Is Canada Ready to Combat the Rising Threat of Deepfakes?

Canada's intelligence agency alerts to the growing threat of realistic deepfakes, urging global cooperation to address the risks posed by advanced AI technologies.

Hui Xin

Hui Xin

Author: 0xDragon888, Medium

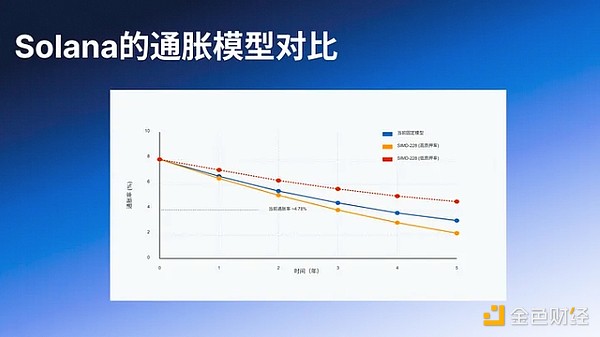

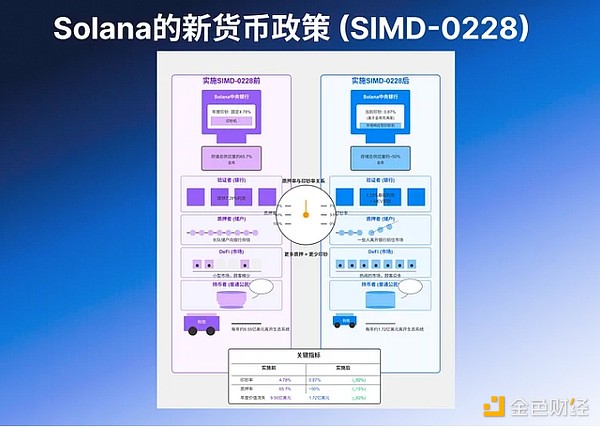

Essence of the proposal: SIMD-0228 significantly reduces Solana's inflation rate (from 4.779% to 0.87%), reduces token issuance, ensures network security, and releases capital to DeFi.

Core mechanism: The current inflation is fixedly decreasing (8% minus 15% year by year, target 1.5%), which is criticized as "stupid issuance"; the new model is market-driven, with high staking rate (>65%) and low inflation, low staking rate (<33.3%) and high inflation, and 33.3% is the balance point.

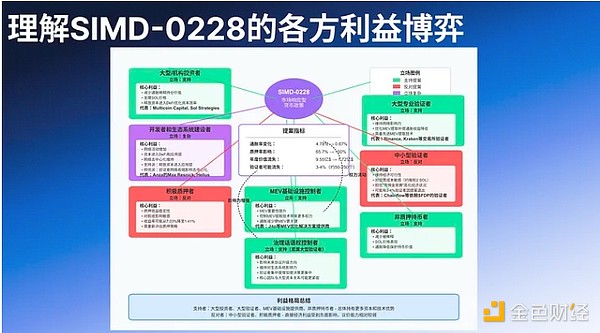

Position differentiation: large investors and non-stakers support (less dilution, stable price); small and medium-sized validators and stakers oppose (revenue decline); large validators support (MEV is strong). Big fish are popular, small fish are struggling, just like supermarkets cut prices, big stores are worry-free, small stores are closed.

Impact on validators: The pledge rate may drop from 65.7% to 45–55%, 3–4% of validators (40–55) may withdraw, income will shift from inflation to MEV, and DeFi locked SOL will increase by 5–10%, just like factory layoffs, efficient ones will stay, and inefficient ones will leave.

Ecological impact: 382 million will be issued annually, of which 25% (955 million) will be lost. The SIMD-0228 proposal will plug the "leaky bucket" and retain 783 million per year, promote the development of DeFi, optimize resources, and reduce dilution.

MEV and inflation: Validator income will shift from "fixed salary" to "tips" (MEV). In 2024, MEV will reach 675 million, accounting for 14% of the issuance, with high returns but unstable.

Security risks: low pledge rate → rising inflation → falling prices → validators withdraw, forming a vicious cycle; MEV relies on increasing centralization risks, and stability under extreme conditions remains to be verified, such as economic recession, which can be prevented but not perfect.

Proposal significance: SIMD-0228 is not only a technological change, but also represents Solana's shift from "overpayment to ensure security" to "finding the minimum necessary payment", from artificial rules to market balance, which is a bit like the transition from a planned economy to a market economy. Solana has the potential to move towards a more mature and market-oriented economic model

Action suggestions: It depends on whether the proposal can be passed. If it is passed, coin holders need to adjust their pledge strategies, validators need to optimize MEV, and developers can seize new DeFi opportunities.

