Gemini, the cryptocurrency exchange founded by the Winklevoss twins and focused on compliance and security, recently officially listed on the Nasdaq (ticker: GEMI), becoming the third US-listed cryptocurrency exchange after Coinbase and Bullish. The IPO raised approximately $425 million and received a warm market response. On its first day of trading, GEMI's stock price soared 45% before closing up over 14%, bringing its market capitalization to $3.8 billion. Gemini, once known for its "compliance-first" approach, now faces a stark reality: a net loss of $282.5 million in the first half of 2025 and persistently negative operating cash flow. With a planned maximum fundraising target of approximately $317 million, the IPO looks more like a defensive strategy, prioritizing debt repayment. Despite its extensive product portfolio, encompassing spot/institutional custody, offshore perpetual contracts, the Gemini USD stablecoin, credit cards, and Nifty Gateway, Gemini remains far ahead of rivals like Coinbase and Robinhood in key metrics like trading volume, monthly active users, and platform assets. Compliance has devolved from a premium tag to an industry threshold. This article analyzes key information from the S-1 from both a product and financial perspective, offering a sober assessment of Gemini's competitiveness and investment value, helping you determine whether this "compliant exchange" is worth investing in. 01 Gemini's Products/Ecosystem Products and Revenue Engines (Multi-Purpose Parallel Development) As a US-based onshore crypto exchange focused on compliance, Gemini's product and revenue engines exhibit a multi-pronged approach. For spot and institutional services, the retail side offers the Exchange App and ActiveTrader, while the institutional side offers Gemini Prime and custody (multi-sig, offline cold storage, and compliance audits). Core revenue comes from trading fees and custody fees. Regarding retail pricing, the Gemini App ("Gemini Model") charges a 1.49% trading fee + a 1.00% convenience fee for Instant/Recurring orders (the convenience fee fluctuates with slippage, capped at 2%). Limit orders have a 1.49% trading fee and no convenience fee. ActiveTrader utilizes a tiered market maker/taker rate: 0.20% for makers and 0.40% for takers with 30-day trading volume <$10,000, decreasing to 0.05%/0.15% for $1 million, 0.00%/0.04% for $100 million, and 0.00%/0.03% for $250 million. For institutional and custodial services, Gemini Custody® charges an annualized fee of 0.40% or $30/month per asset (whichever is greater), with an administrative withdrawal fee of $125. There is no minimum size requirement (assuming it covers the minimum monthly fee). Compliance and security selling points include cold storage, multi-party controls and role governance, ISO 27001 and SOC 2 Type 2 certifications, and disclosure of hot and cold insurance limits ($25M for hot wallets, $100M for cold storage, totaling $125M). The institutional trading stack integrates Prime, eOTC, and Exchange to serve hedge funds, family offices, and financial institutions. eOTC supports delayed net settlement and credit extensions. Regarding revenue structure, the retail side primarily relies on a fixed fee (App) + tiered fee structure (ActiveTrader). The institutional business utilizes a traditional high-volume, low-fee strategy to lower the overall take-rate. Trading fees remain the primary revenue source, accounting for approximately two-thirds. Custody is charged based on management fees and withdrawal fees, and features like "instant trading from cold storage" enhance institutional engagement. Key points of differentiation include security, compliance, and cold storage capabilities (including insurance) on the institutional side. Furthermore, the high-tiered (≥$100 million) maker/taker fees of 0%/0.04% offer attractive pricing for large clients, but this also dilutes the average fee rate. The derivatives offering, managed by the Gemini Foundation, operating outside the US, is positioned as a key tool for increasing trading depth and fee revenue, but places higher demands on compliance boundaries and risk management. The product is a non-US linear perpetual (operating entity: Gemini Artemis Pte. Ltd.). The contract