Source: PermaDAO

AO has created a token minting model for developers, namely developer minting, which is different from the token minting for miners in Bitcoin and Ethereum. Developers can lock aoETH by developing smart contracts and obtain the AO tokens minted by them, thereby realizing developer minting. As of July 15, the $stETH bridged and deposited in the AO network has exceeded 500 million US dollars. This model provides developers with a new way of financing, attracting investors with aoETH to join the project and promote the development of the AO ecosystem.

First, the conclusion: Bitcoin and Ethereum's token minting is for miners, and miners provide security and computing power for the network to obtain newly minted tokens for the network. In contrast, AO has created a token minting model for developers, changing from the original miner minting to developer minting. This article will briefly introduce AO's token model and explain how developers make profits during the entire token minting process.

Token Model

Token Model Overview:

Total: 21 million, the same as Bitcoin.

Minting cycle: Minting every 5 minutes.

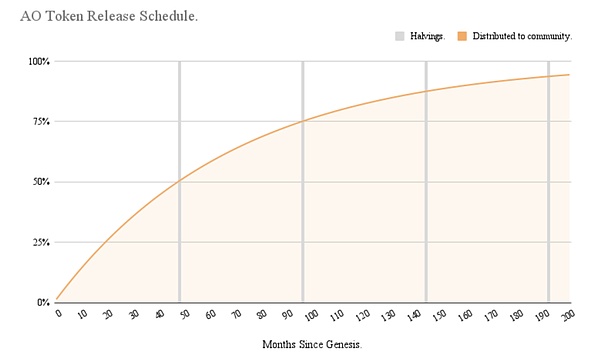

Halving mechanism: Halving occurs approximately every 4 years. Bitcoin will suddenly halve once every 4 years, while AO's halving mechanism is linear, meaning that the number of coins minted every 5 minutes will gradually decrease.

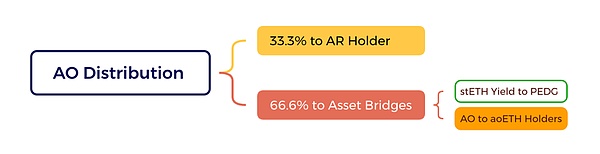

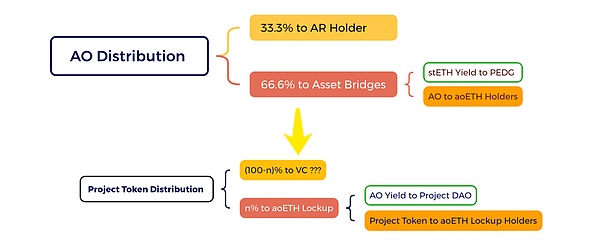

Distribution mechanism: 33.3% of tokens are allocated to AR holders; 66.6% of tokens are allocated to eligible cross-chain bridge assets.

AR holders

The total amount of AR is 66 million. When you have 1 AR in your wallet, the AO token minting rate is roughly estimated to be:

33.3% * 1 / 66,000,000

Cross-chain bridge assets

Not all cross-chain assets can obtain the right to mint AO tokens. AO has a strict definition of cross-chain bridge assets for minting tokens, which must meet the following two points:

1. High-quality assets with sufficient liquidity in the market, such as assets of large public chains.

2. It must be an asset with annualized returns, a token that has been rigorously tested and pledged with liquidity, such as stETH.

Take stETH as an example. As of now, AO has locked up about $530 million of stETH, or 159,580 stETH, in Ethereum's lock-up contract.

If you cross-chain a stETH, the AO token casting rate is roughly estimated to be:

66.6% * 1 / 159,580

For the current pledge, please check Etherscan:

https://etherscan.io/address/0xfe08d40eee53d64936d3128838867c867602665c#tokentxns

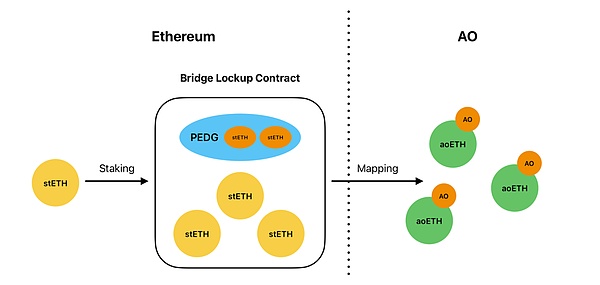

After cross-chain, stETH will generate aoETH tokens on AO. AoETH and stETH are 1:1 mappings. Users holding aoETH can cross-chain back to Ethereum at any time to obtain stETH. If you hold aoETH, the wallet will receive minted AO tokens every 5 minutes.

It is worth noting that the aoETH generated by users after stETH cross-chain will not obtain the native income of stETH, that is, the balance will not automatically increase like stETH. The value of cross-chain aoETH is equivalent to ETH, and aoETH has increased the AO minting capacity.

For example, a user holds 1 stETH on Ethereum, and the current annualized yield of stETH is 3.2%. After one year, the user's stETH holdings will automatically increase to 1.032 (for ease of understanding, compound interest is not calculated), of which 1 stETH is used for principal and 0.032 is the annualized income. When the user crosses stETH to aoETH, the 0.032 income will no longer belong to the user. aoETH loses the native income of stETH and becomes the token minting income of AO. Readers must be wondering, where did the income of stETH go? Please see the figure below:

Among them, the yellow circle entity represents stETH, the green entity represents aoETH, and the orange represents the annualized income asset. After stETH is pledged across the chain, an equivalent amount of aoETH is mapped in aoETH. After the cross-chain, the income of stETH is handed over to the Permaweb Ecological Development Guild (PEDG for short), and these income will be decided in the PEDG Guild on how to use it. The AO tokens minted by aoETH will be sent to the wallet of aoETH holders.

