Source: 137Labs

Organizer:137Labs|Puffer|Jinse Finance

Host:Nina Xiaoerduo

Guests:

Amir|Puffer Founding Contributor

Steven|Puffer Contributor

Jason|Independent Researcher

Elma Ruan|Senior Researcher of Shilian Investment Research

Phyrex|Data Porter

Ming lau|Found of godel lab

Ian|MT Capital Partner

Puffer is the first The native Liquid Restake Protocol (nLRP) built by EigenLayer. It introduces the native Liquid re-staking token (nLRT), which can accumulate PoS re-staking rewards. Nodes within the protocol use Puffer's anti-slashing technology to reduce risks and improve capital efficiency, while increasing rewards through native re-staking.

As one of the hottest tracks in 2024, the concept of "re-staking" was proposed by Sreeram Kannan, founder of Eigenlayer. Its core mechanism is to allow pledgers to re-stake the already pledged ETH (including various types of LST) on other protocols and DApps and participate in their verification process. In this way, third-party projects can enjoy the security of the ETH mainnet, and ETH pledgers can also get more benefits, achieving a win-win situation.

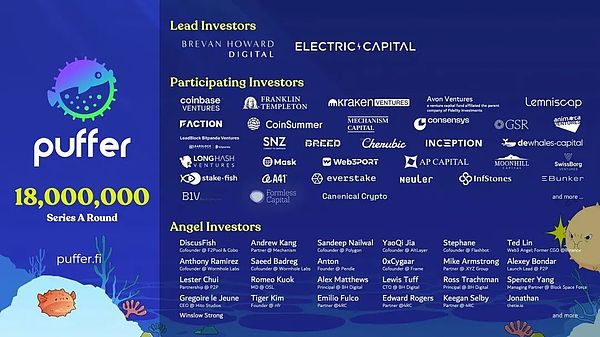

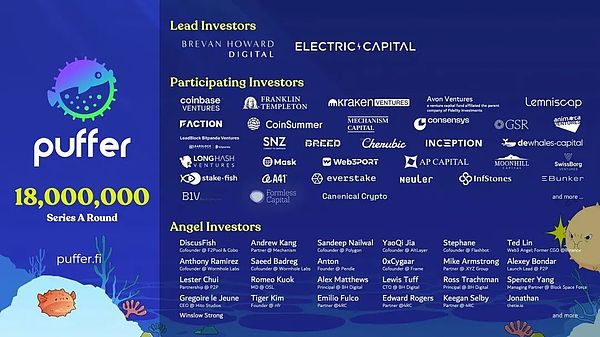

Puffer has received investment from top institutions in the industry, including Jump, Coinbase, Binance, ETF issuers Fidelity and Franklin, and its mainnet was launched on May 8. Today, we are honored to invite Puffer Founder and team to share with us Puffer's advanced concepts, technologies and future development direction in Restaking.

PART 1 |PUFFER VIEW

1. As a popular project in the Restaking track, Puffer has pledged more than 455K ETH and a TVL of nearly 1.4B. It has received the favor and investment of many crypto institutions and individuals including Binance, Shenyu, Fidelity, Coinbase, etc. What is the reason for Puffer's success?

Puffer's goal is to create a top infrastructure layer on Ethereum. Our goal is to create a secure platform for stakers and node operators to participate in staking and participate in re-staking in the future. Our unique architecture combines hardware-based security with the economic guarantees of Ethereum node operators, providing users with a lower risk and lower barrier to entry option.

Unlike other platforms, any user can join Puffer as an operator or staker. For blockchain platforms, security lies in decentralization. This is why we attracted such a high total locked value before the mainnet launch and why our vision has won the support of many industry giants.

2. How does Puffer achieve the minimum requirement of only 1 ETH to become a mainnet node operator, thereby reducing the hard threshold of 32ETH and expanding the scope of Ethereum participants? How does Puffer balance improving ETH staking centralization and ensuring asset security and increasing yields?

Making node operations permissionless and reducing margins is not an easy task. A strong mechanism must be created to ensure the safety of stakers' funds when node operators only have a 1 ETH margin. At Puffer, we must solve three challenges:

Lazy nodes: Traditionally, centralized staking providers have criticized the concept of decentralized pools due to the lazy node operator problem. A lazy node can switch on and off at will within the allowed margin (1 ETH) and deny users rewards. Puffer solves this problem with validator tickets.