Key Terms Explanation

Before we dive into the analysis, let’s first understand a few core concepts:

Staking Rate(s): The percentage of SOL locked for network validation in the total supply, currently about 65.7%

Inflation Rate(i): The percentage of newly issued SOL in the total supply each year, currently about 4.779%

Validator: The node operator of the Solana network, responsible for validating transactions and maintaining network security

MEV (Maximum Extractable Value): The additional income that a validator receives from transaction sorting, similar to “transaction tips”

Leaky Bucket Effect: The phenomenon that the new value created by inflation flows out of the ecosystem through channels such as taxes

Newbie-Friendly Guide: This article analyzes in detail how the SIMD-0228 proposal changes Solana's inflation mechanism. Even if you are not familiar with the concepts of blockchain and cryptocurrency, you can pay attention to the "Newbie Explanation" section in the article. I will explain obscure and complex concepts in simple language. Now let's get to the point.

Solana is standing at a historic turning point - the SIMD-228 proposal may completely change its inflation mechanism, from a fixed schedule to a dynamic model driven by the market. This is not only a change at the technical level, but also a profound reshaping of the economic structure of the entire Solana ecosystem.

The core issue that the SIMD-228 proposal attempts to solve is: how to minimize unnecessary token issuance while ensuring network security?

After understanding the core issues, let’s take a deeper look at the background. The following five questions I have sorted out will help understand why this proposal has sparked such widespread discussion:

What are the deep-seated games behind the proposal? How is the profit pie redistributed?

What impact has the validator economy suffered? How will it be reshaped?

Will a reduction in the staking rate threaten network security? Is there a critical point?

How will the relationship between MEV and inflation change? What impact will the shift in income sources have?

How does the “leaky bucket effect” quietly erode the Solana ecosystem? Hundreds of millions of dollars are being lost every year?

Can low staking rates trigger systemic risks? Will negative feedback loops threaten network stability?

Xiaobai explained: Imagine that Solana is like a country that is considering changing the way it prints money. Currently, the country prints new money every year on a fixed schedule; the new proposal suggests that the amount of new money printed should be determined based on how many people deposit money into the bank (stake). If many people deposit money, print less; if few people deposit money, print more. This change will affect everyone: banks (validators), depositors (stakers), consumers (application users), and ordinary coin holders

The SIMD-0228 proposal was jointly proposed by three influential figures in the Solana ecosystem:

Tushar Jain — Co-founder of Multicoin Capital, one of Solana’s earliest and largest institutional investors. Tushar has publicly expressed his long-term optimism about Solana on many occasions and discussed blockchain monetary policy on many occasions.

Vishal Kankani — Investment partner at Multicoin Capital, focusing on cryptocurrency economics and market structure research. He has published many analytical articles on the Solana ecosystem and value capture mechanisms.

Max Resnick — Engineer at Anza, a member of the Solana core development team, has a deep technical background and in-depth understanding of the Solana codebase. He provided technical implementation expertise in the proposal.

It is worth noting that two authors are from Multicoin Capital, a venture capital firm that is one of the largest institutional investors in the Solana ecosystem and holds a large number of SOL tokens. This background is very important to understand some of the interests of the proposal.

Xiaobai explained: The authors of the proposal are not ordinary people, but "big players" in the Solana world. Two are executives of large investment funds and hold a lot of SOL; the other is a core technical staff of Solana. It is important to understand who is driving this change, because it may affect the way they design the plan.

Proposal timing: January 2025

MEV revenue growth - Solana's MEV revenue in Q4 2024 reached an astonishing $430 million, more than 10 times that of Q1. This data provides strong support for reducing inflation (Solana Floor), indicating that validators already have sufficient alternative sources of income.

High staking rate status - The current staking rate of 65.7% is at a historical high, creating favorable conditions for reducing inflation.

Ecosystem Maturity —The Solana DeFi ecosystem is mature enough to absorb and utilize the capital released from staking.

Market Environment —Monetary policy and inflation control become hot topics in the broader cryptocurrency market.

Core of Change: Current State and Proposal Goals (Idealized)

The following table compares in detail the current state of the Solana network (2025–01–18) with the expected goals after the implementation of the SIMD-0228 proposal:

These data clearly show the core goals of SIMD-0228:

Significantly reduce inflation rate

Reduce unnecessary token issuance

While maintaining sufficient network security and releasing more capital into the DeFi ecosystem.

Xiaobai explanation: The comparison of Solana's inflation model to this table tells us how big the change is. In simple terms: Solana's current annual "printing rate" is 4.78%, and the new proposal wants to reduce it to about 0.9%, a reduction of 82%! This means that the basic salary of validators (network maintainers) will be greatly reduced, but they can make up for it through other income (MEV, which can be understood as a "tip" for transaction sorting). At the same time, there is a potential for about 40-55 small validators to exit the network due to insufficient income.

