street. Where should I find a lawyer? Where should I find a tax and accounting? Whose policy guidance should I listen to? Whose face should I look at? It goes without saying.

The expansion of the industry is accompanied by financial leverage, and the issuance of securities and tokens will bring direct credit asset wealth to Wall Street in the United States. The industrial influence seized by the United States through industrial erosion will enable American capital to gain the ability to continue to cut wool in the future.

02

BTC is under siege

Because of anti-money laundering and anti-terrorism requirements, even payments are facing compliance pressure. Therefore, the current situation is: legal currency sticks to the payment track. Stablecoins compete for BTC transaction medium.

Payment track

If the advantage of crypto assets is the constraints on the chain, then the advantage of the US dollar is the payment off the chain.

The crypto asset US dollar stablecoin has both on-chain constraints and off-chain payments.

Through encrypted accounts and signatures, centralized US dollar stablecoins have encrypted signatures of endorsers. In terms of on-site payment, US financial institutions have long been prepared.

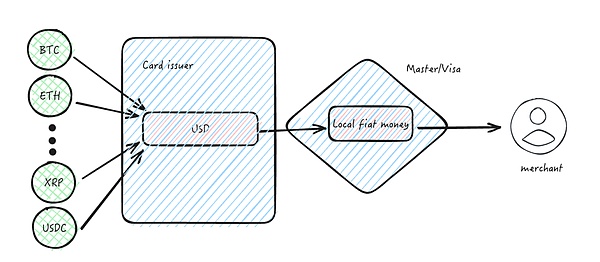

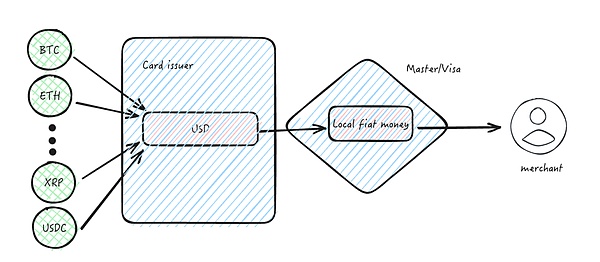

Most of the most common digital asset stored-value cards use Master or Visa to complete the last mile when they are finally put into use. Master and Visa are like the gatekeepers of a residential area. They let whichever takeaway enters the door and whichever one gets the ticket to enter the global real-world payment market.

Even if stablecoins are not used to seize the status of on-chain transaction media, all off-chain payments cannot avoid the coercion of licensed payment institutions. Master and Visa have the most extensive payment interfaces in the world, forcing issuers of digital encrypted stored-value cards to follow its rules: use US dollars for settlement. As long as the card issuer can achieve standard KYC and AML, and convert all kinds of encrypted assets in the world into US dollars in compliance, using US financial institutions can complete global payments for the holders. Binance's payment and Dupay's payment are all completed in this form. In this process, digital encrypted assets exist only as financial assets or means of storing value, and are insignificant in the payment process.

For most people who are not in the currency circle, it is more intuitive and convenient to pay with stablecoins.

RWA track

With the global decentralized network, financial services in various countries will face zero-distance competition. BTC's peer-to-peer cash system is also a kind of financial service. Under these assets that are more related to legal currency, it is more convenient to use stablecoins as the cornerstone as the underlying currency.

One of the biggest characteristics of digital encrypted assets is the penetration of financial supervision. Because it is both decentralized and anonymous. This makes regulators in various countries helpless. Unlike financial institutions that enter a country, they must comply with local regulations and obtain local business licenses. Web3 is the no-man's land that Satoshi Nakamoto promised to crypto enthusiasts. Issuers of digital crypto assets can start their business on the chain without setting up offices or other branches on the ground. The US dollar stablecoin has higher predictability in the payment field and is more easily accepted by the public. However, it is not enough to have payment functions alone. It also needs to have financial management functions like Alipay. Wall Street can provide customers with a ready-made set of compliant financial products to meet the various needs of various groups of people. Let the public take over for Wall Street again after taking over for the US government once.

Compared with decentralized exchanges, centralized exchanges have much better liquidity. Binance and OKX are high-quality exchanges. Aren't the New York Stock Exchange, Nasdaq, and London Stock Exchange high-quality exchanges? Why can't the pink sheet market and small stocks above become shell resources for memes? How many small pink sheets and penny stocks can take over this overwhelming wealth by just changing their names and stories and mapping them to the chain. SBF has done it, but unfortunately it didn't catch up with the good season of memes now.

Compared to BTC, most of Wall Street's financial assets are denominated in US dollars, such as bills, commodities, stocks, and fixed assets. Establishing trading pairs with US dollar stablecoins and providing leverage for US dollar stablecoins are not only more in line with user habits, but also reduce risks. We can even see that because USDC is more compliant than USDT, many RWA projects prefer USDC.

While RWA is exporting US financial services to the world, it has built a more suitable application scenario for US dollar stablecoins. Stablecoin holders can consume and enjoy consumer finance at the same time.

Blockchain Track

Blockchain technology is a decentralized ledger system that cannot be replaced by legal tender. Secondly, most digital cryptocurrencies have strict token issuance disciplines, which cannot be followed by any central bank of any country. Therefore, in the future, blockchain technology is irreplaceable. There is chain-level sovereignty on the blockchain: BTC's accounting currency is BTC, and ETH's accounting currency is ETH.