is denominated and settled in Gemini Dollars (GUSD), equipped with funding fees and a forced liquidation/insurance fund mechanism (a 0.5% forced liquidation fee, calculated hourly). Media reports indicate that initial launch offers up to 100x leverage. Regarding fees, the official Derivatives Fee Schedule utilizes a tiered maker/taker structure, with a cap of negative/zero fees for large market making. Regarding regulatory expansion, the platform obtained a MiFID II investment services license from the MFSA on May 9, 2025, and plans to launch regulated derivatives (including perpetuals) in the EU/EEA. On August 20, 2025, it received a MiCA license, expanding its coverage to 30 European countries and further paving the way for derivatives and structured products. Revenue primarily comes from maker/taker transaction fees, a 0.5% liquidation fee, and withdrawal/funding operating fees. Funding fees are essentially bilateral settlements between long and short positions, and the platform does not necessarily count them as revenue. Overall, the "MiFID II + MiCA" dual-license approach significantly reduces regulatory uncertainty and helps attract high-net-worth and institutional liquidity in Europe. However, ultimate scalability still depends on the robust operation of liquidity, risk management, and clearing systems. Regarding stablecoins, GUSD, issued by Gemini and pegged 1:1 to the US dollar, offers institutional benefits with the advancement of US stablecoin legislation (such as the GENIUS Act), but its volume remains smaller than that of USDT/USDC. Regarding compliance and transparency, GUSD has been regulated by the NYDFS since 2018. Gemini states that its 1:1 reserves are composed of cash, government money market funds, and short-term US Treasury bonds. The company also issues monthly independent accounting certifications, and its reserve account is dedicated to its intended purpose. Size Comparison (for reference): As of September 3, 2025, Gemini's circulating market capitalization was approximately $51 million; USDC was approximately $72 billion, and USDT was approximately $168 billion, a significant gap. If legislative progress is achieved, it will generally benefit compliant stablecoin issuers, including Gemini. Gemini's payment and credit card business is being developed in partnership with WebBank and Mastercard. According to the card agreement document dated February 2025, the card has no annual fee, and the APR is tiered based on creditworthiness and the benchmark interest rate. Rewards are deposited instantly in crypto assets. Gemini states that residents of all 50 US states are eligible to apply (subject to restrictions). The marketing team has previously launched an XRP-themed page. Incentives: Cardholders can choose from a variety of cryptocurrencies offered on Gemini and earn up to 40% cash back on eligible purchases. Cardholders can also earn up to 3% cash back on dining, 2% on groceries, and 1% on other purchases. Rewards are automatically deposited into their Gemini accounts. The revenue structure follows industry norms: interest margin, annual fees, penalty interest, various fees, plus interchange commissions. WebBank serves as the issuer within the Gemini ecosystem, and the specific commission ratio is undisclosed. The strategic value of this business lies in expanding everyday payment touchpoints and strengthening brand penetration. Themed events promote customer acquisition and engagement. Regarding NFTs, Gemini acquired Nifty Gateway in November 2019 and transitioned it to Nifty Gateway Studio (NGS) in 2024. This shift from a trading platform to a platform focused on brand-creator collaboration and publishing. In recent years, the company has announced numerous collaborations with art projects, fostering content and ecosystem engagement that complement its core business. Overall, Gemini is integrating trading, custody, clearing, and compliance through its diverse offerings: spot/institutional trading, derivatives, stablecoins, payment cards, and NFTs. The platform is simultaneously focusing on its fee structure, institutional engagement, and brand engagement, aiming to enhance long-term revenue resilience through the combined benefits of compliance and product depth.