Original formula and design ideas

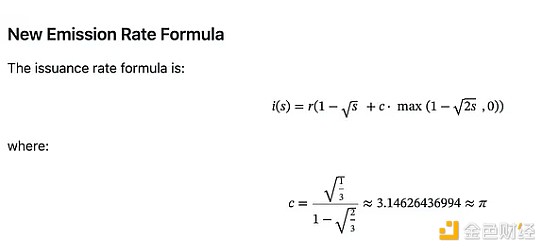

The core of the SIMD-0228 proposal is to introduce a dynamic inflation formula based on the pledge rate:

This formula looks complicated, but its design is very clever:

Using a square root function instead of a linear relationship, it is more moderate to reduce inflation at a high pledge rate and more aggressive to increase inflation at a low pledge rate

A critical point is designed: when the pledge rate is 33.3%, the inflation rate is equal to the current fixed rate

The coefficient c (approximately equal to π) ensures a smooth transition of the formula in different pledge rate ranges

Xiaobai Explanation: Don’t worry about this complicated formula! The following figure will give you a simple understanding. The key is to understand its function: when many people stake SOL (more than 65%), the speed of "printing money" will be greatly reduced; when the number of people staking decreases (less than 50%), the speed of "printing money" will increase moderately; if the staking rate falls below 33.3%, the speed of "printing money" will increase significantly to attract more people to stake. This is like an automatic regulator to keep the network balanced.

SIMD-0228 simulation of different scenarios: high pledge rate, medium pledge rate, and low pledge rate. The formula design reflects: the inflation rate is automatically adjusted through the market mechanism to just meet the network security needs, neither more nor less.

Proposal Interests

By carefully analyzing the content of the proposal, the background of the author, and the timing of the proposal, we can identify the following main interests:

Reduce holding dilution - Multicoin Capital holds a large amount of SOL, reducing inflation and reducing annual dilution by 4.56%.

Support SOL prices - Reduce new supply, which may push up prices (Cryptotimes).

Release capital into DeFi - The proposal repeatedly emphasizes that high pledge rates inhibit the development of DeFi, driving capital into DeFi, and Multicoin's investment projects benefit.

Shaping a market-driven narrative - The proposal emphasizes that "the market is the best price discovery mechanism in the world" and strengthens Solana's "efficient network" positioning.

Validator ecosystem optimization - Max Resnick focuses on long-term sustainability and reduces inflation dependence.

Xiaobai's explanation: There are multiple motivations behind the proposal. Imagine you own 10% of a company. If the company issues 5% of new shares to employees every year, and you don't get these new shares, your ownership ratio will be diluted after a few years. Multicoin, a big investor, wants to reduce this dilution, and also wants SOL prices to rise (reducing supply growth is usually good for prices). In addition, they also want more SOL to flow into DeFi applications because they also invest in these applications.

It is worth noting that, as shown in the cycle below, although the proposal may be in the interests of large investors, its design does take into account the healthy development of the entire ecosystem. Details such as the safety threshold design in the formula and the smooth transition period of 50 rounds show that the author is trying to find a balance between the interests of multiple parties.

Timing of the proposal

The choice of January 2025 for the proposal also has specific strategic significance:

MEV Revenue Growth - MEV revenue in Q4 2024 reached a staggering $430M, more than 10 times that of Q1. This data provides strong support for reducing inflation, indicating that validators already have sufficient alternative sources of income.

High Staking Rate Status - The current staking rate of 65.7% is at a historical high, creating favorable conditions for reducing inflation.

Ecosystem Maturity - The Solana DeFi ecosystem is mature enough to absorb and utilize the capital released from staking.

Market Environment - Monetary policy and inflation control have become hot topics in the broader cryptocurrency market, and this proposal echoes broader market trends.

Xiaobai's explanation: The timing of the proposal is also very particular. Just like choosing to reform when the economy is good, the proposer chose a moment of "right time, right place, and right people": the additional income (MEV) that validators receive from transactions has increased significantly; the current staking rate is high (65.7%); Solana's application ecosystem is already mature. All these factors make it a good time to reduce the speed of "printing money".

Currently, Solana uses a fixed-decline inflation mechanism: starting from the initial 8%, it decreases by 15% each year, and has now dropped to about 4.78%, and will eventually reach a bottom line of 1.5%. This mechanism is called "dumb emissions" by the proposer because it does not take into account the actual situation of the network.

The new model proposed by SIMD-0228 introduces market factors and dynamically links the inflation rate to the staking rate. This design is intended to let the market determine inflation rather than follow a preset fixed schedule. When the staking rate is 33.3%, the inflation rate will be equal to the current fixed rate, forming a critical balance point.

The key feature of this formula is that the higher the staking rate, the lower the inflation rate; the lower the staking rate, the higher the inflation rate. This design enables the network to automatically adjust the inflation rate to maintain an appropriate level of staking participation, ensuring network security while avoiding excessive issuance.

Xiaobai explained: Currently, Solana's "printing money" plan is fixed: it decreases by 15% each year until it reaches 1.5%. This is like a country printing money on a fixed schedule regardless of economic conditions. The new proposal is more like a modern central bank: dynamically adjust the money supply based on economic conditions (pledge rate). If the economy is active (high pledge rate), reduce money printing; if the economy is sluggish (low pledge rate), increase money printing to stimulate activity.

Core interests: Reduce dilution, support prices, and optimize DeFi capital efficiency.

Representative views: Tushar Jain and Vishal Kankani said that reducing inflation stimulates DeFi (SIMD-228 and Solana DeFi).