In order to prevent BTC from becoming too big, cultivating competitors is a means. In addition to BTC, ETH, Solana, Cosmos, Polkadot and various layer2s have emerged: they can do what BTC can do, and these up-and-coming players can do what BTC cannot do. This diverts BTC's attention and reduces BTC's monopoly.

Break BTC's monopoly and increase competition in the blockchain track. It is essentially a good thing. However, in the context of competition between legal currency and native digital cryptocurrency, dividing the digital encryption market and dispersing BTC's value consensus will be more conducive to Wall Street's control of BTC and other native encryption asset pricing, and will be conducive to the formation of an industrial structure that is beneficial to Wall Street. It will further be conducive to the formation of a digital encryption asset pricing system based on the US dollar and US dollar stablecoins, and further enhance the status and weight of US dollar stablecoins as a trading medium in the encryption world.

Thought Stamp

Killing people and destroying their hearts, this is what the United States wants to do and is doing now.

The primary market and the secondary market are all priced in US dollars and equivalents in US dollars. How much US dollars did this project raise, and how much US dollars was the valuation of that project. Once upon a time, we had forgotten that ETH financing was paid in BTC. Many early projects such as EOS, DAO, Near, 1inch, DANT, and BNB used BTC and ETH as financing methods. We forgot the age when we used BTC and ETH to mark the valuation of projects. The clamping of thoughts is the real reason why the digital encryption world has lost liquidity.

Throughout human history, the core of a country's cohesion is cultural identity. What is being done is to destroy the culture and ideals of encryption. Among the newcomers who entered the circle after 2020, how many have read the white paper of Bitcoin, how many have read the letters of Satoshi Nakamoto, how many know the Austrian School, and have recognized or reflected on its value and feasibility. Some people say that NFT and Meme are massive adoption. I raise my middle finger. This is the massive adoption of the currency circle, not the inheritance of Satoshi Nakamoto. After several rounds of bull markets, the crypto veterans were arrested and left. Crypto thinking is no longer mainstream in the crypto world. As the United States wishes, a cultural fault has been formed.

When the faith of an organization collapses, all order will fail, and every individual will desperately try to gain benefits for himself. Isn't this the most true portrayal of the current market and industry?

03

Postscript

Another form of progress: US credit de-intermediation and de-monopoly

As the world currency, the US dollar, through the pervasive digital encryption network, has swept the world with the power of Wall Street. For all countries, it is a bad news. However, for the world's human beings, it is indeed a progress. The euro zone was gradually formed based on the Mundell theory after many years of coordinated national fiscal and monetary policies under the consensus of European countries. This process took decades and left serious sequelae.

The US dollar has eroded global finance through the digital cryptocurrency network, but it has achieved "silent moistening". The monetary discipline of many countries in the world is not as good as that of the United States, and the monetary credit is of course far lower than that of the US dollar. But because of payment requirements and financial environment, many people have to choose to hold local currencies. And countries will endorse their own currencies by holding US dollars and US bonds.

In fact, the credit transmission here is that the credit of the US government is transmitted to a certain government through US bonds and US assets, and the certain government then uses this credit endorsement to increase its own currency. In this chain, the government of a certain country is an intermediary. We agree that it is valuable to remove intermediaries and break the interest structure of intermediaries.

In addition, this move makes the global capital market more integrated and breaks the monopoly of local forces on local financial resources.

Although the globalization of the crypto dollar has not achieved decentralization, it has achieved the removal of credit intermediaries and accelerated the integration of global finance. This is objectively also an improvement in the history of finance

The best is yet to come: the rebirth of encryption

In the past, I thought I was a native of the crypto world. In fact, I am not. I am willing to take the ideal of cryptography as my ideal and goal just because my past experience is in tune with the liberalism advocated by BTC. There are no natives in our generation, and we don't have enough time to accept the baptism and inspiration of cryptography and crypto culture. Generation Z is just the first generation of the Internet.

Twenty years later, thirty years later, people who are truly born under the influence of cryptography technology and crypto culture will truly grow up. They are reading BTC white papers, studying encryption algorithms, playing NFTs, and enjoying the convenience of DePIN. There is no China, the United States, the East, or the West in their minds. By then, decentralized technology will be more developed, the cost of decentralization will decrease exponentially according to Moore's Law, and the disadvantages of centralization will be clearly revealed in the culture and cognition of decentralization.

By then, a spark can start a prairie fire. Perhaps a free and harmonious world will be reborn from the hegemony of the US dollar.

Note: The content and opinions of this article were inspired by Deschool founder Rebecca and Polygon developer relations BrainSeong, and we would like to express our gratitude.

References:

Bitcoin White Paper:

https://bitcoin.org/bitcoin.pdf

Payment Finance Geography: Crypto Adoption in a Global Perspective:

https://s.foresightnews.pro/article/detail/48294

Eurosystem launches digital euro project:

https://www.ecb.europa.eu/press/pr/date/2021/html/ecb.pr210714~d99198ea23.en.html

White Paper on the Research and Development Progress of China's Digital RMB

http://www.pbc.gov.cn/goutongjiaoliu/113456/113469/4293590/2021071614200022055.pdf

The crypto ecosystem: key elements and risks

https://www.bis.org/publ/othp72.pdf

JinseFinance

JinseFinance