Competitive Landscape and Market Share (Exchange)

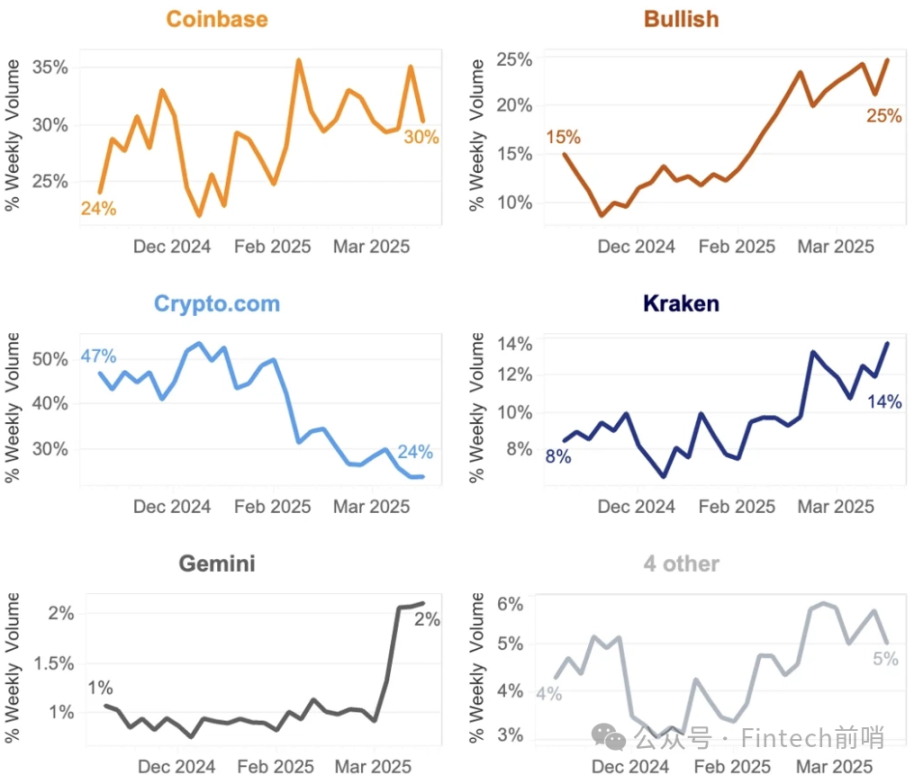

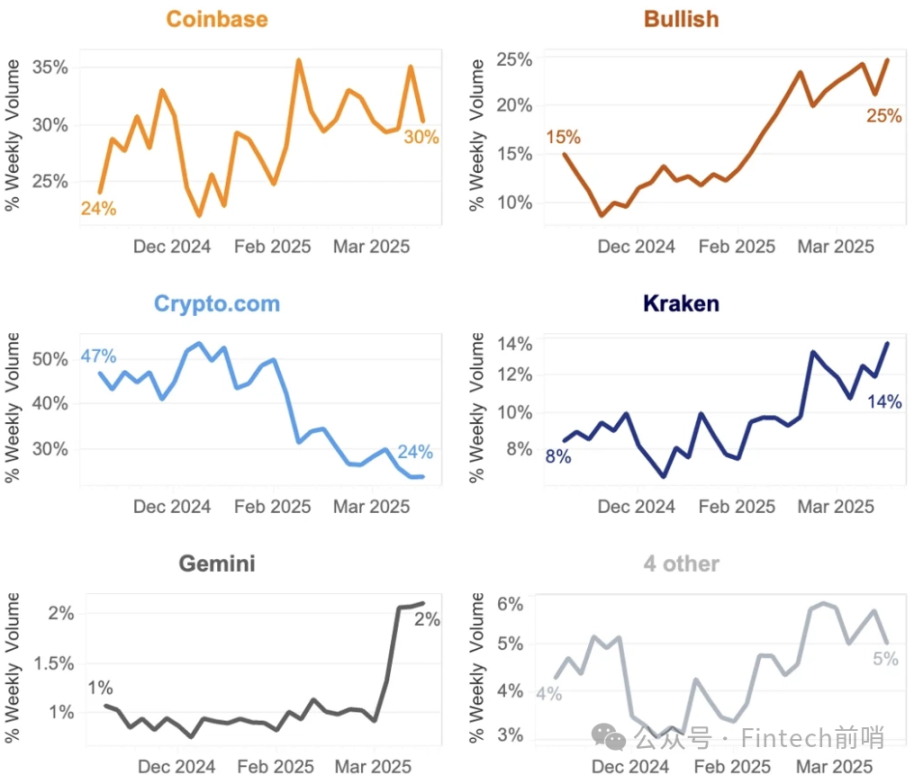

In the landscape of compliant spot exchanges, Gemini is in the "leading tier, but not the first tier." According to Kaiko's comprehensive ranking, its spot market share rose from approximately 1% to 2% in the spring of 2025, demonstrating a resilient "two steps forward, one step back" pattern. This period of growth was followed by a partial reversal, reflecting a coexistence of upward momentum and volatility in the compliant market. Coinbase remains the leading US stock market, with clear advantages in its integrated retail and institutional operations. Its synergy with derivatives businesses like options creates greater economies of scale and brand premium. Kraken, a long-established compliant US exchange, has a long history in the EU market and a more solid regional presence. Regarding retail entry, Robinhood's acquisition of Bitstamp (announced in 2024, closing in 2025) strengthens its institutional and global capabilities, further increasing competitive pressure on retail entry points in the US compliant market. On the primary market, Bullish's successful 2025 IPO has heightened the capital market's risk appetite and valuation for assets on compliant exchanges, providing valuable insights for Gemini's potential future offering window. Within this landscape, we believe Gemini's market share and ranking are not among the top tier, and its exchange products and services are poorly differentiated. While focused on compliance, Gemini's scale is too small and lacks a significant edge compared to its US competitors. User Reputation and Product Variety: In terms of user reputation and product coverage, Gemini's listing and availability align with mainstream compliant platforms: it currently supports over 70 crypto assets and covers over 60 countries (Source: S-1/Reuters). Third-party reviews show a 4.8/5 rating on the App Store and a 4.3/5 on Google Play, indicating generally good mobile experience and stability. However, reviews on Trustpilot are quite mixed, with negative feedback primarily focused on areas like risk control triggering and customer service response, suggesting room for improvement in user communication and process experience within its compliance module. In terms of product diversity, Gemini offers a broad and comprehensive product line: it offers both institutional custody and trading stacks, as well as simultaneous developments in derivatives, credit cards, stablecoins, and the NFT ecosystem, forming a relatively complete business matrix. However, there remains a noticeable gap in depth and activity (such as order book thickness and institutional market-making coverage) compared to first-tier platforms. This not only impacts fee negotiation power but also directly impacts unit economics. Given that the S-1 currently provides inadequate breakdown of key operating metrics, further monitoring is needed to assess the company's progress in liquidity acquisition, institutional partnerships, and fee structure improvements. 02 History and Business Status Founding and Positioning Gemini was founded in 2014 by Cameron and Tyler Winklevoss in New York as Gemini Trust Company, LLC. On October 5, 2015, the New York Department of Financial Services (NYDFS) granted it a Limited Purpose Trust license under the New York Banking Law, establishing its foundational approach of prioritizing safety and compliance. In terms of compliance and auditing, Gemini completed SOC 2 Type 1, conducted by Deloitte, in 2018, and passed both SOC 1 Type 2 and SOC 2 Type 2 (covering the exchange and Gemini Custody) on January 19, 2021. Early on, Gemini differentiated itself from its peers by positioning itself as a "compliance template."