Sol Strategies' Max Kaplan proposed the idea of "preferring to be roughly correct rather than precisely wrong", emphasizing the flexibility of market-driven mechanisms.

Kamino co-founder Marius pointed out that "staking encourages hoarding and reduces financial activity" and supports reducing inflation to enhance liquidity.

Potential motivation: shaping the narrative of "market-driven efficient network" to attract more institutional investment, possibly with diversified investments in the ecosystem, and optimizing the overall portfolio value.

Position: Support, reduce inflation to reduce new supply, protect the value of its holdings, and enhance the attractiveness of the ecosystem through DeFi activities.

Large professional validators

Core interests: maintain network influence and optimize MEV extraction to compensate for reduced inflation gains.

Features: Advanced MEV extraction technology, significant voting power, important influence on network governance, strong adaptability to inflation changes.

Representatives: Validators operated by exchanges, such as Binance and Kraken; institutional key validators, with an average inflation commission rate of 2.75%.

Position: Support, can make up for the reduction in revenue through MEV and transaction fees to maintain profitability.

Small and medium-sized validators

Core interests: Maintain economic viability, sensitive to voting costs (about 2 SOL per round).

Concerns: Helius data shows that 3–4% of validators may withdraw due to proposals; worried that the "zero commission race" will further worsen the economic situation, 49% of validators have zero commission rates, and are less sensitive to inflation changes.

Representatives: Chainflow and other validators that rely on the Solana Foundation Delegation Program (SFDP).

Position: Oppose, may withdraw (David Grider on X)).

Core interests: increased network activity, capital entering DeFi and application layers, and network decentralization maintained.

Differences of opinion:

Supporters: believe that the proposal will release more capital into the application layer, such as Anza's Max Resnick (co-author of the proposal) emphasized the "leaky bucket" effect and reduced tax loss (Solana's SIMD-0228 Proposal Could Slash SOL Inflation to 0.87%).

Worried people: Concerned about the impact of the shrinking validator network on decentralization, such as Leapfrog mentioned in the community discussion that it may trigger an inflation spiral (Six Questions and Answers: A Comprehensive Analysis of Solana’s Latest Proposal SIMD-0228 and Its Impact on the Industry).

Representative: Helius (node service provider) provides neutral data analysis and emphasizes network health.

Position: Complex, some people see the growth potential of DeFi, and some people are worried about the risks of decentralization.

Active stakers

Core interests: Stability of staking income, sensitive to tax impact.

Impact: In a high-staking scenario, the yield will drop slightly but be more sustainable, for example, from 7.03% to 1.41%. The staking strategy needs to be re-evaluated, and it may be concentrated on validators with strong MEV capabilities. .

Position: Oppose, the reduction in income affects its investment return.

Non-staking holders

Core interests: Reduce dilution, SOL price performance.

Impact: Directly benefit from reduced inflation, when the "leaky bucket" effect is reduced, the price may be supported.

Position: Support, reduced inflation protects the value of its holdings.

MEV Infrastructure Controllers

Core Interests: As inflation rewards decrease, MEV becomes more important, and controlling MEV extraction technology brings more power.

Representatives: MEV optimization solution providers such as Jito, entities that control block packaging algorithms.

Position: Support, reduced inflation makes MEV more critical and enhances its market position.

Governance Discourse Controllers

Core Interests: Influence the direction of future protocol upgrades and maintain influence on the ecosystem.

Potential Results: If the concentration of validators increases, governance decisions may be more centralized, and the core development team may have a closer relationship with large capital.

Position: Support (if large validators), increased concentration of validators makes it easy to control network decisions.

Community Controversy:

The community is controversial about IMD-0228, especially the impact on small validators. David Grider's long push shows that 50-250 validators may be lost under different scenarios, which may lead to network decentralization risks and cause community concerns. An unexpected detail is that the exit of small validators may trigger a "zero commission race", further worsening their economic situation, while large validators may increase their influence through MEV.

The latest article in the Helius blog also analyzes: The validator economic model is challenged

Large professional validators: potential winners of survival of the fittest, large professional validators usually have the following advantages:

Possessing advanced MEV extraction technology to make up for the reduction in inflationary returns

Possessing sufficient capital and technical resources to adapt to the new environment

Having a greater voice in network governance

For this group, SIMD-0228 may be an opportunity for them to gain a larger market share in the validator ecosystem. By optimizing MEV extraction and reducing operating costs, they can maintain or even increase profitability.

Small and medium-sized validators: facing survival challenges In contrast, small and medium-sized validators face greater challenges:

Usually lack efficient MEV extraction capabilities

More sensitive to voting costs (about 2 SOL per round)

At a disadvantage in the "zero commission race"

Small validators such as Chainflow have expressed concerns, saying that "despite their best efforts to attract pledges, they still rely heavily on SFDP delegations to continue operations."