MEV theft: One of the biggest challenges of reducing the margin of node operators is that they may steal MEV (if the node gets a MEV block with higher than their margin, they will steal it). Puffer solves this problem again with the concept of validator tickets.

Punishment mechanism: This is an existential risk for user funds on any protocol. Not only that, Puffer has implemented economic guarantees (1/2 ETH), and we also provide our own hardware-based anti-punishment tools to protect users. Our 1 ETH anti-punishment margin is scheduled to go live next month.

Lowering the margin means that node operators can run more nodes, and therefore have a higher chance of proposing blocks and getting higher rewards.

In addition, re-staking can also help users get more rewards than simply staking.

3. What impact will the launch of the Puffe mainnet have on the Restaking track? What are the new changes to Puffer's secure signatures, anti-slashing, and Native Liquid Restaking with the mainnet upgrade?

The Puffer mainnet marks the launch of the native liquid restaking feature on Puffer. stETH deposited in Puffer will be converted to ETH, further decentralizing the Ethereum network. With the launch of native restaking, stakers can now take advantage of AVS rewards. Anti-punishment and secure key management features reduce user risk in staking and restaking. Currently, there is no penalty mechanism on AVS, but once it goes live, this will become very important. Puffer plans to launch its own AVS to provide higher rewards to its stakers and node operators through staking.

4. When will Puffer Token be launched? What are the ways to obtain quotas besides staking? What is the mutual empowerment between the Puffer project and Token?

Every decentralized project needs tokens. We cannot announce a specific timeline at the moment, but there will be news soon. At Puffer, tokens will play an important role in deciding which AVS and which staking operators to introduce. We are also considering introducing the vetoken model.

5. Will Puffer be deployed on multiple chains in the future? What does the next Roadmap look like?

Puffer not only plans to launch its unique L2 solution, but will also soon expand native pufETH casting to other chains to reduce gas fees for stakers. We also plan to build an architecture that allows node operators to join smoothly with lower gas fees and simpler reward redemption. More information will be released soon.

PART 2 |KOLs VIEW

1. From Staking to Restaking, what impact does the re-staking track have on the ETH ecosystem?

Jason: First of all, from a macro perspective, the main impact of re-staking is to enhance the security of Ethereum. Currently, Ethereum has more than 10,300 nodes and is the most secure blockchain after Bitcoin. Through re-staking, especially through decentralized verification services (AVS), Ethereum's security can be released to other Layer 2 networks (Layer2), oracles, cross-chain bridges, etc. This means that Ethereum is not only an independent global computer, but also becomes the security foundation for many other ecological projects, thereby enhancing its overall robustness.

Although Ethereum's narrative appeal seems to have weakened in the current cycle, re-staking is undoubtedly the most important new track in this round of bull market. With projects such as Renzo and the completion of specific TGEs, many people are worried about whether the re-staking track has reached the end, but the reality is that this is just the beginning. At present, the entire re-staking track may have just started the first 20%, and many projects will be launched on the mainnet in the future.

The establishment and sustainability of the re-staking track still need to be verified by time. Some people question whether re-staking is just a points game, but through staking and security release, Ethereum may achieve real prosperity through these accumulations in the future. Therefore, it is wrong to think that Ethereum's re-staking track has reached the end, and this field has just begun.

Elma: Since Ethereum transformed from proof of work (PoW) to proof of stake (PoS) in 2022, more and more people have begun to pay attention to its staking method, and its staking rate has also increased significantly. At present, many Ethereums are staked in centralized exchanges, large swap platforms, or some leading liquidity staking (LSD) protocols. From the data, the staking ratio of Ethereum has far exceeded the original threshold of 15% set for listing. This has led to a certain monopoly tendency in the market. In addition, due to certain technical and economic thresholds for staking, such as the need to own 32 Ethereum, the verification nodes in the network are becoming more and more concentrated.

From the narrative of staking, it started with the LSD protocol to bring liquidity and income to self-staking assets, and then developed to LSD and LSD 5, becoming a strong consensus interest-bearing asset. Restaking provides a new staking method that helps the rapid development of the Ethereum ecosystem and reduces the trend and risk of centralization.

From a financial perspective, staking to restaking has become a very cost-effective investment option. Participating in restaking can basically obtain multiple benefits. In traditional finance, similar practices are also very common. Restaking not only attracts people in the traditional financial field to enter the field of cryptocurrency, but also enhances people's recognition of the financial attributes of Ethereum. Through restaking, Ethereum can achieve business expansion and build a more structured financial system, further improving its self-narrative ability.

