Abstract

Following the introduction of the "Genius Act," the American Bankers Association publicly called for its amendment, arguing that tokens pegged to fiat currency under the "Genius Act" framework would threaten the existing US financial system. The banking industry worried that the rapid development of tokens could lead to a massive outflow of deposits, driving up bank funding costs, weakening lending capacity, and raising loan interest rates for businesses and households. Against this backdrop, JPMorgan Chase launched deposit tokens, striking a delicate balance between bank liquidity management and token business.

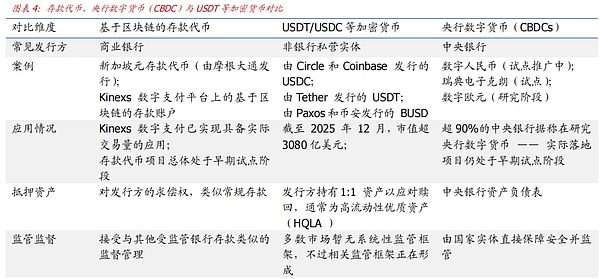

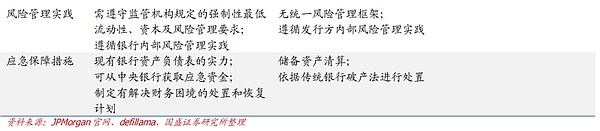

Under the "Genius Act" framework, there will be deposit outflows from the banking industry, and even "financial disintermediation."To some extent, tokens pegged to fiat currency and deposits share similar characteristics with "fiat currency," but the differences between the two are equally significant, and these differences could have some profound impacts on the banking industry. For example, tokens can impact traditional banking lending. The profit model of traditional bank lending, which relies on interest rate spreads, doesn't exist in token issuance. Token issuers receive low-risk asset returns from reserve assets, while users don't receive any interest. Therefore, while tokens seem to avoid credit risk, banks issuing tokens inevitably lose lending business. Consequently, converting deposits into token reserves will drain deposits from the banking system; if companies hold or use tokens long-term, the banking system will also lose corresponding deposits (and the liquidity generated by the money multiplier in financial transactions), losing opportunities to participate in clearing and settlement processes, leading to "financial disintermediation." JPMorgan Chase's deposit token JPMD possesses the novel and unique attributes of cryptocurrencies while retaining the characteristics of traditional bank deposits in key aspects such as interest payments and deposit processing, thus not impacting bank liquidity. In June 2025, JPMorgan Chase announced the launch of a new product, JPMD, a deposit token offering a public blockchain payment solution to institutional clients. JPMD represents clients' actual bank deposits with JPMorgan Chase, has the potential to generate interest income, and is expected to be protected by deposit insurance. JPMD, like other deposit tokens, possesses novel and unique attributes of cryptocurrencies, particularly its programmable peer-to-peer transaction capabilities. At the same time, deposit tokens retain the characteristics of traditional bank deposits in key aspects such as interest payments and deposit processing; that is, deposit tokens represent a claim against the issuing bank just like regular deposits. Clients can include deposit tokens on their balance sheets like other deposit products. The accounting treatment ultimately requires auditor confirmation. Furthermore, deposit tokens are subject to similar regulations as traditional bank deposits, meeting requirements for capital, liquidity, and risk management; in terms of emergency protection measures, deposit tokens can rely on the strength of banks and enjoy deposit insurance and central bank bailout mechanisms. JPMorgan Chase's deposit token possesses characteristics of cryptocurrencies, including peer-to-peer instant settlement, a universal blockchain ledger, and programmability. In different application scenarios, deposit tokens exhibit distinct features: 1) Payment applications: When users transact using deposit tokens, reliance on traditional third-party intermediaries is significantly reduced. 2) Programmable money: The programmability of deposit tokens can bring innovative solutions to existing deposit businesses, such as enabling conditional fulfillment and automated execution. 3) Protocol interaction: In addition to the programmability of deposit tokens themselves, compared to account-based deposits, deposit tokens are also more suitable for interacting with certain smart contract protocols. Investment Recommendation: We believe that driven by relevant regulatory legislation in the United States and Hong Kong, the RWA and asset tokenization market will experience rapid development. We recommend focusing on targets related to the RWA and stock tokenization industry chain. Risk Warning: Blockchain technology development may fall short of expectations; regulatory policy uncertainties may exist; the implementation of Web3.0 business models may fall short of expectations. 1. Core Viewpoints According to the requirements of the US "Genius Act," tokens pegged to fiat currency must have sufficient assets issued by the issuing institution, which presents both opportunities and challenges for the banking industry. A very prominent impact is that the "Genius Act" framework may cause banks to lose deposits, creating liquidity challenges, i.e., financial disintermediation. To address these challenges, JPMorgan Chase, from a banking perspective, has developed deposit tokens. This article analyzes the advantages and characteristics of the deposit tokens issued by JPMorgan Chase. 2. JPMorgan Chase's Token Business Strategy from a Banking Perspective 2.1 The Impact of the Genius Act on the Banking System On August 16, the American Bankers Association (ABA) led 52 banks, lobbying groups, and consumer organizations in a joint letter to the Senate Banking Committee, publicly calling for amendments to the Genius Act. The core demand of the joint action directly targets the special provisions in the Genius Act, arguing that tokens pegged to fiat currency under the Genius Act framework pose a threat to the existing US financial system. Behind the joint letter lies a multi-faceted power struggle between old and new forces over regulatory authority, credit models, and profit sources. Traditional banks are concerned that allowing the "Genius Bill" to be fully implemented in its current form could threaten their core position in the financial industry chain. The American Bankers Association (ABA), along with 52 banks and organizations, publicly opposed Section 16(d) of the "Genius Bill," citing concerns that the rapid development of tokens could lead to a massive outflow of deposits—estimated at $2 trillion, potentially resulting in a $1.9 trillion loss of bank deposits, driving up bank funding costs, weakening lending capacity, and raising interest rates for corporate and household loans. Over the past 20 years of economic and technological changes, bank deposits have demonstrated a certain resilience. US deposits have continued to grow; EU deposits, while experiencing slower growth after the global financial crisis and the Eurozone crisis, have maintained an upward trend in recent years. It is evident that deposits play a crucial role in banking operations, and any situation that could lead to deposit outflows is something the banking industry is unwilling to accept. To some extent, tokens pegged to fiat currency (hereinafter referred to as "tokens") share similar characteristics with deposits, but the differences between the two are equally significant and could have profound implications for the banking industry. For example, tokens can impact traditional bank lending. The profit model of traditional bank lending, which relies on interest rate spreads, does not exist during token issuance. Token issuers receive low-risk asset returns from reserve assets, while users do not receive any interest. Therefore, while tokens seemingly avoid credit risk, banks issuing tokens will inevitably lose lending business. The consequence is that converting deposits into token asset reserves will drain deposits from the banking system; if companies hold or use tokens long-term, the banking system will also lose corresponding deposits (and simultaneously lose the liquidity brought by the money multiplier in financial transactions), and lose the opportunity to participate in the clearing and settlement of funds, resulting in "financial disintermediation." 2.2 As a banking giant, JPMorgan Chase launches a different token roadmap. JPMorgan Chase has been committed to the research and development of blockchain payment technology for many years and actively participates in blockchain financial technology innovation. Since 2019, the company has launched a token product based on a private blockchain—JPM Coin, which has already processed more than $1.5 trillion in institutional payments on its private blockchain. Since its launch in 2019, the company's first token product, JPM Coin, has processed $1 billion in transaction value daily. Initially designed as a temporary tool for real-time full settlement between JPMorgan Chase's institutional clients, the digital token is directly pegged to the US dollar. Its primary purpose is to address fundamental inefficiencies in existing payment infrastructure, such as the speed of cross-border payments, transaction tracking and reconciliation challenges caused by the separation of funds and information, and the issue of fund substitutability. For example, Siemens of Germany completed a euro-denominated payment to a French supplier using JPM Coin, with the transaction taking only seconds. This case demonstrates the efficiency of JPM Coin in cross-border payment scenarios. In June 2025, JPMorgan Chase announced the launch of a new product: Kinexys, a subsidiary of JPMorgan Chase, is piloting the issuance of JPMD to enable institutional financing on the blockchain. JPMD is issued on Base, an Ethereum Layer 2 blockchain built within Coinbase, achieving near-instantaneous 24/7 settlement and near-real-time liquidity. JPMD represents customers' real bank deposits at JPMorgan Chase, has the potential to generate interest income, and is expected to be protected by deposit insurance. This deposit token clearly takes into account the needs of bank liquidity management. JPMD, like other deposit tokens, possesses novel and unique attributes of cryptocurrencies, especially its programmable peer-to-peer transaction capabilities. However, deposit tokens retain the characteristics of traditional bank deposits in key aspects such as interest payments and deposit processing; that is, deposit tokens represent claims against the issuing bank just like regular deposits. Customers can include deposit tokens on their balance sheets like other deposit products. The accounting treatment ultimately requires auditor confirmation. Furthermore, JPMD integrates with JPMorgan Chase's traditional banking system, thereby reducing liquidity silos for customers. At the same time, deposit tokens are subject to similar regulations as traditional bank deposits, requiring compliance with capital, liquidity, and risk management requirements; in terms of emergency protection measures, deposit tokens can rely on the strength of banks and enjoy deposit insurance and central bank bailout mechanisms. Therefore, while deposit tokens, central bank digital currencies (CBDCs), and cryptocurrencies such as USDT are all blockchain assets pegged to fiat currency, they share similarities but also have significant differences. These differences are reflected in the issuers, application scenarios, collateral assets, and regulations.