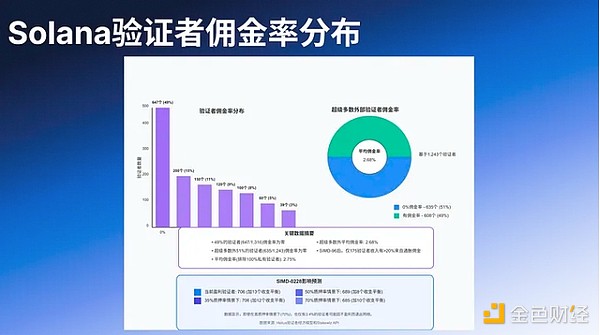

According to the validator economic model data:

647 (49%) of the 1,316 validators have a zero staking reward commission rate, and inflation changes have limited impact on them

Under a high staking rate scenario (70%), it is estimated that about 3.4% of validators may exit due to unprofitability

David Grider's model shows that 50–250 validators may exit under different scenarios

The interest game of the IMD-0228 proposal reflects the complexity of the ecosystem. Large investors and institutions support it, the validator group is divided (large support, small opposition), the developers and ecosystem builders have complex positions, ordinary coin holders are divided (stakers oppose, non-stakers support it), and MEV controllers and governance influencers in hidden power dynamics may support it.

Xiaobai's explanation: This is like the transformation of the retail industry: large chain stores (large validators) have the resources to invest in advanced technology and can survive through efficiency and scale advantages when profits decrease; while small independent stores (small validators) face greater pressure and may be forced to close or be acquired. SIMD-0228 may cause about 40–55 small validators to exit the network because they cannot make a profit in the new environment.

SIMD-0228 may have very different effects on different types of validators. According to Helius's validator economic model:

647 (49%) of the 1,316 validators have a zero staking reward commission rate, and inflation changes have limited impact on them

Under the high staking rate scenario (70%), it is expected that about 3.4% of validators may exit due to unprofitability

David Grider's model shows that 50–250 validators may exit under different scenarios

This change not only affects the economic viability of individual validators, but may also change the structure and competitive landscape of the entire validator ecosystem. The key question is: are we willing to accept a reduction in the number of validators in exchange for a more efficient economic model?

Xiaobai Explanation: The "Survival Game" of Validators

Imagine the Solana network is a large factory, and the validators are the factory's quality inspectors. Now, the factory management (network governance) is adjusting the reward mechanism:

Before: Every inspector gets a fixed salary

Now: Only the most efficient inspectors get more rewards

The result? Some less efficient inspectors may be eliminated, the entire quality inspection process may become more refined, but the overall number of inspectors will be slightly reduced.

18px;">Key question: Are we willing to trade a slightly reduced number of “inspectors” for a more efficient and accurate system?

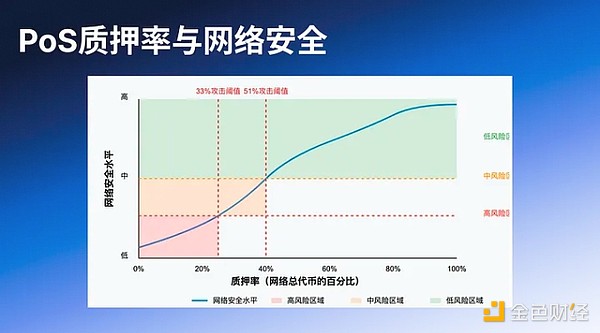

The staking rate is one of the key indicators for evaluating the security of PoS networks. Solana's current staking rate is about 65.7%, much higher than many other PoS networks. SIMD-0228 may cause this number to drop, raising concerns about network security.

Staking rate prediction and security threshold

Based on simulation data:

At the market equilibrium point, the staking rate may drop from 65.7% to the 45–55% range

When the staking rate drops to 33.3%, the inflation rate will be equal to the current fixed rate

In the worst case scenario, the staking rate may drop further, triggering a negative feedback loop

The key question is: what is the "sufficient" threshold for network security? Is it 33%, 40%, or higher? There is no consensus in the community on this.

Another aspect: a shift in the security model

SIMD-0228 essentially represents a shift in the security model:

From "overpaying to ensure security" to "finding the minimum necessary payment"

From "fixed incentives" to "market-determined incentives"

From "inflation-driven security" to "use value to pay for security"

This shift reflects Solana's transition from its start-up phase to maturity. As network activity and MEV earnings increase, excessive inflation may no longer be necessary.

The following figure shows the relationship between the staking rate and network security. As the staking rate increases, the cost of attack increases and the network security improves, but there is a clear diminishing return.

SIMD-0228 is designed to maintain network security while improving capital efficiency: The SIMD-0228 proposal adjusts Solana's staking rate from the current "potentially over-secure" area to a more balanced range while retaining a sufficient safety margin.

Xiaobai's explanation: Imagine a country's military: Currently 65.7% of the population serves in the military, which is far more than actually needed. The new proposal could reduce this number to 45–55%, which is still enough to ensure security while freeing up more manpower to participate in economic activities. But if the proportion drops too low (below 33.3%), it could threaten national security. The key question is: where is the critical point of security?

As blockchain technology continues to mature, the role and importance of MEV will continue to evolve. The key is how to balance the economic incentives brought by MEV while maintaining network decentralization and efficiency.

With SIMD-0228 potentially reducing inflation rewards, MEV (maximum extractable value) will become a more important component of validator income. This shift may have a profound impact on the transformation of validator income structure and the dynamic changes of the Solana network.

Transformation of income structure

Shift in the focus of income sources: Traditionally, the main source of income for validators is inflation rewards. But with the possible implementation of the SIMD-0228 proposal, MEV will gradually become a key component of validator income. This shift reflects the deep evolution of the blockchain economic model.

The rapid growth of MEV income: As can be seen from the data provided, this growth trend shows that MEV has become an important source of income for validators, even exceeding inflation rewards in some quarters of 2024. In 2024, the annual MEV revenue is about 3.7M SOL ($675M), and the MEV revenue shows a significant exponential growth.

Impact Analysis

Inflation rate compression: The SIMD-0228 proposal intends to reduce inflation rewards, which will directly lead to a reduction in the income that validators receive through inflation. In contrast, MEV provides a rapidly growing alternative source of income.

Income diversification: The rapid growth of MEV means that the income structure of validators is undergoing fundamental changes: under the traditional inflation model, income is relatively stable and predictable, and under the MEV model, income is more dynamic and volatile. Network dynamic changes.

Network dynamic changes: The growth of MEV income will bring a series of far-reaching impacts: Validator behavior is more market-oriented, competition for block construction and transaction order is intensified, and the incentive mechanism for network participants is more complex.

Potential risks and challenges

Income uncertainty: The volatility of MEV income may: increase the financial uncertainty of validators, lead to more aggressive network participation strategies, and may trigger new centralization risks.

Reshaping the economic incentive model of blockchain: MEV income (3.7M SOL) in 2024 is close to 14% of the new issuance under the current inflation rate, which means: MEV is becoming a source of income similar to inflation rewards. In the long run, it may reshape the economic incentive model of blockchain.

New risks of chain reaction of validator behavior

This shift will lead to:

Validators are more focused on optimizing MEV extraction technology

MEV extraction ability becomes a key differentiator in validator competitiveness

Network security shifts from relying on inflation incentives to relying more on MEV income

However, this also brings new risks:

MEV income is highly volatile, which may lead to unstable income for validators

Validators may optimize MEV extraction rather than network security

Dependence on MEV infrastructure may become a new centralized risk point

This shift is not only a change in the economic model, but also a profound reconstruction of the incentive mechanism for network security.

Xiaobai explanation: Imagine the blockchain is a busy restaurant, and transactions are customers. In the traditional model, waiters (validators) mainly rely on fixed wages (inflation rewards). Now, they can get extra tips by providing better services (MEV).

In 2024, these "tips" will increase from the initial $42 million per quarter to $430 million in the fourth quarter! This means that validators are changing from passively waiting for "salary" to actively creating value.

The proposal author emphasizes that inflation has a "leaky bucket effect" — part of the value flows out of the ecosystem through channels such as taxes. This concept is one of the important reasons to support SIMD-0228.

Basic inflation data:

Market value: $80B

Annual inflation rate: 4.779%

Annual new issuance value: $3.82B

Multiple channels of value loss

1. Tax channel: compliance cost

2. Centralized exchange commission

3. Overall value loss structure

Tax channel: $650M (68%)

Exchange commission: $305M (32%)

Total loss: $955M (25%)

The intervention effect of SIMD-0228

Deep economic impact

Ecosystem capital retention

Reduce external value extraction

Enhance internal capital circulation

Improve ecosystem autonomy

2. Investor incentive reconstruction

Reduce selling pressure

Attract long-term investors

Improve market expectations

3. Capital flow dynamics

Increased DeFi activity

Increased innovative funding pool

Reinvestment of value within the ecosystem

As Kamino co-founder Marius said: “Staking encourages hoarding and reduces financial activity…similar to the Fed raising interest rates and tightening financial conditions. "From this perspective, lowering inflation may enhance the overall vitality of the ecosystem.

The leaky bucket effect reveals a truth: the resilience of an economic system lies not only in the total amount of capital, but also in the efficiency and direction of capital flows.

SIMD-0228 represents a sophisticated and systematic economic intervention, marking a major evolution in the governance model of the Solana ecosystem.

Xiaobai explained: The "leaky bucket effect" is Solana's "water-saving" project. Imagine Solana as a large reservoir:

Past: Nearly $1 billion "leaked" out every year

Now: Through precise management, the leakage has been reduced to less than $200 million

Effect: Retaining nearly $800 million of “water” for the ecosystem

Another major concern of SIMD-0228 is the negative feedback loop that may be triggered under low pledge rates, especially when the pledge rate is significantly lower than the current level.

