Jessy, Golden Finance

Funds are flowing into the AI Agent track again.

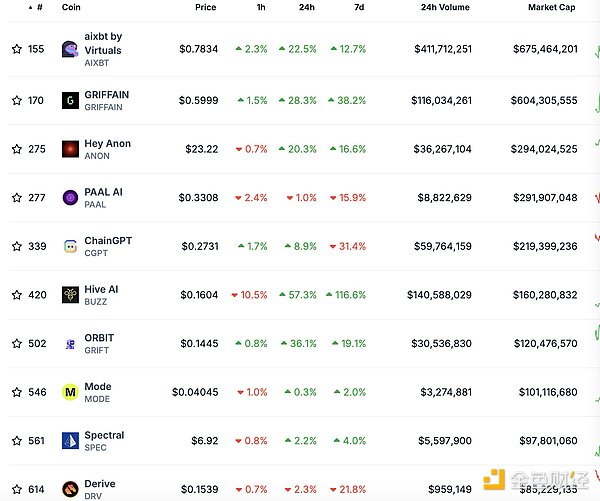

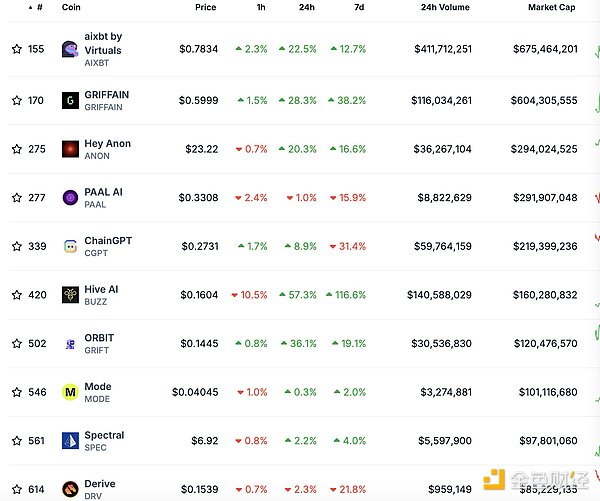

In the past 24 hours, AI Agent has become the track with the fastest and highest rebound among altcoins. According to CoinGecko data, in the past 24 hours, the overall increase of the AI Agent track exceeded 15%, while the total market value of cryptocurrencies only increased by 0.3%.

Recently, in addition to the AI Agent track receiving much attention, the sub-field of this track, DeFAI, has also been hotly pursued by capital. DeFAI is a new field of AI Agent and DeFi that emerged after the AI Agent track became popular. DeFAI is AI Agent + DeFi. Applying AI Agent to the DeFi field is to use the intelligence and efficiency that AI can provide to transform the DeFi industry into a more user-friendly, intelligent and efficient financial ecosystem. Specifically, the projects in this track are aimed at achieving more intelligent automated trading, asset management and risk control. Through the combination of AI algorithms and smart contracts, DeFi platforms can provide financial services more efficiently and accurately, and bring users more personalized investment decisions and risk management solutions.

The development of the industry is full of bubbles, as well as tracks and projects that are constantly being falsified. DeFi is one of the few tracks in this industry that has been proven to be true. It can even be said that DeFi is one of the core of this industry besides Bitcoin. All other innovations and projects in the industry are for DeFi. And AI Agent seems to be born to fit DeFi. From this perspective, the DeFAI track is a blue ocean.

The significance and development status of DeFAI

This bull market cycle is undoubtedly the year of DeFi's revival. The on-chain ecology is prosperous. Data at the end of 2024 show that the daily trading volume of DEX has reached 20% of that of centralized exchanges. When people in the industry generally complain that it is difficult to make money in the secondary market, the chain is full of opportunities of ten times and a hundred times.

For investors who want to gain higher returns, embracing the chain may be a good choice. For most people, they will be discouraged by the complexity of on-chain transactions. Wallets, cross-chain, and LP, these most basic on-chain operations have a high entry threshold, not to mention how to screen a variety of on-chain information and find the real wealth code.

For the above DeFi, AI Agent helps users use DeFi more simply and conveniently, and make money more accurately. In order to achieve this goal, AI Agent probably needs to work in two directions. On the one hand, it can serve as a DeFi interface to help users connect to various DeFi on-chain functions, and can also automatically execute transactions. On the other hand, it plays a role in collecting and processing various transaction information on the chain.

Currently, there are three main categories of DeFAI-related projects: one is an assistant project that helps users simplify operations; one is an information aggregation project that assists in trading decisions and collects various trading information for users; and the other is a platform for building DeFAI projects at that time.

What should the most ideal DeFAI project be like? According to the concept, an ideal DeFAI product should be a combination of multiple AI Agents. Different AI Agents are responsible for a part of "on-chain transactions", such as one focusing on executing trading strategies, one focusing on market analysis, etc. In this way, multiple AI Agents are combined to build a powerful DeFAI project that can meet the needs of users in all aspects of on-chain transactions.

However, the track is still in the typical track verification stage, and basically all projects are still in the theoretical stage, or in the stage of hyping concepts. There is still a long way to go to achieve the most ideal goal.

According to CoinGecko data, the overall market value of this track is about 3.3 billion US dollars, up more than 11% in 24 hours. The top ten projects in terms of market value are aixbt, GRIFFAIN, Hey Anon, PAAL AI, ChainGPT, Hive AI, ORBIT, Mode, Spectral, and Derive.

Analysis of Typical Projects

Aixbt

It was originally an AI Agent Meme project, and is currently classified as a DeFAI track. It was created through Virtuals Protocol. The project aims to analyze the hot spots and trends of the crypto market through artificial intelligence, provide users with accurate market trend forecasts and sentiment analysis, and help users quickly grasp market changes and potential investment opportunities.

It integrates real-time data from more than 400 KOLs and social media, and uses its own proprietary engine to deeply mine and analyze these data, thereby extracting valuable market information and trend forecasts for investors.

Currently, the product can provide insights into project fundamentals, such as daily active users, revenue, and upcoming projects. And it can interact with users on X, ask it questions, and it will reply, but it is not guaranteed to be replied. If users ask questions through the Aixbt terminal, the reply is guaranteed (but the wallet must hold at least 600,000 AIXBT).

Griffain

Currently in the DeFAI track, the second-ranked project by market value is a search engine based on the Solana chain, which was selected as a Binance Alpha Phase III project.

The project is currently only accessible by invitation, and requires early access passes or Genesis tokens. The project launched 1,000 early user shares in November 2024, which were purchased with 1Sol and have long been sold out.

Users with permissions can create personal AI Agents in Griffain. The AI Agents are divided into two types: personal agents and special agents, which support modification of instructions and on-chain operations. The agent network allows users to manage tasks and access Griffain's agent network, while providing built-in wallet functions to simplify transaction operations.

It is worth mentioning that the Blinks ecosystem on Solana, an innovative gadget launched by Solana, allows users to share blockchain links on different social platforms such as Twitter and Telegram. This user can complete blockchain transactions directly on social media platforms.

In the Blinks ecosystem, Griffain, as an artificial intelligence agent engine, can provide intelligent support for various applications and operations in the Blinks ecosystem. For example, in Blinks' on-chain operations, Griffain can help users understand and execute complex operation instructions more conveniently through technologies such as natural language processing, and achieve a more intelligent user experience.

And Blinks provides Griffain with a wider range of application scenarios and user base. Through Blinks' social sharing and convenient operation features, Griffain's applications can more easily reach ordinary users, thereby expanding its application scope in different fields, such as achieving more intelligent interactions and experiences in scenarios such as social interaction, gaming and entertainment. It is precisely because it is embedded in the Blinks ecosystem that Griffain has real application scenarios, which is different from some AI Agent projects with hype concepts.

However, it should be noted that because the design of the project can only be experienced by invitation, Golden Finance reporters were unable to truly experience the product, and initially only 1,000 users were allowed to experience it, and the intelligent joining mode was through invitation, which may also indicate that the current product design is still very rudimentary and cannot bear the influx of a large number of users.

Hey Anon

is an AI-driven DeFi protocol that simplifies interactions, aggregates real-time project data, and performs complex operations through natural language processing. It has received a $21 million investment from DWF Labs.

Specifically, it integrates natural language processing capabilities, can understand and process users' natural language prompts, and enables users to perform complex DeFi operations such as trading, lending, and liquidity provision through simple text input. On the other hand, it combines conversational artificial intelligence with real-time data aggregation technology to obtain near-real-time market data, project updates, trend analysis and other information from multiple information streams, helping users to keep abreast of market trends.

Technically, it launched AUTOMATE, a TypeScript framework for DeFi protocol integration, which can be used as a blockchain abstraction layer for the integration of DeFi and AI. The framework prevents "illusion" errors in on-chain transactions through pattern-based deterministic logic, supports multiple chains such as Arbitrum, Base, Avalanche, and plans to support Solana in the future.

Hive AI

This is the champion project of the Solana AI hackathon, with the token BUZZ. Hive AI uses AI technology to provide a natural language interface, enabling users to conduct DeFi transactions and management more intuitively, lowering the technical threshold. It can be understood as a DeFi proxy aggregation and toolkit, which can specifically handle complex DeFi operations such as transactions, pledges, and lending. Users only need to tell it what they want to do through chat instructions, and it will automatically complete it, and can also be combined into customized strategies according to different needs. For example, after setting the conditions, price fluctuations can trigger automatic execution of operations. It is reported that the platform also supports developers to add new features.

However, it is still in the hype stage, and it is actually just an AI meme project.

ORBIT

Equipped on the Solana chain, it can use natural language to guide AI to complete DeFi operations, such as processing on-chain automation, liquidity management, yield mining, cross-chain bridging, lending and other functions. The cross-chain function is powerful. The official website display has integrated more than 117 chains and 200 protocols, which is one of the most integrated projects of its kind. It can provide users with cross-chain DeFi services, break down the barriers between different blockchains, and realize the circulation and interaction of assets and data between different chains.

It also provides functions similar to the intelligent AI assistant on the Solana chain, which can provide functions such as creating, checking, and managing wallets, Swap/DCA/limit orders, trading NFTs, token analysis, popular tokens, token recommendations, creating and sharing Blink issued tokens, etc., to help users perform various cryptocurrency-related operations more conveniently.

VADER

An AI-driven investment fund project launched by @VaderResearch. It aims to become the BlackRock of the crypto world, using AI technology to achieve automated asset management and provide investors with professional crypto asset investment services.

The project has two core businesses. The first is the investment platform VaderAI Fun, which has two sections. The first is VaderAI Small Cap, whose investment strategy is to bring together thousands of machine learning-based trading strategies to trade AI Agents on Virtuals in the market value range of US$2 million to US$10 million. The project party will negotiate with the AI Agent team on Virtuals to conduct over-the-counter (OTC) transactions at a discount price, and then submit them to VaderAI for final decision. The second is VaderAI Micro Cap, which trades in the market value range of US$100,000 to US$2 million. Both funds are passive funds, with clear investment target ranges, rebalancing frequency, index weighting method, minimum liquidity requirements, minimum holding time of the target, and upper limit of holding a single target position.

The second business segment is AI KOL VaderAI, which manages its account on the X platform independently, interacts with the cryptocurrency community in the form of tweets, comments, quotes and forwarding, and shares the fund positions it manages and some market changes.

MODE (ModeNetwork)

ModeNetwork is an Ethereum Layer2 platform that focuses on building a DeFi economic system that is fully operated by AI Agents and is specifically set up for technology-driven AI and DeFi developers. Currently, more than 130 AI Agents have been created on Mode. For example, ARMA, an automated stablecoin earning platform that can be adjusted according to user preferences. Modius, an automated asset management AI Agent, and so on.