Phyrex:They (re-staking) are actually a continuation of the ecosystem, especially restaking. I don't think restaking is a brand new track. It may actually be just an extension of decentralized finance (DeFi). DeFi itself has already had an impact on the traditional economy. Therefore, whether it is staking or restaking, they are further extensions of DeFi.

In the past, Ethereum's on-chain income was relatively low. Through staking and restaking, this not only helps Ethereum itself, but also promotes the on-chain development of the Ethereum ecosystem. Many people believe that staking and re-staking slows down the liquidity on the Ethereum chain, thereby reducing selling pressure. For those who trade frequently, more liquidity being locked may have a positive impact on prices.

In summary, staking and re-staking not only enhance the security and stability of Ethereum, but also promote the development of the entire ecosystem and provide potential support for prices. This not only enhances user trust, but also creates more opportunities for Ethereum's application in the DeFi field.

2. What is the current situation of the EigenLayer ecosystem? What will be the future development of the re-staking track?

Ian: The current ecology is mainly divided into the Layer ecology and the AVS (decentralized verification service) ecology. In these ecologies, I am very optimistic about the current development. In addition to Puffer, Puffer itself has received investment from Balance Lab. In addition, some projects have been launched on Binance. Therefore, I think the current market environment is relatively hot for these projects, attracting a lot of attention and fierce competition.

Regarding the future development form, from the perspective of the primary market, EigenLayer is a very important ecological project, and Puffer has also been invested by the Agenda team. This makes me very optimistic about Puffer. I believe that there will definitely be a leading project in the AVS ecosystem, just like the projects with very high returns and great influence that have appeared in the Polkadot ecosystem.

In general, there will be many projects emerging in the AVS ecosystem, but it is very likely that one or several leading projects will stand out and become the core and leader of the entire ecosystem. I am confident in the future development of Puffer and EigenLayer, and look forward to seeing them play a greater role in the ecosystem.

3. How do you view the saying that Restaking is a game of passing the parcel, TVL repeated calculation, false prosperity, and a problem with a project may lead to a series of stampedes?

Jason:There is a certain overheating phenomenon in the Restaking track, which has led to a mixture of good and bad projects, and phenomena such as "nesting dolls" and repeated calculation of TVL, which need to be treated with caution.

The actual benefits that can be obtained through restaking are not the so-called "one fish, two kills" points game, but the benefits of staking Ethereum itself, plus the benefits of capturing the security of other chains and protocols through restaking.

Participating in projects endorsed by strong VCs and becoming a node or contributor of the project is a relatively safe way to participate in the primary market, and you can share the benefits with the big guys.

Try to avoid participating in wild chicken protocols. Even if they may give exaggerated returns, you must ensure that your efforts are rewarded and the cost of investment is safe.

Emphasis on the careful selection of projects, especially in the hot market, beware of the risks of bad projects, and choose to participate in projects with reliable endorsements and strict background checks.

4. How can retail investors or novices identify and participate in high-quality Restaking projects?

Ian: We have conducted in-depth research on the nesting doll phenomenon in the Restaking track and have concerns. For a certain period of time, the market has been overheated.

The risks are mainly divided into two aspects: one is that after participating in high-quality LRT projects, other related or non-core protocols may have arbitrage risks; the other is that some projects may abuse points due to overheated markets, and there are problems of opacity and centralization.

The method of identifying high-quality Restaking projects includes paying attention to primary market information such as team background and fund endorsement. In addition, TVL is also an important indicator for evaluating the attractiveness of projects, especially for asset management projects such as Ethereum.

As a crypto-treasury bond, Ethereum's TVL reflects the degree of participation of institutions and asset management, so projects with high TVL often have the support of large institutions. For retail investors, participating in projects requires careful selection and attention to indicators such as TVL.

Elma:In addition to financing and TVL, the incentive policy and technical level of the project are also important considerations. Especially for Restaking projects, technical security is crucial.

Restaking is not a simple game of passing the parcel, but a leverage opportunity for investors. But high returns are often accompanied by high risks, so security issues are crucial.

When choosing a project, pay attention to its technical aspects. For example, the Puffer project has outstanding technical security, and its security center is supported by the Ethereum Foundation, which can effectively reduce technical risks and penalty risks and provide financial guarantees. Reducing technical risks is one of the important aspects of choosing high-quality projects.

JinseFinance

JinseFinance