Business transactions with related parties

In terms of related parties and business cooperation, the company has signed service agreements with entities jointly held by WCF (such as Elysian, Salient, and WCM) to obtain key operational support such as equipment leasing, cloud services, data centers, and management consulting; for the C-end and payment ecosystem, it has in-depth cooperation with multiple parties: first, it has linked its business with Ripple to expand Ripple USD (RLUSD) as the base currency for all spot trading pairs on the platform, and jointly launched an XRP reward credit card; second, it has cooperated with WebBank, and it has launched an XRP co-branded credit card as the issuing bank, expanding the application scenarios of encrypted payment and customer acquisition touchpoints under a compliance framework.

Operating scale (media reports based on S-1 disclosure, used as a reference for magnitude)

Platform size (as of 2025-06-30)

Lifetime trading volume ≈ $285bn;

Assets on our platform (AUC) > $18bn;

Monthly trading users (MTUs) ≈ 523k; Institutional clients ≈ 10k;

Cumulative processed transfer amount > $800bn. The above information is available from multiple authoritative secondary sources reporting on S-1 extracts/database pages: Investopedia, Renaissance Capital/IPO-Scoop, Investing.com, etc. Product Coverage Supplement (S-1/DRS Extract): Supports over 80 trading assets, Custody covers over 130 assets (as of June 30, 2025). S-1/A Filing Index (for original verification): SEC EDGAR CIK: 0002055592 (latest S-1/A index page). 03 Financial Analysis: Financial Analysis: Growth Fails to Overshadow Losses, Severe Dependence on External Funding. Performance Overview: Significant Losses. 2024 Operating Data: Demonstrated Growth, Achieving 512,000 Monthly Trading Users, Annual Trading Volume of US$38.6 Billion, and Platform Custody Assets of US$18.2 Billion. Continuous Significant Losses: Growth is offset by significant losses. A net loss of US$159 million was recorded for the 2024 period. Losses worsened in the first half of 2025: The company achieved revenue of $68.6 million and processed $24.8 billion in spot trading volume, but suffered a net loss of $282.5 million during the same period. Balance Sheet and Cash Flow Status: Operating cash flow remains negative: The company's core business has yet to achieve self-sustaining profitability. Operating cash flow was -$109 million in 2024 and -$207 million in 2023, primarily due to adjustments for non-cash items and changes in working capital. Cash Reserves (as of December 31, 2024): $42.8 million in cash and equivalents, $28.4 million in restricted cash. Client Fund Segregation: $575.6 million in client funds are held in segregated custody, dedicated to client interests, demonstrating the company's commitment to asset security and compliance. Survival Mode: Reliance on External Funding. High-Risk Financial and Asset Strategies: Bitcoin "Treasury Asset" Strategy: The company uses BTC as a core reserve asset and prefers to finance its holdings through US dollar debt rather than directly selling BTC. This can alleviate cash pressure during bull markets, but it also amplifies cyclical risks during downturns. Clearing Historical Risks ("Earn Incident"): Following regulatory requirements from the NYDFS, Gemini has returned over $2 billion worth of crypto assets to Earn users and paid a $37 million fine. While costly, this move has substantially resolved the historical issue, repaired some of its reputation, and reduced contingent liability risks.