Potential negative feedback loop mechanism

In the worst case scenario, the following cycle may occur:

Low staking rate (such as 30%) → triggers an increase in inflation rate

Inflation rate increases → Increased selling pressure, leading to price drops

Price drop → Validator yields decrease, some validators exit

Validator exits → staking rate further decreases

When the yield is lower than 3.5%, the "punishment mechanism" may be triggered to accelerate the withdrawal of staking

Key considerations for system stability

This negative feedback loop is not just a theoretical model, but a substantial threat to the security of the Solana network and the stability of the ecosystem. The key challenges are:

How to maintain network security in a low staking rate environment

How to design a self-regulating economic incentive mechanism

How to prevent small-scale fluctuations from evolving into systemic risks

Mitigation strategies

To address this potential risk, the following countermeasures can be considered:

Set up a smoother inflation adjustment mechanism

Introduce a dynamic staking reward mechanism

Establish an emergency buffer mechanism to protect network stability in extreme cases

Strengthen community communication and enhance investor confidence

Resilience comparison

It is worth noting that although this risk exists, SIMD-0228 is designed to be more resilient than the current fixed model:

Set up a smoother inflation adjustment mechanism

Introduce a dynamic staking reward mechanism

Establish an emergency buffer mechanism to protect network stability in extreme cases

Strengthen community communication and enhance investor confidence

Resilience comparison

It is worth noting that although this risk exists, SIMD-0228 is designed to be more resilient than the current fixed model:

Provide higher yields when the pledge rate is low to attract pledge return

As the pledge rate recovers, the inflation rate will automatically adjust downward to form a self-balancing mechanism

The adjustment coefficient c (approximately equal to π) in the formula is designed to make the curve more incentive when the pledge rate is low

This adaptive mechanism is one of the key advantages of SIMD-0228 over the fixed model, although there are still risks in extreme cases.

Xiaobai explained: This is like a vicious cycle of economic recession:

When too many people withdraw money from banks (low pledge rate)

Banks raise interest rates (inflation rises) to attract deposits;

But high interest rates hurt the economy, causing more people to withdraw money to cope with difficulties;

Banks are overwhelmed and some go bankrupt; people panic, more people withdraw money…

This cycle is difficult to break. Although SIMD-0228 has designed mechanisms to prevent this, it is still risky under extreme conditions.

If SIMD-0228 is implemented, it could have a profound impact on the Solana ecosystem, ranging from short-term adaptation to long-term structural change.

Short-term adaptation period (0–6 months)

The staking rate gradually decreases from 65.7% to the 50–55% range

Some small validators exit or are acquired

SOL prices may be supported and market attention increases

Validators begin to adjust their business models to adapt to the new environment

Medium-term adjustment period (6–18 months)

Validators focus more on MEV extraction optimization

New staking pools and services emerge to help stakers obtain MEV

Increase in DeFi activities and growth of applications using unstaked SOL

Measures to reduce voting costs are implemented to help small validators survive

Long-term structural changes (18+ months)

Validators focus more on MEV extraction optimization

New staking pools and services emerge to help stakers obtain MEV

DeFi activities increase and applications using unstaked SOL grow

Voting cost reduction measures ... list-paddingleft-2">

The validator industry landscape is restructured and the degree of specialization is improved

The network security model shifts from relying mainly on inflation incentives to market-driven comprehensive incentives

Solana's economy shifts from "inflation-driven" to "use value-driven"

It may become a model for monetary policy innovation for other PoS networks

Xiaobai's explanation: Imagine a country shifting from a planned economy to a market economy: in the short term, there will be adjustment pains, and some companies will go bankrupt; in the medium term, new business models and services will emerge; in the long term, the entire economic structure will be more efficient. SIMD-0228 may transform Solana from a network that mainly relies on "printing money" to incentivize participation to a network that is mainly supported by actual use value, which represents a kind of maturity.

These changes not only affect the technical and economic levels, but may also change the power structure and development trajectory of the entire ecosystem.

SIMD-0228 is not just a technical proposal, but also a profound transformation of the Solana ecosystem in terms of economics, governance, and technology. This proposal represents a major leap in the blockchain world from a simple inflation model to a complex market mechanism.

Economic dimension:

Reduce unnecessary token issuance and avoid value loss

Adjust inflation rate through market mechanisms and optimize network security costs

Release capital into DeFi and improve overall capital efficiency

Governance dimension:

Reflects the ability of the Solana community to discuss complex economic models

Seek a balance between optimizing resources and maintaining network health

Different stakeholders can express their positions and influence decisions

Technical dimension:

Reflects the ability of the Solana community to discuss complex economic models

Seek a balance between optimizing resources and maintaining network health

Different stakeholders can express their positions and influence decisions

Technical dimension:

Use mathematical models to adjust core economic parameters

Design dynamic response mechanisms to adapt to network changes

Provide new ideas for blockchain monetary policy

Key issues for the future

With the discussion and possible implementation of SIMD-0228, the following issues deserve our continued attention:

Can the diversity of the validator ecosystem be maintained?

What new risks will the increase in MEV dependence bring?

Can the market-driven mechanism remain stable under extreme conditions?

Can this model be used as a reference for other blockchain networks?

Xiaobai’s explanation: SIMD-0228 represents the evolution of the blockchain world from "simple inflation rules" to "complex market mechanisms", just as modern central banks replaced the simple gold standard. This is both a revolution (because it fundamentally changes the rules) and a natural evolution (because it reflects the actual needs of the network as it matures). Whatever the outcome, this is an important experiment in blockchain economics.

In a sense, SIMD-0228 is both a revolution and an evolution — it represents a revolutionary shift in mindset, while also reflecting Solana’s natural transition from a startup blockchain to a mature financial infrastructure. Regardless of the final outcome, this proposal and the extensive discussion it has sparked reflect the blockchain community’s growing maturity in economic design and governance.

Ordinary SOL Holders:

If you are mainly holding SOL rather than staking, SIMD-0228 may be beneficial to you, and reducing inflation will help protect the value of your holdings

If you are staking SOL, consider re-evaluating your staking strategy, and you may need to look for validators who can efficiently extract MEV

Pay close attention to the implementation progress of the proposal, especially the staking rate and price changes

Validators:

Large validators: Invest in MEV optimization technology and prepare to adapt to the new income structure

Small validators: Assess economic feasibility and consider specialization strategies or differentiated services

All validators: Pay attention to the progress of voting cost reduction measures, which may have a significant impact on the economic model

Developers:

Large validators: Invest in MEV optimization technology and prepare to adapt to the new income structure

Small validators: Assess economic feasibility and consider specialization strategies or differentiated services

All validators: Pay attention to the progress of voting cost reduction measures, which may have a significant impact on the economic model

list-paddingleft-2">

Be prepared to take advantage of the capital liquidity that may be released

Consider developing tools to help stakers participate in MEV revenue distribution

Explore new application scenarios for more efficient use of SOL in DeFi

Xiaobai's explanation: Whether you are a SOL holder, validator or developer, you should prepare for the changes that SIMD-0228 may bring according to your role. Ordinary holders should pay attention to the progress of the proposal; validators need to adjust their business models; developers can look for new opportunities. Like any economic policy change, those who prepare in advance usually benefit from the changes.

SIMD-0228 represents an important turning point, marking that Solana is moving towards a more mature and market-oriented economic model.

By introducing a dynamic inflation mechanism, it attempts to build a more efficient and sustainable ecosystem that maximizes capital efficiency while ensuring network security.

Like any major change, it brings both opportunities and challenges, and has both supporters and opponents. By understanding the motivations, mechanisms, and potential impacts behind the proposal, we can better prepare for this change and find our place in the new economic environment.

No matter what the final result is, the discussion process of SIMD-0228 itself has demonstrated the ability of the blockchain community to solve complex economic problems through collective wisdom, which may be the truly revolutionary aspect of blockchain technology.

SIMD-0228: Market-Based Emission Mechanism

Proposal For Introducing a Programmatic, Market-Based Emission Mechanism Based on Staking Participation Rate

SIMD-228 and Solana DeFi

Solana’s SIMD-0228 Proposal Could Slash SOL Inflation to 0.87%v

Solana Inflation May Drop 80% if SIMD-0228 Passes

David Grider’s Analysis on X

Six Questions and Answers: SIMD-0228 Analysis

Canada's intelligence agency alerts to the growing threat of realistic deepfakes, urging global cooperation to address the risks posed by advanced AI technologies.

Hui Xin

Hui XinXi Jinping's APEC summit attendance gathered dignitaries like Joe Biden, Elon Musk, and tech titans, with reports suggesting a lavish $40,000 dinner. Xi proposed business initiatives amid declining foreign investment, but a mix-up stole attention when CZ, mistaken for another, sparked lively crypto discussions. His humorous response lightened the unexpected twist.

Joy

JoyA specialised team is poised to elevate its concentration on the educational applications of ChatGPT, with an aim to bolster advancements in learning and child development.

Kikyo

KikyoOpenAI's abrupt CEO dismissal triggers industry-wide speculation, raising concerns about the organisation's future direction and technological advancements.

Hui Xin

Hui XinAmidst the departure of CEO Sam Altman and President Greg Brockman, the ripple effect extends to the resignation of three senior OpenAI researchers.

Catherine

CatherineOpenAI faces internal turmoil as founder Sam Altman is ousted, triggering resignations and casting uncertainties on the company's future stability.

Hui Xin

Hui XinJustin Sun sent blockchain messages on the Ethereum network to the hackers' addresses warning them to return the unlawfully acquired funds in exchange for a reward or face legal action.

Catherine

CatherineThe restructuring unfolds as the corporate parent of Facebook approaches the conclusion of its designated "year of efficiency."

Kikyo

KikyoThe Dogecoin team has unveiled plans for a lunar mission set to launch on 23rd December 2023. Astrobotic, a pioneering space company, is spearheading this mission, transporting physical Dogecoin to the moon via the DHL Moonbox aboard ULA's Vulcan Centaur Rocket.

Jasper

JasperThe security breach has led to a temporary suspension of trading operations on the Woo network, which heavily relies on Kronos.

Catherine

Catherine