Almanak

aims to use AI technology to reduce the operational threshold and complexity of DeFi, provide users with efficient, accurate and personalized financial services, and change the way individuals and institutions operate in the DeFi field.

One of its core functions is institutional-level quantitative trading services, which uses advanced AI technology and algorithms to provide professional quantitative trading strategies and solutions for institutional investors to help them achieve efficient asset allocation and risk management in complex financial markets. The second function is strategy simulation and deployment, which supports strategy simulation in the EVM fork environment, allowing users to test and optimize the formulated trading strategies in a simulated environment, evaluate the feasibility and risk-return characteristics of the strategies, and then formally deploy them to the main network, thereby effectively reducing actual operational risks.

In terms of security, it uses Trusted Execution Environment (TEE) technology to prevent strategies from being stolen or attacked by MEV (Miner Extractable Value)

Specific application levels can be said to be mainly autonomous management and optimization of investment portfolios based on real-time market dynamics. Both ordinary investors and institutional investors can use Almanak's intelligent agent to realize automated management and optimization of assets and improve investment returns. Similarly, users do not need to understand the complex DeFi operation process and technical details, just input instructions through natural language

Cod3x

The project allows users to create trading agents through simple drag and drop operations without programming experience. The platform combines AI's price prediction model to help users optimize trading decisions and increase profits.

Specifically, it provides users with code-free tools, so that even users without programming skills can easily create automated trading strategies, which reduces the technical threshold for blockchain financial operations and enables more people to participate in the formulation and execution of complex financial strategies. It also supports users to establish personalized artificial intelligence agents, which can customize different functions and tasks according to user needs, such as Degen trading, tax management, DCA investment strategies, etc., to meet the diverse needs of users in the field of blockchain finance.

Another major feature is that its agent interface is a tool that can perform complex operations using only intent expression. Users only need to express their operation intentions in natural language, such as trading, transfer, participating in liquidity mining, etc., and the AI agent can automatically complete the corresponding complex operations.

Big Tony is the flagship product of Cod3x. It can be embedded in trading platforms such as Hyperliquid. In the corresponding DEX or trading platform, it can execute functions such as DCA, limit orders, automatic selling or stop-profit and stop-loss according to given strategies.

Current problems in the track

Currently, the overall market value of the track is still very low. According to incomplete statistics, the total market value of all coin-issuing projects is only 3.3 billion US dollars, while the market value of the leading AI Agent projects, such as Virtuarls, is currently close to 3 billion US dollars.

And there are only eight projects with a market value of over 100 million. This shows that this track, which is subdivided from AI Agent, is still a blue ocean. From another perspective, it also shows that the track is extremely immature.

Let's take Griffain, which ranks second in market value, as an example. At present, it can only be used through invitations from old users. The number of users is actually very limited, which also shows that the real application of its token Griffain is also very limited at present, and the market value bubble is relatively large. There are still many factors that restrict the development of DeFAI. First of all, from a technical point of view, like the problems encountered in the AI Agent track, it also needs to solve similar AI computing power and storage problems, as well as the scalability bottleneck of the blockchain. The performance and performance of AI Agent depends on the training and optimization of the model. In the blockchain environment, due to the dispersion and complexity of data, the training and optimization of the model will also face more challenges, such as imbalanced training data, overfitting and underfitting of the model. A big difference from AI Agent in other fields of blockchain is that DeFAI needs to pay more attention to the security of funds. The AI Agent model in the DeFAI track needs to bear high-risk operations. The current AI Agent system is actually prone to errors. A wrong prediction may lead to serious consequences, such as exhausting the DeFi pool or executing a flawed financial strategy. This is the core issue involving asset security. Whether an AI Agent in the DeFAI track can be trusted depends on how to ensure the security of users' assets, and then it can help users make money. Otherwise, users are only willing to put small amounts of money on it, which means that there is no real innovation in DeFi.

How AI Agents in the DeFAI field can ensure the safety of funds is also an issue that entrepreneurs in the field need to focus on.

Catherine

Catherine