Source of funds: Credit support from multiple parties to maintain operations:

1. Outstanding cryptocurrency loans: 5,054 BTC, 26,629 ETH

2. Outstanding US dollar principal: US$116.5 million

3. WCF also holds all convertible bonds issued by the company.

Future Plans: IPO Focused on Debt Repayment

Summary

Gemini's financial condition is precarious, with significant net losses largely driven by non-cash or highly volatile items, such as fair value adjustments on related-party convertible bonds, interest on borrowings, and changes in the fair value of its crypto holdings. The company has long relied on external funding from the two founding brothers. The purpose of the IPO financing is to prioritize the repayment of third-party debts, but the US$400 million financing amount still cannot fully cover all the company's debts, and the company's operating cash flow outflows an average of 100-200 million yuan per year. The funds raised from the IPO can only support the company's operations for 2 years.

Operational Data Comparison with Peers: Significant Gap

Analysis of Gemini's Own Operational Status

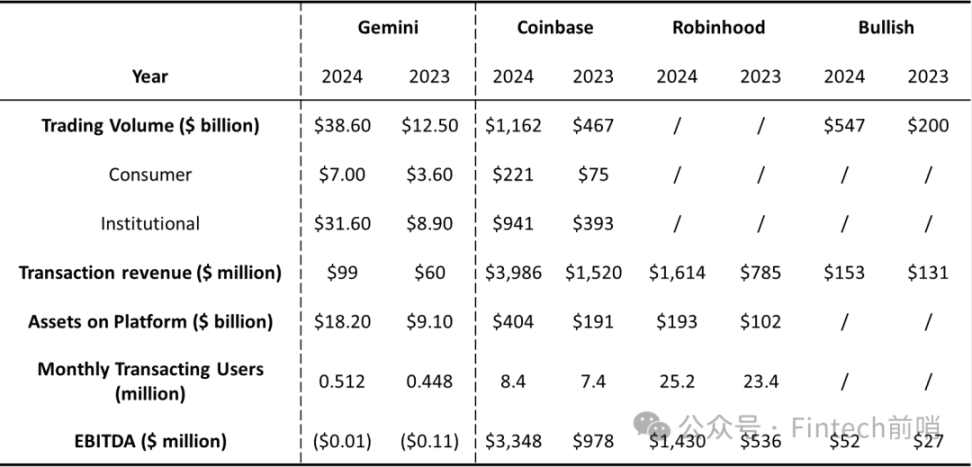

Operational Data: Gemini achieved relatively modest growth in both user numbers and trading volume in 2024. The number of monthly trading users increased from 448,000 in 2023 to 512,000 in 2024, and the total trading volume increased from US$12.5 billion to US$38.6 billion. Platform assets also saw significant growth, increasing from $9.1 billion to $18.2 billion. Profitability: However, despite improved operating figures, Gemini's profitability remains a significant challenge. While EBITDA has improved slightly, from negative $110,000 in 2023 to negative $13,000 in 2024, it remains negative. This means Gemini's revenue cannot cover its operating costs, including employee salaries. Its path to profitability remains uncertain, raising concerns about profitability. Comparison with Peers' Operating Data: Trading Volume: Gemini's trading volume is significantly lower than that of Coinbase and Bullish. Coinbase's trading volume in 2024 is projected to reach $1.162 trillion, Bullish's $547 billion, and Gemini's just $38.6 billion. Gemini's primary revenue comes from retail investors. Despite a significant increase in institutional trading, its total trading volume lags far behind Coinbase's. User size: Gemini's user base is significantly smaller than both Coinbase and Robinhood. Coinbase's monthly trading users in 2024 will be 8.4 million, Robinhood's will be 25.2 million, and Gemini's will be just 512,000. This represents a significant gap in user numbers compared to Coinbase and Robinhood. Profitability: Coinbase and Robinhood are expected to be profitable (with positive EBITDA) in 2024, while Gemini's EBITDA remains negative. Coinbase demonstrates a clear advantage in profitability. Platform Assets: Coinbase and Robinhood have significantly higher platform assets than Gemini. Coinbase's platform assets in 2024 are expected to be $404 billion, Robinhood's $193 billion, and Gemini's $18.2 billion.

Summary

In summary, despite its growth, Gemini still lags significantly behind its main competitors in terms of market share, user base, and profitability, requiring further improvement in profitability and market competitiveness. Therefore, the company's core competitiveness lies not in market share but in its differentiated compliance strategy.

04 Core Team

Founders and Background

Key Figures: The company was founded and led by twin brothers Cameron and Tyler Winklevoss. They are widely known for their early legal dispute with Mark Zuckerberg over Facebook's founding rights. They used the settlement funds to become early investors in Bitcoin and staunch advocates of cryptocurrencies.

Serial Entrepreneurship and Investment: Prior to founding Gemini, they established Winklevoss Capital in 2012 as their family office and venture capital vehicle. Through the firm, they actively invested in numerous cryptocurrency and technology startups, building a broad network within the industry ecosystem.

Political Involvement and Policy Lobbying

Open Support for the Trump Campaign: The Winklevoss brothers are the most prominent supporters of Donald Trump in the crypto industry. In 2024, the two each donated $1 million worth of Bitcoin to Trump's campaign and publicly criticized the Biden administration's "war on crypto," arguing that its regulatory policies are stifling innovation. Systematic Political Donations and Lobbying: Their donations are not isolated acts, but part of a broader $190 million wave of political contributions from the crypto industry. According to reports from the Financial Times and other media outlets, the Winklevoss twins, along with key figures from companies like Coinbase, Ripple, and a16z, have invested vast sums of money through Super PACs, aiming to systematically influence the American political landscape. 05 Summary: Investment Value Ranks Bottom Among Verticals Despite Gemini's foray into compliance and its diligent efforts to build a diversified product portfolio encompassing spot trading, derivatives, stablecoins, and payments, a deeper analysis of its financials, operational data, and competitive landscape reveals that its investment value is near the bottom of the regulated crypto exchange market. 1. Weakening Differentiation: Its "compliant" label no longer provides a sufficiently wide moat against similarly licensed giants like Coinbase and Kraken. The exchange's products and services are poorly differentiated, and Gemini's small scale hinders its ability to generate strong network effects and cost advantages. Its "compliant" selling point has failed to translate into sustained market share leadership or profitability. 2. Dire Financial Condition: Sustained and growing losses, perennially negative operating cash flow, and heavy reliance on funding from the founders' fund reveal the fundamental fragility of its business model. The IPO's primary purpose is clearly to repay third-party debt, making it more of a survival measure to maintain operations than a strategic expansion to drive future growth. The funds raised will only cover approximately two years of the company's cash burn, leaving the path to profitability distant and uncertain. 3. Significant operational data gap: Gemini's operational data reveals a comprehensive gap with the industry leaders. Whether in terms of trading volume, monthly trading users, platform asset size, or profitability, Gemini lags far behind competitors like Coinbase and Robinhood. With Robinhood's acquisition of Bitstamp, market competition will intensify, further squeezing the space left for second-tier players like Gemini. Therefore, for investors seeking compliant cryptocurrency trading platforms, Gemini is not an ideal investment. Allocating capital to industry leaders with solid market share, resilient business models, and demonstrated profitability, such as Coinbase, Kraken, and Robinhood, is undoubtedly a more prudent and wise choice.

Catherine

Catherine

Catherine

Catherine Aaron

Aaron Hui Xin

Hui Xin Davin

Davin Jixu

Jixu Jixu

Jixu Hui Xin

Hui Xin Aaron

Aaron Hui Xin

Hui Xin Davin

Davin