2.3 Typical Application Scenarios of Deposit Tokens

JPMorgan Chase deposit tokens possess the characteristics of cryptocurrencies, including peer-to-peer instant settlement, a universal blockchain ledger, and programmability. In different application scenarios, deposit tokens exhibit distinct characteristics:

1) Payment Applications.

1) Payment Applications.

When users transact using deposit tokens, reliance on traditional third-party intermediaries—such as banks—is significantly reduced. These intermediaries would otherwise be responsible for multi-layered information verification and financial settlement of user-to-user payment transactions. Deposit tokens enable direct peer-to-peer transfers of funds, with banks and other financial institutions playing a crucial role in building a trusted payment environment. For example, in Project Guardian, the Monetary Authority of Singapore (MAS), JPMorgan Chase issued Singapore dollar deposit tokens for pilot foreign exchange transactions with an affiliate of SBI Digital Asset Holdings (SBI) on a public blockchain. The tokens and protocols used to facilitate the transactions were designed to restrict unknown parties from using Singapore dollar deposit tokens—both the token smart contracts and transaction protocols were programmed to interact only with certain known blockchain addresses. The deposit token smart contracts also required the authorizing party instructing the transfer to attach a "verifiable credential" developed by JPMorgan Chase and provided by the issuer. The Project Guardian pilot demonstrated that even with peer-to-peer transfer tools available on public blockchains, banks can maintain control over fund transfers. Digital identity tools (such as the verifiable credentials developed by JPMorgan Chase) can support such transfers by ensuring that transactions are executed only with verified counterparties. 2) Programmable Money. The programmable nature of deposit tokens can bring innovative solutions to existing deposit businesses. The most significant innovation is leveraging the characteristics of cryptocurrency smart contracts to achieve conditions fulfilled and automated execution, such as issuing loans or paying interest according to agreed conditions. Furthermore, the future combination of smart contracts and AI algorithms is expected to create more intelligent financial solutions. This automation not only improves payment efficiency but also enhances liquidity and collateral management, as well as other processes including account reconciliation. 3) Protocol Interaction. In addition to the programmability of deposit tokens themselves, compared to account-based deposits, deposit tokens are also more suitable for interacting with certain smart contract protocols. A pilot transaction between JPMorgan Chase and SBI under the Monetary Authority of Singapore's "Guardian" framework demonstrated the feasibility of deposit tokens and smart contract protocols in institutional applications. The transaction used a modified decentralized finance (DeFi) protocol to execute a foreign exchange transaction involving JPMorgan Chase's SGD deposit tokens and SBI's JPY tokenized assets. The use of such protocols could be another way to achieve certain advantages in automation and interoperability, especially in multi-party transaction scenarios requiring the application of common rules. 3. Investment Recommendations: Focus on Payment-Related Sectors We believe that driven by relevant regulatory legislation in the US and Hong Kong, the RWA and asset tokenization market will experience rapid development, with US stock tokenization being the next important RWA sector. We recommend focusing on companies related to the RWA and stock tokenization industry chain. Risk Warning: Blockchain Technology Development Falls Short of Expectations: The underlying blockchain technologies and projects for Bitcoin are in their early stages of development, and there is a risk that technological development may fall short of expectations. Regulatory Policy Uncertainty: The actual operation of blockchain and Web3.0 projects involves multiple financial, internet, and other regulatory policies. Currently, regulatory policies in various countries are still in the research and exploration stage, and there is no mature regulatory model. Therefore, the industry faces the risk of regulatory policy uncertainty. Web3.0 business model implementation may fall short of expectations: Web3.0 related infrastructure and projects are in their early stages of development, and there is a risk that business models may not be implemented as expected.

Alex

Alex

Alex

Alex Catherine

Catherine Kikyo

Kikyo Anais

Anais Catherine

Catherine Weatherly

Weatherly Kikyo

Kikyo Anais

Anais Alex

Alex Miyuki

Miyuki