Introduction to PEDG from the AO white paper:

PEDG is an AO ecosystem organization and builder alliance dedicated to developing, growing and maintaining the infrastructure required for the AO network. PEDG is funded by native revenue generated during the use of cross-chain assets on the AO network. These revenues will not fund a single core team, but will be distributed to a diverse group of teams and builders who are contractually committed to promote the growth of AO. At the time of the AO token launch, PEDG consists of 5 ecosystem partners who collaborated in the AO network launch, and more partners will join as the protocol matures and grows.

AO's minting and distribution mind map is shown below:

When the economic model was first announced, many people criticized the AO token minting for being beneficial to stETH and detrimental to the AR/AO ecosystem. The vast majority of people believe that more minting rights should be allocated to AR holders rather than stETH. The author's views are as follows:

1. Cross-chain bridge assets are not limited to stETH. In the future, there will be more assets such as stSOL. As long as these assets meet the two requirements mentioned above, they will have the right to mint AO tokens after the cross-chain. When other assets enter the minting system, the minting rights allocated to a single currency will be diluted. When the number of cross-chains of two tokens is basically the same, the minting rights of a single token are 33.3%. When the number of three tokens is the same, the minting rights of a single token are 22.2%. As the number of tokens increases, the minting rights will continue to be diluted.

2. AO is an open global supercomputer and a unified blockchain computer protocol. The AO ecosystem is broad and should not be limited to the Arweave ecosystem. AO needs to accept more assets from existing excellent public chains in order to grow and develop in a longer-term and stable manner. If a large number of incentives are used to incentivize the original small-scale AR holders, development will be restricted.

More importantly, AO is creating a new token minting model, which is also the focus of this article, developer minting. Please continue reading below?

Developer Minting

Through the above, we have learned that AO token minting and cross-chain bridges are closely related. In this process, a cross-chain asset aoETH (more assets such as aoSOL will be available in the future) circulating on AO is generated. During the AO token minting process, 66.6% of the assets were distributed to the holders of the cross-chain asset aoETH. In this way, isn't AO a cross-chain farming system? But we must know that aoETH is liquid, so where will these circulating aoETH go?

The answer is: up to 400 million US dollars of aoETH will flow to ecosystem developers!

This flow does not mean that aoETH will be paid to developers, but that AO minted by aoETH will flow to developers.

We know that in the field of DeFi, everyone pays attention to the total locked value (TVL). It is an indicator to measure the total value of all assets on the decentralized finance (DeFi) platform. TVL is often used to evaluate the scale and health of DeFi protocols or platforms, reflecting the total value of all crypto assets locked in smart contracts on the platform.

When developers develop a Uniswap-like trading system on AO, liquidity needs to lock the native tokens and various cross-chain assets on AO. Native tokens must establish liquidity with various cross-chain assets, otherwise AO native tokens will be worthless, and high-quality cross-chain assets will bring better liquidity and value to AO native tokens. As mentioned above, AO cross-chain assets must be high-quality assets with sufficient liquidity in the market. At this time, native cross-chain assets such as aoETH will become the preferred liquidity targets. When users use aoETH and AO native assets to establish liquidity, aoETH will be locked into the smart contract developed by the developer, and the AO tokens minted by aoETH will also be transferred to the developer contract. In the end, developers can have the right to use these AOs. This is the developer minting emphasized in this article. The current $400 million stETH locked position is still growing, and it is expected to reach billions of dollars in the future. After the AO mainnet is officially launched in February next year, these cross-chain assets will be officially circulated. It can be foreseen that billions of dollars of cross-chain assets need to be used and consumed on AO, and the smart contracts developed by developers are the consumption scenarios of formal cross-chain assets. In the process of cross-chain asset circulation and lock-up such as aoETH, the AO minting rights will eventually come to the hands of AO developers. Only when AO developers continue to create more valuable applications can the AO ecosystem rise.

Another way to invest?

For a project to get investment, it not only needs a good idea, but also a good deck (project display), and even more a good pitch (promotion). Venture capital institutions also face huge risks when selecting projects (otherwise why is it called venture capital?). A project has a good idea, deck and pitch does not mean that they can really realize the product, and the realization of the product does not mean that the product can really meet market demand. The traditional investment process is lengthy and inefficient.

Now there is a better choice. As an investor, use your annualized income to invest instead of the principal. Developers do not need to rush to beautify Idea, make Deck, and learn marketing skills, but build the project from a prototype, MVP (minimum implementation). At the beginning, developers should consider Staking and staking, so that investors with aoETH can join your project. When the application prototype begins to be built, developers will receive financial support, and these funds come from AO tokens minted by aoETH.

If the project gets bigger and bigger, more and more aoETH will be staked through this project, and developers will get more benefits. Isn't this a new way of investment? Investors will not lose their principal, developers build lightly, and everything is very consistent with the principles of agile development. This is an agile investment.

An application with real market demand will never lack funds. The market will determine where aoETH will flow, where to stake or lock it. Finally, please check out the "nesting doll" diagram above for readers to think about. This may be an opportunity for AO projects and developers.

JinseFinance

JinseFinance

JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance